Navigating the Tax Season: Insights on American and Expat Filing Trends

The dread of tax season resonates differently between Americans living stateside and those abroad. The Greenback team conducted a survey involving 1,046 Americans residing in the US and abroad, and performed an analysis of tax-related search trends. Our findings reveal surprising attitudes towards filing deadlines, perceptions of foreign tax systems, and the timing of when individuals intend to file their taxes. Read on to learn the differences and similarities in tax filing approaches between US residents and expats this time of year.

Key Takeaways

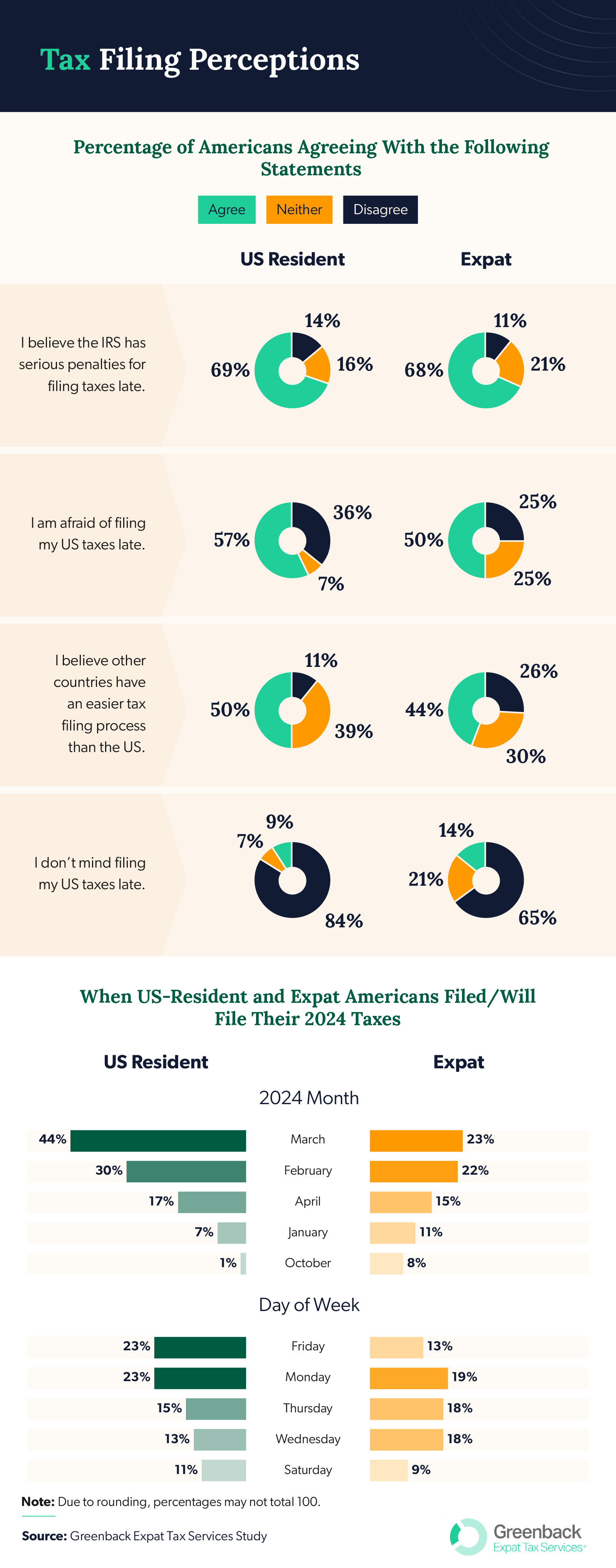

- US-residing Americans are 14% more likely than expats to be afraid of filing their US taxes late.

- Expats are 136% more likely than US residents to disagree that other countries have an easier tax filing process than the US.

- Gen Z (56%) is the most likely to believe other countries have an easier tax filing process than the US.

- Expats are 56% more likely than US residents to not care about filing their US taxes late.

- March is the most common month US residents and expats plan to file taxes in 2024 (44% and 23%, respectively).

Understanding Filing Fears and Preferences

- US-residing Americans are 14% more likely than expats to be afraid of filing their US taxes late.

- Expats are 136% more likely than US residents to disagree that other countries have an easier tax filing process than the US.

- Gen Z (56%) is the most likely to believe other countries have an easier tax filing process than the US.

- Expats are 56% more likely than US residents to not care about filing US taxes late.

- March is the most common month US residents and expats plan to file taxes in 2024 (44% and 23%, respectively).

- Friday and Monday are the most common days of the week that American residents plan to file taxes in 2024 (23% each); Monday is the most common day of the week that expats plan to file taxes in 2024 (19%).

Peak Tax Filing Interests: When Americans Hit Search

These are the top five months Americans searched for “how to file taxes” the most in 2023, by total search volume:

- April – 263,693 searches

- January – 202,839 searches

- February – 182,557 searches

- March – 162,272 searches

- December – 79,000 searches

These are the top five weeks of the year Americans searched for “how to file taxes” since 2019, by average search volume:

- Week 15 (in April) – 74,518 average searches

- Week 4 (in January) – 64,482 average searches

- Week 5 (in January and/or February) – 62,133 average searches

- Week 3 (in January) – 53,166 average searches

- Week 14 (in April) – 52,738 average searches

Methodology

For this study, we surveyed 895 US-residing Americans and 151 expatriates to understand their perspectives on taxes, particularly in filing taxes late. Additionally, we leveraged Glimpse to analyze the search volume by month and week for “how to file taxes” from March 2019 to February 2024.

About Greenback Expat Tax Services

Greenback Expat Tax Services is dedicated to easing the tax burden for US expats living worldwide. Our team combines extensive tax expertise with a passion for empowering expats. By offering a hassle-free, digital solution to tax preparation, we make life easier for our clients so they can concentrate on what matters most to them, wherever they are in the world.

Fair Use Statement

If you find the insights about filing federal taxes from our study enlightening and believe they could benefit others, we encourage you to share this article for noncommercial purposes. Please link to this article so readers can access the full context and data.

Who doesn’t love a tax break? Download our easy-to-use excel calculator to get an estimate of how the foreign earned income exclusion can save you money.

"*" indicates required fields