What Is IRS Form 8854? A Guide for Expats

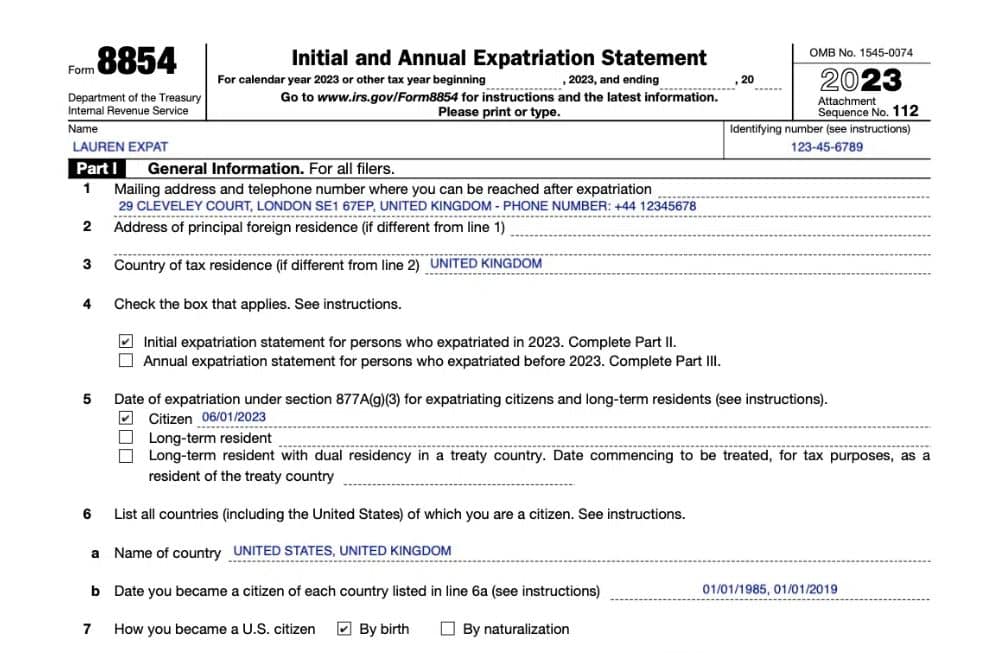

To renounce your US citizenship, you must file a variety of forms. One of the most important is IRS Form 8854. Until you’ve filed this form, you will still be considered a citizen by the Internal Revenue Service.

But what is Form 8854—and how do you complete it? Here’s what you need to know.

Key Takeaways

- US citizens must file Form 8854 to certify tax compliance after relinquishing their citizenship.

- Certain long-term residents must also file Form 8854 to terminate their residency.

- Form 8854 is used to determine whether a US person will have to pay the exit tax when renouncing their citizenship or terminating their residency.

What Is Form 8854?

Form 8854 is an IRS tax form used to show that you have settled your US taxes once and for all. Until you’ve done this, the US government will consider you a citizen for income tax purposes and expect you to continue filing US taxes.

Form 8854 also determines whether you are a covered or non-covered expat. If you are a covered expat, you will be required to file an exit tax in order to finalize your renunciation.

Who has to File IRS Form 8854?

US citizens who are renouncing their citizenship must file Form 8854. Certain long-term residents must also file this form when terminating their US residency. Specifically, US residents who have held a Green Card for at least eight out of the past 15 years must file Form 8854 if they wish to be considered non-residents.

What Is the Penalty for Failing to File Form 8854?

The penalties for failing to file Form 8854 when required can be steep. First, there is the noncompliance penalty—up to $10,000. (However, this penalty only applies to covered expats.)

Beyond this, because you will be considered a US citizen until you have filed Form 8854, you will continue to be subject to US taxes. That means that you will also have to pay any unpaid taxes you incurred before filing, along with any associated interest or penalties.

Regardless of whether you are a covered or noncovered expat, it is always best to file this form as required.

What Is a Covered Expatriate?

The question of whether you are a covered or noncovered expat will have a major impact on the costs of renouncing your citizenship. In fact, it can be the primary factor that determines whether renouncing your citizenship makes financial sense at all.

So what’s the difference between a covered expat and a non-covered expat? In short, a covered expat must pay an exit tax to renounce their citizenship or terminate their residency. A non-covered expat, on the other hand, can renounce their citizenship or terminate their residency without needing to pay an exit tax.

The IRS will consider you a covered expatriate if any of the following standards apply:

- You have a personal net worth of more than $2 million

- Your average taxable income of the past five years exceeds a certain threshold ($190,000 for the 2023 tax year)

- You have failed to file or pay your taxes as required during any of the last five years

If you meet any of the above qualifications, you are a covered expat, and you will be required to pay an exit tax. Otherwise, you are a non-covered expat, and the exit tax does not apply to you. Either way, you will still have to file Form 8854 to determine your status, whether covered or non-covered.

There are rare exceptions when you may not be considered a covered expat even if you meet the usual standards. Namely, if you became a dual citizen at birth or if you expatriated from the US before the age of 18 ½, you may be able to avoid the exit tax even if it would otherwise apply. These exceptions can be complex, however. Consult an expat tax professional to learn more.

The exit tax is calculated based on the “deemed sale” of your worldwide assets the day before expatriation. However, for 2023, there is an exemption: the first $767,000 of gains (adjusted for inflation) is exempt from the exit tax. This means that only gains exceeding this threshold are subject to the exit tax.

How to File Form 8854

Form 8854 is an incredibly complicated form to complete. We do not recommend completing this form yourself, as even a minor mistake or miscalculation could have wide-ranging tax implications.

For example, to avoid being considered a covered expat, you must certify on Form 8854 that you have been entirely tax-compliant for the previous five years. This is a significant claim, and you could face severe penalties if you are wrong about this.

For the sake of security and peace of mind, consult a qualified tax professional to ensure that you complete Form 8854 accurately.

What If I’m Behind on My Expat Taxes?

One of the most common reasons expats qualify as covered expats is that they aren’t up to date on their taxes when they renounce their citizenship. This is because many Americans are unaware that they must file a US tax return even after moving overseas.

If you are behind on your expat taxes, don’t panic. The IRS provides an amnesty program for expats in your position. It’s called the Streamlined Filing Compliance Procedures.

To use this program, you must:

- Self-certify that you failed to file by accident and not because you chose to violate US tax law

- File up to three delinquent income tax returns and pay any delinquent taxes you owe based on those returns

- File Foreign Bank Account Reports (FBARs) for the last six years

Once you’ve completed these steps, the IRS will consider you to be in basic compliance with US tax law.

However, as noted above, to become a noncovered expat, you must certify that you have been compliant for at least the previous five years. If your noncompliance stretches back farther than the three years required by the Streamlined Filing Compliance Procedures, you will have to file any additional returns needed to meet that standard.

If you have been delinquent in your expat taxes for any amount of time, don’t wait to use this program! If the IRS contacts you about your delinquency before you start the process yourself, you may lose the privilege of claiming amnesty.

Still Have Questions about IRS Form 8854 and Your Expat Taxes?

We hope this post has helped you understand what Form 8854 means to you as a US expat.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.