IRS Form 1040: How to File Your Expat Tax Return

Are you preparing to tackle your US tax returns and wondering about Form 1040? This comprehensive guide demystifies the IRS Form 1040, the standard federal income tax form used by US residents to report their annual income. Understand the essentials of who needs to file, the various sections and schedules of the form, and the key deadlines for submission.

Whether you’re self-employed, an investor, or a traditional employee, we’ll guide you through the process to ensure your tax filing is as seamless as possible.

Key Takeaways

- Form 1040 is an annual tax form that must be submitted by all US citizens and residents who meet certain income thresholds each year (e.g., interest from bank accounts, wages from employment outside of the US, etc.)

- Virtually every American must file Form 1040 annually, regardless of where they live.

What Is Form 1040?

Form 1040 is the standard tax return for US individuals, regardless of where they live. This form is used to report: total income; taxable income after deductions; whether you owe taxes–and if so, how much; and if you do not owe taxes, how much of a refund can be received.

Dreading the last minute scramble pulling together your tax documents? Despair no more! This simple checklist lists the documents you need to have on hand when preparing to file.

There are a few variations of Form 1040, each with its own purpose.

- Form 1040 is the most common variant, used by most employed or self-employed taxpayers.

- Form 1040-SR is meant for senior taxpayers (age 65 and older). This form is nearly identical to the regular Form 1040, but the print is larger to make it easier for senior taxpayers to read it. It also includes a handy chart for determining the taxpayer’s standard deduction.

- Form 1040-NR is for non-resident aliens or NRA’s. These individuals are not US citizens, are not Green Card Holders, but have income earned from the United States. This form is several pages longer than the standard Form 1040.

- Form 1040-X is used to amend a previously filed tax return. Amended returns are used to correct mistakes or add additional information.

Depending on the types of income you have to report, you may have to attach additional forms to your Form 1040, known as schedules. For example, self-employed taxpayers must attach Schedule C to their tax return to report any self-employment income.

Who Has to File Form 1040?

The US tax code requires all US citizens to file a Form 1040 tax return each year, regardless of where they live. Whether you live in Tampa or Tokyo, you still have to report your income to Uncle Sam if it exceeds certain thresholds.

So what are those thresholds? That depends on your age and filing status. See the table below for the minimum income to file for the 2023 tax year. (All amounts refer to traditional employment income.)

| Filing Status | Minimum Income if Under 65 | Minimum Income if 65 or Older |

| Single | $12,950 | $14,700 |

| Married filing jointly (Both spouses) | $25,900 | $28,700 |

| Married filing separately | $5 | $5 |

| Head of household | $19,400 | $21,150 |

| Qualifying widow(er) with dependent child | $25,900 | $27,300 |

If you are married and filing jointly, and one spouse is under 65 while the other is 65 or older, the minimum income to file is $27,300. (And no, that $5 for married filing separately isn’t a typo. That really is the filing threshold!)

As mentioned, the table above refers only to traditional employment income. If you receive $400 or more in self-employment income, you must file Form 1040 to report it. Self-employment income is income earned as a business owner and includes work done as a freelancer and contractor.

You may also have to file Form 1040 if you receive other non-traditional types of income, such as:

- Income from a partnership, S corporation, estate, or trust

- Insurance policy dividends that exceed your premiums

- Tips that weren’t reported to your employer

In other cases, you may want to file Form 1040 to claim certain tax benefits, such as a refund, even if you wouldn’t otherwise be required to file.

When Is Form 1040 Due?

For most US citizens, Form 1040 is due on April 15th. However, expats are granted an automatic two-month extension to June 17th. If necessary, you can also request an additional filing extension to October 15th

An extension to file Form 1040 is not an extension to pay. Regardless of your extension, you will still have to estimate and pay your annual taxes by the original April deadline to avoid potential penalties.

Form 1040 Penalties

Failing to file Form 1040 can result in severe penalties. These penalties vary depending on a few factors.

- If you do not file Form 1040 by the filing deadline, the standard penalty is 5% of all unpaid taxes per month (or part of a month) that your return is late. This can accrue up to a maximum penalty of 25% of your unpaid taxes.

- If your return is more than 60 days late, the minimum failure-to-file penalty is $435 or 100% of your unpaid taxes, whichever is less.

In addition to these penalties, you will also face penalties if you file Form 1040 but do not pay the taxes you owe by the April deadline. These penalties are much lower than a failure-to-file penalty, so it is always best to file even if you don’t think you can pay all of what you owe right away.

When you live in the US, tax day is simple: April 15th! When you move abroad, it’s not so straightforward! Learn about all the expat deadlines and extensions you need to know to file.

How to File Form 1040?

Before beginning the process of completing Form 1040, you will want to gather all relevant documents.

- W-2s are only issued by US-based organizations – most expats would not have one. For employed expats, the most important documents are those that show your total salary for the year. Many employers must provide an annual statement to their employees showing their total salary, somewhat similar to a W2.

- If you are self-employed or receive other forms of income, such as investment income or interest, you would receive forms 1099 if you were living in the US. When living abroad, will need documents similar to Form 1099 if available, or other forms of evidence that show your total income. This could include, for example, bank statements.

- When claiming deductions or credits, you may also need certain documents to justify your claims.

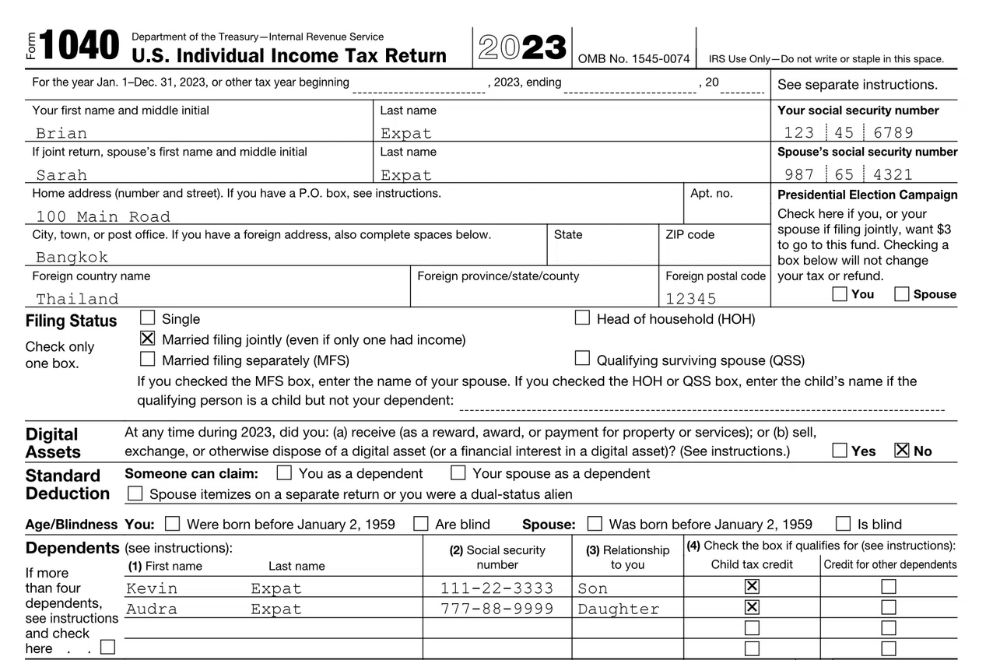

Once you have the right documents, it’s time to start on Form 1040 itself. Look at the example below.

How to Fill Out 1040 and Where to Report Foreign Income?

Once you’ve gotten all the income and deductions associated with your return, you’ll be ready to start filling out Form 1040 for your US expat taxes. To better demonstrate the process of completing the form, let us introduce you to Brian Expat. Brian and his wife, Sarah, are US citizens and have lived in Pennsylvania all their lives. They got married in 2022 and have been living in Thailand ever since. They also have two small children, Kevin and Audra Expat.

Brian works for a Thai company that handles American clients and has been working there since January 1, 2023. Brian has been earning just over THB 4,000,000, which translates into $114,936 at the year’s average annual exchange rate. Sarah, on the other hand, does freelance writing from her home office while taking care of their young children, which earned Sarah $10,000. They have a savings account back in the US that generated $1,000 in interest income. Their last source of income in 2023 was the sale of their second property back in the US, which landed a gain of $30,000.

For deductible business expenses, Sarah completed an online Thai course administered by the US Department of Education. This cost $300 for six weeks and was work-related, as she is attempting to have articles published in Thai. She also has other expenses from her business, that total $1,000. Lastly, Brian is still paying back his loans for his education back in Pittsburgh, allowing him to deduct the $39 in interest that he paid.

With this information, we can successfully prepare their Form 1040 for their 2023 US expat taxes.

The first part of how to fill out 1040 is going to be completing the information section. This includes your name, spouse’s name (if filing jointly), and any dependents you may be claiming. Since Brian and Sarah are filing jointly this year, they will both be included in their section. Their children’s information is also provided in this 1040 example.

Assuming for the 2023 Tax Year; they

- Received the corresponding amount for their third Economic Impact Payment

- They did not receive any Advance Child tax Credit Payments

- They filed their tax return in a timely manner

Next, Brian and Sarah will report their income on their US expat taxes by using the appropriate tax documents from Brian’s employer, Sarah’s accountant, the sale of their property, and the bank statement proving the interest they earned.

Most of the income earned will be reported directly on the first page of Form 1040. Brian’s wages will be listed on Line 1, the Total amount from Form(s) W-2, box 1, etc. Their interest income will be listed on Line 2b, Taxable Interest.

Because Brian and Sarah are both US citizens who have lived abroad the entire year, they are eligible for the Foreign Earned Income Exclusion (FEIE). The FEIE will apply to each of them separately. For 2023, the maximum amount of FEIE is $120,000 per qualifying person (the amount for the 2024 Tax Year is $126,500.) Because of this, Brian will be eligible to exclude $114,936 of his $114,936 in wages, and Sarah will be able to exclude the entire $8,700 she earned from freelance writing. They will reflect this total ($123,021) FEIE on line 9 of Schedule 1 and also attach individual Forms 2555 to their return, which flows to their Form 1040 Line 8 reducing their income. In the same manner, Sarah’s deductible portion of self-employment tax (Schedule 1 Line 15), and Brian’s student loan interest (Schedule 1 Line 21), will flow to their Form 1040 Line 10, reducing their income as well.

1040 Form Example: Calculating Taxes Owed

Since Brian and Sarah are filing jointly in the 1040 tax form example, they are allowed a standard deduction of $27,700. This reduces their taxable income to $3,261 (line 15 of Form 1040).

Brian and Sarah can reduce their taxes with certain credits for the total amount owed. As expats, they could claim a credit for foreign taxes on foreign source income. When the foreign earned income exclusion is claimed, the amount of foreign tax paid or accrued must be scaled down to reflect the portion of foreign source income that was excluded from income. Brian and Sarah paid $301 of Thai tax; however, after considering the foreign earned income exclusion and deductions, Brian and Sarah have no foreign tax credits to utilize for 2023. Although there is no available foreign tax credit, Brian and Sarah may utilize the child tax credit, a child tax credit of $489, to reduce their tax (shown on Form 1040, line 19).

Calculating your taxes owed on your US expat taxes can be intimidating, but the IRS provides you with useful tools to identify how much you owe. If you made less than $100,000, you can find your tax rate on pages 65 – 76 of the IRS’s Instructions for Form 1040

. If you earned more than $100,000, use the tables found on page 77 of the IRS’s Instructions for Form 1040.It is important to note that when you are claiming the Foreign Earned Income Exclusion, there is a special worksheet to complete to calculate your tax due for the year. This can be found on page 35 of the IRS’s Instructions for Form 1040.

This special worksheet is needed because when you claim the foreign-earned income exclusion, you are not allowed to use the lower tax brackets that would have applied to your income if you had not claimed the foreign-earned income exclusion. The foreign earned income has the effect of pushing you out of the lower tax brackets altogether.

Sarah is responsible for self-employment tax on her net business profits, which are accounted for on Schedule 2 (and calculated on Schedule SE).

After considering these additional credits and other taxes, their total amount due is $1,229, as seen on line 37 of Form 1040.

The last steps in finishing Form 1040 for US expat taxes are signing the form, filling out the preparer’s information (if necessary), and either mailing the return or, better yet, having it electronically filed. If you owe taxes, you will also need to make a payment, with a bank transfer generally being the best option.

Now that Brian and Sarah have completed their taxes for 2023, they only need to focus on staying compliant with the IRS moving forward. The best way to do so is to stay aware of deadlines for expats, keep up to date on information for completing the returns to come in the future (including prior-year tax returns), and keep up to date on annual changes in tax policies.

Form 1040 is a notoriously complicated tax form, and even a minor mistake could have major implications for your tax bill—especially as an expat. We recommend always consulting a qualified expat tax professional rather than attempting to complete and file this form on your own.

Filing Form 1040 Doesn’t Have to Be Complicated

We hope this guide has helped you understand what Form 1040 means to you as an expat.

Contact us, and one of our customer champions will be happy to help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.