Capital Gains Tax Reforms: Who’s Taking the Biggest Hit

President Biden has proposed capital gains tax reforms to address wealth inequality by taxing higher incomes and larger estates more heavily. The key changes would be:

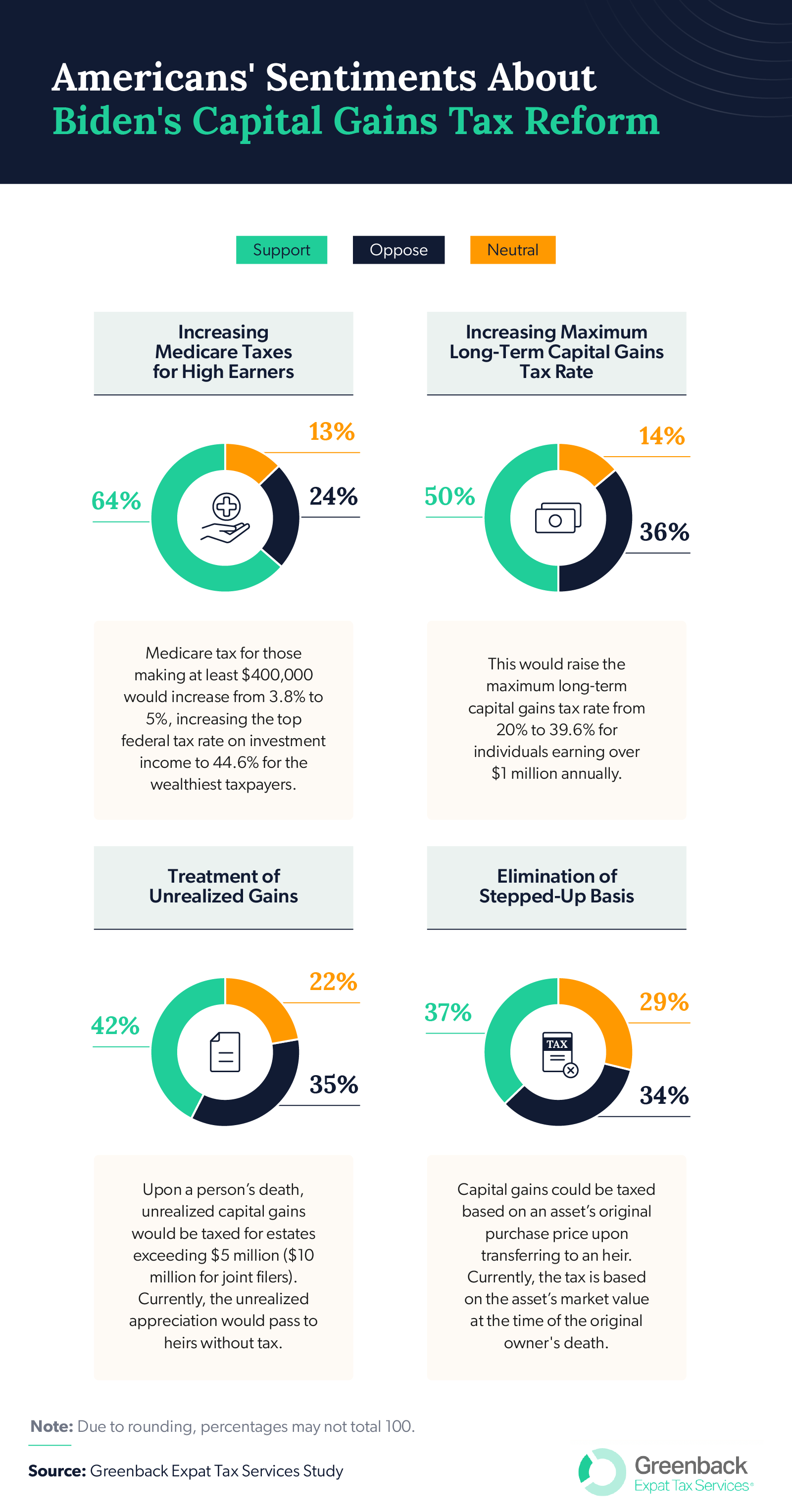

- Increasing Medicare taxes for high earners: The Medicare tax rate for individuals earning at least $400,000 would rise from 3.8% to 5%, elevating the top federal tax rate on investment income to 44.6% for the wealthiest taxpayers.

- Increasing maximum long-term capital gains tax rate: For individuals earning over $1 million annually, the maximum long-term capital gains tax rate would increase from 20% to 39.6%.

- Treatment of unrealized gains: Under the new proposal, unrealized capital gains would be taxed at death for estates exceeding $5 million ($10 million for joint filers), shifting away from the current system, in which such gains could pass untaxed to heirs.

- Eliminating stepped-up basis: The reforms would also eliminate the “stepped-up basis” at death. Instead of being taxed based on the market value at the time of the original owner’s death, capital gains taxes would be levied based on the original purchase price of an asset when transferred to an heir.

President Biden’s capital gains tax reform could have many economic effects, particularly on expatriates and people in higher income brackets. Are you wondering how the proposed changes to capital gains tax could affect you and your state in 2024? The Greenback Expat Tax Services team recently examined the specifics of these changes to help you understand the broader implications and prepare for the future.

In this analysis, we explore which states are expected to bear the brunt of the tax reform based on population and income figures. By examining these metrics and incorporating expert opinions, we provide an overview of the potential economic impact across the US. We also surveyed over 1,000 Americans to gauge perceptions and gather insights into the upcoming tax adjustments. This article will guide you through our key findings and highlight the most affected regions.

Key Takeaways

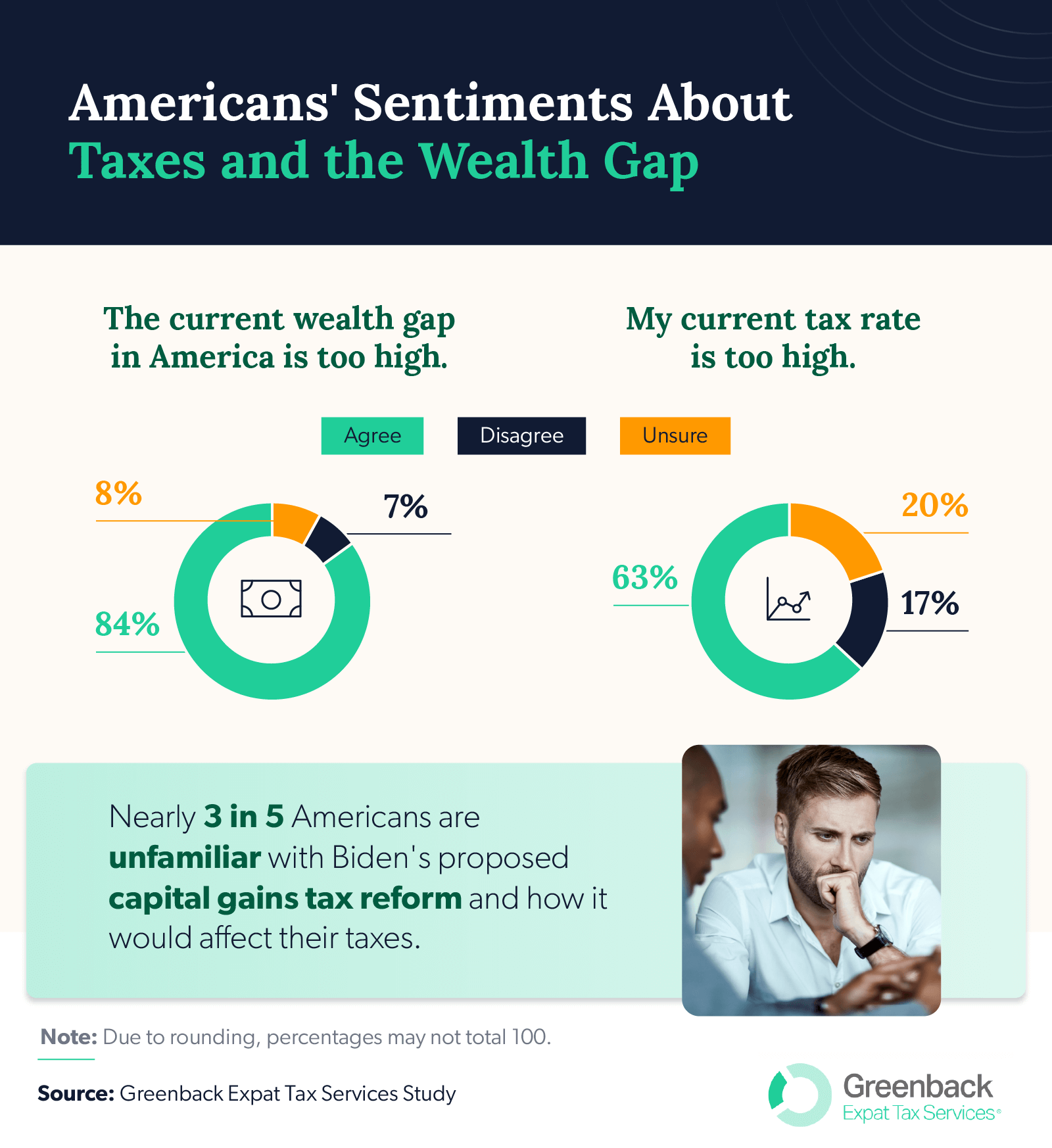

- 84% of Americans believe the current wealth gap in America is too high; Democrats are 43% more likely than Republicans to believe this.

- 64% of Americans support additional Medicare taxes on high earners; Democrats are 141% more likely than Republicans to support this.

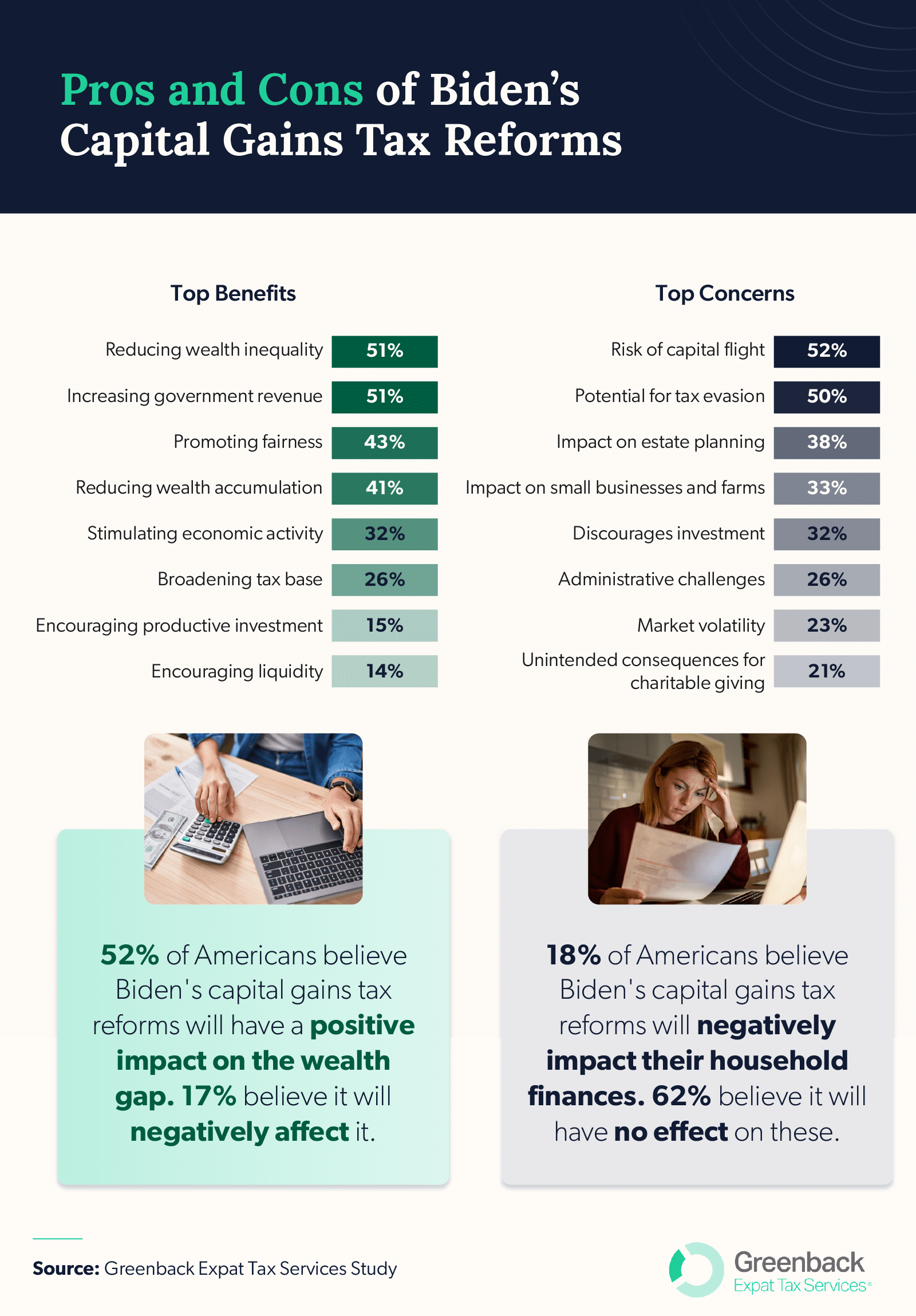

- 52% of Americans believe Biden’s proposed capital gains tax reforms will have a positive impact on the current wealth gap; Democrats (69%) are 146% more likely than Republicans (28%) to believe this.

- The top 5 states most likely to be impacted by the proposed reforms are Kansas, Massachusetts, Iowa, Connecticut, and Utah.

Thoughts on Wealth Inequality and Tax Policy

- Millennials (89%) and Gen Z (86%) are the most likely to believe the current wealth gap in America is too high.

- Democrats (93%) are 43% more likely to believe the current wealth gap in America is too high compared to Republicans (65%).

- Gen X (68%) is the most likely to believe their current tax rate is too high; Gen Z (56%) is the least likely to believe that.

- Republicans (75%) are 39% more likely to believe their current tax rate is too high compared to Democrats (54%).

- Republicans (48%) are more likely to understand how Biden’s proposed capital gains tax reform affects their personal taxes compared to Democrats (43%).

- Democrats are:

- 263% more likely than Republicans to support the treatment of unrealized gains.

- 218% more likely than Republicans to support increased tax rates.

- 200% more likely than Republicans to support the elimination of stepped-up basis.

- 141% more likely than Republicans to support additional Medicare taxes on high earners.

- Democrats are:

- 222% more likely than Republicans to believe the proposed tax reforms promote fairness.

- 179% more likely than Republicans to believe the proposed tax reforms will reduce wealth inequality.

- 163% more likely than Republicans to believe the proposed tax reforms stimulate economic activity.

- Republicans are:

- 250% more likely than Democrats to believe the proposed tax reforms will discourage investment.

- 143% more likely than Democrats to believe the proposed tax reforms will have unintended consequences for charitable giving.

- 56% more likely than Democrats to believe the proposed tax reforms will cause market volatility.

- Democrats (69%) are 146% more likely than Republicans (28%) to believe Biden’s proposed capital gains tax reforms will have a positive impact on the current wealth gap.

Methodology

For the first half of this study, we surveyed 1,003 Americans on their sentiment toward President Biden’s proposed tax reforms. Among the respondents, 40% reported earning between $10,000 and $49,999, 27% between $50,000 and $74,999, 14% between $75,000 and $99,999, 13% between $100,000 and $149,999, and 6% earned $150,000 or more. Additionally, 51% of respondents reported as Democrats, 25% as independents, and 23% as Republicans.

About Greenback Expat Tax Services

At Greenback Expat Tax Services, we provide US expats with precise and straightforward tax solutions. Our services are designed to simplify your tax obligations worldwide, ensuring compliance and peace of mind.

Fair Use Statement

You can spread these findings for noncommercial purposes, just make sure to link back to this page, please.

Who doesn’t love a tax break? Download our easy-to-use excel calculator to get an estimate of how the foreign earned income exclusion can save you money.