Form 8283: How to Claim a Tax Deduction for Noncash Charitable Contributions

- What Form 8283 Does for You

- When You Must File Form 8283

- Two Simple Sections Based on Value

- What You Can Deduct with Form 8283

- How to Value Your Donations

- Filing Steps for Form 8283

- Special Expat Considerations

- Avoiding Common Mistakes

- Maximizing Your Tax Benefits

- Record-Keeping Made Easy

- Your Next Steps

More than 35% of Americans donate noncash items to charity each year, yet many miss valuable tax deductions simply because they don’t know how to properly document these gifts. If you’re an American expat who donated property, clothing, household goods, or other noncash items worth more than $500, Form 8283 lets you claim these deductions on your US tax return—even while living abroad.

Here’s what you need to know: When your total noncash charitable contributions exceed $500 in a tax year, you must file Form 8283 to claim the deduction. This includes everything from clothes donated to Goodwill during a US visit to artwork given to a museum. For most expats, these deductions either reduce your US tax bill to zero or provide valuable tax savings on any remaining liability after applying international tax benefits.

At Greenback, we’ve helped over 23,000 expats claim charitable deductions they didn’t know they qualified for. The good news? Most expats who properly document their charitable giving pay little to no additional US taxes after taking advantage of all available deductions and credits.

What Form 8283 Does for You

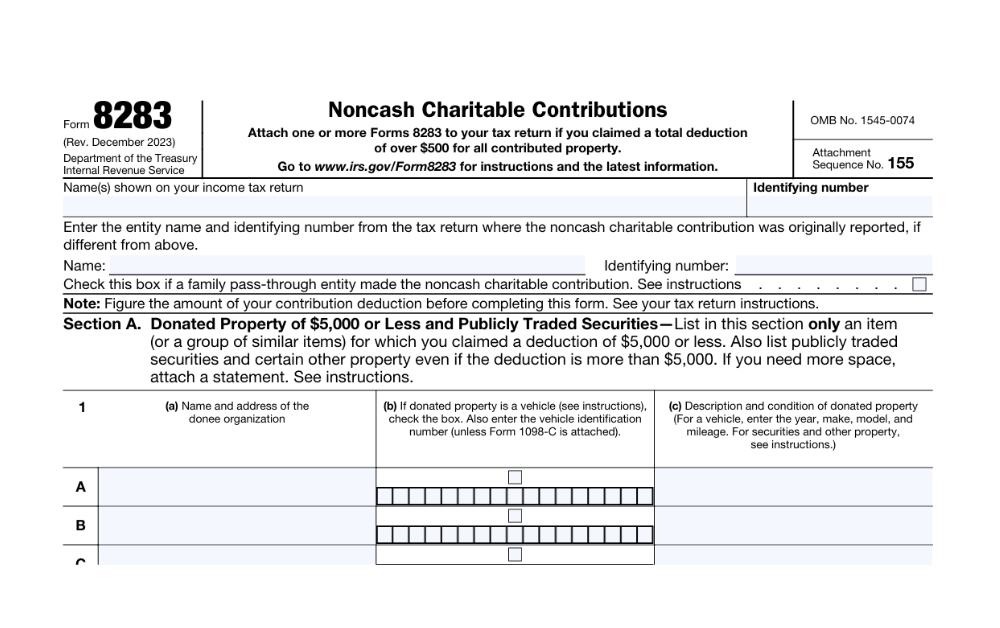

Form 8283, “Noncash Charitable Contributions,” is your ticket to claiming tax deductions for donated property valued at more than $500. Unlike cash donations that go directly on Schedule A, noncash donations require this additional form to prove legitimacy and prevent inflated valuations.

For expats, charitable deductions work especially well alongside the Foreign Earned Income Exclusion and Foreign Tax Credit. These deductions can eliminate any remaining US tax liability on income above the FEIE exclusion amount or provide additional tax savings when using the Foreign Tax Credit strategy.

When You Must File Form 8283

You need Form 8283 if all of these apply:

- You donated noncash property to a qualified US charity

- Your total noncash contributions exceed $500 for the tax year

- You’re itemizing deductions instead of taking the standard deduction

Qualifying Organizations

Your donations must go to IRS-recognized organizations like 501(c)(3) nonprofits, religious organizations, educational institutions, or government agencies. Generally, only donations to US-based organizations qualify, though some US organizations operating abroad may count.

Two Simple Sections Based on Value

Section A: Donations Worth $500 to $5,000

For individual items or groups of similar items valued between $500 and $5,000, use Section A. You’ll provide basic information including:

- What you donated and when

- How you got the property originally

- Fair market value on the donation date

- How you determined that value

No appraisal needed, just be reasonable and document your valuation method.

Section B: High-Value Donations Over $5,000

Section B requires more documentation but offers larger deductions:

- Everything from Section A

- Professional appraisal from a qualified appraiser

- Charity signature acknowledging the donation

- More detailed property information

Exception: Publicly traded stocks over $5,000 use Section B but don’t need an appraisal.

Get the Free Download That Makes Filing Taxes Simple

"*" indicates required fields

What You Can Deduct with Form 8283

Common Noncash Donations:

- Clothing and household goods in good condition

- Vehicles (with special Form 1098-C requirements)

- Real estate and land

- Artwork and collectibles

- Stocks and securities

- Business equipment

What Doesn’t Count:

- Cash, checks, or credit card donations

- Your time volunteering

- Travel expenses for volunteer work

- Donations to foreign charities (with rare exceptions)

How to Value Your Donations

Fair Market Value Rule

Use the price a willing buyer would pay a willing seller when neither is forced to buy or sell. For most items, this means:

- Used clothing: Thrift store prices for similar items

- Household goods: Garage sale or online marketplace values

- Electronics: Current resale value in working condition

- Vehicles: Kelley Blue Book or similar guides

Be Conservative

The IRS scrutinizes large charitable deductions. It’s better to be slightly conservative than to inflate values and trigger an audit.

Filing Steps for Form 8283

Step 1: Gather Your Documentation

Collect receipts, photos, and written acknowledgments from charities. Take pictures of donated items if you haven’t already.

Step 2: Choose Your Section

- Section A for items worth $500-$5,000

- Section B for items over $5,000

Step 3: Complete the Form

Fill out Form 8283 with detailed information about each donation. List similar items together (like clothing) rather than individually.

Step 4: Get Required Signatures

For Section B donations, obtain a qualified appraisal and have the charity sign Part IV of the form.

Step 5: Include with Your Tax Return

Attach Form 8283 to your Form 1040 when filing.

Special Expat Considerations

- Donations Made Before Moving Abroad: You can claim deductions for donations made during any part of the tax year, including before your move or during US visits.

- Documentation While Living Abroad: Living overseas can complicate getting appraisals or charity signatures. If you’re planning significant donations, arrange documentation before leaving the US or during visits.

- Currency Conversion: For any donations made while abroad (to qualifying US organizations), convert values to US dollars using the exchange rate on the donation date.

- Timing Strategy: Since you’re already dealing with complex expat tax forms, charitable deductions often provide excellent value with minimal additional complexity when properly documented.

Dreading the last minute scramble of pulling together your tax documents? Despair no more!

"*" indicates required fields

Avoiding Common Mistakes

- Don’t Overvalue Items: The IRS pays special attention to charitable deductions that seem unusually high relative to income. Be realistic about values.

- Get Required Appraisals: For donations over $5,000, skipping the appraisal requirement can cost you the entire deduction.

- Keep Detailed Records: Save all receipts, photos, and written acknowledgments. You need to prove both the donation and its value.

- Use the Right Form: Cash donations go directly on Schedule A—don’t use Form 8283 for checks or credit card contributions.

Maximizing Your Tax Benefits

- Smart Timing: Consider timing large donations in years when itemizing deductions makes sense compared to the standard deduction.

- Appreciated Assets: Donating stocks or other appreciated property lets you avoid capital gains tax while deducting the full fair market value.

- Coordination with Expat Benefits: Charitable deductions work particularly well for expats using the Foreign Tax Credit since they directly reduce US tax liability.

Record-Keeping Made Easy

Essential Documents:

- Charity receipts and acknowledgment letters

- Photos of donated items

- Appraisals for high-value items

- Documentation of your valuation method

How Long to Keep Everything

Maintain these records for at least three years after filing your tax return.

Getting Professional Support

Charitable deduction rules can become complex, especially for high-value items or unique situations. The IRS carefully reviews large charitable deductions, making accuracy essential.

Our CPAs and Enrolled Agents at Greenback have extensive experience helping expats maximize charitable deductions while avoiding audit triggers. We know how to properly document donations and coordinate them with other expat tax benefits for maximum savings.

You’ll have peace of mind knowing your charitable contributions are properly reported, allowing you to give generously while keeping your US tax liability as low as possible.

Your Next Steps

If you donated noncash items worth more than $500 this year, start gathering your documentation now. Contact the charities to get written acknowledgments if you haven’t received them already.

Calculate your total itemized deductions to see if itemizing beats the standard deduction. For many expats, charitable contributions combined with other allowable deductions make itemizing worthwhile.

Bottom line: Your charitable giving shouldn’t cost you valuable tax benefits. With proper documentation, these deductions can significantly reduce or eliminate your US tax liability while supporting causes you care about.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.

This information is for general guidance only. Charitable contribution rules can be complex, and professional consultation is recommended for your specific situation.