Schedule 1 Form 1040: Additional Income and Adjustments Guide for U.S. Expats

- When Do I Need to File Schedule 1 as an Expat?

- How Does Schedule 1 Differ from Schedule 2?

- What About Schedule 1-A?

- What Is the Difference Between Schedule 1 and Schedule 1-A?

- What Income Must I Report on Schedule 1?

- Which Deductions Can I Claim on Schedule 1?

- How Do I Fill Out Schedule 1 Step by Step?

- How Does Schedule 1 Work with Expat Tax Benefits?

- What Are Common Schedule 1 Mistakes to Avoid?

- When Should I File Schedule 1?

- How Do I Get Started with Schedule 1?

- Related Resources

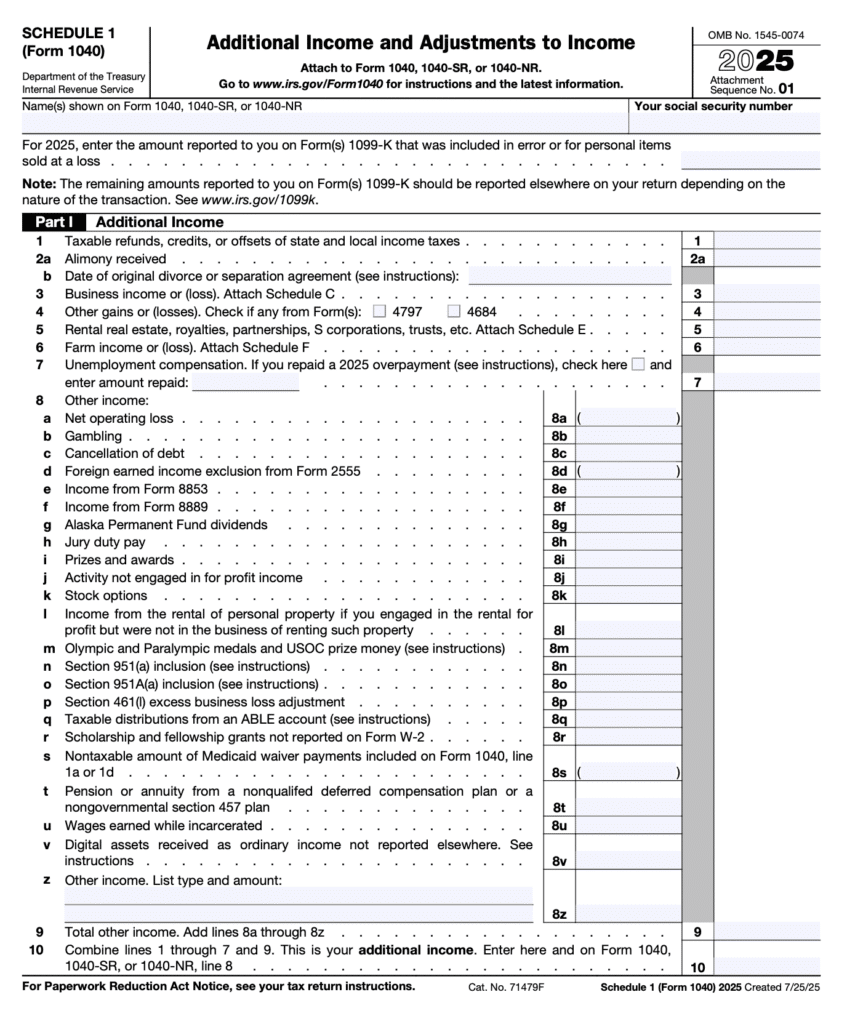

According to IRS data, excluded income under the Foreign Earned Income Exclusion is entered as a negative amount on Schedule 1 (Form 1040), demonstrating how this form directly connects to your biggest tax savings as an expat. Schedule 1 is used to report additional income sources and claim valuable deductions when your income doesn’t fit on the main Form 1040. For U.S. expats, this form is essential for properly reporting worldwide income and maximizing tax-saving adjustments.

Most American expats who properly use Schedule 1 alongside forms like Form 2555 (Foreign Earned Income Exclusion) end up owing little to no U.S. taxes. For the 2025 tax year, you can exclude up to $130,000 of foreign earned income, and Schedule 1 helps you report additional income and claim deductions that work together with this exclusion.

Schedule 1 has two main parts: Part I for additional income that doesn’t fit on your main Form 1040, and Part II for adjustments to income (also called “above-the-line” deductions). These adjustments are particularly valuable because they reduce your adjusted gross income without requiring you to itemize deductions.

Schedule 1 Is Where Most Expat Mistakes Happen

When Do I Need to File Schedule 1 as an Expat?

You’ll need Schedule 1 if you have any of these common expat situations:

Part I – Additional Income:

- Self-employment income earned abroad (reported on Schedule C first)

- Rental income from U.S. property while living overseas

- Foreign pension distributions

- Unemployment compensation from any country

- Prize winnings or gambling income

- Income from foreign partnerships or S corporations

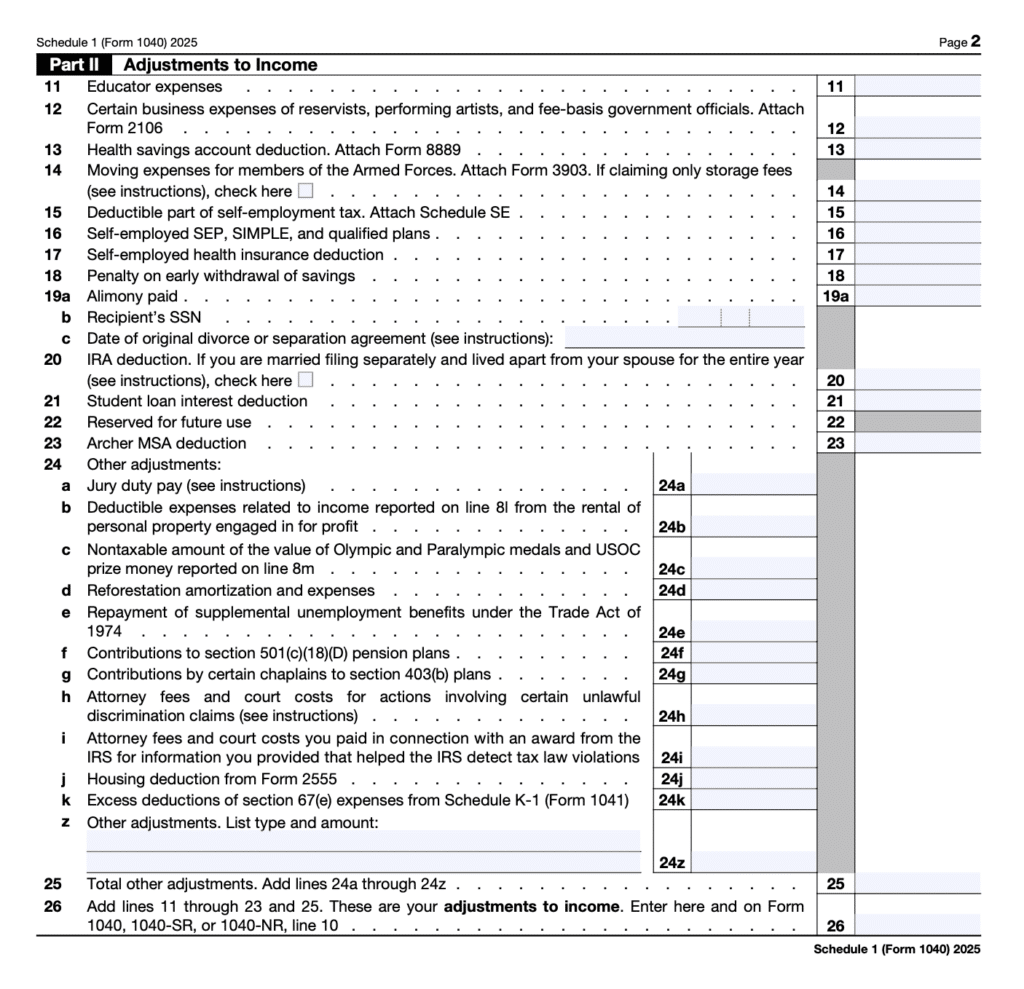

Part II – Adjustments to Income:

- Foreign housing deduction (self-employed expats only)

- Student loan interest deduction

- Health Savings Account (HSA) contributions

- Self-employment tax deduction

- IRA contribution deductions

- Educator expense deductions

Even if you’re using the Foreign Earned Income Exclusion, you still need to report all worldwide income first, then apply exclusions. Schedule 1 helps ensure nothing gets missed.

How Does Schedule 1 Differ from Schedule 2?

Many expats wonder about the difference between these numbered schedules since both are commonly needed:

Schedule 1: Additional Income and Adjustments

- Reports additional income and above-the-line deductions

- Can reduce your tax liability

- Used for foreign housing deduction

- Includes business income and valuable adjustments

Schedule 2: Additional Taxes

- Reports additional taxes owed

- Increases your tax liability

- Used for the Alternative Minimum Tax and the self-employment tax

- Includes additional Medicare tax

Key Differences:

| Schedule 1 | Schedule 2 |

|---|---|

| Reports additional income and deductions | Reports additional taxes owed |

| Can reduce your tax liability | Increases your tax liability |

| Includes above-the-line deductions | Includes Alternative Minimum Tax, self-employment tax |

| Used for foreign housing deduction | Used for the additional Medicare tax |

Many self-employed expats need both schedules – Schedule 1 to report business income and claim the foreign housing deduction, and Schedule 2 to report self-employment taxes.

What About Schedule 1-A?

NEW for 2025: The IRS has introduced a separate form called Schedule 1-A (Additional Deductions) for temporary deductions created under the One Big Beautiful Bill Act (OBBBA). Despite the similar name, this is a completely different form from Schedule 1.

Key Differences:

| Schedule 1 | Schedule 1-A |

|---|---|

| Reports additional income and adjustments | Reports OBBBA deductions only |

| Permanent form, updated annually | Temporary form (2025-2028) |

| Includes foreign housing deduction | Includes tips, overtime, car loan interest, senior deduction |

| Used by most expats with business income | Limited applicability for expats |

Important: Most expats will still need Schedule 1 for reporting business income, rental income, and claiming the foreign housing deduction. Schedule 1-A is an additional form for specific OBBBA deductions that largely don’t apply to Americans working abroad due to foreign employer reporting requirements.

For a detailed analysis of Schedule 1-A and why most expats can’t use these deductions, see our comprehensive Schedule 1-A guide for expats.

What Is the Difference Between Schedule 1 and Schedule 1-A?

For 2025 tax returns, you may need both Schedule 1 AND the new Schedule 1-A. Here’s how they differ:

Schedule 1: Additional Income and Adjustments to Income

- Reports additional income (Part I) and above-the-line deductions (Part II)

- Reduces your Adjusted Gross Income (AGI) before calculating taxable income

- Permanent part of the U.S. tax system

- Essential for expats claiming the foreign housing deduction or reporting self-employment income

Schedule 1-A: Additional Deductions (NEW for 2025)

- Contains four NEW “below-the-line” deductions created by the One Big Beautiful Bill Act

- Reduces taxable income AFTER AGI is calculated (similar to itemized deductions)

- Temporary provision (2025-2028 tax years only)

- Goes on Form 1040, line 13b

- Available whether you itemize or take the standard deduction

The Four Schedule 1-A Deductions:

- Qualified tip income deduction – For service workers (not common for expats)

- Qualified overtime compensation deduction – For overtime wages (not common for expats)

- Qualified passenger vehicle loan interest deduction – For car loans (may apply to expats)

- Enhanced deduction for seniors – Additional $6,000 deduction for taxpayers age 65+ (highly relevant for retired expats)

Schedule 1-A deductions have income phase-outs starting at $150,000 ($300,000 for married filing jointly), calculated using Modified Adjusted Gross Income (MAGI).

Expat Applicability: Most expats won’t benefit from the tip or overtime deductions, but the qualified passenger vehicle loan interest and enhanced seniors deduction could provide valuable tax savings for eligible expats.

What Income Must I Report on Schedule 1?

For expats, Schedule 1 Part I commonly includes:

- Business and Self-Employment Income: If you’re a freelancer, consultant, or business owner abroad, you’ll first complete Schedule C to calculate your net business income, then report the result on Schedule 1. This applies whether you’re a digital nomad in Bali or a contractor in Dubai.

- Rental Property Income: Own rental property in the U.S. while living abroad? You’ll use Schedule E to calculate net rental income, then report it on Schedule 1. This income cannot be excluded under the FEIE but may qualify for Foreign Tax Credit treatment.

- Foreign Pension Distributions: Distributions from foreign pension plans are typically taxable and reported on Schedule 1. The tax treatment varies by country and pension type.

- Unemployment Compensation: Unemployment benefits, whether from the U.S. or a foreign country, are taxable and reported on Schedule 1.

One Line on Schedule 1 Can Trigger IRS Questions

Which Deductions Can I Claim on Schedule 1?

Part II of Schedule 1 offers valuable deductions that reduce your adjusted gross income:

- Foreign Housing Deduction: Self-employed expats can deduct eligible housing costs above 16% of the FEIE ($20,800 for 2025). This includes rent, utilities (excluding cable/phone), and property insurance.

- Student Loan Interest: You can deduct up to $2,500 of student loan interest paid during the year, even on loans for foreign education expenses.

- Self-Employment Tax Deduction: You can deduct half of your self-employment tax (7.65%), but remember that the FEIE doesn’t eliminate the 15.3% self-employment tax itself.

- IRA Contributions: Traditional IRA contributions may be deductible, but expats using the full FEIE often lack the taxable earned income needed to qualify for IRA contributions.

How Do I Fill Out Schedule 1 Step by Step?

Completing Schedule 1 is straightforward when you follow the proper sequence:

Before You Start: Gather all necessary documents: foreign income statements, business expense receipts, Form 1099s, and currency conversion rates. Complete any supporting schedules (C, E, etc.) first, as these feed into Schedule 1.

Part I – Additional Income (Lines 1-10):

- Line 1: Taxable refunds of state and local income taxes (usually not applicable to expats)

- Line 2a: Alimony received (if divorce decree was finalized before 2019)

- Line 3: Business income or loss from Schedule C (your net self-employment income)

- Line 4: Other gains or losses from Form 4797 (business asset sales)

- Line 5: Rental real estate, royalties, partnerships, etc., from Schedule E

- Line 6: Farm income or loss from Schedule F

- Line 7: Unemployment compensation (from any country)

- Line 8: Other income – This catch-all line includes foreign pension distributions, gambling winnings, and other miscellaneous income

- Line 10: Total additional income (sum of lines 1-9)

Part II – Adjustments to Income (Lines 11-26):

- Line 15: Self-employment tax deduction (half of your self-employment tax)

- Line 20: Student loan interest deduction (up to $2,500)

- Line 24j: Foreign housing deduction (self-employed expats only)

- Line 25: Other adjustments – Include IRA contributions and other qualifying deductions

- Line 26: Total adjustments to income

Final Steps:

- Transfer Line 10 total to your Form 1040

- Transfer Line 26 total to your Form 1040

- Attach Form 2555 if claiming the FEIE

- Attach Schedule 1-A if you qualify for any of the four new deductions

The excluded amount from Form 2555 appears as a negative adjustment with the notation “Form 2555” – this is normal and correct.

How Does Schedule 1 Work with Expat Tax Benefits?

The real power of Schedule 1 comes from how it coordinates with expat-specific tax benefits:

- FEIE Integration: When you claim the Foreign Earned Income Exclusion on Form 2555, the excluded amount flows to Schedule 1 as a negative adjustment, reducing your adjusted gross income.

- Foreign Tax Credit Coordination: Income reported on Schedule 1 may qualify for the Foreign Tax Credit on Form 1116, allowing you to claim dollar-for-dollar credits for foreign taxes paid.

Strategic Planning Example: Maria lives in Germany and earns $140,000 in salary plus $25,000 in rental income from her U.S. property. She uses Form 2555 to exclude $130,000 of her salary, reports the remaining $10,000 salary and $25,000 rental income on her Form 1040, and uses Form 1116 to claim credits for German taxes paid on both income sources.

What Are Common Schedule 1 Mistakes to Avoid?

- Currency Conversion Errors: Always convert foreign currency to USD using the appropriate exchange rates. For a consistent monthly income, you may use the monthly average rates from the Treasury Department.

- Missing the Foreign Housing Deduction: Self-employed expats often overlook this valuable deduction. Only housing costs above the base amount ($20,800 for 2025) qualify, and the deduction goes on Schedule 1, line 24j.

- Incorrectly Reporting FEIE: The excluded amount from Form 2555 is entered as a negative amount on Schedule 1 with the notation “Form 2555.” Don’t simply omit excluded income from your return.

- Forgetting Self-Employment Tax: The FEIE excludes income from regular income tax but not from self-employment tax. You’ll still owe 15.3% on business income unless you qualify for an exemption under a totalization agreement.

- Confusing Schedule 1 and Schedule 1-A: Schedule 1 reduces AGI (above-the-line), while Schedule 1-A reduces taxable income after AGI (below-the-line). Both can be filed together for 2025 tax returns if you qualify.

When Should I File Schedule 1?

Schedule 1 (and Schedule 1-A, if applicable) is filed with your Form 1040 by these deadlines:

- June 15, 2026: Automatic extension for expats (no forms required)

- October 15, 2026: Final deadline with Form 4868 extension request

If you’re behind on filing, the Streamlined Filing Procedures offer penalty-free catch-up options, but you must act before the IRS contacts you first.

How Do I Get Started with Schedule 1?

If you’ve determined you need Schedule 1, here’s your action plan:

- Gather Documentation: Collect foreign income statements, business expense receipts, and Form 1099s

- Complete Supporting Schedules: Finish Schedule C (business income) or Schedule E (rental income) first

- Coordinate Expat Forms: Ensure Schedule 1 works properly with Forms 2555 and 1116

- Convert Currency: Use appropriate exchange rates and maintain documentation

- Consider Schedule 1-A: If you’re 65+, have car loan interest, or earned tips/overtime, check if you qualify for Schedule 1-A deductions

- File Timely: Submit by the June 15 automatic extension or the October 15 final deadline (with extension form submitted before June deadline)

Greenback is an American company founded in 2009 by U.S. expats for expats. We focus exclusively on expat taxes and always have. Many of our CPAs and Enrolled Agents are expats themselves, and because they live in 14 time zones, they experience firsthand the challenges of living abroad. They have the knowledge and patience to help you handle the complicated U.S. tax system and local rules.

No matter how late, messy, or complex your return may be, we can help. You’ll have peace of mind knowing that your taxes were done right.

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.

Make Sure Schedule 1 Is Done Right

Disclaimer: This article provides general information about Schedule 1 and Schedule 1-A for Form 1040. Tax laws change frequently, and individual circumstances vary. Please consult with a qualified tax professional for advice specific to your situation.

Related Resources

- Form 1040 for U.S. Expats: Filing Made Simple

- Form 2555: How to Claim the Foreign Earned Income Exclusion

- Schedule C for U.S. Expats: Self-Employment Tax Guide

- Form 1040 Schedule 2: Additional Taxes for U.S. Expats

- Foreign Tax Credit Guide for U.S. Expats

- Self-Employment Tax for U.S. Expats

- Foreign Housing Exclusion and Deduction

- Digital Nomad Taxes: Complete Guide