Behind on Your U.S. Taxes? Tax Help for Late Filers

Does Your Expat Life Resonate With These Realities?

-

You missed one or more U.S. tax deadlines while adjusting to life in a new country and now you’re not sure where to begin.

Between visa applications, finding housing, starting new jobs, and adapting to a new culture, tax deadlines slipped by unnoticed and now catching up feels daunting.

-

You didn’t realize you had to keep filing U.S. taxes after moving abroad, and discovered it only after years had passed.

You assumed your tax obligations ended when you left the country, or that working abroad meant you were exempt from U.S. filing requirements.

-

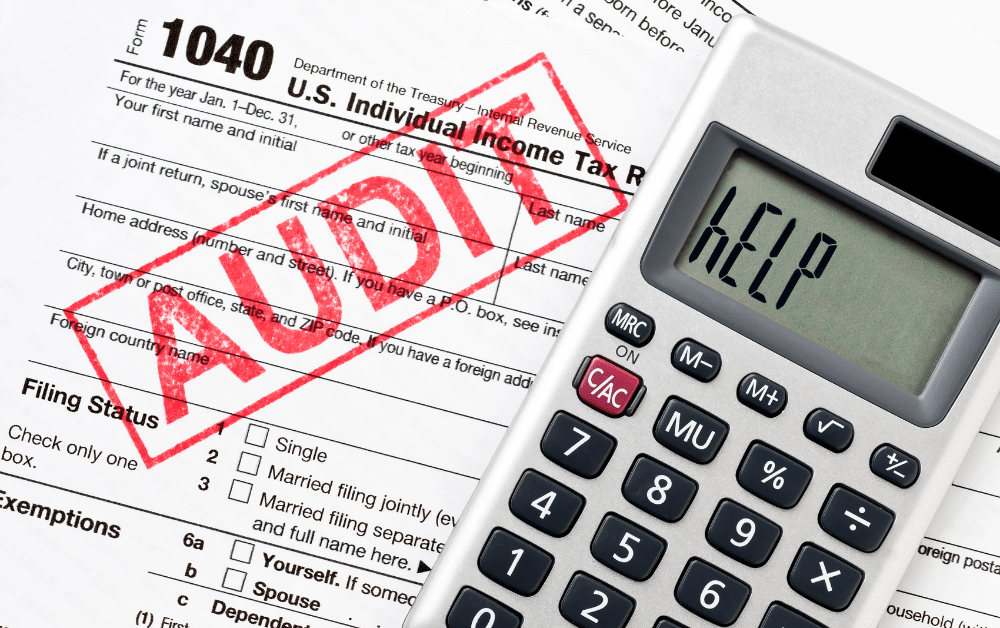

You’re worried about potential IRS penalties, notices, or consequences but unsure how serious your situation really is.

You’ve heard scary stories about FBAR penalties and late filing fees, but you don’t know if they actually apply to your specific situation or if relief programs are available.

-

You’re unsure whether you owe anything at all and want clarity before taking action.

You’ve heard that many expats don’t actually owe U.S. taxes because of exclusions and credits, but you need to understand your specific situation before deciding whether to file.

-

You’ve avoided dealing with taxes because it feels stressful, confusing, or embarrassing, and now the problem feels bigger.

Every year you put it off, the backlog grows and the anxiety increases, making it even harder to take that first step toward compliance.

-

You’re missing documents from prior years, like foreign tax returns, bank statements, or employer info, and aren’t sure if you can still file.

You’ve moved countries multiple times, changed jobs, or simply didn’t keep records because you didn’t know you’d need them for U.S. tax purposes.

-

You’ve read about “Streamlined Filing” but aren’t sure whether it applies to you, or what it would realistically involve.

You’ve seen mentions of penalty relief programs online but don’t know if you qualify, what documentation is required, or how the process actually works.

-

You want to get compliant, but you need a nonjudgmental, step-by-step path that won’t make things worse.

You’re ready to fix the situation but you need expert guidance to ensure you’re doing it correctly and not triggering additional scrutiny or problems.

Start your U.S. expat tax return today.

"*" indicates required fields

You Need Certainty. We Provide the Blueprint. Before you decide what to do next, you deserve to understand your situation. These guides walk you through the most common questions late-filing expats have, so you can explore your options, understand the rules, and feel confident about your next step.

What does “late filing” actually mean for U.S. expats?

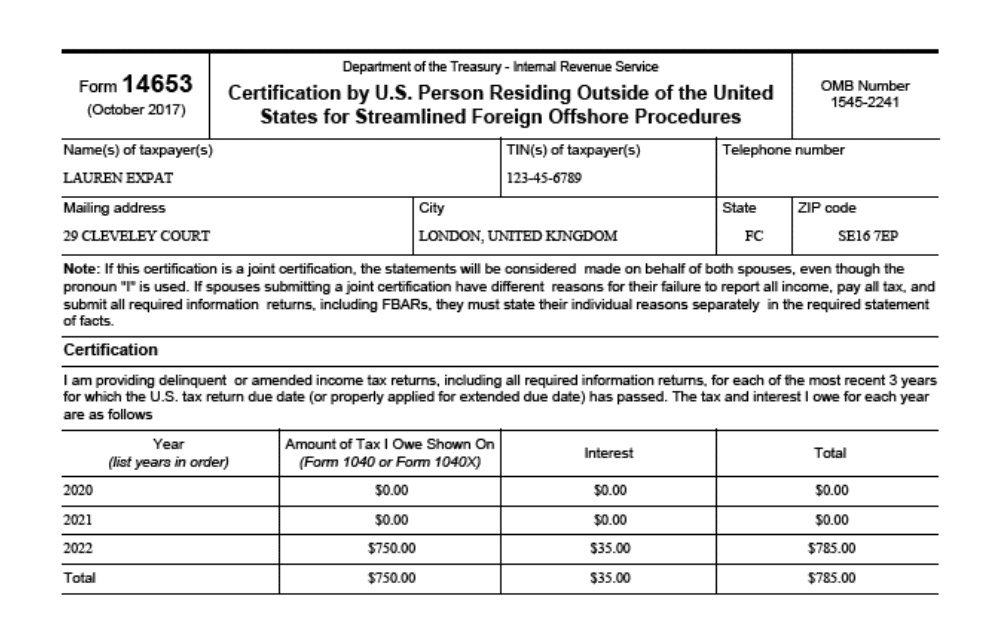

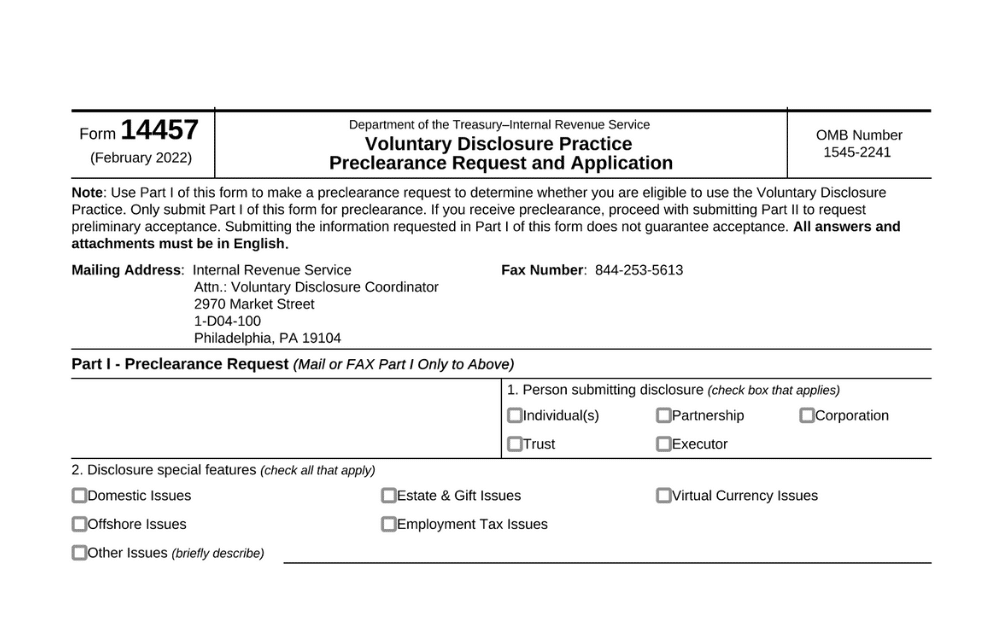

Get clear on how the IRS defines late filing and what penalties may apply. Learn why late filing situations are often fixable for expats, especially when you owe little to no tax. Learn about late filing penalties and how to resolve themHow does the IRS Streamlined Filing program work?

The Streamlined Foreign Offshore Procedures help expats catch up without penalties by filing the last 3 years of returns and 6 years of FBARs. Most non-willful late filers qualify for this penalty-free program. Understand how Streamlined Filing works and who qualifiesHow is foreign income treated on U.S. tax returns?

Whether your income comes from salary, freelance work, pensions, or investments, the Foreign Earned Income Exclusion can exclude up to $130,000 (2025) from U.S. taxation. Many expats owe $0 after applying this and Foreign Tax Credits. Learn about the Foreign Earned Income Exclusion protectionsWhat if I’m self-employed and behind on taxes?

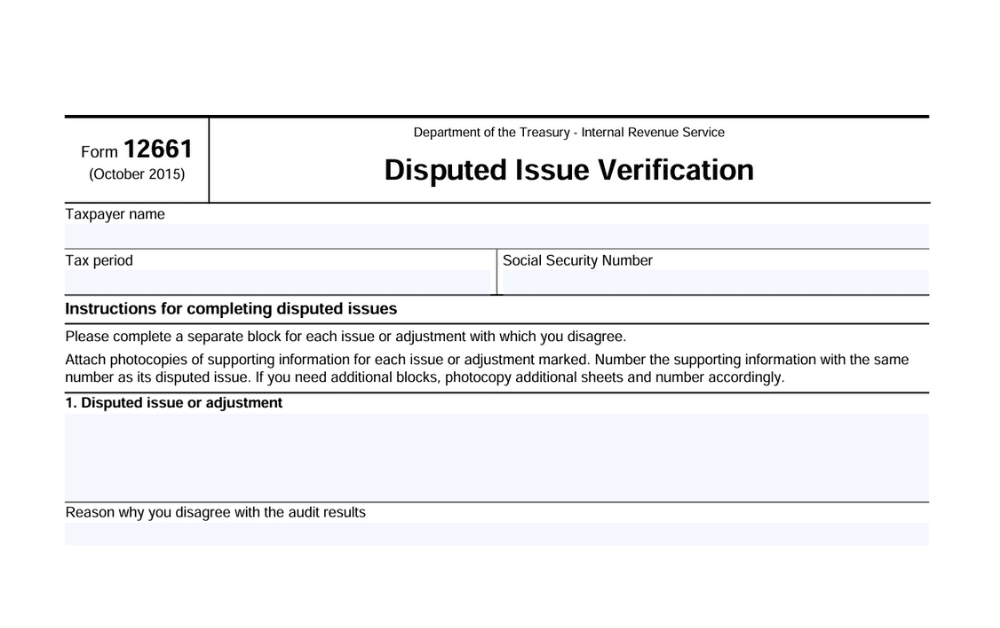

Self-employed expats need to catch up on Schedule C reporting, self-employment tax (Schedule SE), and possibly quarterly estimated taxes. The Streamlined Procedures work for self-employed filers too. Get guidance on catching up with Schedule C and SE tax reportingWhat happens if I missed FBAR filings?

If you didn’t file FinCEN Form 114 (FBAR), delinquent submission procedures can often resolve the issue without penalties, especially if you properly reported the income from those accounts. The FBAR requirement applies when foreign accounts exceed $10,000 combined. Learn how to file delinquent FBARs without penaltiesWhat if I’m missing documents or records?

Even if your records aren’t perfect, you can still catch up. We help you reconstruct your tax history using bank statements, employment contracts, foreign tax assessments, and other available documentation. Get practical steps on rebuilding your tax history and avoiding penaltiesFeatured In

Streamlined Filing Success Stories From Expats Just Like You

4.84/5

4.84/5

4.9/5

4.9/5

4.8/5

4.8/5

Tax Help for Late Filers – Solutions That Help You Get Back On Track

Whether you’re one year behind or many, our services are designed to meet you where you are. Choose the path that fits your situation, or explore your options before deciding.

Catch-Up Filing (Streamlined Procedures)

If you’ve fallen behind, the IRS Streamlined Program may allow you to become compliant, often without penalties. We prepare all required returns, foreign income forms, and FBARs to help you get back on track quickly and safely.

$1,750

USD

Annual Expat Tax Filing

Once you’re current, we handle your yearly U.S. return so you never have to fall behind again. We apply the right strategies, e.g., Foreign Earned Income Exclusion (FEIE), Foreign Tax Credits (FTC), and treaty provisions, to help minimize what you owe.

$565

USD

Small Business & Self-Employment Filing

Behind on reporting freelance income, small business earnings, or foreign entities? We prepare Schedule C, SE tax, and entity filings (like Form 5471) so you can catch up fully and confidently.

$750

USD

FBAR and FATCA Compliance

Missed FBARs can feel intimidating, but expats often have a path to correct them without penalties. We guide you through foreign account reporting and ensure everything is filed accurately going forward.

$125+

USD

Strategic Tax Consultation

If you’re unsure where to begin, or want to understand your options before committing, talk with an expat tax expert. We help clarify your situation, outline possible paths, and answer the questions keeping you up at night.

$250+

USD

State Tax Returns for Expats

Some expats need to file a State Tax Return even while living abroad. Whether you need to file a state return or not depends on the last state you resided in and your ongoing association with that state.

$185

USD

Your Questions, Answered: US Tax Guides & Resources

Visit the Knowledge CenterLate Filer FAQs: Catching Up on U.S. Expat Taxes

What’s included in Greenback’s Streamlined Filing Package?

Our Streamlined Filing Package includes preparation of 3 years of federal tax returns (Form 1040, 2555, schedules), 6 years of FBAR reports (FinCEN Form 114), Form 14653 certification of non-willful failure, and expert guidance from CPAs and Enrolled Agents who specialize in late filing. Most clients who qualify pay minimal or no penalties.

Learn more about our Streamlined Filing service.

How much does it cost to catch up on years of missed tax returns?

Greenback’s Streamlined Filing Package is a flat fee of $1,750 and covers everything needed to get you back into compliance: 3 years of federal returns, 6 years of FBARs, and Form 14653. If you need additional services like state returns or business filings, those have separate transparent pricing.

Use our pricing calculator to get a complete estimate.

Can Greenback help me if the IRS has already contacted me?

If the IRS has initiated enforcement action against you, you may not qualify for Streamlined Filing, but we can still help. We assess your specific situation and recommend alternative compliance paths, such as Delinquent FBAR Procedures or Reasonable Cause arguments. We handle complex cases and IRS correspondence.

Schedule a consultation to discuss your situation.

Does Greenback prepare late business tax returns for self-employed expats?

Yes, we specialize in catching up on Schedule C (self-employment income), Schedule SE (self-employment tax), and foreign business entity reporting like Form 5471. We maximize deductions while ensuring compliance and help you understand quarterly estimated tax requirements going forward.

Learn more about our small business tax services.

What if I don’t have all my records from previous years?

Greenback can help you reconstruct your tax history using bank statements, employment contracts, foreign tax assessments, and other available documentation. Most late filers are missing some records, and we guide you through the process of providing reasonable estimates based on what you can access.

Our Streamlined Filing service includes support for document reconstruction.

Can Greenback file my late FBAR reports?

Yes, we file delinquent FBAR reports through the proper IRS procedures. If your non-compliance was non-willful and you properly reported the income from your foreign accounts, you can often file late FBARs with minimal or no penalties. We include 6 years of FBARs in our Streamlined Package or can file them separately.

Learn more about our FBAR filing services.

After I catch up, can Greenback handle my annual filing going forward?

Absolutely. Once your Streamlined package is filed and processed, you’re fully compliant. We then handle your yearly federal tax return to keep you on track. Our annual service includes strategic application of FEIE, Foreign Tax Credits, and all necessary forms and schedules.

Learn more about our annual federal tax filing service.