What Is Form 1120?

- Who Must File Form 1120?

- What Is Form 1120 Used For?

- When to File Form 1120?

- Why Do I Have to File Form 1120?

- What Do You Report on Form 1120?

- Who Signs Form 1120?

- Where Is Form 1120 Filed?

- How to Fill Out Form 1120

- How Much Does It Cost to File Form 1120?

- Have Questions Regarding Form 1120? We Are Here to Help!

Most US corporations file their federal income tax returns using Form 1120. In this guide, we’re going to discuss some of the key points to know concerning Form 1120 for US Expats. Let’s get started!

Key Takeaways

- All domestic US corporations must file Form 1120 unless they meet an applicable exception.

- Form 1120 is used to report the income, gains, losses, deductions, and credits of a corporation and to calculate its income tax liability.

- A corporation generally must file its Form 1120 by the 15th day of its fourth month after the end of its tax year.

Who Must File Form 1120?

Form 1120 is the standard tax form most US corporations use to file their annual taxes. This form is used to report income and expenses, calculate taxes due, and pay them to the IRS.

Dreading the last minute scramble pulling together your tax documents? Despair no more! This simple checklist lists the documents you need to have on hand when preparing to file.

Typically, all domestic corporations must file Form 1120. Some corporations are required to file a variant of Form 1120. Below, you can see a list of some of these alternatives:

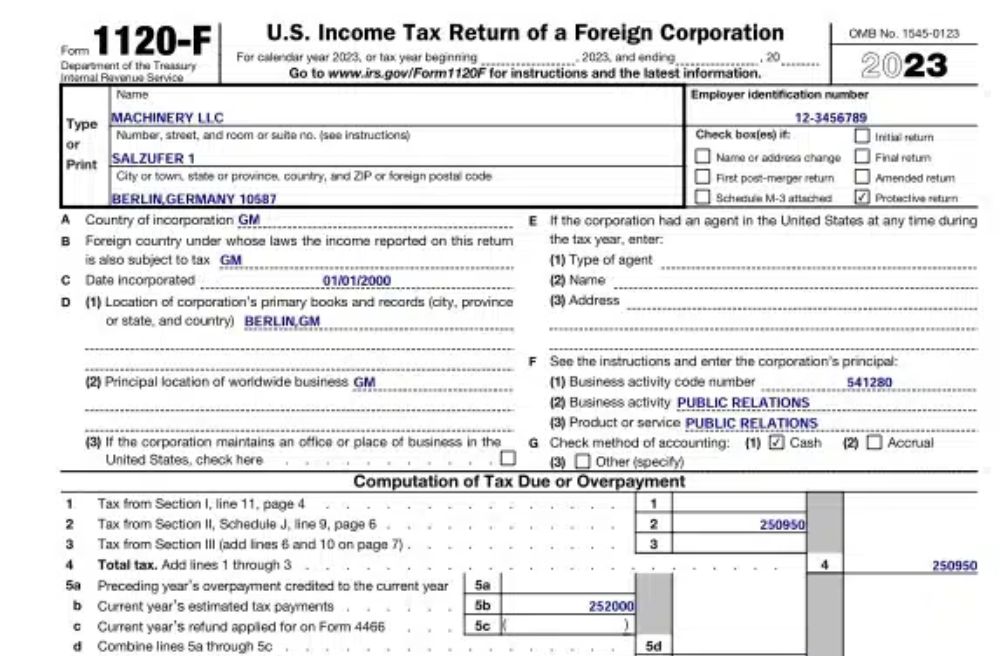

- Foreign corporations must use Form 1120-F

- Life insurance companies must use Form 1120-L

- Property and casualty insurance companies must use Form 1120-PC

- Real estate investment trusts must use Form 1120-REIT

- Regulated investment companies must use Form 1120-RIC

- S corporations must use Form 1120-S

Other than those exceptions, virtually every US corporation will use the standard Form 1120. Form 1120 is also used by proprietorships and LLCs that have elected to be taxed as a corporation.

If you have a domestic corporation, please note that your corporation generally is required to file Form 1120, even if you are a US citizen who moves abroad and becomes an expat.

What Is Form 1120 Used For?

Form 1120 is used to do the following:

- Report the income, gains, and losses of a corporation

- Claim certain tax deductions and credits

- Calculate the corporation’s tax liability for that year

- Pay any outstanding tax debt the corporation has accrued

The form asks for detailed information about your business’s assets and liabilities, as well as your gross receipts and expenses. The form also asks for information about any eligible dividends that you paid out to shareholders during the year.

If you’re using a calendar year as your business’ tax year, then you’ll also need to report any adjustments made during the year that change the original total amount of money owed or refunded by the IRS.

When to File Form 1120?

A corporation generally must file its Form 1120 by the 15th day of its fourth month after the end of its tax year. Thus, a corporation with a calendar tax year generally must file its Form 1120 by April 15 of the following calendar year.

A new corporation filing a short-period Form 1120 must generally file by the 15th day of the fourth month after the short period ends. A corporation that has dissolved must generally file its Form 1120 by the 15th day of the fourth month after the date it dissolved.

However, a corporation with a fiscal tax year ending June 30 must file its Form 1120 by the 15th day of the third month after the end of its tax year. A corporation with a short tax year ending anytime in June will be treated as if the short year ended on June 30 and must file its Form 1120 by the 15th day of the third month after the end of its tax year.

If the due date of the Form 1120 falls on a Saturday, Sunday, or legal holiday, the corporation can file its Form 1120 on the next business day.

For S-Corporations, Form 1120-S is due by March 15th. This is a crucial deadline for many businesses, as S-Corps are a common corporate structure. Mark your calendar to ensure timely filing and avoid penalties.

Why Do I Have to File Form 1120?

Filing Form 1120 is a mandatory requirement for most corporations in the US. If you own a domestic corporation, you will likely have to file Form 1120 to report your income and losses, calculate your tax liability, and pay any tax debt your corporation has accrued.

What Do You Report on Form 1120?

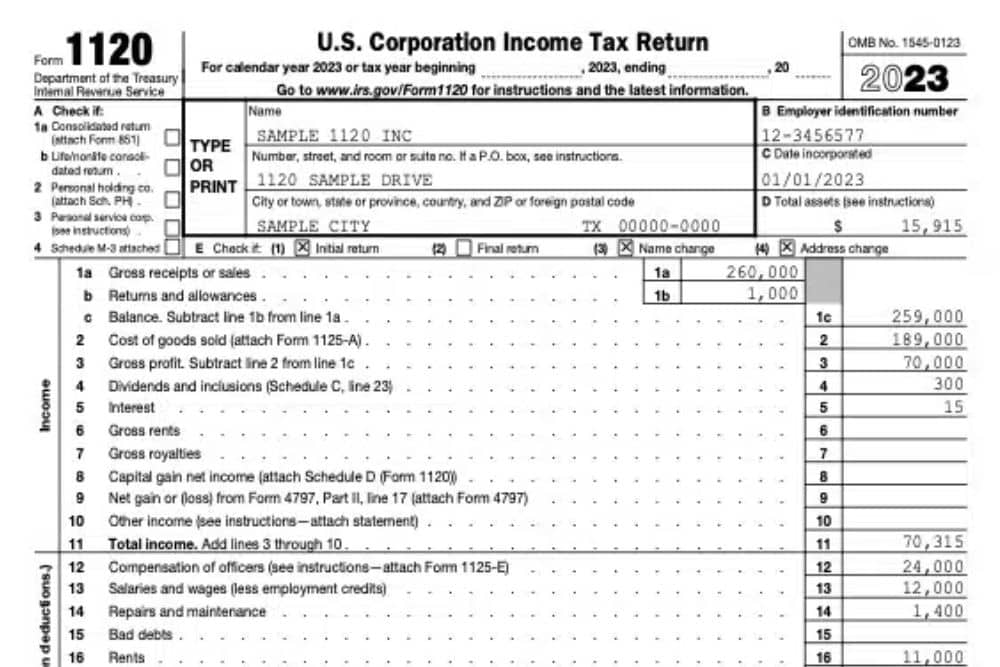

Form 1120 – Page 1

At the top of page 1, the corporation must answer certain factual questions, including concerning:

- The time period covered by Form 1120 (generally the calendar year, unless a different time period is designated)

- The name, address, employer identification number, and total assets of the corporation (including whether the corporation had total assets of $10 million or more on the last day of its tax year)

- The date the corporation was incorporated

- Whether the corporation is filing a certain type of consolidated return

- Whether the corporation is a personal holding company or a personal service corporation

- Whether Form 1120 is an initial or final return

- Whether Form 1120 reflects a name change or address change

The corporation also must report on page 1:

- Its income, including from gross receipts, less returns and allowances and cost of goods sold, plus ‘dividends and inclusions’, interest, rents, royalties, capital gain, and other gains or income

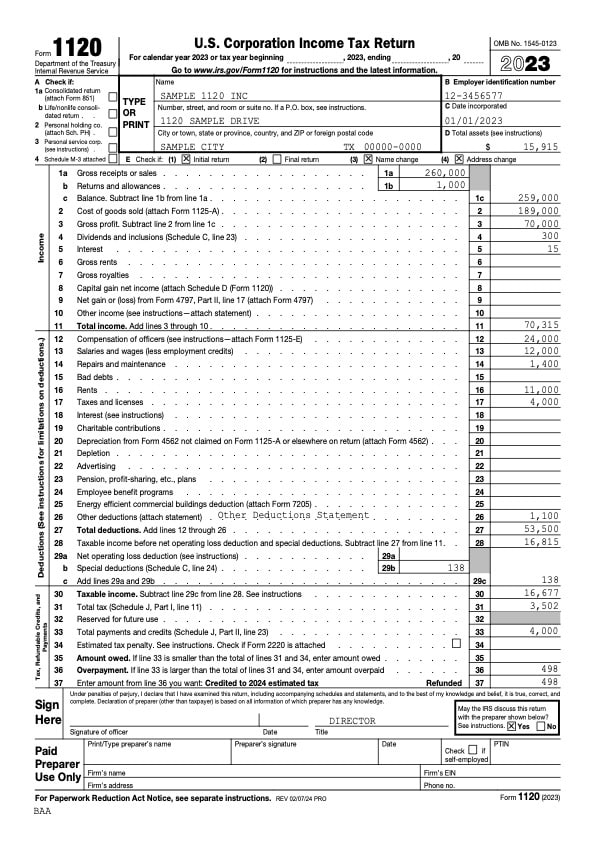

- Its deductions, including from compensation of officers, salaries and wages, repairs and maintenance, bad debts, rents, taxes and licenses, interest, charitable contributions, depreciation, depletion, advertising, pension, and profit-sharing plans, employee benefit programs, net operating loss, “special deductions” (see below), and other deductions

Based on this income and these deductions, the corporation then determines on page 1 its taxable income, ‘total tax,’ and ‘total payments and credits,’ whether there is an amount owed or an overpayment, and certain estimated tax issues.

At the bottom of page 1, Form 1120 must be signed and dated.

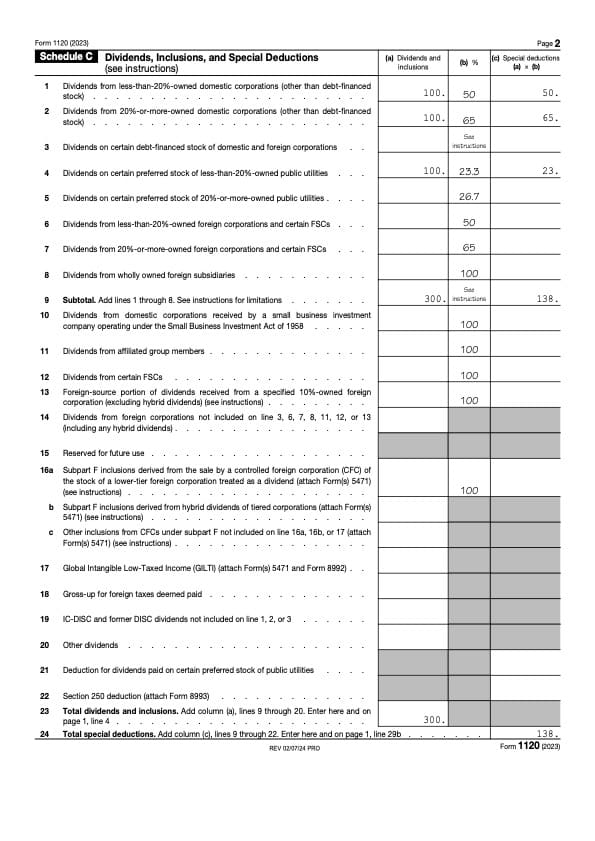

Form 1120 – Page 2

On page 2 (which has the heading, ‘Schedule C Dividends, Inclusions, and Special Deductions’), the corporation must report the ‘dividends and inclusions’ and the ‘special deductions’ that are referenced on page 1.

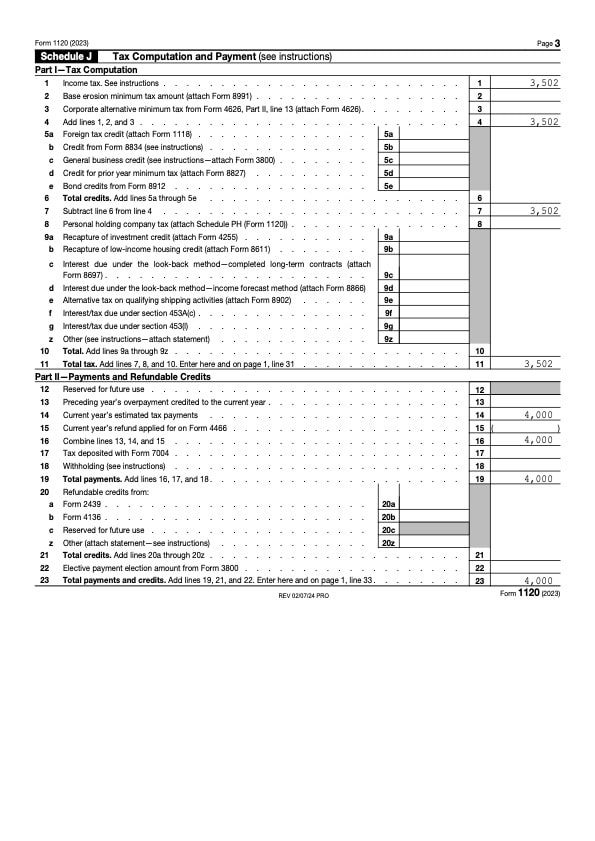

Form 1120 – Page 3

On page 3 (which has the heading, ‘Schedule J Tax Computation and Payment’), the corporation determines the ‘total tax’ that is referenced on page 1 by:

- Computing an amount of ‘Income Tax,’ generally equal to taxable income multiplied by 21%;

- Subtracting certain credits, including the foreign tax credit, the general business credit, and the credit for prior year minimum tax; and

- Adding certain items, including the personal holding company tax and the recapture of investment credit.

The corporation also on page 3 determines the ‘total payments and credits’ that are referenced on page 1.

If the ‘total payments and credit’ are less than the sum of ‘total tax’ plus any applicable estimated tax penalty, the corporation will owe a tax liability. Alternatively, if the total payments and credit are more than the sum of ‘total tax’ plus any applicable estimated tax penalty, the corporation can receive a refund of the excess amount or credit it to future estimated tax liability.

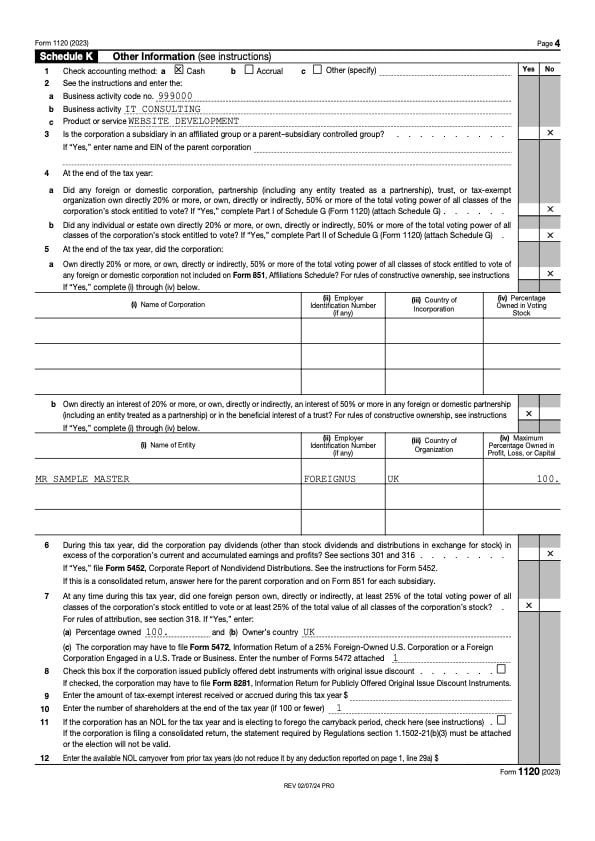

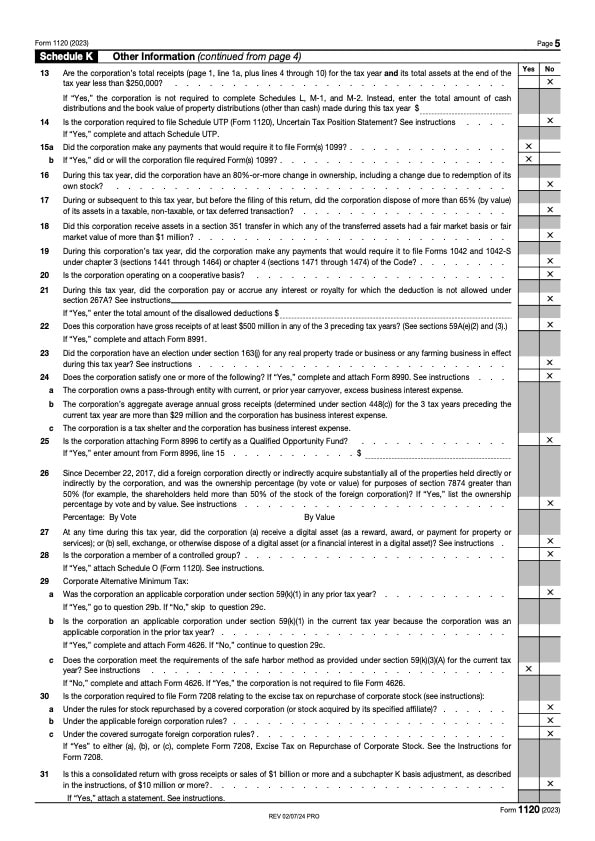

Form 1120 – Pages 4 and 5

On pages 4 and 5 (Schedule K Other Information), the corporation must answer 26 additional factual questions, including concerning:

- The accounting method used by the corporation

- Whether the corporation is a subsidiary in an affiliated group or a parent-subsidiary controlled group

- Whether one foreign person owns, directly or indirectly, at least 25% of the total voting power of all classes of the corporation’s stock entitled to vote or at least 25% of the total value of all classes of the corporation’s stock

- The amount of tax-exempt interest received or accrued by the corporation

- Whether the corporation’s total receipts and total assets are less than $250,000

- Whether the corporation made any payments that would require it to file Form(s) 1099

- Whether the corporation had an 80%-or-more change in ownership, including a change due to redemption of its own stock

- Whether the corporation disposed of more than 65% (by value) of its assets in a taxable, non-taxable, or tax-deferred transaction

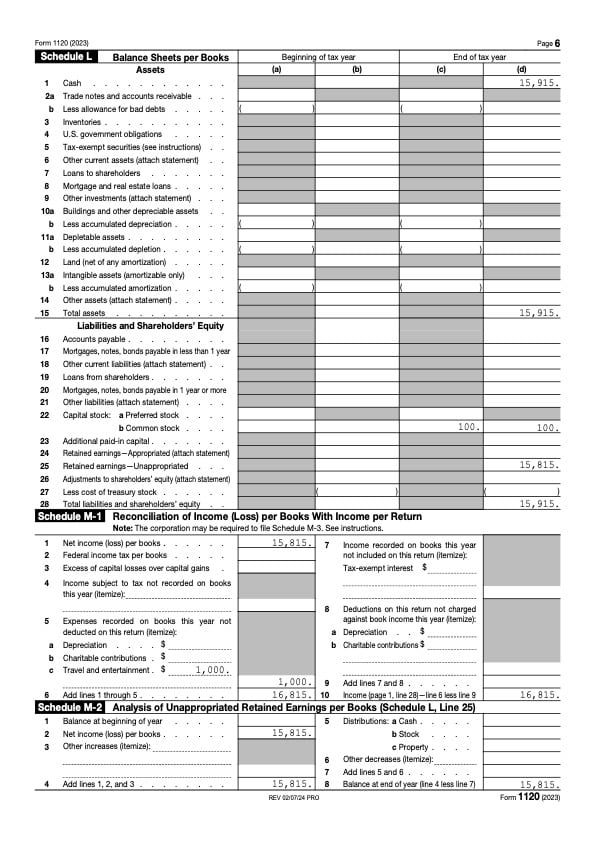

Form 1120 – Page 6

Page 6 consists of three financial Schedules:

- Schedule L Balance Sheets per Books

- Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return

- Schedule M-2 Analysis of Unappropriated Retained Earnings per Books

The corporation does not have to complete Schedules L and M if its total receipts and total assets are less than $250,000.

Because Form 1120 is so complex, it’s always wise to start preparing long before the deadline, if possible. Keep relevant financial records organized and on hand throughout the year. That way, when the time comes to file, you’ll have everything you need.

Who Signs Form 1120?

As the corporation is an entity and not a natural person, someone who is authorized to act on behalf of the corporation must sign and date Form 1120. This can be the president, vice president, treasurer, assistant treasurer, chief accounting officer of the corporation, or any other corporate officer authorized to sign Form 1120.

If a ‘paid preparer’ is used for Form 1120, the preparer must include identifying information and sign and date the Form 1120 at the bottom of page 1.

Where Is Form 1120 Filed?

Form 1120 can generally be filed electronically (“e-filing”). If there is a balance due, the corporation can authorize an electronic funds withdrawal while e-filing.

Form 1120 can also be filed by mail. Form 1120 is mailed to an address determined by where the corporation’s principal business, office, or agency is located and the amount of the corporation’s total assets.

How to Fill Out Form 1120

A critical resource to help persons prepare Form 1120 is the instructions for Form 1120 available on the IRS website. This 31-page document provides specific details on how to prepare and file Form 1120.

How Much Does It Cost to File Form 1120?

If you choose to file Form 1120 on your own, it is technically free. However, Form 1120 is nothing if not complicated, and even a minor mistake could be costly. It is wise to get help from a qualified tax professional when filing Form 1120. The fee for filing Form 1120 averages around $900. This rate could vary depending on the complexity of your corporate taxes.

Have Questions Regarding Form 1120? We Are Here to Help!

At Greenback Expat Tax Services, we specialize in helping expats manage their US tax obligations. Among the many services we offer US expats, we can assist you in filing Form 1120.

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.