Tax Guide for Americans Living in Colombia

- Living as an Expat in Colombia

- Colombia at a Glance

- What Are Expat Taxes like for Americans Living in Colombia?

- Who Has to File Taxes in Colombia?

- Who Qualifies as a Tax Resident in Colombia?

- What Is the Income Tax Rate in Colombia?

- What Is the Deadline for Tax Returns in Colombia?

- What Is the Penalty for Failing to File a Tax Return in Colombia?

- What Other Types of Taxation Does Colombia Have?

- Essential Tax Forms for US Expats in Colombia

- Does the US Have a Tax Treaty with Colombia?

- Does the US Have a Totalization Agreement with Colombia?

- Navigating Tax Compliance for US Expats in Columbia

Living as an Expat in Colombia

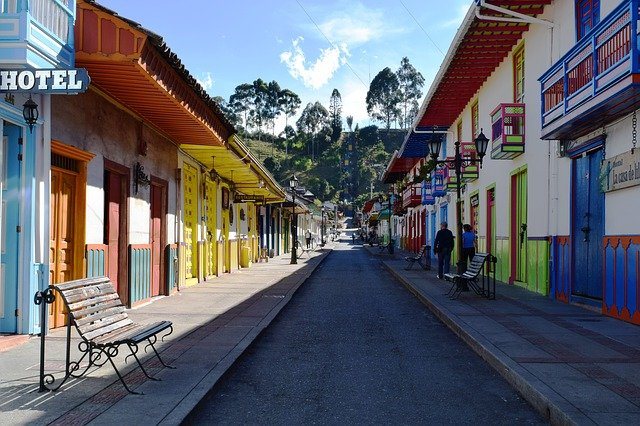

Living as an expat in Colombia can be an exciting and enriching experience. Colombia has a rich cultural heritage, stunning natural beauty, and a welcoming and friendly population.

The cost of living in Colombia is relatively low compared to other countries, which makes it an attractive destination for expats. Housing, transportation, and food are all affordable, and there are many options for entertainment and recreation.

Colombia is also known for its excellent healthcare system, which is both high-quality and affordable. Expats can choose to take advantage of the public healthcare system or opt for private healthcare, which is still much cheaper than in many other countries.

While Colombia has made great strides in recent years in terms of safety and security, it’s important for expats to be aware of their surroundings and take necessary precautions to stay safe. It’s also helpful to learn some basic Spanish, as it will make day-to-day life much easier and allow you to better connect with locals.

In fact, it’s estimated that 60,000 US citizens have made Colombia their new home. But what are Colombia’s taxes like for US expats? Here’s what you need to know.

Colombia at a Glance

- Primary Tax Form for Residents: “Declaración de Renta y Complementarios” or Income Tax and Complementary Tax Return

- Tax Year: January 1–December 31

- Tax Deadline: Varies

- Currency: Colombian Peso (COP)

- Population: ~52 million

- Number of US Expats in Colombia: Estimated 60,000

- Capital City: Bogota

- Primary Language: Spanish

- Tax Treaty: No

- Totalization Agreement: No

What Are Expat Taxes like for Americans Living in Colombia?

When discussing expat taxes in Colombia, it’s important to remember that Americans living overseas still have US tax obligations. That’s because all US citizens are required to file a federal tax return regardless of where they live in the world. Whether you’ve settled down in Bogotá or Boston, you still have to report your worldwide income to Uncle Sam.

But beyond this, as an American living in Colombia, you will almost certainly have to file taxes with the Colombian government. For now, let’s take a closer look at Colombia’s tax policies.

Learn where the best tax havens are, common traps, and ways to save money on your US expat taxes.

Who Has to File Taxes in Colombia?

In Colombia, expat taxation is based on residency status. If you qualify as a resident, you will be taxed on your worldwide income. If you are a non-resident, you will only be taxed on your Colombia-source income.

In either case, if the entirety of your income is from traditional employment, you may not have to file an annual tax return at all. This is because your Colombian taxes will be withheld at the source by your Colombian employer.

However, if you receive other forms of income, such as self-employment income, you will typically have to file a tax return.

Who Qualifies as a Tax Resident in Colombia?

Anyone who spends more than 183 days in Colombia within a given 365-day period will be considered a resident of Colombia for tax purposes. This applies regardless of whether those days were continuous or split up over multiple trips.

If you spend 183 days or less in Colombia, you will be considered a non-resident.

What Is the Income Tax Rate in Colombia?

As we discussed, Colombian residents are taxed on their worldwide income, while non-residents are only taxed on income from a Colombian source. But what are the rates for each?

- Residents are taxed at progressive rates ranging from 19% to 39% based on their income level

- Non-residents are taxed at a flat rate of 35% regardless of income level

Get the Free Download That Makes Filing Taxes Simple

What Is the Deadline for Tax Returns in Colombia?

Just like in the US, Colombia’s tax year is the same as the calendar year—January 1 to December 31. As for the filing deadline, that varies based on your financial details and the last digit of your tax ID number. The due date for each category also changes from year to year, making it even more difficult to keep track.

Consult an expat tax professional to learn more about your tax filing deadline and other obligations you may have as an American living in Colombia.

Note: if you owe taxes on your Colombian tax return, you may be required to pay your tax debt in two or three installments throughout the year.

What Is the Penalty for Failing to File a Tax Return in Colombia?

If you fail to file a Colombian tax return when required, the standard penalty is 5% of any tax debt you owe per month past the deadline. This can add up to a maximum penalty of 100% of your outstanding tax debt.

If you receive a summons from the Colombian tax authority before coming into compliance, the penalty increases to 10% per month up to a maximum penalty of 200% of your tax debt.

In addition to this, interest will begin accruing on your tax debt as soon as the deadline has passed.

What Other Types of Taxation Does Colombia Have?

On top of the income tax, the Colombian government imposes several other forms of taxation. Here are some of the most common examples

Value-Added Tax (VAT)

Colombia levies a value-added tax (VAT) on most goods and services. The standard rate for this tax is 19%. Some goods and services are taxed at a lower rate of 5%, and others are exempt. Exemptions include:

- Exports

- Livestock

- Meat and certain other foodstuffs

- Sale of tourism packages

- Certain books and magazines

- Military and police equipment

Sales to Colombian free trade zones are also exempt from the VAT.

Capital Gains Tax

The standard capital gains tax in Colombia is 10%. However, gains made from lotteries, gaming, and some other activities are taxed at an increased rate of 20%.

Inheritance Tax

There is no official inheritance or gift tax in Colombia. However, inheritances and gifts are generally considered capital gains and taxed as such.

Corporate Tax

Colombia also imposes a corporate income tax. The rate is currently at 35% in the year 2023 and the foreseeable future.

Property Tax

In Colombia, property taxes are managed at the municipal level rather than the national. The rate for this tax depends on how the property is used. Usually, however, it ranges between 0.4% and 1.2%.

Financial Transactions Tax

Colombia levies a small tax on all financial transactions, including:

- ATM withdrawals

- Wire transfers

- Promissory notes

- Internet banking

- Bank drafts and checks

- Term deposits

- Overdrafts

- Installment loans

- Currency exchanges

- Overdrafts

The standard rate for this tax is 0.4%.

Social Security Tax

Like the US, Colombia maintains a social security system funded by contributions from employees and employers. Currently, the rate for mandatory contributions is 30.5%, with employers contributing 20.5% and employees contributing the remaining 10%.

Because there is no US-Colombia totalization agreement, Americans living abroad in Columbia may be required to contribute to both systems.

When you live in the US, tax day is simple: April 15th! When you move abroad, it’s not so straightforward! Learn about all the expat deadlines and extensions you need to know to file.

Essential Tax Forms for US Expats in Colombia

US expats living in Colombia are generally required to file US federal tax returns, as well as any applicable state tax returns. In addition, they may also need to file Colombian tax returns depending on their individual circumstances.

The primary US tax form for expats is Form 1040, which is used to report all income earned by US citizens and resident aliens worldwide. US expats may also be required to file additional forms, such as the Foreign Bank Account Report (FBAR), if they have financial accounts outside the US with a combined value of $10,000 or more.

Colombian tax forms that US expats may need to file include the “Declaración de Renta y Complementarios” or Income Tax and Complementary Tax Return, which is used to report all income earned in Colombia. Expats may also need to file other forms, such as the “Declaración de Activos en el Exterior” or Foreign Assets Declaration if they have assets located outside of Colombia with a value over a certain threshold.

It’s important for US expats in Colombia to consult with a tax professional who is familiar with the tax laws of both countries to ensure they are complying with all applicable tax requirements and taking advantage of any available tax benefits.

Does the US Have a Tax Treaty with Colombia?

No. There is currently no US-Colombia tax treaty. This leaves Americans living in Colombia at risk of double taxation on their income. Fortunately, the IRS tax credits listed above can help reduce the risk of double taxation for most US expats, such as:

- Foreign Earned Income Exclusion

- Foreign Tax Credit

- Foreign Housing Exclusion or Deduction

Using these tax benefits, most expats are able to erase their US tax bill entirely, removing the risk of double taxation.

Does the US Have a Totalization Agreement with Colombia?

No. The US and Colombia have not entered into a totalization agreement. This means that Americans who live and work in Colombia may have to contribute to both nations’ social security systems.

Navigating Tax Compliance for US Expats in Columbia

We trust that this guide has improved your comprehension of the tax landscape for US citizens residing in Colombia. If you have any remaining questions or concerns, please do not hesitate to reach out to us for further assistance.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.