FBAR vs. Form 8938: Which Should You File?

Every year, Americans living abroad find themselves scratching their heads. Tax season can be stressful for everyone—and for expats, things only get more complicated. The alphabet soup doesn’t help anything either, with FATCAs and FBARs and FinCENs to wade through.

Don’t worry. We’re here to help make sense of it all. In this guide, we’re going to look at two common forms for Americans abroad: the FBAR and Form 8938. These two forms are similar, but with some noteworthy differences.

Key Takeaways

- The FBAR is a purely informational tax form. Expats aren’t automatically taxed on the money they have stored in a foreign bank account.

- Form 8938 is similar to the FBAR, and many expats assume that they’re the same thing. However, they are different forms—and understanding the differences is important.

- Form 8938 is issued by the IRS rather than FinCEN. Form 8938 is also more complex and in-depth than the FBAR.

What Is an FBAR?

Americans who have an aggregate highest balance in a year totaling $10,000 or more in non-US accounts are required to file FinCEN Form 114, also known as a Foreign Bank Account Report (FBAR). The name ‘FBAR’ can be a little deceiving as you are generally required to report all financial accounts, including investment accounts, pensions, and insurance policies that have cash surrender values. The filing threshold is also not so straightforward, and an example helps to explain it.

For example, you have two accounts in a foreign bank, one with the highest balance on June 30th of $4,000 during the year and the second with the highest balance of $4,000 during the year. In this example, you do not need to file an FBAR as the total of the highest balances was $8,000. But if both accounts had the highest balance of $5,000 on any day, you are required to file an FBAR as the total highest balances were $10,000.

As another example, you have two foreign bank accounts and the highest balances of each totaled $4,000 on the morning of June 30th. At this point, there is no filing requirement as the highest balances total $8,000. That afternoon you received a $1,000 deposit into your first account, and you still have no filing requirement as your highest balances total $9,000. However, you transfer $1,000 from the first account to the second account later that afternoon. You now must ‘file an FBAR as the highest balance in each account totaled $5,000 (or $10,000 overall), even though you never had more than $9,000 in total between both accounts.

The FBAR was designed to combat tax evasion by making it harder for US citizens to hide money in offshore accounts. FBAR reporting requirements have been in place since 1970. However, those requirements only became enforceable in 2010 with the passing of the Foreign Account Tax Compliance Act (FATCA). FATCA requires virtually all foreign banks to disclose the details of any account holders who are US citizens. That means that the IRS generally knows which expats are failing to file an FBAR when required.

Americans who shirk their tax obligations won’t get away with it for long. If the IRS contacts you about your failure to file an FBAR, you could face severe penalties.

The good news is that the FBAR is a purely informational tax form. Expats aren’t automatically taxed on the money they have stored in a foreign bank account. You simply have to report it to the IRS for the purpose of transparency.

In short, you won’t lose anything by filing an FBAR when required—and you could lose plenty if you refuse. It’s always best to file.

What Is FinCEN?

FinCEN is the Financial Crimes Enforcement Network, a bureau of the US Treasury Department tasked with combating financial crimes such as money laundering, tax evasion, and fraud.

Their mission is to “enhance U.S. national security, deter and detect criminal activity and safeguard financial systems from abuse by promoting transparency in the U.S. and international financial systems.”

One of FinCEN’s responsibilities is ensuring that US citizens are fulfilling their FBAR filing obligations. (They do this in cooperation with the IRS.)

To submit an FBAR, you will need to complete FinCEN Form 114 and file it with FinCEN’s BSA E-Filing System.

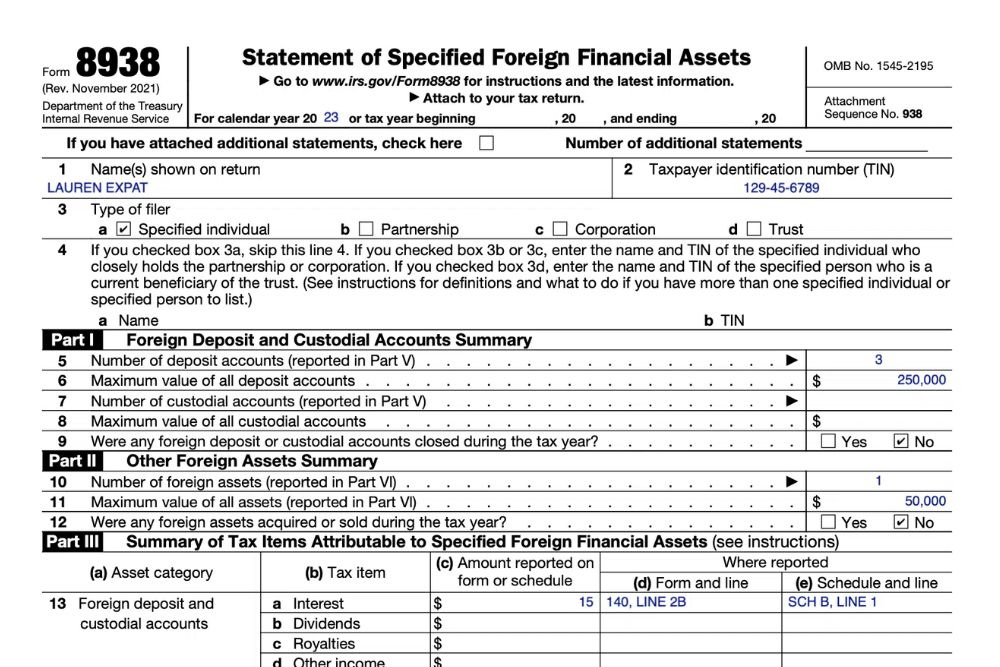

What Is Form 8938?

Like the FBAR, Form 8938 is an informational form used to report foreign assets. Those assets include:

- Bank accounts

- Brokerage accounts

- Stock or securities of foreign issuers and other similar securities

- Foreign financial instruments

- Foreign-issued life insurance

- Annuity contracts with cash value

- Shares in foreign hedge funds and private equity funds

Form 8938 is similar to the FBAR, so many expats fail to understand that they are two separate forms —and understanding the key differences is important to filing your Expat Taxes accurately.

To start with, Form 8938 is issued by the IRS rather than FinCEN. Form 8938 is also more complex and in-depth than the FBAR.

The reporting requirements for Form 8938 are also more complex. While the FBAR applies when any taxpayer has at least $10,000 stored in a foreign bank account, the reporting thresholds for Form 8938 vary by your residency and filing status.

For specified individuals living inside the US, there are two thresholds to consider for filing Form 8938:

- Single or Married Filing Separately – 1) The total value of your foreign assets is greater than $50,000 on the last day of the tax year (December 31st) or 2) more than $75,000 at any point during the year.

- Married Filing Jointly – 1) The total value of the foreign assets owned by you and your spouse is greater than $100,000 on the last day of the tax year or 2) more than $150,000 at any point during the year.

For specified individuals living abroad, there are also two thresholds to consider for filing Form 8938 are:

- Single or Married Filing Separately – 1) The total value of your foreign assets is greater than $200,000 on the last day of the tax year or 2) more than $300,000 at any point during the year.

- Married Filing Jointly – 1) The total value of the foreign assets owned by you and your spouse is greater than $400,000 on the last day of the tax year or 2) more than $600,000 at any point during the year.

FBAR vs. Form 8938: Is There a Difference?

Yes, the FBAR and Form 8938 are different. While both forms may seem to be collecting the same information, there are some subtle—and not-so-subtle—differences of which every taxpayer needs to be aware. In general, when you have to file Form 8938, you will almost always need to file an FBAR.

Some expatriates must file both an FBAR and Form 8938, while others are only required to file an FBAR. Some expats may not need to file either form.

To help you understand the numerous nuances between the FBAR and Form 8938 better, we’ve put together a table comparing them below.

| Form 8938 | FBAR | |

| Who must file? | Specified individuals (US citizens, resident aliens, and certain nonresident aliens) and domestic entities that have an interest in specified foreign financial assets and meet the reporting threshold. | US persons (US citizens, resident aliens, trusts, and estates) that have an interest in foreign financial accounts and meet the reporting threshold. |

| Reporting threshold | Reporting thresholds vary by residency and filing status. (See above for more.) | The aggregate value of all foreign financial accounts exceeds $10,000. |

| What is reported? | The maximum value of the specified foreign financial asset. | The maximum value of the foreign financial account. |

| When is the form due? | The form is due with your federal tax return, including extensions. | The form is due April 15, with an automatic extension to October 15 available. |

| How is it filed? | With your federal income tax return. | Filed electronically through FinCEN’s BSA E-Filing System. |

| Penalties | Up to $10,000 for failure to disclose and an additional $10,000 for every 30-day period of non-filing up to a potential maximum penalty of $60,000. Criminal penalties may also apply. | Up to $12,500 per violation for non-willful failure to file. If your failure to file is considered willful, the fine can be $100,000 or 50% of the balance of the account at the time of the violation, whichever is greater. Criminal penalties may also apply. |

Remember, not all accounts and/or financial assets need to be reflected when determining your filing obligation for each form. A financial asset that is reported on Form 8938 (FATCA) does not necessarily need to be reported on your FBAR form and vice versa. There are some exceptions to these rules for financial accounts held in US Territories.

The table below outlines what needs to be considered for each when verifying your obligation.

| Form 8938 | FBAR | |

| Financial accounts held at a foreign financial institution | Yes | Yes |

| Financial accounts held at a foreign branch of a US bank | No | Yes |

| Financial accounts held at a US branch of a foreign bank | No | No |

| Foreign financial account for which you have signature authority | No—unless you have an ownership interest in the account as described above | Yes |

| Foreign stock held in a foreign brokerage account | The account is reportable; however, the stock within the account does not need to be reported separately. | The account is reportable; however, the stock within the account does not need to be reported separately. |

| Foreign stock held outside a foreign brokerage account | Yes | No |

| Foreign partnership interests | Yes | No |

| Foreign mutual funds | Yes | Yes |

| Domestic mutual funds that invest in foreign stock | No | No |

| Foreign accounts or non-accounts investments held by foreign or domestic grantor trusts where you are the grantor | Yes for both | Yes for foreign accounts |

| Foreign-issued life insurance or annuity with cash value | Yes | Yes |

| Foreign hedge and private equity funds | Yes | No |

| Foreign real estate held directly | No | No |

| Foreign real estate held through a foreign entity | No; however, the foreign entity is a specified foreign financial asset, and its value will include the value of the real estate. | No |

| Foreign currency held directly | No | No |

What Should I Do If I Haven’t Filed an FBAR or Form 8938 When Required?

If you failed to file an FBAR or Form 8938 when required, don’t panic. Many Americans living abroad are unaware of their US tax obligations. To help solve this problem, the IRS has created two tax amnesty programs that might help you get caught up:

Both will let you come into compliance with US tax law without paying any penalties.

These tax amnesty options are only available if you reach out to the IRS and start the process yourself. If the IRS contacts you about your delinquency first, you may lose the privilege of using these programs. In that case, you would be subject to the standard penalties.

Need Help Filing an FBAR of Form 8938? That’s Why We’re Here.

We hope this guide has helped you understand the differences between FBAR vs. Form 8938 (FATCA).

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.