What Are the U.S. Tax Requirements for Foreign Partnerships?

- Do I Have to Report My Foreign Partnership to the IRS?

- Does the Foreign Partnership Itself Owe U.S. Taxes?

- When Do I Need to File Form 8865?

- How Is My Foreign Partnership Income Taxed?

- What's My Filing Timeline for Foreign Partnership Returns?

- What Common Mistakes Should I Avoid?

- What If I Haven't Filed in Previous Years?

- Working with Greenback: Expert Foreign Partnership Support

- Related Resources

American expats who partner in foreign businesses face complex U.S. reporting requirements that most don’t anticipate until they receive IRS penalty notices. According to the IRS, partnerships are the second most common business structure among U.S. taxpayers; however, foreign partnership reporting violations trigger automatic penalties starting at $10,000 per year. The relief: proper filing eliminates most tax liability for expats in foreign partnerships, and even late filers can often qualify for penalty relief.

Do I Have to Report My Foreign Partnership to the IRS?

Yes. As a U.S. citizen or resident, you must report your share of foreign partnership income on your U.S. tax return, even if the money never enters the United States. The U.S. taxes worldwide income, which includes your distributive share of partnership profits, whether or not the partnership distributes cash to you.

What Defines a Foreign Partnership?

A foreign partnership is any partnership not created or organized in the United States or under U.S. state law. Typical examples for expats:

- Consulting firms abroad: You and another expat form a consulting business in Singapore serving regional clients.

- Freelancer collectives: You partner with other freelancers in Portugal to share office space, resources, and client referrals.

- Real estate investments: You co-own rental properties in Mexico with local or expat partners.

- Joint ventures: You partner with a foreign company to operate a business abroad.

- Professional practices: You join a law, accounting, or medical practice in Canada as a partner.

If you’re splitting profits with others in an unincorporated business structure abroad, you likely have a foreign partnership for U.S. tax purposes.

Get Help With Your Foreign Business Taxes Beyond Partnerships

Does the Foreign Partnership Itself Owe U.S. Taxes?

No. Partnerships are pass-through entities. The partnership doesn’t pay U.S. tax; instead, each partner reports their share of income, deductions, and credits on their individual tax return.

When Must the Foreign Partnership File Form 1065?

The partnership must file Form 1065 (U.S. Return of Partnership Income) if it has either:

- Effectively Connected Income (ECI): Income from a U.S. trade or business, or

- U.S. Source Income: Income derived from U.S. sources (dividends, interest, rents from U.S. property)

Example – Partnership Filing Requirement:

Sofia and Marco, both U.S. expats living in Spain, operate a digital marketing agency serving European clients. The partnership has no U.S. source income and no U.S. business activities.

Filing requirement: The partnership does NOT need to file Form 1065 because it has no U.S. source income or effectively connected income.

However, both Sofia and Marco must report their partnership income on their individual U.S. tax returns using Schedule C or Schedule E.

Exceptions for Small Foreign Partnerships

A foreign partnership with U.S. partners may skip Form 1065 filing if ALL of these apply:

- No effectively connected income

- U.S. source income under $20,000

- Less than 1% of partnership items allocable to U.S. partners

- Not a withholding foreign partnership

A foreign partnership with NO U.S. partners may skip Form 1065 if all required Forms 1042 and 1042-S were filed and tax was withheld correctly.

When Do I Need to File Form 8865?

Form 8865 (Return of U.S. Persons With Respect to Certain Foreign Partnerships) has stricter requirements than Form 1065 and applies directly to individual U.S. partners. You must file Form 8865 if you fall into any of the four categories.

Category 1: Controlling U.S. Partner

You owned more than 50% of the partnership at any time during the tax year.

Example:

- James owns 60% of a consulting firm in London. His partner owns 40%.

- Form 8865 requirement: Yes, Category 1 filer (controls the partnership).

Category 2: Significant U.S. Partner in U.S.-Controlled Partnership

You owned at least 10% of the partnership, AND the partnership was controlled by U.S. persons (each owning at least 10%).

Example:

- Three U.S. expats each own 33.3% of a software development firm in India.

- Form 8865 requirement: Yes, all three file as Category 2 filers (each owns 10% or more, and together they control the partnership).

Category 3: Contributions Over $100,000

You contributed property worth $ 100,000 or more to the partnership during the year (or cumulative contributions during a 12-month period exceeded $100,000), and you owned at least 10% of the partnership after the contribution.

Example:

- Maria contributes $120,000 in equipment to a manufacturing partnership in Vietnam in exchange for a 15% stake in the partnership.

- Form 8865 requirement: Yes, Category 3 filer (contribution over $100,000 and owns 10%+).

Category 4: Reportable Events

You had certain acquisitions, dispositions, or changes in proportional interest during the year.

Reportable events include:

- Acquiring a 10%+ interest

- Disposing of a 10%+ interest (complete or partial)

- Your interest changing from less than 10% to 10%+ (or vice versa)

Example:

- Chen owned 8% of a partnership in Singapore. During 2025, he purchased an additional 5% interest, bringing his total to 13%.

- Form 8865 requirement: Yes, Category 4 filer (reportable event: crossed the 10% threshold).

What If I Don’t File Form 8865?

Penalties start at $10,000 per year for failure to file. If the IRS sends a notice and you still don’t file within 90 days, you face an additional $10,000 penalty for each additional 30-day period (up to a maximum).

Additionally, the IRS can reduce your foreign tax credits, potentially increasing your actual tax liability by thousands.

Worried about foreign partnership reporting? Greenback specializes in helping expats with complex foreign business structures, including partnership filing requirements, Form 8865 preparation, and penalty relief for late filers. See how we help foreign business owners

How Is My Foreign Partnership Income Taxed?

Your share of partnership income is taxed based on the character of the income (ordinary business income, capital gains, dividends, etc.) and whether you can apply U.S. expat tax benefits.

Applying the Foreign Earned Income Exclusion

If the partnership income qualifies as foreign earned income (compensation for personal services), you may exclude up to $130,000 (2025 tax year, filed in 2026) using the Foreign Earned Income Exclusion.

Partnership income typically appears on Schedule K-1, which reports your distributive share. You’ll report this K-1 income on your individual Form 1040, where you can apply FEIE or Foreign Tax Credits.

What qualifies:

- Active participation in a partnership business

- Income from personal services (consulting, professional services, manual labor)

- Your share of guaranteed payments for services

What doesn’t qualify:

- Passive rental income

- Dividends or interest

- Capital gains

- Portfolio income

Example – FEIE Application:

David is a 50% partner in an architectural firm in Germany. His share of 2025 partnership income:

- Guaranteed payments for services: $80,000

- Distributive share of firm profits: $60,000

- Total partnership income: $140,000

FEIE application:

- Can exclude: $130,000 (meets Physical Presence Test)

- Taxable income: $10,000

U.S. tax owed: Approximately $1,000 (after standard deduction if available)

Applying the Foreign Tax Credit

If you can’t use FEIE (income exceeds the exclusion, or income is passive), you can claim the Foreign Tax Credit for foreign taxes paid on partnership income.

Example – Foreign Tax Credit:

Lisa is a 30% partner in a French real estate partnership that owns rental properties. Her 2025 partnership income:

- Rental income share: $85,000

- French taxes paid on this income: $22,000

U.S. tax calculation:

- U.S. tax on $85,000: ~$15,000

- Foreign Tax Credit: $22,000 (limited to $15,000 U.S. tax)

- U.S. tax owed: $0

- Excess credit: $7,000 (can carry forward 10 years)

Self-Employment Tax on Partnership Income

If your partnership income is from a trade or business and you’re actively involved, you likely owe self-employment tax (15.3% on net earnings).

Critical point: The Foreign Earned Income Exclusion does NOT eliminate self-employment tax. Income excluded from income tax under FEIE is still subject to self-employment tax.

Example – Self-Employment Tax:

Paulo is a partner in a consulting firm in Brazil. His 2025 partnership income: $100,000

Taxes owed:

- Income tax: $0 (excludes $100,000 using FEIE)

- Self-employment tax: ~$14,130 (15.3% on $92,350 after deduction)

Total U.S. tax: $14,130 (many expats miss this)

Exception: If your home country has a Totalization Agreement with the U.S. (like Germany, UK, France, Canada), you may be exempt from U.S. self-employment tax if you’re paying into the foreign social security system.

What’s My Filing Timeline for Foreign Partnership Returns?

Partnership return (Form 1065):

- Deadline: 15th day of the 3rd month after tax year end

- For calendar year partnerships: March 15

- Extension available: 6 months (Form 7004)

Individual partner return:

- Deadline: April 15 (or June 15, automatic extension if living abroad)

- Form 8865 attached to your individual return (same deadline)

- Extension available: October 15 (Form 4868)

Critical timing issue: If the partnership files Form 1065, you need the Schedule K-1 from the partnership to complete your individual return. If the partnership misses its March 15 deadline, you may need to file for an extension.

What Common Mistakes Should I Avoid?

Mistake 1: Assuming the partnership files U.S. returns

Many expats assume that if the partnership operates entirely abroad, no U.S. filing is required. Wrong. If YOU are a U.S. person, you must report your partnership income regardless of where the partnership operates.

Mistake 2: Not filing Form 8865 when required

The $10,000 penalty applies even if you owe no tax. Track your ownership percentage and contributions carefully.

Mistake 3: Forgetting self-employment tax

FEIE excludes income from income tax but not from self-employment tax. Budget for this 15.3% tax.

Mistake 4: Not claiming Foreign Tax Credits

If you pay foreign taxes on partnership income, claim the credit using Form 1116. Don’t pay twice.

Mistake 5: Mixing partnership and personal accounts

Keep separate bank accounts. Mixing complicates FBAR reporting and makes income tracking difficult.

Mistake 6: Not documenting guaranteed payments

If the partnership pays you guaranteed payments for services, document these separately. They’re treated differently from distributive shares.

Confused about foreign partnership filing? Greenback specializes in helping expats navigate partnership tax requirements, prepare Form 8865, optimize FEIE and Foreign Tax Credit applications, and handle late filing penalty relief. See how we help foreign business owners

What If I Haven’t Filed in Previous Years?

If you’ve had unreported foreign partnership income or unfiled Form 8865 obligations, you can often qualify for penalty relief through the Streamlined Filing Procedures.

Requirements:

- File the last 3 years of tax returns (including Form 8865)

- File the last 6 years of FBARs (if foreign accounts exceeded $10,000)

- Certify your failure to file was non-willful (not intentional)

Result: No penalties if you qualify, bringing you into compliance.

According to IRS data from 2016-2021, 62% of expats owe $0 in U.S. taxes after applying available exclusions and credits. Most partnership income, when properly reported with FEIE or Foreign Tax Credits, results in little or no U.S. tax owed.

Working with Greenback: Expert Foreign Partnership Support

Foreign partnership taxation encompasses pass-through entity rules, international tax provisions, self-employment tax calculations, and complex reporting requirements, all of which are presented across multiple forms. Getting it right requires specialized expertise in expat business taxation

If you’re ready to be matched with a Greenback accountant who specializes in foreign business taxation, click the get started button below. For general questions about foreign partnerships or working with Greenback, contact our Customer Champions.

Get Your Foreign Partnership Reporting Done Right.

This article provides general information about U.S. tax requirements for foreign partnerships. Tax laws change frequently, and individual circumstances vary. This content is for educational purposes only and does not constitute tax or legal advice. Always consult with qualified tax professionals before making business or tax planning decisions.

Related Resources

Foreign Business Taxation:

- What Tax Forms Do I Need to File for My Foreign Business?

- Form 8865: Return of U.S. Persons With Respect to Certain Foreign Partnerships

- Form 1065: Guide for American Expats with Partnership Income

- Schedule K-1 for American Expats: What You Need to Know

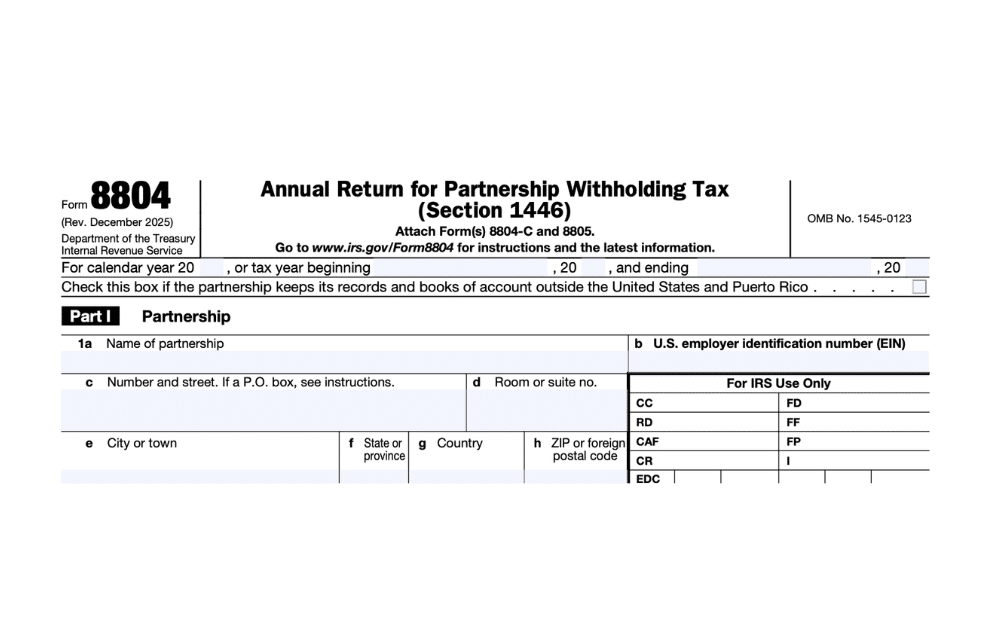

- Form 8804 & 8805: Partnership Withholding Requirements

- Schedule C for Expats: Self-Employment Income Abroad

- Self-Employed Expat Taxes: What You Need to Know

Tax Benefits for Partnership Income:

- Foreign Earned Income Exclusion: How to Claim

- Foreign Tax Credit: How Expats Can Reduce U.S. Taxes

- Form 1116: Claiming the Foreign Tax Credit