Estate Taxes for US Citizens Living Abroad

- What Are Estate Taxes?

- Does the US Have an Estate Tax?

- Do US Citizens Living Abroad Have to Pay Tax on Inheritance?

- Are Foreign Assets Subject to Estate Taxes?

- Do I Have to Pay Estate Taxes on My Foreign Inheritance?

- What If I Leave an Inheritance to a Foreign Person?

- Foreign Tax Credits for Estates

- Estate Planning Ideas for Americans Abroad

- Have Questions regarding Estate Taxes? Get Help from the Greenback Team

US federal estate taxes can be complicated at the best of times. Thankfully, many states have eliminated inheritance taxes. For Americans living overseas, things only get more complex when it comes to expat taxes. Fortunately, you don’t have to figure it out on your own. Here’s everything you need to know about estate taxes for US citizens living abroad.

Key Takeaways

- Under US law, inheritances left by deceased US citizens are subject to an estate tax

- A high exemption amount means that most Americans do not have to pay the estate tax

- For expats who are required to pay, careful tax planning can reduce the tax burden

What Are Estate Taxes?

An estate tax is levied on any assets a deceased person leaves to their heirs. For example, if a man leaves his house and investments to his son, then those assets would be taxed upon his death. Once the tax is applied, the son would inherit the remainder of his father’s estate.

When estate taxes are owed, the deceased person’s estate, not the heirs, is responsible for payment. The tax is applied before the inheritance passes into the hands of any heirs.

Does the US Have an Estate Tax?

Yes. The US has a federal estate tax. This tax is calculated as a percentage of the fair market of all assets involved. The rate ranges from 18% to 40%, depending on the total value of the inheritance. The good news is that there is a generous exemption for the federal estate tax.

For the 2023 tax year, inheritances worth less than $12.92 million are exempt from taxation.

This means that most US citizens will not have to pay the US federal estate tax. Even if an inheritance is subject to the tax, only the portion that exceeds the exemption threshold will be taxed.

For married couples, the estate tax exemption doubles. This means that in 2023, a husband and wife could leave up to $25.84 million to their heirs without owing estate taxes.

Do US Citizens Living Abroad Have to Pay Tax on Inheritance?

Technically, yes. Expats are subject to the same inheritance taxes as Americans living in the US. However, as mentioned above, the IRS only taxes inheritances that exceed the exemption threshold. As a result, most expats will not end up owing any federal taxes on an inheritance.

Note that some states have their own inheritance taxes. If you are considered a resident of those states, your inheritance may be taxed at the state level, even if you are exempt from federal estate taxes.

Are Foreign Assets Subject to Estate Taxes?

Yes, any asset owned by a US citizen may be subject to US estate taxes, regardless of where it is located in the world.

For example, let’s say Joe Expat moves to Mexico. Joe buys a large property there and saves up a substantial amount of wealth in the form of Mexican pesos. He writes a will leaving all that he owns to his niece, then passes away at a ripe old age. Because Joe is a US citizen, his property and other assets are subject to US estate taxes, even though they are located in Mexico.

Do I Have to Pay Estate Taxes on My Foreign Inheritance?

No. Under US tax law, the recipient of an inheritance never has to pay estate taxes on the inheritance. Generally speaking, the estate of a foreign person will not be subject to US estate taxes. Thus, an inheritance that passes from a foreign person to a US citizen would be free from taxation.

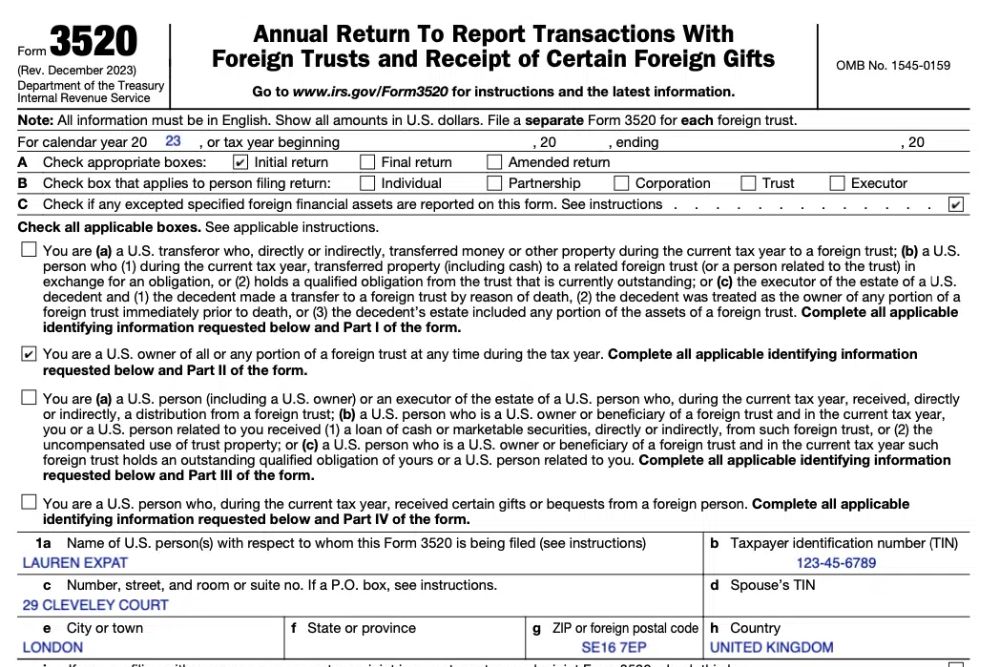

While foreign inheritances are not subject to US estate taxes, taxpayers are still required to report any foreign inheritances and gifts valued at more than $100,000. However, you would only have to report this gift—not pay any taxes on it. Not reporting a foreign inheritance or gift could result in a penalty equal to 25% of the amount received.

What If I Leave an Inheritance to a Foreign Person?

If you are a US citizen or a resident alien, you may wonder what happens if you leave an inheritance to a foreign person. In such a scenario, the US federal estate tax would apply, regardless of the nationality of the recipient. This means that the inheritance would be subject to taxation by the US government.

However, the likelihood of having to pay US estate taxes on an inheritance left to a foreign person is low, thanks to the high exemption threshold. This means that if your estate is valued below certain thresholds, your estate will not be subject to estate taxes, whether your heirs are US citizens or foreign nationals.

If your estate exceeds the exemption threshold, estate taxes may apply, depending on the value of the estate and the tax rate in effect at the time of your death. In such cases, the executor of your estate will need to file a federal estate tax return and pay any applicable taxes.

It’s worth noting that some countries have their own inheritance and estate tax laws, which may also apply to your estate and your heirs. It’s advisable to seek the advice of a qualified tax attorney or financial advisor to understand the implications of leaving an inheritance to a foreign person and to plan accordingly. They can help you explore options for minimizing your tax liability and maximizing the value of your estate for your heirs.

Foreign Tax Credits for Estates

As you are likely aware, expats can use the Foreign Tax Credit to reduce or erase their US income tax liability. The IRS offers a similar tax credit for estate taxes, as well. If a foreign government taxes your inheritance, you can claim that tax as a credit to offset any US estate taxes you may owe. This is commonly known as the Foreign Death Tax Credit.

Estate Planning Ideas for Americans Abroad

While many expats will be safe from estate taxes due to the standard exemption, others may have assets that exceed that threshold. If that’s the case for you, then a little estate planning goes a long way. With an estate tax rate of up to 40%, it’s worth it to reduce your potential tax liability as much as possible. Here are some handy tips for US citizens living abroad on estate taxes.

1. Get Married

Consider marrying the love of your life (if you haven’t already). This is the simplest estate tax strategy around. The exemption limit for US estate taxes doubles for married couples. That will greatly increase the tax-free inheritance you and your spouse could leave for your heirs. And in cases where both spouses are US citizens, any inheritance left to the surviving spouse will be entirely exempt—with no limits.

2. Create a Trust

Trusts are one of the most common forms of reducing estate tax liabilities. There are a variety of trusts that can be created, including:

- Irrevocable Life Insurance Trusts

- Charitable Remainder Trusts

- Qualified Personal Residence Trusts.

Each one of these has its different advantages and disadvantages. Consult a qualified tax professional to learn which option is best for you.

3. Give Generously

US citizens have the right to gift up to $17,000 every year without having to file a Gift tax return or owe any taxes. By giving away gifts each year, you can lower the value of your estate and reduce any taxes that may apply to an inheritance. (The recipients of your gifts will also appreciate your generosity.)

4. Spend, Spend, Spend!

Another very simple way to reduce your estate’s value is to spend your finances. However, this strategy is harder to plan precisely since you cannot predict how long you will live. Additionally, you would need to be careful in how you spend it because real property—such as homes and vehicles—would be included in the value of your estate.

If you are considering any of the above strategies, consult your tax advisor before making any final decisions. A misstep could be costly.

Have Questions regarding Estate Taxes? Get Help from the Greenback Team

Still have questions about estate taxes for US citizens living abroad? Contact us, and we’d be happy to help you. If you’re ready to be matched with a Greenback accountant, click the get started button below.