Form 1099-A (Complete Guide for 2025)

If a property you owned was foreclosed or abandoned, you will receive Form 1099-A to report this. What does Form 1099-A mean for you? Here’s what you should know.

Key Takeaways

- Form 1099-A is used to report the foreclosure or abandonment of property secured by a loan.

- Lenders must file Form 1099-A with the IRS and send a copy to the borrower.

- The borrower will use their copy of Form 1099-A to report a gain or loss on their tax return.

What Is Form 1099-A?

Form 1099-A is a tax form used to report the transfer of a foreclosed or abandoned property. Lenders are required to file this form with the IRS to report the property details, the date of acquisition or abandonment, and the amount of outstanding debt. This allows the IRS to track any potential taxable events arising from the transfer.

In contrast, Form 1099-A is NOT used to acquire any property, such as a home or car. It is also not used by borrowers to report income or loss directly to the IRS. Form 1099-A merely informs the IRS of the acquisition or abandonment of property that was secured by a loan.

Purpose of Form 1099-A

The primary purpose of Form 1099-A is to inform the IRS about the change in ownership of secured property, whether through foreclosure, repossession, voluntary surrender, or abandonment. This helps the IRS track whether there is any taxable gain or loss that the borrower must report on their tax return.

- Foreclosure: In the event of a foreclosure, the lender who takes back the property as a means of settling the debt must file Form 1099-A to report the acquisition of the secured property.

- Repossession: In cases where personal property (not real estate) that serves as loan collateral is repossessed, the lender must file Form 1099-A.

- Voluntary Surrender: If a borrower voluntarily surrenders property that serves as collateral for a loan, the lender must file Form 1099-A to report the acquisition.

- Abandonment: When a property is deemed abandoned by the borrower, and the lender becomes aware of this situation, the lender is responsible for filing Form 1099-A to report the abandonment.

Who Can File Form 1099-A?

Form 1099-A is filed by lenders that have lent money against a property as security. This lender may be any of the following:

- Bank

- Credit union

- Mortgage Company

- Government agency (such as the Department of Housing and Urban Development)

- Private lender

If the borrower defaults or the property is otherwise deemed abandoned, the lender must report this event to the IRS using Form 1099-A. If you are not involved in the lending of money, there is no reason you would need to file Form 1099-A.

However, the lender is also required to send a copy to the borrower who has lost or abandoned the property. This ensures that borrowers are aware of the information reported to the IRS and can use it to fulfill their own tax obligations, such as reporting any gain or loss from the acquisition or abandonment of the property.

How to File Form 1099-A

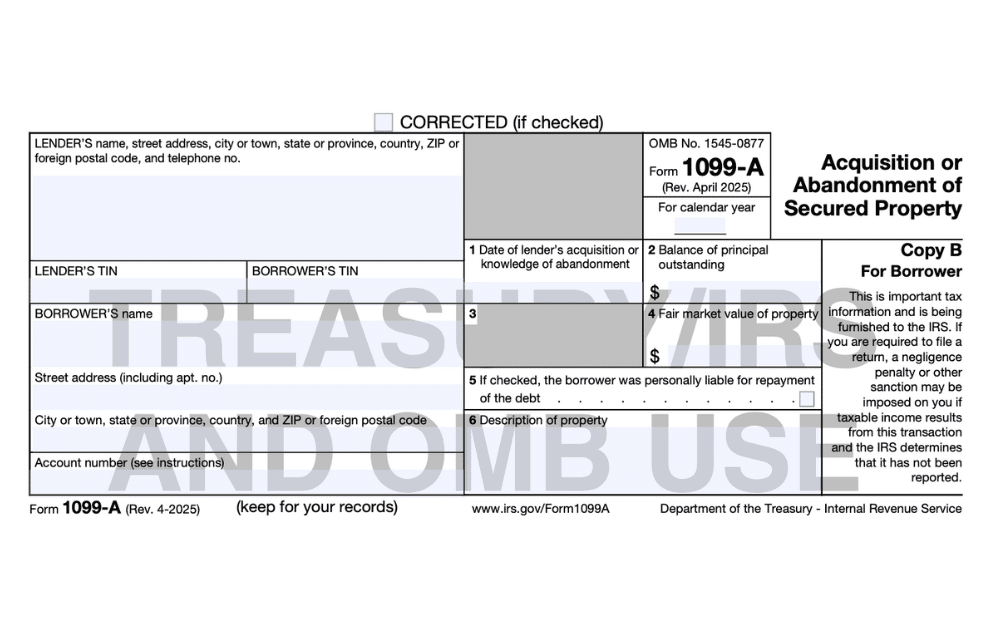

When filling out Form 1099-A, the lender must provide several pieces of information, including:

- A description of the property: This includes the location and identifying details of the property.

- The date of acquisition or abandonment: This indicates when the property was officially taken back by the lender or left by the borrower.

- The balance of principal outstanding: This figure represents the amount of the loan that remained unpaid at the time the property was acquired or abandoned.

- The fair market value (FMV) of the property: This is an estimate of the property’s value at the time of acquisition or abandonment. For tax purposes, this value is crucial as it plays a significant role in determining any potential gain or loss on the disposition of the property.

- The borrower’s contact information: This includes the borrower’s name and tax identification number (usually a social security number).

Lenders must send a copy of this form to the borrower and file another with the IRS.

If you have lost a home due to foreclosure and received Form 1099-A, you will not have to file it yourself. That is the lender’s responsibility. However, you will need to report the information provided on Form 1099-A when filing your taxes.

If you had more than one mortgage or loan for a single property, you will receive multiple 1099-A forms, one for each. These are always sent by January 31 of each year.

Form 1099-C, Cancellation of Debt

Form 1099-A is part of the 1099 series of forms. If the debt associated with the secured property is canceled, lenders may also need to file Form 1099-C, Cancellation of Debt. This form reports the amount of debt forgiven—which can be considered taxable income for the borrower.

What Is Form 1099-A Used For?

Form 1099-A is primarily used to inform the IRS about the transfer of ownership of property under loan, either through foreclosure or abandonment. It helps determine any tax implications for the borrower, such as income from the discharge of debt.

How to Get a Copy of Form 1099-A

If your property has been acquired or abandoned, you should receive Form 1099-A from your lender. If you have not received this form but believe you should, you can contact your lender directly to request a copy.

Reporting Form 1099-A on Your Tax Return

If you have received Form 1099-A from your lender, you must report the information it provides on Schedule D of Form 1040 when filing your taxes. To calculate your gains or losses, follow these steps:

- Determine the fair market value (FMV): Look at Box 3 on Form 1099-A, which shows the FMV of the property when it was acquired or deemed abandoned.

- Find your adjusted basis: Your adjusted basis is generally the original cost of the property plus any improvements you made, less any depreciation taken.

- Calculate gain or loss:

- If the FMV (from Box 3) exceeds your adjusted basis in the property, you have a gain.

- If your adjusted basis in the property is higher than the FMV, you have a loss.

For a deeper understanding, review IRS Publication 544 (Sales and Other Dispositions of Assets) and Publication 4681 (Canceled Debts, Foreclosures, Repossessions, and Abandonments) for detailed guidance on reporting requirements and tax implications.

File Form 1099-A Easily with Greenback

If you need to file or report Form 1099-A, we can help! Our expat tax services are customized for each taxpayer’s unique needs.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.