FinCEN Form 114: Everything You Need to Know to File the FBAR Form

- What is the FBAR Form?

- Who Must File FinCEN Form 114?

- What About Exchange Rates?

- What Are the Requirements for FinCEN Form 114 ?

- What Information Do You Need to Prepare the FinCEN Form 114?

- How to File FBAR and When?

- Is There a Record Retention Timeframe?

- Are There Any Penalties?

- Can I Have Someone File FinCEN 114 for Me?

- Still Have Questions Related to FinCEN 114? We are Here to Help!

The Foreign Bank Account Report or “FBAR” is the name for FinCen Form 114, a form required by the US Treasury Department if an individual has over $10,000 in their combined foreign bank accounts. This has been a requirement since the 1970s, but unfortunately, the threshold was not adjusted for inflation, and now the FBAR is required by many more individuals than originally intended. Learn all about this form, including if you need to file, upcoming deadlines, and penalties.

Key Takeaways

- FinCEN Form 114, also known as the FBAR (Foreign Bank Account Report) is a US Treasury form that must be filed annually by any person having more than $10,000 in aggregate total of foreign financial accounts at any time during the previous calendar year.

- The deadline for the FBAR is April 15th, but there is an automatic extension in place until October 15th.

- The FBAR is not a complicated form to complete, but failing to file an FBAR when required could result in severe penalties.

What is the FBAR Form?

The name FBAR is an old name for the form FinCEN 114. This form reports your foreign bank information to the US Treasury and is required to be filed each year you meet or exceed the threshold. The FBAR is technically not a tax form because it does not generate taxes or amounts due to the IRS. Its purpose is to be informational, and it was originally designed to help catch individuals hiding assets overseas. Individuals must file the FinCen 114 if they have an interest in or signatory authority over a foreign bank account(s) or financial account(s) and the balance of the account(s) exceeded $10,000 at any point during the year.

Who Must File FinCEN Form 114?

US citizens who have an interest in or hold signature authority over a foreign financial account are required to file the FBAR if the total value of all foreign accounts combined reaches $10,000 or more at any point during the year. The owner or the individual with legal title to the account determines financial interest in the foreign account. Those who have some degree of control over the assets and can directly communicate with the institution to move funds out of the account are considered to have signature authority. It’s important to note that individuals holding signature authority over the account may need to comply with these regulations for both personal and work accounts.

The IRS says that the FBAR is required for “United States persons” who meet the reporting threshold. The term “US persons” refers to citizens, resident aliens, trusts, estates, and domestic entities.

For example:

- You open a savings account for your 2-year-old child at a non-US bank outside the US and keep joint ownership to manage the account with a balance of $12,000 at the end of the year. You and your child will each need to file separate FBAR forms for the year, each declaring the bank account and the full balance of $12,000 on the form.

Joint Foreign Bank Account Holders

Joint account holders must each file separate FBAR forms, each reporting the full balance of the jointly held account. Spouses with only jointly held accounts may file a joint FBAR form, but only if the individuals do not have any separately held foreign accounts. There are some exceptions to filing, including spouses of jointly owned accounts and foreign financial accounts maintained on overseas military banking facilities.

For Example:

- If you and your spouse have a joint checking and savings account at the local HSBC branch in London, where you live, these accounts are the only non-US financial accounts you own. Then you can file a joint FBAR form for the year.

- If you and your spouse jointly held checking and savings accounts in a non-US bank. But you also each own separate investment accounts, which manage your foreign investments. Then, you will each need to file separate FBAR forms detailing the information from the checking and savings accounts as well as the information for your separate investment accounts. Only the investment account attributable to each individual needs to be reported on the individual FBAR form.

US Companies with Foreign Accounts

A US company is any corporation, partnership, LLC, trust, or estate formed or organized under the laws of the United States.

Foreign companies can also be subject to this reporting if an individual who has signature authority on the account is a US Person and the account had over $10,000 or the USD equivalent at any point during the year.

It’s worth noting that the $10,000 threshold can be triggered by smaller amounts of money. Say, for example, that you have $5,000 worth of euros in a checking account in your German bank account. You decide you would like to earn some interest on these funds, so you move them to your savings account with the same bank. Now you have had $5,000 in a checking account AND $5,000 in a savings account for a total of $10,000 across your foreign financial accounts, which triggers the reporting requirement.

What About Exchange Rates?

When reporting foreign financial accounts on FinCEN Form 114 (FBAR), all amounts must be reported in US dollars.

FinCEN requires you to use the US Treasury foreign exchange rate as of December 31st of the year in question. The US Treasury publishes this rate here.

What Are the Requirements for FinCEN Form 114?

The term FBAR can seem a bit misleading as it includes more than just bank accounts. It includes other financial accounts as well, including investment accounts and certain pension and retirement accounts. According to FinCEN’s website, the following accounts need to be reported:

- Foreign bank accounts and balances

- Foreign stock or securities held in a financial account at a foreign financial institution.

- Financial account held at a foreign branch of a US bank

- Foreign mutual funds

- Foreign-issued life insurance or annuity contract with a cash value

If you’re unsure which accounts to report, we recommend consulting a professional to ensure you report all required accounts.

What Information Do You Need to Prepare the FinCEN Form 114?

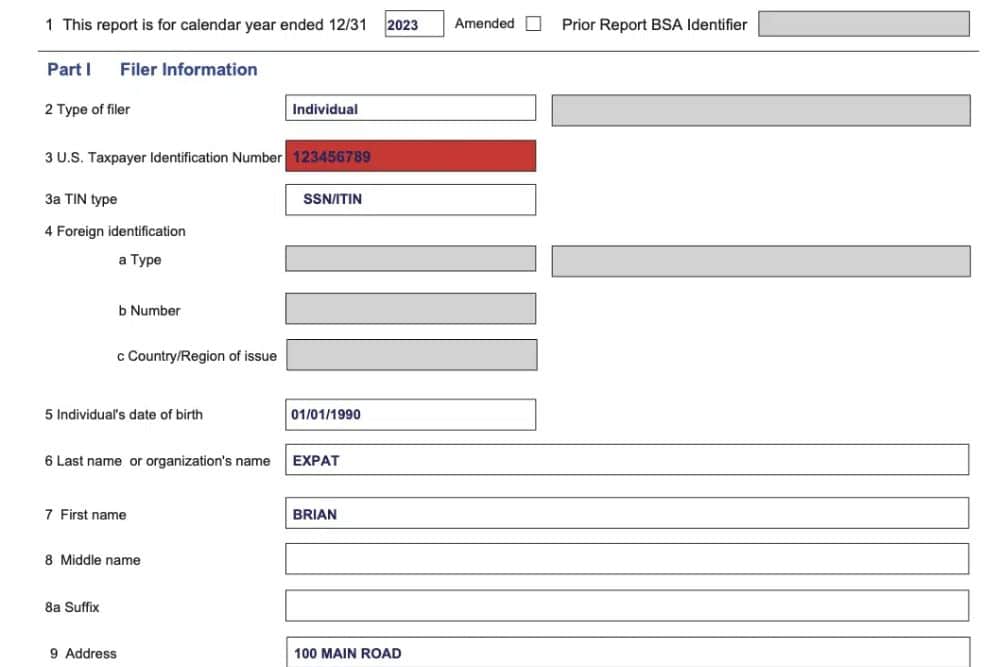

In order to complete the FBAR form, you will need the following information:

- Your name, address, and Social Security Number or ITIN

- The name, address, and social security number (if any) of all joint owners of the account

- Your foreign banks’ name and address

- The type of account – bank, securities, or other

- Your foreign account number for each account

- The maximum balance of your foreign financial account during the year is converted to US dollars.

Ensure you enter all phone numbers and identifying numbers in a single text string without characters (i.e., a phone number would not be entered as 111-222-3333 but 1112223333).

When recording your maximum account balances, record all amounts in US dollars, rounded up to the next whole dollar. If your accounts are held in a different currency, convert the maximum account value for each account into United States dollars. Convert foreign currency using the Treasury’s Financial Management Service rate (select Exchange Rates under Reference & Guidance at www.fms.treas.gov) for the last day of the calendar year. If no Treasury Financial Management Service rate is available, then use another verifiable exchange rate and make sure you provide the source of that rate. In valuing a country’s currency that uses multiple exchange rates, use the rate that would apply if the currency in the account were converted into USD on the last day of the calendar year.

How to File FBAR and When?

FinCEN requires that all FBAR forms be electronically filed through their website or via a tax professional. The FBAR is due April 15th, but there is currently an automatic extension for US citizens living abroad, which extends the due date to October 15th. Please note that the tax deadline with an extension for 2023 returns (filed in 2024) is October 15th, but the FBAR deadline is still October 15th.

When you live in the US, tax day is simple: April 15th! When you move abroad, it’s not so straightforward! Learn about all the expat deadlines and extensions you need to know to file.

Is There a Record Retention Timeframe?

Individuals who are obligated to file an FBAR must maintain records of their bank information in order to demonstrate the accuracy of their form submissions to FinCEN during an audit. You must keep the following information for 6 years:

- Name that the account is held in

- Account number

- Name and address of the foreign financial institution

- Type of account

- Max value of the account during the year

- Keeping a copy of the FBAR filed each year will help fulfill the requirement.

Are There Any Penalties?

The penalty for not filing an FBAR form, if required, is about $12,500 per year. This amount tends to increase a little each year based on the inflation rate. This penalty can be waived if you can convince the IRS that you have a reasonable cause for not filing.

Willfully failing to report an account or account number may be subject to a penalty greater than $129,210, or 50% of the account’s balance, at the time of the violation. Willful violations may also be subject to criminal prosecution.

If you have failed to file an FBAR when required, don’t panic. You might be able to use the IRS Streamlined Filing Compliance Procedures to get up-to-date without facing any penalties.

Can I Have Someone File FinCEN 114 for Me?

FBARs can be prepared and filed by a third-party tax professional on behalf of you or the account owner. The filer or owner using a third-party preparer must complete and maintain a record of FinCEN Form 114a, FinCEN BSA E-Filing Signature Authorization Record, to authorize the third-party filing. You don’t need to file or send the completed Form 114a to FinCEN—you hang onto that form in case the IRS requests it. Spouses filing a joint FBAR may also use Form 114a to approve/designate which spouse will sign the report.

Still Have Questions Related to FinCEN 114? We are Here to Help!

You can also contact the expert CPAs and IRS Enrolled Agents at Greenback to file on your behalf. We are always here to help, with countless FBAR examples for reference. Our expat accountants have helped hundreds of expats successfully file their FinCEN 114 and are happy to assist you too.

If you’re ready to be matched with a Greenback accountant, click “Get started” below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.