FATCA: 5 Things You Need to Know

The Foreign Account Tax Compliance Act, commonly known as FATCA, is a pivotal piece of legislation that has reshaped the landscape of international banking and finance for Americans abroad. Enacted as a key component of the HIRE Act in 2010, FATCA’s primary objective is to combat tax evasion by US persons holding assets in offshore accounts and investments.

This guide aims to provide a clear explanation of what FATCA reporting entails, its significance, and the steps necessary to ensure adherence to IRS regulations. We’ll delve into the specifics of FATCA, including who is required to report, what needs to be reported, and how to complete the reporting process accurately. By understanding these key elements, expatriates and foreign financial institutions can navigate FATCA requirements more confidently and remain compliant with US tax laws.

Key Takeaways

- FATCA requires US citizens to report their foreign assets if they exceed certain thresholds.

- Failing to file a FATCA report when required could result in severe penalties.

- If you have failed to file when required, you can become compliant without having to pay the usual heavy fines.

What Is the Foreign Account Tax Compliance Act (FATCA)?

The Foreign Account Tax Compliance Act (FATCA) was created as part of the HIRE Act of 2010 and was designed to uncover tax cheats hiding money and assets offshore. FATCA created new information reporting and withholding for payments made to certain foreign financial institutions and foreign entities. This program is designed to make it easier for the US government, specifically the IRS, to keep track of US persons and businesses earning income through foreign bank accounts.

FATCA is not administered by the IRS.

It is run by a different agency within the US Treasury Department—the Financial Crimes Enforcement Network, or FinCEN. While FinCEN is not a part of the IRS, they can and do share information at times.

What Are FATCA Filing Requirements?

Under FATCA filing requirements, all US citizens are required to report certain foreign assets to the IRS if they exceed certain thresholds. These thresholds are determined based on two criteria. First, do you live in the United States? Second, do you file as married filing jointly?

Many local privacy laws prevent foreign financial institutions from reporting information on any of their account holders, including Americans. FATCA specifically states that these rules must be disregarded even when this would be a direct violation of a country’s law. So that foreign international institutions do not break their own country’s laws, the US government has arranged for foreign financial institutions to report information to their country’s national government and for that national government to report information on American account holders directly to the US government. If a foreign financial institution does not report the FATCA information requested by the US, then 30% of any payments they received from the US will be withheld. The US government has therefore been successful in obtaining information on overseas accounts owned by Americans.

While the primary goal of FATCA is to force tax evaders to come forward, US expats are often caught in the crossfire. Of course, it makes sense that expats will have assets and accounts overseas as it is part of their daily life. With the extra reporting and private nature of the reporting, the Act has been called a violation of privacy.

However, the fact remains that FATCA is a requirement for all US citizens, including expats. So what do you need to know to remain compliant? Here are 5 tips to know when filing FATCA:

1. It’s Similar to–but Different from–FBAR

The Foreign Bank Account Report (FBAR) is similar to FATCA, as it is also designed to uncover tax evaders who use bank accounts abroad to hide money from Uncle Sam. FBAR reporting is different, as it pertains to foreign account balances of $10,000 or higher (even if accounts only held that balance for one minute!) If it applies, you must file FinCEN 114 electronically by October 15 of each year. FBAR is just about accounts held by foreign financial institutions, such as bank accounts, retirement accounts, and certain insurance accounts that have a cash surrender value. FBARs do not extend to any assets held outside of foreign financial institutions, such as paper stock certificates or other paper-based forms of business ownership or investment ownership.

On the other hand, FATCA is more comprehensive. You do have to report almost all foreign financial assets, including those held in a financial institution and those held outside of a financial institution. However, there are a few items for assets held outside of financial institutions that do not have to be reported under FATCA, including real estate, cash/currency, and precious metals such as gold.

While you must report your bank accounts and other foreign assets, the thresholds are much higher. You must file FATCA if your assets exceed the following values:

- Single taxpayers living abroad: $200,000 on the last day of the tax year or $300,000 at any point during the year.

- Married taxpayers living abroad: $400,000 on the last day of the tax year and $600,000 at any point during the year.

- Single taxpayers living in the US: $50,000 on the last day of the tax year or $75,000 at any point during the year.

- Married taxpayers living in the US: $100,000 on the last day of the tax year or $150,000 at any point during the year.

2. The Most Difficult Part of FATCA Reporting Is Identifying Exactly What Needs to Be Reported

Reporting requirements for FBAR are straightforward, but for FATCA reporting, not so much! Specified foreign assets make it difficult to decipher exactly what assets are within that definition. The IRS defines the assets as:

- Foreign pensions

- Foreign stockholdings

- Foreign partnership interests

- Foreign financial accounts

- Foreign mutual funds

- Foreign-issued life insurance

- Foreign hedge funds

- Foreign real estate held through a foreign entity (You don’t need to report the real estate, but the foreign entity itself is a specified foreign financial asset, and its maximum value includes the value of the real estate)

- Your foreign home does NOT need to be reported.

When in doubt as to whether or not you should report an item, remember this. There are no penalties for reporting items that do not need to be included on a FATCA report, but there are harsh penalties for leaving items off a FATCA report that should be included. When in doubt, be safe and report it.

3. Renouncing Citizenship to Avoid FATCA May Be Unrealistic for Some

With the increased information about the ‘invasive’ nature of FATCA, many Americans are considering the option of renouncing their citizenship. Giving up your US citizenship WILL relieve you of FATCA reporting requirements—but it’s not always that simple.

First off, the cost of renouncing is $2,350. That’s right—it will cost you $2,350 to hand over your passport. This price tag may be too much for some expats, and they will be ‘forced’ to continue filing US taxes as citizens.

Secondly, there is a possibility that you would be considered a ‘covered expat’, which may mean you will be subject to an exit tax.

Third, even if you renounce, you may still have to file US tax returns if you have any income or assets from the US. And the tax rates on investment income as a non-US citizen can easily be a flat 30%.

It is important to know that if you intend to expatriate, you must prove 5 years’ worth of compliance with US expat taxes. So if you are not current on your US taxes, you will need to become compliant prior to filing for renunciation.

4. You May Encounter Banking Issues

Overseas Americans may experience issues with foreign banks. FATCA reporting requirements for banks have become quite extensive, and many banks choose to avoid it altogether by simply refusing to work with American clients.

Regardless of whether US expats are well-established citizens or not, sometimes the reporting requirements are not worth the effort for banks. US citizens may find that they are unable to open accounts or have been dropped by their current bank (sometimes without notice), so it’s essential that Americans be prepared for this possibility and keep a bank account in the US just in case this occurs.

The Internal Revenue Service publishes a monthly list of financial institutions that are signed up and complying with FATCA by reporting their US account holder details to the IRS.

5. Penalties for Non-Compliance Are Harsh

The IRS states that penalties for failing to file FATCA are “$10,000 per violation, plus an additional penalty of up to $50,000 for continued failure to file after IRS notification, and a 40% penalty on an understatement of tax attributable to non-disclosed assets.”

There are several options for becoming compliant if you were unaware of the reporting requirements. The most popular option for expats is to file under the Streamlined Filing Compliance Procedures. This IRS program allows innocent delinquent filers the opportunity to catch up without late filing penalties. There are no restrictions to filing under this program. All you have to do is self-certify that your lack of filing wasn’t willful or purposeful.

Expats hesitant to alert the IRS to their existence tend to lean towards doing ‘quiet disclosures’, which means you file back returns outside of an IRS amnesty program and try to ‘slide in under the radar.’ While this is an option, it is a risky one. If the IRS realizes you are trying to do a quiet disclosure and contacts you, you are now ineligible to participate in the amnesty programs, which opens you up to astronomical penalties.

Typically, Greenback advises US expats to file under the Streamlined Filing Compliance Procedures to minimize risks—there are no penalties, and by simply filing 3 years of taxes and 6 years of FBARs, you can become compliant.

Who Is a US Person Under FATCA?

Under the Foreign Account Tax Compliance Act (FATCA), a US person is defined as:

- A citizen of the United States, including individuals born in the United States, as well as those born abroad to at least one US citizen parent.

- A US resident, including a lawful permanent resident (i.e., green card holder) or an individual who meets the substantial presence test, which is a calculation based on the number of days an individual is present in the United States.

- A domestic partnership, corporation, estate, or trust that is created or organized in the United States or under the laws of the United States or any state.

- A foreign partnership or corporation that is owned at least 10% by a US person or a US corporation.

- A foreign trust that has a US person as a grantor or a beneficiary.

It’s important to note that this is just a general overview, and there may be additional rules and regulations that apply in specific situations. If you’re unsure about whether you qualify as a US person under FATCA, it’s best to consult with a tax professional service like Greenback or a qualified attorney.

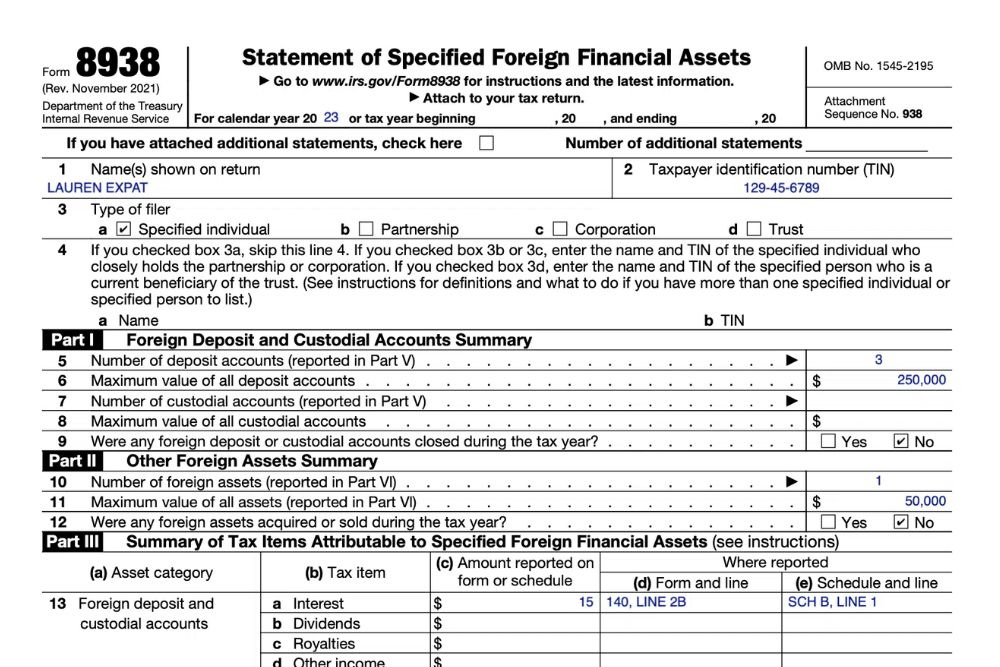

FATCA Reporting Doesn’t Have to Be Complicated

We get it! Foreign financial reporting can feel confusing. But, if you know you need to file FATCA, the good news is that you don’t have to go it alone. We can help you file Form 8938 to meet your FATCA reporting requirements and avoid penalties for non-compliance. If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.