Form 8621 and Passive Foreign Investment Company Management

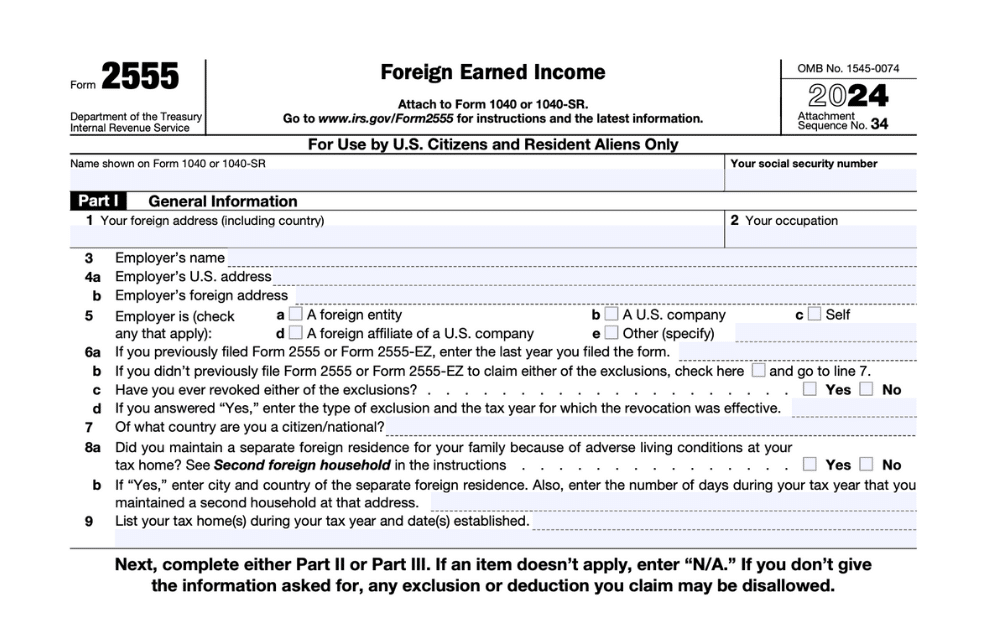

As an American living abroad, you may be familiar with the most common forms for expats. For example, Form 2555 (Foreign Earned Income Exclusion) and Form 1116 (Foreign Tax Credit) are both relatively easy to understand. But if you’re an expat with shareholder investments, you may also have to complete disclosure forms that must be filed according to very specific tax rules, such as Form 8621.

Form 8621, or the “PFIC form” is an information reporting form that first came into being in 1986 when new regulations were put into place to close some loopholes folks were using to shelter offshore investments. The form’s purpose is to stop people from deferring tax on passive income earned through non-US corporations.

In 2013, the rules were updated such that anyone owning a PFIC directly or indirectly had to report it yearly, even if distributions were not received. If you are a shareholder of a company or fund that fits the definition of a Passive Foreign Investment Company (PFIC) or Qualified Electing Fund (QEF), then you may need to add Form 8621 to your to-do list.

Key Takeaways

- Most foreign mutual funds, REITs, and ETFs listed on foreign exchanges will be considered PFICs by the IRS and must be reported annually on form 8621

- Shares in Private Corporations overseas that hold assets but do not carry on an active business would also be considered PFICs.

- Publicly traded stocks and bonds of non-US corporations are generally not considered PFICs.

What is Form 8621 used for?

Passive foreign investment companies are taxed by the IRS through a special form called Form 8621. The IRS would consider a foreign entity a Passive Foreign Investment Company (PFIC) if it meets either the Income or Asset Test. The Income Test states that a company is a PFIC if at least 75% of the corporation’s annual gross income is investment-type income such as interest, dividends, capital gains, rents, royalties, etc. The Asset Test states that a company is a PFIC if at least 50% of the average percentage of its assets produce or are held to produce passive income.

Do I Need to File IRS Form 8621?

This form is required when you have any direct or indirect ownership interest in a PFIC (defined below). It does not matter if you own just one share or just one dollar in a PFIC; you still are required to report it. Form 8621 is used to report information about PFICs (Passive Foreign Investment Companies) to the IRS.

You can own PFICs directly, or you can own them indirectly. You are an indirect shareholder of a PFIC if you are:

- A direct or indirect owner of a pass-through entity that is a direct or indirect shareholder of a PFIC. Passthrough entities include partnerships, s-corps, trusts, or estates.

- A Shareholder of a PFIC that is a shareholder of another PFIC or

- A 50% or more shareholder of a foreign corporation that is not a PFIC and that directly or indirectly owns stock of a PFIC

Direct ownership is much simpler – you would own the PFIC directly, such as owning a foreign mutual fund in your personal foreign investment account.

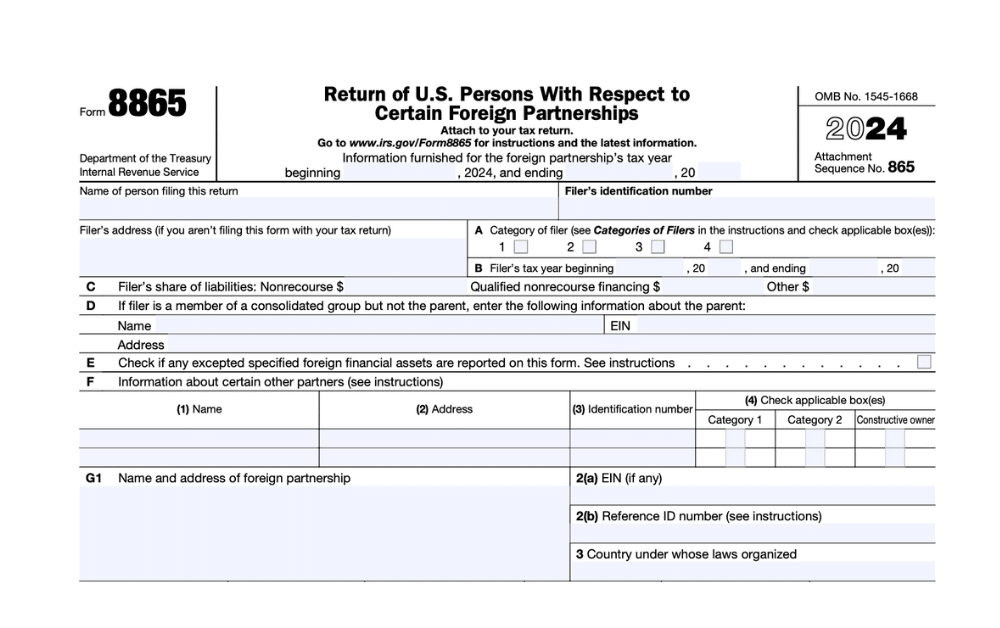

Depending on the type of company in which you have ownership, other forms (such as Form 8858 or Form 8865) might also be required. We recommend reviewing the requirements for the Tax Cuts and Jobs Act as well since Section 965 affects many foreign investment taxes.

How Do Most People End Up Owning PFICs?

Most US expats will end up owning PFICs accidentally. This can happen if you invest in foreign mutual funds, REITs, and ETFs listed on foreign exchanges. The IRS will consider these investments to be PFICs 99 out of 100 times. These can be funds run by US fund companies like BlackRock or Fidelity, but they are run outside of the US, so they don’t need to comply with US reporting requirements. If you own or suspect you might own any such assets, we strongly recommend speaking with an Expat tax professional to help assess if these assets would be considered Passive Foreign Investment Companies.

PFIC guidelines are notoriously strict and complicated, making PFICs quite tedious for most US persons. If you own or suspect an investment or investments that would be considered PFIC, ensure you keep very accurate records of all income and transactions on the account. We also recommend speaking with an expert expat tax advisor to determine if the investment is a PFIC and how best to deal with it.

Form 8621 Examples and Exclusions

Ownership in a Passive Foreign Investment Company (PFIC) can be direct or indirect. If you own foreign mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs) directly, it is likely that you are a direct owner of a PFIC. Check your existing investments carefully, and make sure you ask your tax preparer to check any foreign investments before you make them. If you determine that you do own a PFIC, be sure to include Form 8621 with your tax return.

There are two exceptions to the PFIC rules.

The first is called the De Minimis Holdings rule, which says that the rules allow simplified reporting if the yearend value of all PFICs owned by the US Person does not exceed $25,000 ($50k for MFJ). In this case, all PFICs can be reported on one form, 8621, instead of each PFIC having to be reported on its separate form, 8621.

The second exception is the Foreign Pension Plan Exception. This exception states that the annual PFIC reporting does not apply to PFICs held in a qualified foreign pension plan where the taxation of the income earned in the plan is deferred. We strongly recommend that you check with a qualified tax advisor to ensure your funds and pension qualify before assuming they will and potentially have an issue.

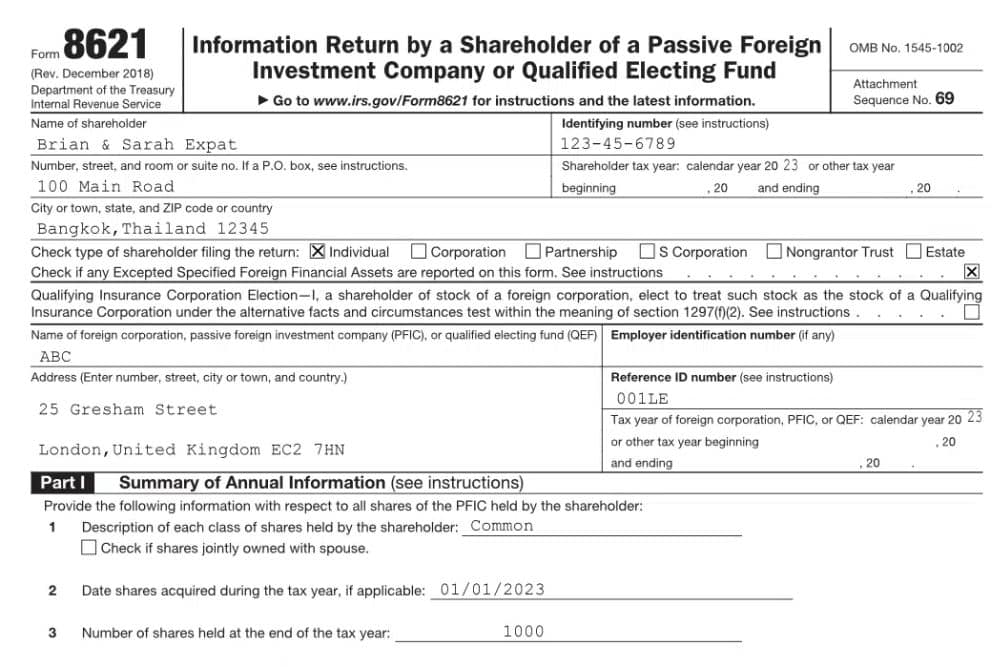

What Does Form 8621 Look Like?

The form below is an example of Form 8621. A separate form is required for each investment that qualifies as a PFIC, so if you own 10 foreign mutual funds, you would need to complete 10 forms, including the Shareholder’s personal information, the type of shares held (Part I), and the method you choose for the PFIC to be taxed (Part II).

Beyond Form 8621 Filing Requirements

Form 8621 is just one of a number of Informational Reports that you may be required to file. If you have an ownership interest in a foreign partnership or a foreign LLC, you may want to check the rules of filing disclosure Form 8865 (for foreign partnerships) or Form 8858 (for foreign LLCs taxed as disregarded entities) to make sure you are meeting all your US tax filing requirements. If you own shares in a foreign corporation, you may be required to file Form 5471. But, If you have more than $10,000 in all of your foreign bank and investment accounts combined, you must complete the FinCen Form 114 (“FBAR”) report each year reporting all of these accounts.

Filing Form 8621 Doesn’t Have to Be Complicated

At Greenback Expat Tax Services, we specialize in helping expats manage their US tax obligations.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.