Understanding Form 8832: Entity Classification Election

Form 8832—Entity Classification Election—is a key part of the US taxation system for domestic and foreign businesses seeking flexibility in their tax classification.

This form allows entities to elect their tax status, such as being treated as a corporation, partnership, or disregarded entity, thus influencing how the IRS views them for tax purposes. The choice of classification through Form 8832 can lead to significant tax implications and potential benefits, depending on the specific attributes and objectives of your business.

As an American company founded by US expats, for expats, we at Greenback Expat Tax Services have firsthand knowledge of these tax rules because we file tax returns on behalf of thousands of clients each year, many of whom rely on Form 8832.

In this guide, we look into the essentials of Form 8832, shedding light on its purpose, function, and impact. You will gain insights into who can file this form, the process involved, and the strategic considerations businesses must evaluate to make an informed decision.

Key Takeaways

- Form 8832, Entity Classification Election, is a tax form that allows certain businesses to select whether they want to be considered a C corporation, partnership, or entity disregarded as separate from its owner for federal tax purposes.

- Form 8832 is not mandatory, so it does not have a deadline. You can file it at any point in the lifetime of an eligible business.

What Is Form 8832?

Form 8832, Entity Classification Election, is a tax form that allows certain types of businesses to select whether they want to be taxed as a:

- C corporation

- Partnership

- Disregarded entity

If you don’t use Form 8832 to make an election, the IRS will tax you based on your default classification, and you could end up paying more than you need to. By making the proper election, however, you may be able to save thousands of dollars every year.

For example, a single-member LLC (limited liability company) is taxed as a disregarded entity by default, and a multi-member LLC is taxed as a partnership. In both cases, the LLC members will be responsible for the business’s taxes on their individual tax returns. To avoid this, many LLC members prefer to be taxed as a C corporation, which stops the business’s profits and losses from “passing through” to their personal finances.

Of course, if you’re happy with your business’s default entity tax status, there’s no need to worry about Form 8832.

Form 8832 is not used to elect to be taxed as an S corporation (S corp). To do that, you’ll need to file IRS Form 2553 instead.

Who Must File Form 8832?

This form is not mandatory for anyone. It just allows eligible business owners to change their entity classification if they want to.

Who can file Form 8832? The following are eligible to file:

- Domestic partnerships

- Domestic LLCs

- Foreign partnerships

- Foreign LLCs

- Foreign eligible entities (in certain jurisdictions)

- US-owned foreign corporations (in certain jurisdictions)

Typically, domestic corporations cannot file Form 8832, nor can foreign entities listed in IRS Regulations 301.7701-2(b)(8).

For more details on eligibility, refer to the instructions on Form 8832 provided by the IRS.

When Is Form 8832 Due?

Often, tax deadlines for businesses are strict. But because Form 8832 isn’t mandatory, it doesn’t have a deadline, per se. You can file it at any point in the lifetime of an eligible business. Whether you’re operating a brand new small business or a business entity that’s been around for decades, you can still elect to change its entity classification.

There are some basic rules worth knowing about, however. When filing Form 8832, you can include a date that the change will take effect. This date has to fit within a specific timeframe, namely:

- Up to 75 days before you file the form

- Up to one year after you file the form

An accountant can help you choose the ideal effective date to put on your entity classification election form. There’s often some strategy involved, and making the right call could help you optimize your business taxes.

Once the IRS accepts your entity election, your new classification will remain indefinitely. There’s no need to file Form 8832 a second time unless you want to change your entity classification again.

However, in most cases, you can only change your classification once every five years, so you may have to wait. But there are a few exceptions, so consult your accountant to see if you can make a new election before the five years are up.

How Do I Fill Out Form 8832?

If you’ve decided that you want to change the entity classification for your business, there are a few quick steps to take.

First, review the IRS instructions for Form 8832 and gather the information you’ll need to complete it. Then, download the form from the IRS website.

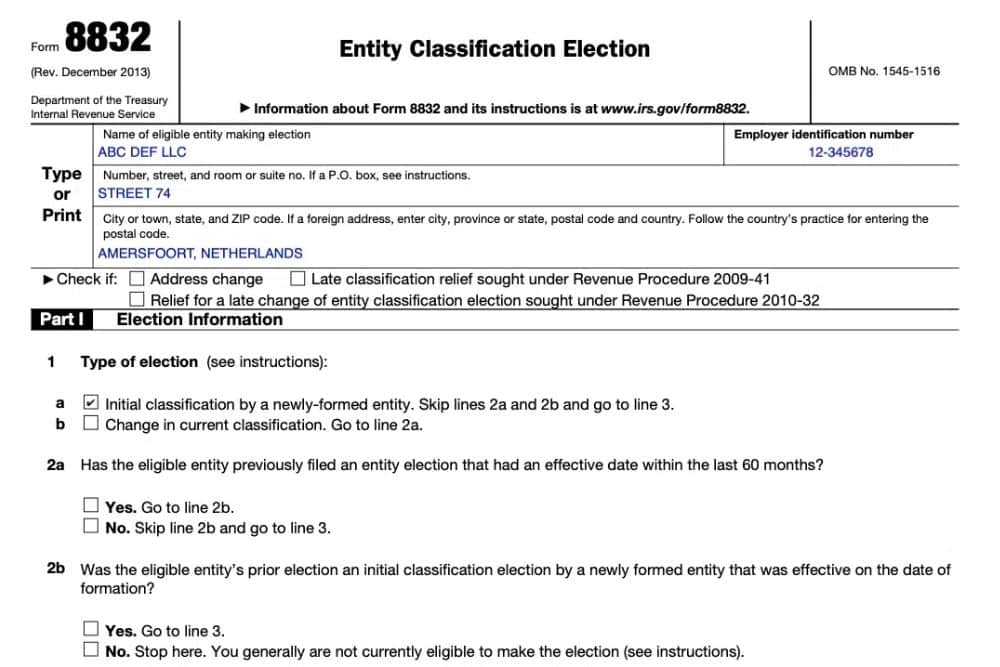

At the top of the form, fill out your basic business information, such as its name, mailing address, and employer identification number (EIN).

This will bring you to Part I: Election Information. Complete it to choose how you want your business to be taxed.

Then there is Part II: Late Election Relief. This is only necessary if you want to set an effective date earlier than 75 days before your filing date. You can use this section to request that the IRS make an exception to their standard timeframe. If you don’t need an exception, then you can skip Part 2 entirely.

Finally, sign the document with the appropriate signature (or signatures) and send it to the IRS. If you live in the US, you’ll mail it to either Kansas City, Missouri, or Ogden, Utah, depending on what state you’re in.

But if you’re living as an expat in a foreign country—or US possession such as Puerto Rico—you’ll want to mail the form to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0023

Once you’ve sent the complete form in, all you have to do is wait for a reply. The IRS should send you a letter either accepting or denying your request to change your status within 60 days. If you haven’t heard back after 60 days, you can call the IRS at 1-800-829-0115 or send a letter to the service center to check on the status of your form.

And that’s it! You’re all set. If your entity classification is accepted, attach a copy of the form to your US Federal Income Tax Return for the first tax year it’s effective, and you’re good to go.

Filing Form 8832 Doesn’t Need To Be Complicated

Form 8832 may be the key to optimizing your tax return if you own a foreign business that pays US taxes. And hopefully, after reading this article, you will have the knowledge you need to start.

Contact us at Greenback Expat Tax Services, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.