What Expats Need to Know about US Tax Deadlines in 2024

- When Does the 2024 US Tax Season Start?

- When Is the US Tax Deadline for 2024?

- When Are Estimated Taxes Due?

- When Is the US Tax Deadline for Business Taxes?

- When Is the Deadline for FBAR?

- When Is the Deadline for a FATCA Report?

- What If I Can’t File by the Tax Deadline?

- What If I Miss the US Tax Filing Deadline for 2024?

- If You Have Questions Regarding Tax Deadlines, We Have Answers!

Understanding the US tax deadlines for 2024 (2023 Tax Year) is crucial, especially for American expats with unique tax filing requirements. While Tax Day is a well-known date for most US residents, expats must navigate a more complex tax calendar.

This guide will provide a curated list of critical dates and deadlines relevant to US citizens living abroad. From the standard filing deadlines to the extended due dates for those residing overseas, we cover all the essential information to help ensure timely and compliant tax submissions. We aim to demystify the complexities of US tax deadlines for expats in 2024, offering clarity and expert guidance to navigate these obligations confidently.

Key Takeaways

- The standard deadline for Americans living in the US filing a US tax return is April 15, 2024.

- Expats are granted an automatic two-month extension for filing their US tax returns, which extends the US tax filing deadline for expats to June 17, 2024. They may also request additional extensions if needed.

- If you’ve already missed your filing deadline, you may be able to use the IRS amnesty program to come into compliance without paying any fines.

When Does the 2024 US Tax Season Start?

The US tax year is the same as the calendar year—January 1 to December 31. “Tax season” is when the IRS begins accepting income tax returns. The Internal Revenue Service will ideally accept returns for the 2023 tax year towards the end of January 2024.

When Is the US Tax Deadline for 2024?

The standard deadline for US residents to file a Federal Tax Return for the 2023 tax year is April 15, 2024. However, this deadline automatically extends two months to June 17, 2024, for US citizens living overseas. (If a deadline falls on a weekend or holiday, it is moved to the next business day.)

If you need more time to file your expat tax return, you can request an additional filing extension to October 15. In extreme cases, you can even request an extension to December 16th, 2024.

When Are Estimated Taxes Due?

Some taxpayers must file estimated quarterly tax payments rather than a single annual return. Generally, you must file estimated quarterly tax payments if you expect to owe at least $1,000 in US taxes when filing your return. The rules for this are the same for US residents and expats.

If you’re behind on your US taxes, you may qualify for a special compliance program to get back on track without penalties. Download our Streamlined Filing Eligibility guide to understand if you qualify.

Some taxpayers should pay estimated taxes quarterly. There is no requirement to do so, but this is done for two reasons. First, it helps to avoid having a huge tax bill when your return is prepared since your payments are made throughout the year. Second, it will help reduce or eliminate the failure to pay the estimated tax penalty timely. This penalty applies in several circumstances. It can apply if you owe more than $1,000 in taxes when your tax return is prepared. This penalty can apply if you pay less than 110% of your overall tax bill from the previous year.

The most common categories of taxpayers who should consider filing estimated quarterly taxes are:

- Taxpayers who are self-employed

- Taxpayers with significant investment or retirement income

- Taxpayers who receive a large windfall, such as from the sale of a major asset

- Taxpayers who receive alimony income

- Taxpayers who receive income distributions from a partnership or S corporation

In addition, expats employed by a foreign business that does not withhold or pay taxes to the US government on their behalf may also want to file estimated quarterly payments.

So what about the deadlines for these payments? The last estimated payment for the tax year 2022 is due on January 15, 2024. Estimated payments for the tax year 2023 will be due on:

- April 15, 2024

- June 17, 2024

- September 16, 2024

- January 15, 2025

When Is the US Tax Deadline for Business Taxes?

The deadline for filing a business tax return depends on how the business is structured. The deadlines for each structure are as follows:

- S corporation: March 15, 2024

- Partnership: March 15, 2024

- Multi-member LLC: March 15, 2024

- Sole proprietorship: April 16, 2024

- Single-member LLC: April 16, 2024

- C corporation: April 16, 2024

If your business operates on a fiscal year rather than the calendar year, the standard filing deadline is the 15th day of the third (or fourth month for C corporations) following the close of your fiscal year. If this deadline falls on a Saturday, Sunday, or a legal holiday, the deadline is moved to the next business day.

If you need more time to file a business tax return, you can request an extension. The deadline to file your extension is the date it is normally due.

When Is the Deadline for FBAR?

The deadline for FBAR filing is April 16, 2024. If you miss this deadline, there is an automatic extension to October 15, 2024.

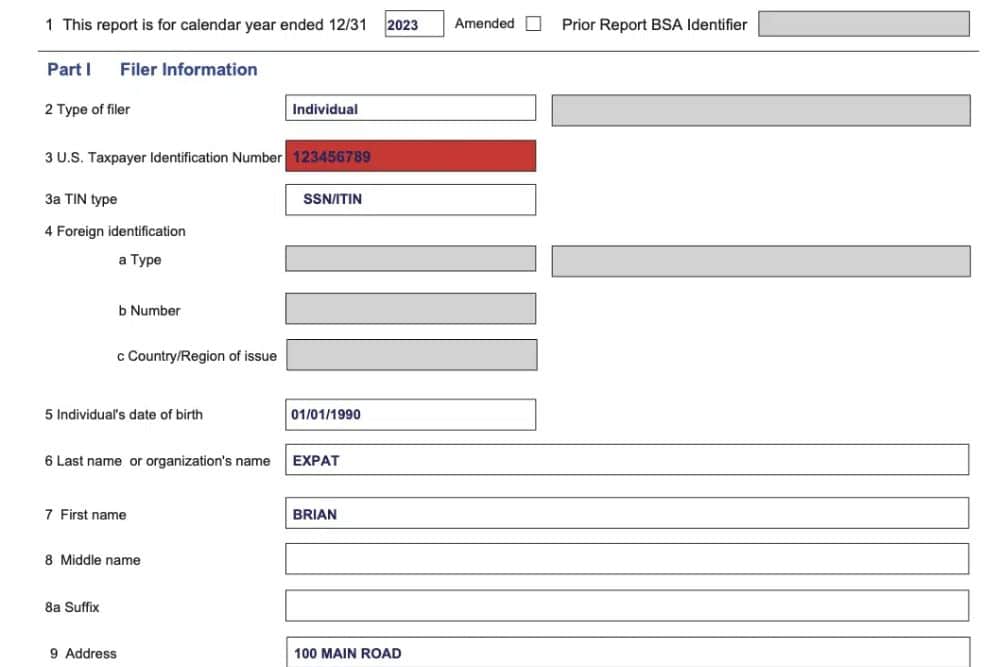

An FBAR is a Report of Foreign Bank and Financial Accounts that US taxpayers with foreign accounts with an aggregate value exceeding $10,000 at any time during the year must file. The FBAR is not a separate tax form and isn’t reported to the IRS; it’s a report filed electronically with the Department of Treasury using FinCEN Form 114 (formerly TD F 90-22.1).

When Is the Deadline for a FATCA Report?

If you own non-US financial assets valued above certain thresholds, you must file a FATCA report. (The specific threshold will depend on your filing status and whether you qualify as a bona fide resident of a foreign country.)

If you are required to file a FATCA report, you’ll have to fill it out and attach it to your individual income tax return. That means the standard deadline for the FATCA report is the same as your individual tax return: April 16, 2024. FBARs get an automatic six-month extension, which is not due until October 15, 2024.

What If I Can’t File by the Tax Deadline?

Most US tax forms allow you to file for an extension if necessary. Plus, as a US citizen living abroad, you probably have specific automatic extensions without even requesting them, such as the automatic extension to June 15 for personal tax returns.

What If I Miss the US Tax Filing Deadline for 2024?

Filing—or paying—late taxes can result in penalties. However, if you have already missed the deadline for the previous year, don’t panic. You probably have options, with the details depending on your situation. Let’s take a look at some of the most common scenarios.

- If you are owed a tax refund, there generally isn’t any penalty for filing late. Still, you should file immediately to comply with the IRS. (You typically have three years from the original filing deadline to claim a refund, so the window for claiming a 2023 refund—due in 2024—would close in 2027.)

- If you owe taxes, the IRS may charge additional interest or even impose failure to file and/or penalties. The good news is that as an expat, you may qualify to file using the IRS’ Streamlined Filing Compliance Procedures. If you do, the IRS will likely waive any penalties you might otherwise be subject to. (This is an amnesty program for expats unaware they had to file.)

- If you can’t afford to pay the taxes you owe, you should still file as soon as possible. The IRS may agree to let you reduce your tax debt or pay over time through regular installments. (Though in the case of a payment plan, you will still incur interest until the debt is paid off.) Regardless, it’s always better to file.

If You Have Questions Regarding Tax Deadlines, We Have Answers!

Hopefully, this guide has given you a better understanding of US expat tax deadlines for 2024. If you still have questions, we’d be happy to provide you with the answers. We can even help you meet your US tax obligations.

Contact us, and one of our customer champions will gladly help. If you need precise advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.