The Foreign Tax Credit: What Expats Need to Know

- What Is the Foreign Tax Credit?

- Who Qualifies for the Foreign Tax Credit?

- Who Can Claim the Foreign Tax Credit?

- How to Claim the Foreign Tax Credit

- What Taxes Can Expats Claim toward the Foreign Tax Credit?

- The Foreign Tax Credit vs. The Foreign Earned Income Exclusion

- Foreign Tax Credit Limit

- How to Calculate the Foreign Tax Credit

- Does the Foreign Tax Credit Carry Over?

- Get Expert Help with Your Foreign Tax Credit with Greenback!

One of the most common problems US expats face is double taxation—paying taxes twice on the same income. Fortunately, the IRS offers multiple tax credits and deductions to help expats avoid this costly burden. One example is the Foreign Tax Credit (Form 1116). Using this credit, many Americans living abroad are able to erase their US tax debt entirely.

Here’s what you need to know to take advantage of the Foreign Tax Credit and how to calculate Foreign Tax Credit.

Key Takeaways

- The Foreign Tax Credit allows American expatriates to offset their United States tax liability with foreign income tax obligations.

- Some taxpayers may not be able to use it, such as those who only have income from sources within the United States and those that do not pay any foreign taxes.

- Instead of claiming the foreign tax credit on Form 1116, there is the option to claim a deduction for foreign taxes paid as an itemized deduction on Schedule A of Form 1040.

What Is the Foreign Tax Credit?

The Foreign Tax Credit (FTC) lets US expats use their foreign income tax obligations to offset their US tax debt. To get a better understanding of how the Foreign Tax Credit works, we need to take a look at how tax deductions and tax credits work in general.

- Tax deductions reduce how much of your income is subject to taxation. Specifically, a deduction lowers your taxable income by the tax rate in your federal income tax bracket. For example, if you fall into the 22% tax bracket, a $1,000 deduction would reduce your final tax bill by 22% or $220.

- Tax credits reduce your tax bill by a dollar-for-dollar amount. This means that a $1,000 tax credit would reduce your final tax bill by the exact same amount—$1,000.

For Example, If you owe $2,000 in US taxes but can claim a $500 Foreign Tax Credit, you’ll only have to pay $1,500 ($2,000 – $500 = $1,500).

If you’re an American living abroad, you can use the Foreign Tax Credit to reduce your US tax liability based on the amount you’ve paid in income taxes to a foreign government. If you live in a country with a higher tax rate than the US, such as China, you can often use the credit to eliminate your US tax debt entirely.

However, there are limitations to what types of taxes you can include in the Foreign Tax Credit calculation, as well as the maximum amount you can claim.

Who Qualifies for the Foreign Tax Credit?

To qualify for the Foreign Tax Credit, you must meet the following criteria:

- You are a US citizen or tax resident

- You earn income from a foreign source

- You pay taxes on that income to a foreign government

For example, an American who works in Singapore—and whose income is thus taxed by the Singaporean government—would likely be able to claim their Singaporean income tax bill under the Foreign Tax Credit to offset their US tax bill.

The Foreign Tax Credit can only be used to offset US taxes on the same income that was taxed in the foreign country. Additionally, if you receive any foreign tax refunds, you may need to adjust your Foreign Tax Credit to avoid double-dipping.

Who Can Claim the Foreign Tax Credit?

If you’re an expat, understanding the eligibility criteria and which tax credit to claim can help you optimize your tax liability.

Expats Living in High-Tax Countries

Expats living in high-tax countries are better off claiming the Foreign Tax Credit. This credit allows them to claim a more significant value of US tax credits than they need to eliminate their US tax liability. They can then carry forward any excess credits for up to ten tax years, which can be applied to future income or carried back to the previous tax year. This is particularly useful for expats who have worked abroad for several years.

Expats with Earned Income

Expats who don’t pay foreign taxes or who pay them at a lower rate, whose only income is earned (and doesn’t exceed over $100,000), and who can meet either the Physical Presence Test or the Bona Fide Residence Test are generally better off claiming the Foreign Earned Income Exclusion. This provision allows them to exclude a certain amount of their foreign-earned income from US taxation.

Expats with Dependent Children

Expat parents with dependent children may want to consider claiming the Foreign Tax Credit over the Foreign Earned Income Exclusion. This is because the US Child Tax Credit is partially “refundable,” meaning parents can receive up to a $2,000 payment per child even if their US tax liability is already at $0 after applying for other available credits. The Foreign Earned Income Exclusion restricts parents from claiming refundable child tax credits.

Expats Hoping to Contribute to Roth IRAs

Expats hoping to contribute to Roth IRAs should also consider claiming the Foreign Tax Credit over the Foreign Earned Income Exclusion. This is because contributions to Roth IRA plans are made from post-tax reportable earned income. Expats who exclude all their income by claiming the Foreign Earned Income Exclusion have no reportable earned income, so they cannot contribute to Roth IRA plans. For this reason, expat parents wishing to claim the Child Tax Credit may also be better off claiming the Foreign Tax Credit.

How to Claim the Foreign Tax Credit

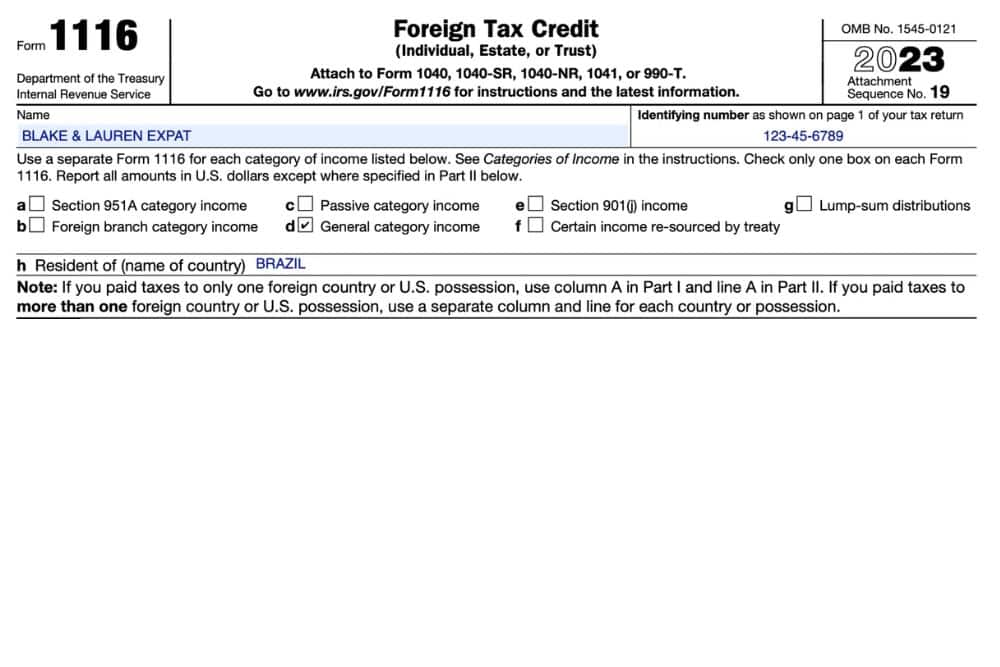

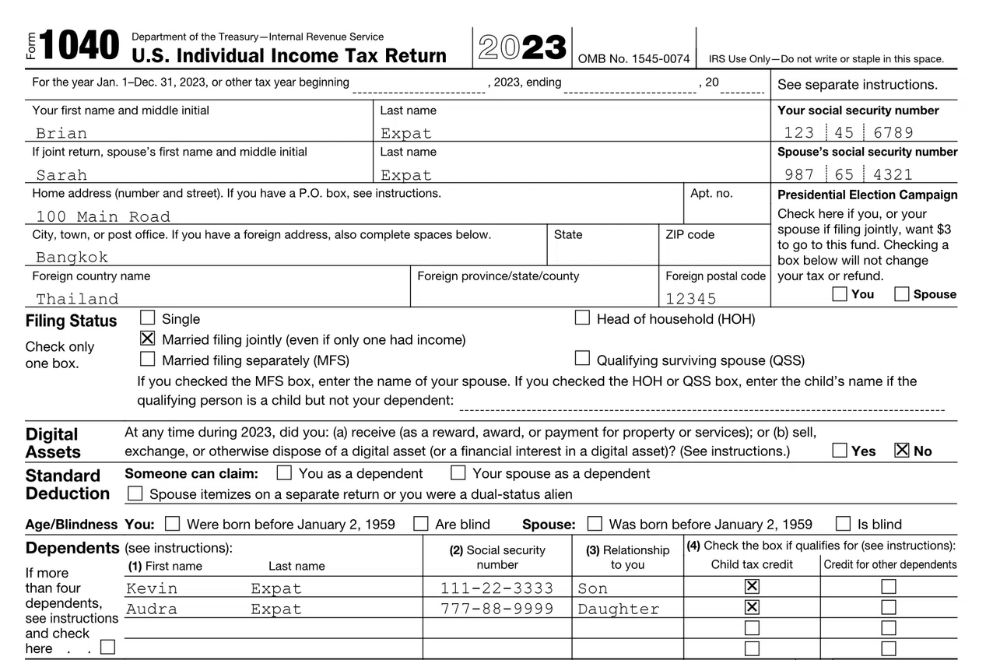

In most cases, you will claim the Foreign Tax Credit by filing IRS Form 1116. This two-page form requires you to fill out some basic information, including:

- Which country you owe your foreign income tax to

- What types of income the foreign government is taxing

- How much you owe (in both foreign currency and US dollars)

- What deductions, exclusions, and credits apply to your foreign tax debt

There are rare instances when you won’t need to file Form 1116 to claim the Foreign Tax Credit, such as:

- Your foreign income for the full tax year is entirely passive

- Your qualified foreign income for the tax year is $300 or less ($600 or less if filing a joint return)

- The entirety of your gross foreign income and foreign taxes is reported to you on a payee statement, such as forms 1099-DIV or 1099-INT, and you elect this procedure for the full tax year.

If any of the above conditions apply, you may be able to claim the Foreign Tax Credit directly on Form 1040, Schedule 3, without needing to file Form 1116.

Once you’ve completed Form 1116, you must attach it to your annual income tax return (IRS Form 1040) and file both simultaneously.

What Taxes Can Expats Claim toward the Foreign Tax Credit?

In order for an income tax payment to count toward the Foreign Tax Credit, all of the following must apply:

- The tax must be a Foreign Income Tax

- The tax must be your “legal and actual” foreign tax liability

- The tax must be mandatory

- You must have paid or accrued the tax

Let’s look at each of these qualifications in detail.

The Tax Must Be an Income Tax

You can’t claim just any tax under the Foreign Tax Credit, such as a property tax or sales tax. It has to be an income tax. (Or, if you live in a country without an income tax, you may be able to claim another tax imposed in place of an income tax.)

Some forms of foreign income tax are excluded, such as:

- Taxes on excluded income (for example, if you’re also claiming the Foreign Earned Income Exclusion)

- Taxes for which you can only take an itemized deduction

- Taxes from an international boycott operation

- Taxes paid to a country deemed to support international terrorism

- Taxes on foreign mineral income

- A portion of taxes on combined foreign oil and gas income

- Social Security taxes paid to a foreign government that has a totalization agreement with the US

The Tax Must Be Imposed on You

The foreign income tax you are claiming for the Foreign Tax Credit must be mandatory. It’s important to note that the Foreign Tax Credit can only be used to offset US taxes on the same income that was taxed in the foreign country. If the foreign tax is not mandatory or not imposed on you, you may not be able to claim the credit.

The Tax Must Be Your “Legal and Actual” Foreign Tax Liability

This means that you must actually owe or have paid the full amount of foreign income tax you’re claiming. Under IRS law, you are responsible for taking advantage of all possible means of reducing your foreign income tax bill, such as foreign credits and deductions. If you fail to do so, the excess amount you didn’t truly need to pay won’t count toward your Foreign Tax Credit.

You Must Have Paid or Accrued the Foreign Income Tax

In order to claim the Credit, you will need to show that you have already paid the qualifying foreign income tax you are claiming or that you have accrued or formally recognized the tax and intend to pay it. You also cannot claim income taxes that have been (or will be) refunded to you.

As you can see, the rules for what forms of taxation count toward the Foreign Tax Credit can be complicated. We always recommend consulting an expat tax professional when calculating your US tax bill. Otherwise, you could end up overpaying—or neglecting to pay the full amount you owe.

Use our simple excel calculator to get an estimate of how the foreign earned income exclusion will save you money. It will make your day!

The Foreign Tax Credit vs. The Foreign Earned Income Exclusion

As an expat, maximizing your tax savings is essential, and you don’t have to rely only on the Foreign Tax Credit (FTC) to do so. The Foreign Earned Income Exclusion (FEIE) is another way to reduce your US tax liability by excluding foreign income from your tax filing. However, deciding which one to use depends on your unique circumstances and location.

If you’re wondering how the FEIE differs from the FTC, here are some key points. The FEIE applies only to salaries and wages as a source of income, while the FTC encompasses all forms of gross income, such as rental and investment income. The FTC only applies if you pay taxes to your current country of residence.

The FEIE is a way for Americans living abroad to lower their US tax bill by excluding foreign income from US taxation, much like a tax deduction. To qualify for the FEIE, you must meet one of two criteria: be a bona fide resident of a foreign country (or multiple foreign countries) for an entire tax year or be physically present in a foreign country (or multiple foreign countries) for at least 330 full days during a given 12-month period.

The FEIE allows you to exclude a set amount of foreign income, which varies from year to year. For foreign income earned in the 2023 tax year, qualifying Americans can exclude up to $120,000.

Choosing between the FTC and the FEIE requires careful consideration of various factors, such as income type and source, housing expenses, future plans, dependents, residency, and local tax laws. Expats can claim both the FEIE and FTC, but not for the same income. To determine the best option for your situation, it’s always wise to consult a tax expert like Greenback.

Foreign Tax Credit Limit

There is a maximum Foreign Tax Credit that you can claim in any one year, which is based on several factors. If you pay foreign taxes above this limit, then what happens to the amount of foreign tax paid that you can’t claim as a Foreign Tax Credit? Do you just lose it? No. This excess is called a Foreign Tax Credit carry forward and can be used for up to ten years in the future to reduce US taxes owed. Any carry forwards not used in ten years expire and can no longer be used as a Foreign Tax Credit.

There is also an option to carry back Foreign Tax Credits for one year. This allows you to use excess credits in the current year and apply them to your tax return from last year to claim a refund. You file an amended return to do this.

Because the limit is based on prior year tax returns, taxpayers are advised to maintain accurate records regarding income earned abroad in order to avoid any surprises during the filing season.

How to Calculate the Foreign Tax Credit

If you’re wondering, “How much foreign tax credit can I get?” The answer is that you can claim a dollar-for-dollar representation of the qualified foreign income taxes you’ve paid. However, there is a limit to the amount of your claim that can be applied to a single tax year. To calculate your maximum credit amount and income limit, you must divide your taxable foreign income by your total taxable income, then multiply that by your US tax liability.

Example of Calculating the Foreign Tax Credit

Let’s say Jenna moved to Germany to work as an English teacher at a German school. Her salary in Euros is equivalent to $50,000, and she earns the equivalent of $1,000 in interest from her German bank account. She also has investments in the US that bring her a total of $10,000 in dividends.

As for the foreign taxes paid, Jenna pays $20,000 in income taxes to the German government out of her salary and another $200 for her interest income. She also owes $14,000 in taxes to the US government.

To calculate her Foreign Tax Credit, Jenna will need to separate her foreign income into passive and general categories and then apply the Foreign Tax Credit limit formula to each. Her dividends are from investments in the US, and the Foreign Tax Credit cannot be claimed against any tax due on her dividends.

Jenna’s total taxable foreign income is $51,000. Of that, $50,000 is general (her salary), and $1,000 is passive (the interest on her bank account).

- General Income: Jenna will divide her general foreign income ($50,000) by her worldwide taxable income ($61,000). This creates a percentage of roughly 81.2%. Jenna will then multiply that percentage by her US tax liability ($14,000), coming to $11,368. That will be the maximum Foreign Tax Credit Jenna can claim for general income.

- Passive Income: Jenna will divide her passive foreign income ($1,000) by her worldwide taxable income ($61,000). This creates a percentage of roughly 1.64%. Jenna will then multiply that percentage by her US tax liability ($14,000), coming to roughly $230. That will be the maximum Foreign Tax Credit Jenna can claim for passive income.

The total dollar-for-dollar Tax Credit that Jenna can hypothetically claim is $21,000 ($20,000 + $1,000). However, because of the limit in place, she can only actually use $11,598 for the current year ($11,368 + $230).

In the end, Jenna’s $14,000 US tax bill will be reduced to $2,402 ($14,000 – $11,598).

In this example, Jenna could only use $11,598 of the $21,000 Foreign Tax Credit technically available. This leaves an unused excess of $9,402 that she could carry back one year and/or forward up to 10 years, helping to protect even more of her foreign income from double taxation by the US government.

Reality is rarely as simple as the above example, though. The factors determining what income taxes you can include and how they should be calculated are incredibly complex.

Does the Foreign Tax Credit Carry Over?

Yes. If you do not use the full credit potentially available, the excess will carry over to future years, up to a limit of 10 years later. Or, if you were short on credits the previous year, you can carry the excess back to cover them.

In the example shown above, Jenna could only use $11,598 of the $21,000 Foreign Tax Credit technically available. This leaves an unused excess of $9,402 that she could carry back one year and/or forward up to 10 years, helping to protect even more of her foreign income from double taxation by the US government.

Get Expert Help with Your Foreign Tax Credit with Greenback!

We hope that this guide has given you a better understanding of what the Foreign Tax Credit is and how it might help you reduce your tax bill.

Don’t let the complexities overwhelm you, Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.