Foreign Trust Reporting: A Tax Guide for Expats

As a US citizen, becoming the owner or beneficiary of a foreign trust can complicate your taxes quite a bit. Fortunately, we’re here to help clear things up. In this guide, we will look at everything you need to know about foreign trusts.

Key Takeaways

- A foreign trust is any trust that is based in a foreign country and subject to that country’s laws.

- US owners and beneficiaries of foreign trusts are generally subject to US tax reporting and possibly taxation

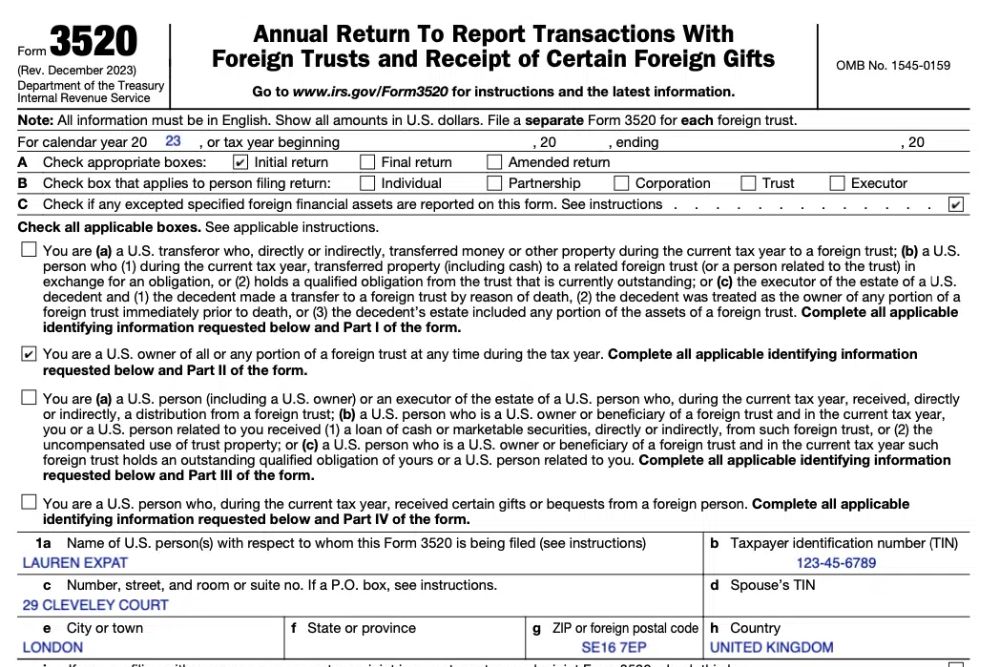

- If you are the beneficiary of a foreign trust and have received any distributions from that trust, you will have to report it to the IRS using Form 3520 and 3520A.

What Is a Trust?

A trust refers to an arrangement where a grantor gives an asset to a third-party trustee to hold or manage on behalf of one or more beneficiaries. The grantor is the person who creates the trust, while the trustee is responsible for managing and distributing assets to beneficiaries. A trust can be revocable or irrevocable.

A typical example of this is a US 401(k) retirement plan. In that case, the grantor is an employer, employee, or both. The grantor(s) deposit money (the asset) into a 401(k) account, which is typically held by a third-party administrator (the trustee). The trustee manages this money on behalf of the employee (the beneficiary) until the employee is eligible to withdraw funds for retirement.

Based on this definition, a retirement plan established and managed outside the US would qualify as a foreign trust. One example of this would be an Australian superannuation fund.

What Is a Foreign Trust?

A foreign trust is a trust that is established in a foreign country and primarily subject to that country’s laws. In the United States, a foreign trust is generally defined as a trust created by a nonresident alien or foreign corporation or one of its residents. A US-based trustee is required if the trust contains any US source income and/or assets.

To determine whether a trust is foreign or not, we can ask the following two questions:

- Does a US person or persons substantially control the trust?

- Does the US court system have jurisdiction over the administration of the trust?

If the answer to both questions is no, then that trust will likely be considered a foreign trust.

Does the IRS tax Foreign Trusts?

Yes, any income you receive from a foreign trust will be taxable by the IRS, even though many taxpayers hope that because a foreign trust is not governed by US jurisdiction, it is also exempt from US taxation. Unfortunately, this is not the case. As a US citizen, you will still have to report specific details of any foreign trusts you own or are the beneficiary of.

The rules for how the IRS taxes a foreign trust depend on whether it’s a grantor trust or a non-grantor trust for tax purposes.

Foreign Grantor Trusts vs. Foreign Non-Grantor Trusts

In most circumstances, the following rules will determine whether a trust is a grantor or non-grantor trust:

- A grantor trust means the grantor, generally the person who created the trust, has retained some ownership and control over the trust.

- A non-grantor trust means that the grantor has given up all ownership and control over the trust.

However, when talking about a foreign trust, the rules are a bit more complicated.

- A foreign trust that is created by a US person who retains control over that trust will be treated as a grantor trust for tax purposes. Even if the US grantor gives up control of the trust, it will still be considered a grantor trust if the beneficiary is a US person. The US grantor will also still be considered the owner, even if they no longer have direct control over the trust.

- A foreign trust that is created and controlled by a non-US person will generally be treated as a non-grantor trust for tax purposes. The only exceptions to this are if: The trust is revocable by the grantor or distributions may be made only to the grantor or the grantor’s spouse during the grantor’s lifetime.

A trust that is not treated as a grantor trust under the above rules will be treated as a non-grantor trust for tax purposes. So what does this mean for your taxes?

How Are Foreign Trusts Taxed?

The IRS taxes foreign trusts differently based on whether they are considered grantor or non-grantor trusts. If the trust is considered a grantor trust, the individual who created it will be taxed on any income or capital gains generated by the assets in the trust. If it is not considered a grantor trust, then the beneficiaries of the trust are taxed on its earnings instead.

- If a foreign trust is considered a grantor trust for tax purposes, the IRS will tax the trust’s grantor rather than the trust itself or the trust’s beneficiaries. For US owners, this means that the trust’s worldwide income and capital gains will be taxed as if the owner had earned the income personally.

- If a foreign trust is considered a non-grantor trust for tax purposes, the IRS will only tax distributions the trust makes to a US beneficiary. The only exception to this is if the trust earns US-source income or income that is effectively connected to a US trade or business. In that case, the IRS will tax the non-grantor trust itself for that income.

What Do I Have to Report as the Owner or Beneficiary of a Foreign Trust?

If you are the beneficiary of a foreign trust and have received any distributions from that trust, you will have to report it to the IRS using Form 3520. This applies even if the distribution wouldn’t otherwise qualify as taxable income.

If you are the owner of a foreign trust, you will have to report the income and capital gains of the trust. To do this, you may need to file some or all of the following forms:

- Schedule B (IRS Form 1040)

- IRS Form 3520

- IRS Form 3520-A

- IRS Form 8938 (FATCA report)

- FinCEN Form 114 (FBAR)

Regardless of the details of your tax obligations, failing to file as required could result in severe penalties. The same is true if you make a mistake or withhold information when filing.

Foreign Trusts Don’t Have to Be Complicated

Hopefully, this post has helped you understand how foreign trusts are taxed under US law. Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.