Form 2350 vs. Form 4868: What Is the Difference?

One of the perks of living abroad is an automatic two-month extension to file your taxes. While most Americans have to scramble to complete their taxes by April of each year, expats don’t have to file until June.

Of course, even that may not be enough time to get everything ready for filing. Expat taxes are nothing if not complicated. Fortunately, Americans living overseas can request additional extensions by filing Form 4868 or Form 2350. But what is the difference between Form 4868 and Form 2350? Which should you file?

In this guide, we’re going to answer those questions and more. Here’s what you need to know.

Key Takeaways

- Form 4868 and Form 2350 are both used to request a filing extension for US tax returns.

- All taxpayers can use Form 4868 to request a filing extension to October 15 (or a few days later if the 15 falls on a weekend or holiday).

- Americans living overseas can use Form 2350 to request a filing extension if more time is needed to qualify for the Foreign Earned Income Exclusion.

What Is the Difference Between Form 4868 and Form 2350?

Form 4868 and Form 2350 are both IRS forms used to request a filing extension. However, there are several key distinctions between them. Form 4868 is used to apply for a standard extension to October 15. Form 2350, on the other hand, is intended to help new expatriates qualify for the Foreign Earned Income Exclusion.

Let’s look at each one in detail.

Form 4868

Form 4868 is the standard IRS form all taxpayers can use to request a filing extension for their tax return. If the IRS accepts this request, the filing deadline will be extended to October 15 ( or a few days later if the 15 falls on a weekend or holiday). This will allow taxpayers six months to file after the original April deadline. For expats, it will really be a four-month extension from the June deadline for Americans living outside of the US and Puerto Rico. This will allow taxpayers six months to file after the original April deadline. For expats, it will really be a four-month extension from the June deadline for Americans living abroad.

Virtually everyone is eligible for this extension. To qualify, you only have to file Form 4868 by the original due date for your tax return. You don’t even have to explain why you need more time. In most cases, the IRS will grant your request with no questions asked. (The IRS will only contact you about your request if it is denied. If you don’t hear from the IRS, you can assume that they granted the extension.)

Form 4868 will automatically extend the filing deadline for the FBAR along with your tax return.

An extension until October 15th is automatically granted for FBARs, so nothing needs to be filed. Some states, including California, automatically grant extensions to file. Extensions for New York returns can only be filed directly on the NY Department of Revenue’s website. Many states grant an automatic extension if a federal extension was filed and approved.

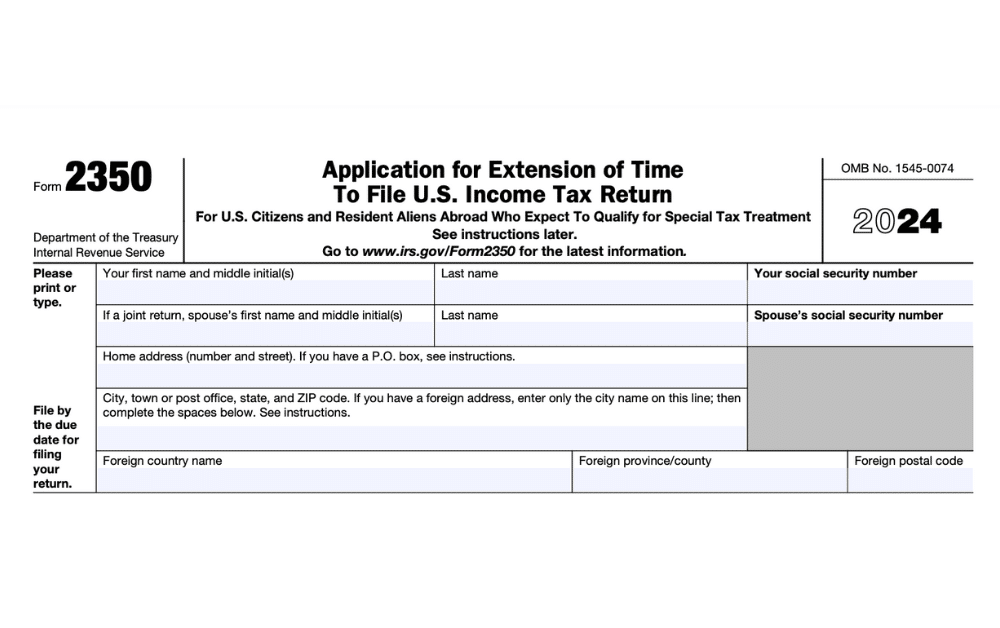

Form 2350

Form 2350 is only for Americans living abroad. Using this form, expats can request more time if needed to qualify for the Foreign Earned Income Exclusion (FEIE). To claim this tax benefit, you must pass either the physical presence test or the bona fide residence test. Both tests require you to live outside of the US for a certain amount of time.

For the 2024 tax year (filed in 2025), the Foreign Earned Income Exclusion (FEIE) has been increased to $126,500.

If you recently moved abroad and need more time to meet the requirements of either test, you can file Form 2350 to request a filing extension. If granted, this will extend your filing deadline until 30 days after you become eligible for the FEIE. You can then claim the Foreign Earned Income Exclusion on your tax return.

To file this form, you must reasonably expect to qualify for the Foreign Earned Income Exclusion in the foreseeable future. Just like Form 4868, Form 2350 must be filed by the original deadline for your tax return.

Form 2350, unfortunately, cannot be electronically filed – it must be sent through postal mail. Extension approvals are also sent by postal mail. One good thing about this extension is that you can request the approval be sent directly to your tax professional.

Requesting an Extension to December 15 Without Form 2350

Form 2350 is only for Americans who need more time to qualify for the FEIE. If you need more time to prepare your tax return after the October 15 extension, Americans overseas can request an additional discretionary two-month extension from the IRS. This would extend the filing deadline to December 15.

To qualify for this extension, you must first file Form 4868 for the October 15 standard extension. Once you have filed Form 4868, you must mail a letter to the IRS before October 15 explaining why you require another two months to file.

For example, you could inform the IRS that you are waiting to receive documentation about an investment. Alternatively, you might need more time because your host country’s tax assessment will not be available until after October 15.

You will mail your letter to the following address:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0045

Because this extension is discretionary, taxpayers are not guaranteed an additional two months simply because they ask for more time. You will need to offer a reasonable explanation in your letter to explain why you are delayed in completing your expatriate tax return. As with form 4686, the IRS will only contact you if your request is denied.

You cannot request this discretionary extension if you have already filed Form 2350, and it does not apply to the FBAR.

What If I Owe Money on My Expat Tax Return?

It’s important to note that an extension to file is not an extension to pay. You must estimate and pay your taxes by the original filing deadline in April. (This is true regardless of whether you live in the US or abroad. The automatic two-month extension to June does not apply to the deadline for payment.)

Failing to pay your taxes on time will result in penalties and interest. The good news is that if you overestimate your taxes and pay more than you end up owing, you will receive a refund once you file your return.

If you’re not sure about how much tax you owe, it’s best to estimate conservatively and err on the side of caution. You can always amend your return later if the final figures differ from what you estimated.

If you’re behind on your US taxes, you may qualify for a special compliance program to get back on track without penalties. Download our Streamlined Filing Eligibility guide to understand if you qualify.

What Happens If I Don’t File an Extension or My Extension Is Denied?

If you miss the filing deadline without an extension granted, you will be subject to late filing penalties and interest on any taxes owed. If you think you need more time to file, request an extension as quickly as possible to avoid this.

If, for any reason, you’re hit with a penalty, there is a first-time penalty abatement (FTA) waiver. The IRS may grant relief to taxpayers from failure-to-file, failure-to-pay, and failure-to-deposit penalties if the criteria are met. The policy behind this procedure is to reward taxpayers for having a clean compliance history; everyone is entitled to one mistake.

Beyond this, you can use the Streamlined Filing Compliance Procedures. This tax amnesty program allows some Americans living overseas to catch up on their tax obligations without facing the usual penalties.

To qualify for this program, all you have to do is:

- Self-certify that you failed to file because you didn’t know you were supposed to

- File the last three delinquent income tax returns and pay any taxes you owed during that period

- File FBARs for the past six years

Once you’ve completed these steps, you will be in compliance with IRS regulations. In some cases, you may even receive a refund for previous years.

Don’t wait to use the Streamlined Filing Compliance Procedures! If the IRS contacts you about your delinquency before you start the process yourself, you may lose the privilege of amnesty. In that case, you will have to pay the standard penalties.

Filing an Extension Doesn’t Need to Be Complicated

Many people wonder if filing an extension will somehow negatively affect their tax situation. It does not. Millions of Americans file extensions each year, though it is always recommended that you file as soon as you can so that you can complete your taxes for the year.

Even if you do have to file an extension because you are waiting for additional information, you can normally have most of your return prepared while waiting.

We hope this guide has helped you understand the essential distinctions between Form 4868 and Form 2350.

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.