Renting My House While Living Abroad: Understanding US Expat Taxes

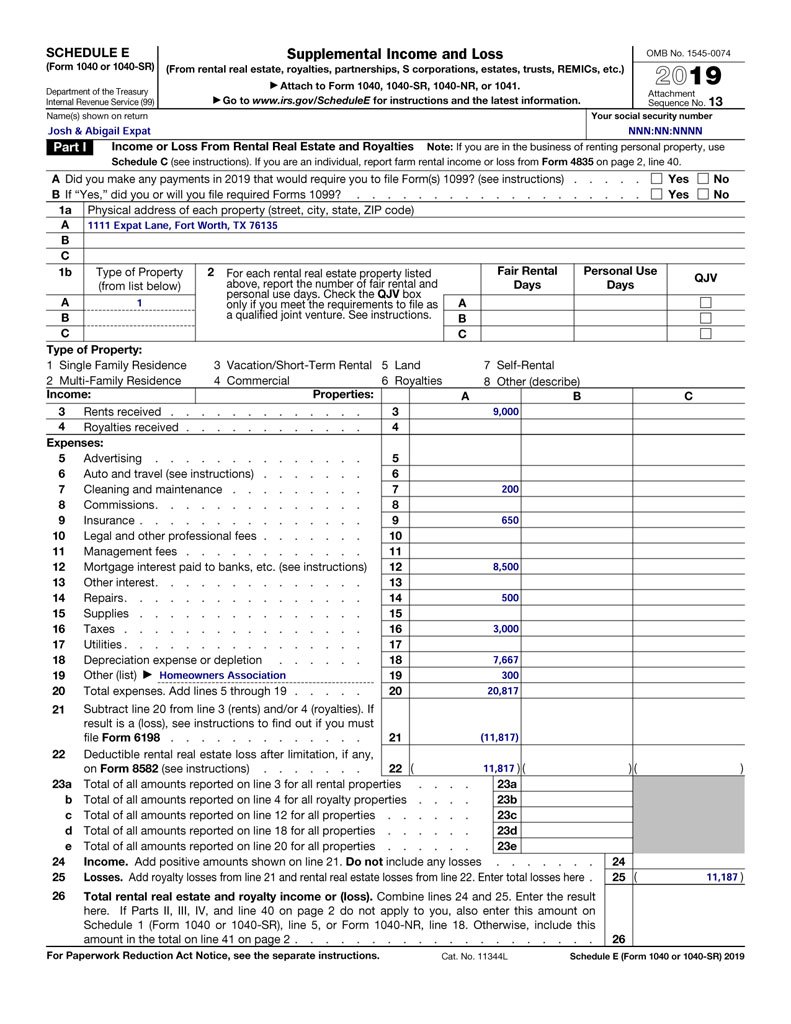

How are your US expat taxes affected when renting my house while living abroad? Renting is a good way to retain the equity built in a home, while making the property pay for itself over time. If you have decided to rent out your home, the related income and expenses must be reported on your US expat taxes, and this will be done via Schedule E, Supplemental Income and Loss.

Completing Schedule E for US Expat Taxes – Record-Keeping

Good recordkeeping throughout the year is essential to accurate US expat tax reporting of the transactions associated with rental properties. If you’ve opted to hire a rental management company, your personal responsibility will be somewhat relieved in that you will be provided with an organized statement at the end of the year that lists your income and detailed expenses, simplifying your US expat tax preparation.

However, these management companies often charge a significant percentage of the gross income; so many expatriates opt to manage their own property from abroad. If you choose to do this, it’s recommended that you maintain electronic records of all your transactions from the beginning of business via an Excel spreadsheet or more elaborate rental property management software. Developing a habit of good record keeping will help to ensure that all of your expenses are being captured, and thus reduce your overall US expat tax liability.

So what expenses do you need to track?

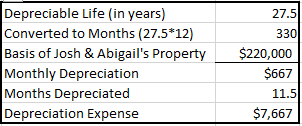

One of the largest US expat tax deductions and often one of the most overlooked is the depreciation associated with the rental property. From the date that you offer your house for rent, you can begin depreciating the property over a 27-and-a-half-year period. The amount you depreciate, or “basis,” will be the lesser of the fair market value of the home, or the adjusted basis (typically your purchase price, adjusted for any improvements). We will demonstrate this aspect of the rental property business in more detail in our example below.

Other deductible expenses on your US expat taxes include mortgage interest, homeowner association dues, cleaning, maintenance, repairs, taxes, and even money you spend on travel to collect rent or repair your property. Be diligent in tracking all of these expenses.

What are the tax implications of renting your primary residence?

Naturally, all of the amounts that you receive as rent will be reported as income. Also, any amount that your tenant pays you for services, such as appliances or window repair, would be reported as income. These are some of the tax implications of renting your primary residence.

Security deposits that you receive that you expect to pay back will not be taxable to you on your US expat taxes. However, if the tenant defaults on their payments or damages the property and does not get their security deposit returned, you will then claim that deposit as income.

In addition, if a tenant barters services in exchange for rent, then you will claim the fair market value of the rent on that property as income. However, you will be able to claim the same amount as an expense on your US expat taxes.

Completing Schedule E: Josh and Abigail Expat – Can I Rent My House and Live Abroad?

Once you’ve gotten all of the income and expenses associated with the property organized, you’ll be ready to complete the Schedule E of your US expat taxes. To better demonstrate the process of completing the form, let us introduce you to Josh Expat.

Josh and his wife, Abigail, are US citizens and have lived in Texas all their lives. They got married in 2013, bought their first home for $220,000 in 2015 and have lived there happily for six years. Josh has a great job as a financial consultant, and Abigail is a stay-at-home mom to their two beautiful children.

In December 2020, Josh is offered a position in London, and he and his family move abroad right after Christmas. While the market value of their home is attractive at $280,000 when they move, they have too many memories and begin to think, can I rent my house and live abroad? Abigail insists that she can handle the management of the property from abroad, so they forego engaging a property management group.

They are lucky enough to find a renter immediately, who moves in January 1, 2020. Their renter pays $550 of the $750 security deposit, and barters the other $200 in exchange for cleaning services. The tenant pays her rent of $750 on time every month and covers the utilities herself. However, Josh and Abigail continue to pay the Homeowners’ Association dues (Abigail was the Treasurer, after all!) of $300 annually.

Because Josh and Abigail have been good at maintaining their home, they have minimal repairs of only $550 throughout 2020. Their property taxes are escrowed with their mortgage payment, and they receive a 1098 at the end of the year reporting $8,500 in mortgage interest and $3,000 in real estate taxes. They also pay $650 for the year for property insurance. Armed with all of this information, we can successfully complete their Schedule E for 2021 US expat taxes, as follows:

You will notice that you can list three different properties (A, B or C) on each Schedule E. This is convenient if you have multiples properties or duplexes to report on your US expat taxes.

There are a couple of important discussion points regarding the Josh & Abigail’s Schedule E: bartered services and depreciation. If you remember, Josh & Abigail applied a $200 credit toward their tenant’s security deposit in exchange for cleaning services. However, in theory, they paid her $200 for cleaning services, and she turned around and gave the money back to them as her security deposit, even though money did not physically change hands. They can claim a $200 cleaning expense on their US expat taxes. However, if their tenant moves out with no balance due and no damage to the apartment, she will receive the full $750 back as a security deposit. The deposit is not taxable to Josh & Abigail, so it is not reported on the Schedule E of their US expat taxes.

Depreciation expense is likely the most difficult part of the Schedule E for most taxpayers. All residential rental real estate is depreciated monthly over a 27-and-a-half-year period, and it always starts on the 15th of the month. So, in the example of Josh and Abigail’s US expat taxes above, they were allowed to depreciate 11 and a half months in 2019. In 2020, they will be able to depreciate the entire 12 months. The calculation is as follows:

You may have noticed that the Schedule E downloaded from the IRS website has a second page. However, these parts (Parts II, III, and IV) only concern partnerships, S corporations, estates and trusts. If you do not have your property management established as one of these entities, you can disregard this page on your US expat taxes.

How Much of a Loss Can I Deduct on My US Expat Taxes?

Rental real estate properties are often a source of debate among tax preparers regarding the deductibility of losses. If you and your spouse actively participated in rental real estate, you can deduct up to $25,000 of the loss on your US expat taxes. But what does “participated” exactly mean?

If you own at least 10% of the property, and you were active in making management decisions, then you are deemed to have materially participated in the rental real estate activity. If you do not actively participate, then your loss cannot exceed the amount of income generated by the activity on your US expat taxes.

Rent House and Move Abroad: What if I use a property management company?

Generally speaking, the property management company will wholly manage your property, and alleviate you of all management decisions, should you opt to rent a house and move abroad. However, having a discussion with the property management group about remaining active in management decisions may be beneficial to you from a tax perspective if you are facing a loss on the property. You can meet the active participation test if you remain active in approving new tenants, establishing lease provisions and approving property improvements. Doing so may likely reduce the final payment on your US expat taxes.

For More On US Expat Taxes

We have put together a blog post that covers the many opportunities to save money on your US expat taxes via deductions and credits. If you need help preparing your Schedule E or are thinking, should I be renting my house while living abroad, please contact us.

Use our simple excel calculator to get an estimate of how the foreign earned income exclusion will save you money. It will make your day!