Partnership Withholding: All About US Tax Forms 8804 & 8805

- What Is Partnership Withholding?

- What Is the Withholding Rate for Partnerships with a Foreign Partner?

- Are There Any Exceptions to Partnership Withholding?

- What Is Form 8804?

- What Is Form 8805?

- When Are These Forms Due?

- What If the Partnership Doesn’t File These Forms on Time?

- How Do I File Form 8804 and Form 8805?

- Have Questions Regarding Forms 8804 and 8805?

If a partnership with a foreign partner has income that is effectively connected with a US business or trade, it must report a partnership withholding tax. This is done by filing Form 8804 and Form 8805.

This is a somewhat complicated area of US tax law, but don’t worry! We’re here to help you understand how partnership withholding on foreign partners works.

Key Takeaways

- Form 8804 and Form 8805 are used to report any withholding tax applied to the income of a partnership.

- Failing to file forms 8804 and 8805 when required can result in severe tax penalties.

- If you are delinquent in filing these forms, you should try to come into compliance as quickly as possible to avoid worse fines.

What Is Partnership Withholding?

If a nonresident alien is a partner in a US partnership—or a foreign partnership with effectively connected income (ECI) to a US business of trade—then that partnership must withhold the foreign partner’s share of the ECI.

(This also applies to LLCs taxed as a partnership, whether domestic or foreign.)

Partnerships must pay this withholding tax even if the partnership never makes any cash distributions to the foreign partner, and regardless of the foreign partners’ ultimate US tax liability. The good news is that the withholding tax does not apply to any income that isn’t effectively connected to a US business or trade.

What Is the Withholding Rate for Partnerships with a Foreign Partner?

The standard withholding rates are:

- 21% for corporate foreign partners

- 37% for non-corporate foreign partners

However, because the US has entered into tax treaties with some countries, the rate may be lower for some foreign partners. An experienced expat accountant can help you calculate the correct rate for your business.

Are There Any Exceptions to Partnership Withholding?

The IRS does have some exceptions to partnership withholding. For example, it lets foreign partners certify some losses and deductions to the partnership. Foreign partners may also certify that their partnership investment will be the only way they contribute to the ECI during that tax year.

In the event of these certifications, the partnership won’t be required to pay a withholding tax for the foreign partner as long as the estimated annualized or actual tax due is less than $1,000.

However, even if no withholding tax is due, the partnership must still report the ECI income of the foreign partner. You can do this with Form 8804 and Form 8805.

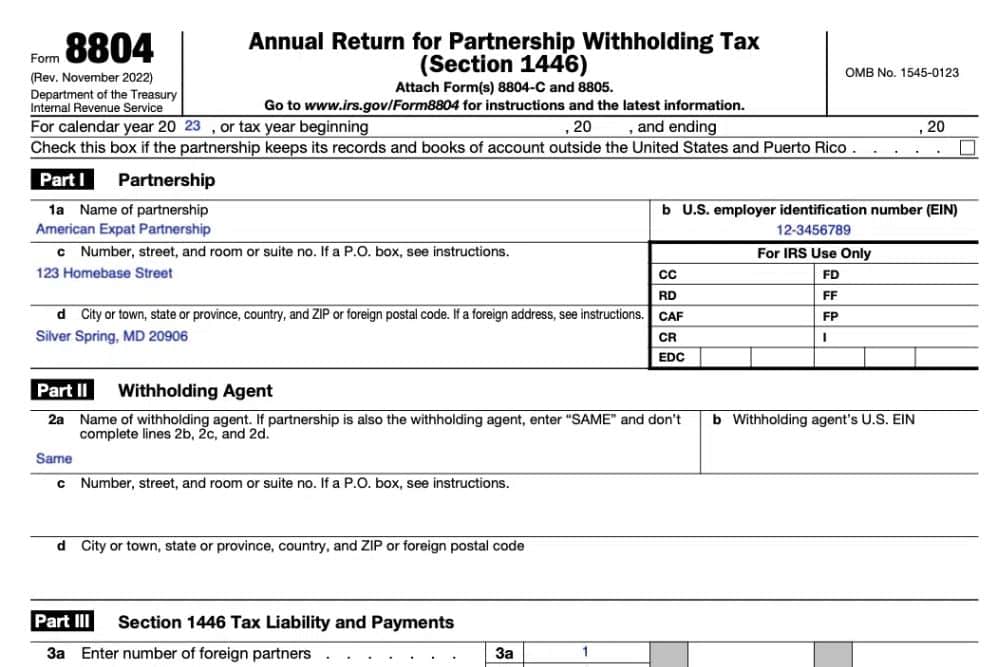

What Is Form 8804?

Form 8804 is an annual summary statement of any Forms 8805 that were sent to foreign partners. The partnership must complete Form 8804 and attach a copy of every foreign partner’s 8805—again, even if no withholding tax is paid.

What Is Form 8805?

Form 8805 reports the amount of ECI allocated to a foreign partner. The partnership must send a completed copy of this form to all foreign partners involved, even if no withholding tax is paid.

If a withholding tax is paid, the foreign partner can attach Form 8805 to their US individual tax return to claim a credit for their share of income that was withheld

When Are These Forms Due?

Most partnerships must send copies of Form 8805 to every foreign partner no later than March 15th. The same deadline applies for filing Form 8804 and duplicate copies of every Form 8805 with the IRS.

However, if the partnership is exclusively made up of foreign partners, the deadline for both forms is June 15 instead.

If you cannot file on time, you can use Form 7004 to request an extension. Just remember that this only extends the deadline for filing, not the deadline for paying the withholding tax.

Since many other small business tax deadlines fall on the same dates, it’s important to plan ahead when filing Form 8804 and Form 8805.

What If the Partnership Doesn’t File These Forms on Time?

The IRS mandates penalties for failing to file these forms or filing them too late.

If a partnership fails to file Form 8804 by the deadline, the IRS will typically apply a penalty of 5% of any unpaid withholding taxes for each month (or part of a month) that have passed since the deadline, up to a maximum of 25% of the unpaid taxes. And if the partnership files Form 8804 more than 60 days late, the minimum penalty will be $330 unless the total amount owed is less than that.

For Form 8805, if a partnership fails to do the following, it may be subject to penalties:

- Send copies of Form 8805 to its foreign partners

- File duplicate copies with the IRS

- Provide complete and accurate information on each Form 8805

The penalty generally ranges from $50–$280 per Form 8805, up to a maximum penalty of $3,392,000.

However, in any of these cases, you may be able to avoid all penalties if you can show reasonable cause for filing late. For more information, see the combined Form 8804 and Form 8805 instructions.

How Do I File Form 8804 and Form 8805?

Form 8804 is more like Forms W-3 or 1096. It merely summarizes the amounts withheld from each foreign partner. But remember: You must attach a copy of Form 8805 for every foreign partner, regardless of whether any withholding tax is paid.

Form 8805 is similar to Forms W-2 or 1099-MISC. All it requires is information about the partnership and the foreign partner. Then, you’ll fill in the amount of tax the partnership withheld from the foreign’ partners ECI.

Again, review the combined Form 8804 and Form 8805 instructions for more details.

If you owe any withholding taxes for a foreign partner, these must be paid using Form 8813. These payments must be made quarterly through the tax year, on the 15th day of April, June, September, and December.

To learn more about the laws surrounding these forms, review IRC section 1446.

Have Questions Regarding Forms 8804 and 8805?

We hope this article has cleared up any confusion you may have had about Forms 8805 and 8804.

Have questions about the process or next steps? Contact us, and one of our Customer Champions will happily address all your concerns.

If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.