New Greenback Expat Tax Services Survey Reveals US Expat Government Dissatisfaction

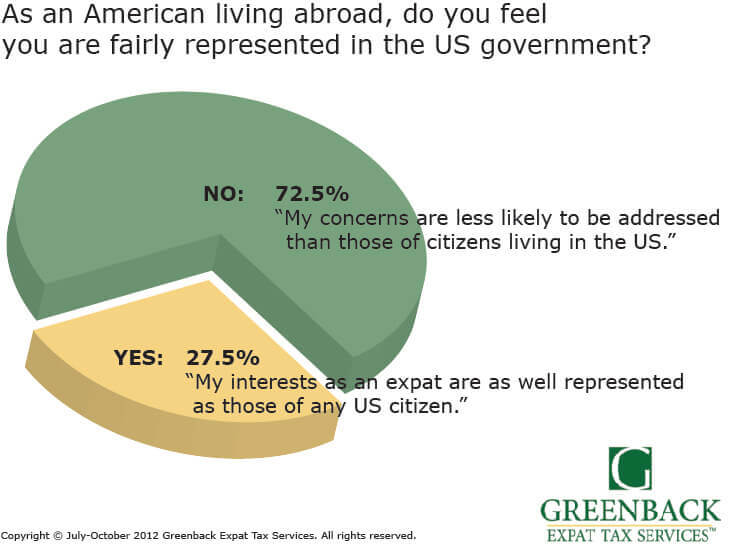

Survey results show that the majority of American expat polled do not feel fairly represented by the US Government. Implications of the dissatisfaction may play a role in the upcoming elections as an estimated 6 million US citizens currently living overseas cast their votes in the hopes of having their concerns and needs addressed.

New survey results show that more than 72% of U.S. expatriates polled do not feel fairly represented by the U.S. Government. The survey also found that, of those polled, 74% were either prepared or planning to vote. Conducted by Greenback Expat Tax Services, which specializes exclusively on American expat tax services, the results represent a growing dissatisfaction among Americans living overseas with the lack of support and attention paid to their unique needs. “We’re not surprised by our survey’s results,” said David McKeegan, Greenback Expat Tax Services President. “For years, we’ve been hearing from our customers a mounting swell of frustration and dissatisfaction with the government as it relates to addressing their concerns, particularly when it comes to their expat tax preparation.”

It’s estimated that there are roughly 7.6 million American expatriates currently living overseas. That number may play an important role in the upcoming election: it’s larger than the population of 34 US states per capita.

“Last night’s first presidential debates focused heavily on US taxes,” said Mr. McKeegan. “However, the lack of focus on expat issues, and particularly on US expat taxes, is one of the main reasons many of our customers feel unfairly represented,” he noted.

Stemming from a crack down by the U.S. Treasury Department on money laundering and the use of international banking systems triggered by the Sept 11, 2001, terrorist attacks as well as by the financial crisis of recent years, expats are finding themselves caught in overseas tax return issues that shouldn’t necessarily impact them. According to Mr. McKeegan, “Policies such as the Foreign Account Tax Compliance Act (better known as FATCA) and Report on Foreign Banks and Financial Accounts (FBARs) weren’t designed with the average American expatriate tax return in mind. Yet, they need to comply nonetheless.”

The deadline to file taxes is October 15. The deadline to register as an absentee overseas voter is also nearing, starting with October 6 to Election Day, depending on which U.S. state the voter registers. “We encourage all of our customers to register and vote,” added Mr. McKeegan. “Now is the time to act on their expat tax return concerns and have their united voice heard.”

The survey was issued to Greenback Expat Tax Services customers in July 2012 and received 115 tallied responses.