Foreign Rental Property Taxes: What to Know

Foreign rental property can be a profitable investment and a popular choice for expats seeking passive income. However, it is also subject to US taxation. If you own foreign rental property, you must report your income just like any other US property owner. The tax rules for a foreign rental property are majorly the same as those in the US. However, there are some differences.

This article provides vital insights into the intricacies of reporting rental income from your foreign property to the IRS. We’ll cover the necessary forms, possible deductions, and the nuances of tax treaties that might affect how you report this income. Whether you own a villa in Italy or an apartment in Dubai, it’s crucial to navigate these regulations correctly to ensure compliance and optimize your tax situation.

Key Takeaways

- Rental property owned by a US citizen or resident outside of the US is subject to US taxation.

- Foreign rental property and US rental property are mostly governed by the same rules, with a few differences.

- The IRS provides certain tax benefits that expat property owners can use to reduce their US tax bill.

Does the IRS Tax Foreign Rental Property?

Yes. Just like rental property located in the US, foreign rental property owned by a US citizen or long-term resident is subject to US taxation. If you own a foreign vacation/second home that you rent out, you will need to report income from this vacation/rental home if your rental income meets the threshold requirements shown in the chart below:

| Owners’s Use | Time Rented out | Tax Treatment |

| None | 0-365 Days | Regular rental property |

| 15+ Days | Less than 15 Days | Not reportable on tax return |

| Less than 15 days or 10% of days rented | 15+ Days | Vacation home AND rental property |

| More than 14 Days or 10% of days rented | 15+ Days | Vacation home AND secondary residence |

Any rent you receive will be considered taxable income. Any expense associated with operating the rental property is used as a deduction against taxable rental income.

For example, let’s say you collected $30,000 in rental income in 2023. In the same year, the expenses required to maintain and operate your rental income came to $10,000. This would mean that you have taxable rental income of $20,000 (the $30,000 rental income less the $10,000 in rental property expenses).

You can find a detailed list of income and expense rules for rental property on Schedule E of IRS Form 1040. Common deductions include:

- Foreign mortgage interest

- Repair expenses

- Management fee expenses

- Travel expenses when inspecting your foreign property (if personal days are involved, you will only be able to deduct expenses related directly to the management of your foreign property)

Note: You can no longer deduct foreign property taxes.

How to Report Foreign Rental Income from Real Estate

For the most part, foreign rental property is treated the same as a domestic rental property. This means that as an expat property owner, you will generally report your foreign property rental income and expenses just like you would with a US rental property. There are only a few distinctions, such as the foreign tax credits available for expat property owners and the changes to depreciation rules.

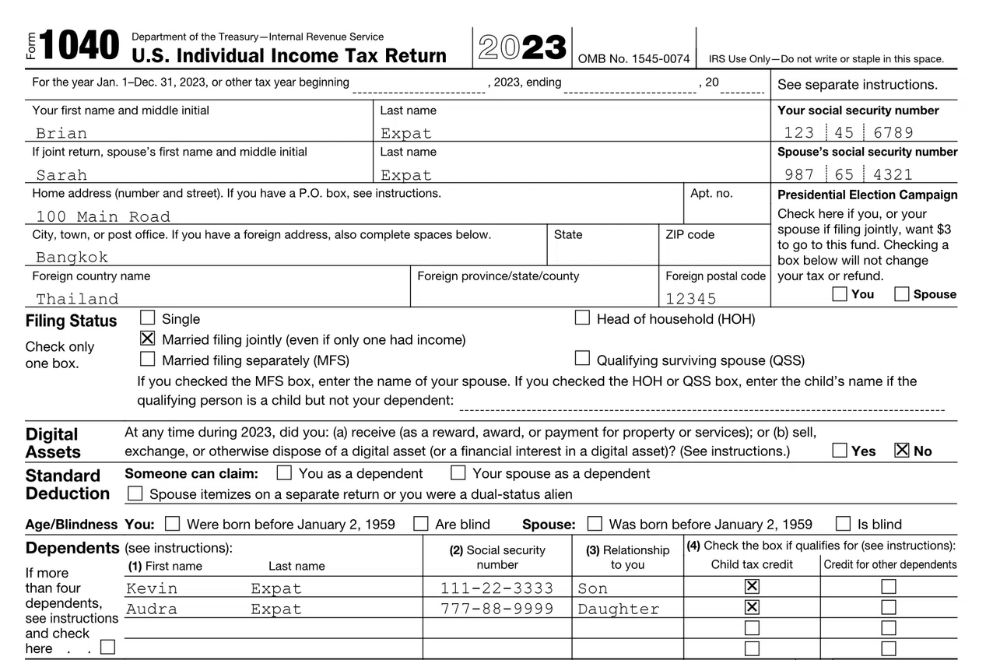

To report your foreign rental income, you should determine the structure used to hold the ownership of the foreign property real estate. A popular choice is a limited liability company (LLC). If you own the foreign rental property directly or through a single-member limited liability company (which is considered a disregarded entity for US income tax purposes), you must report your rental income and expenses on Schedule E and attach it to your US tax return.

If the ownership is through a US LLC with more than one member (except for LLCs created by spouses in US community property states) or through a foreign corporation, foreign partnership, or foreign trust, then you will have additional filings and reporting requirements (which may include Forms 1120, 1065, 5471, 8865, or 1041).

However, foreign rental expenses need to be reported in US dollars (USD). This will likely require you to change the foreign currency you receive for rent into USD. So how do you do that?

The IRS currently has no official exchange rate. In general, you should use the exchange rate prevailing (i.e., the spot rate or exchange rate on the day of the transaction) when you received the property, made any major repairs and improvements, and sold the property. The IRS website has more information about foreign currency and currency exchange rates and yearly average currency exchange rates.

If you are required to pay foreign income taxes (or capital gains taxes on a foreign rental property sale), you may be able to offset any US income taxes paid on this foreign-sourced income with a Foreign Tax Credit to prevent this real estate income from being subject to double taxation.

Other US Reporting Requirements

You may have an FBAR reporting requirement if you set up a foreign bank account for receiving income and paying expenses related to the foreign rental property. FBAR reporting rules require that all US citizens must file a report if they have at least $10,000 stored in one or multiple foreign financial accounts.

Additionally, if the foreign rental is held through a foreign entity such as a foreign corporation, partnership, or trust, you may have to report your interest in that entity on a FATCA report (Form 8938). , Form 5471, Form 8865, or Forms 3520 and 3520A. These additional forms are complex forms that come with penalties starting at $10,000.

Dreading the last minute scramble pulling together your tax documents? Despair no more! This simple checklist lists the documents you need to have on hand when preparing to file.

How to Depreciate Foreign Rental Property

One of the differences in owning foreign property rentals abroad versus domestically is depreciation. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life and is used to account for declines in value. In other words, the IRS allows an annual deduction for the “wear and tear” of the property.

Let’s run a hypothetical calculation to see how this works in practice. If the cost of your domestic rental property were $275,000, the depreciation expense would be $275,000 divided by the IRS-allowed 27.5 years of useful life (for residential real estate) for an annual depreciation expense of $10,000. The $10,000 depreciation expense offsets your rental income and ultimately reduces any associated tax liability connected with the rental income.

However, foreign real estate follows a different set of rules. Under IRC Section 168(g)(1)(A), any tangible property that is used predominantly outside the United States during the taxable year must use the alternative depreciation system. This part of the Internal Revenue Code [Section 168(g)(2)(C)] specifies a period of 30 years. Prior to the 2017 Tax Cuts and Jobs Act, the length of time was 40 years. Simply put, when looking at how to depreciate foreign rental property, rather than using the 27.5 years described in the above calculation, the specified time is increased to 30 years.

For instance, if you own a rental property overseas valued at $275,000, you can calculate the annual depreciation expense by dividing the property’s worth by the IRS-allowed useful life of 30 years under the Alternative Depreciation System. This calculation results in a depreciation expense deduction of $9,167 each year, which you can claim on your tax return.

Can You Use the Foreign Tax Credit for Foreign Rental Income?

In most cases, yes. If you operate your home abroad as a rental property, you will often pay foreign taxes on your foreign rental property income, while the same income is subject to tax here in the US. Luckily, taxes paid or accrued to a foreign country can be used to offset US taxes through the Foreign Tax Credit.

For example, if you paid or accrued $100 of income tax in a foreign country, you can typically deduct $100 from your US tax liability.

Get Expert Help with Your Foreign Rental Property Taxes

Now you should have a better understanding of the tax implications for your foreign rental property! If you have more questions, we have the answers. In fact, we can even prepare and file your expat tax return on your behalf. Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.