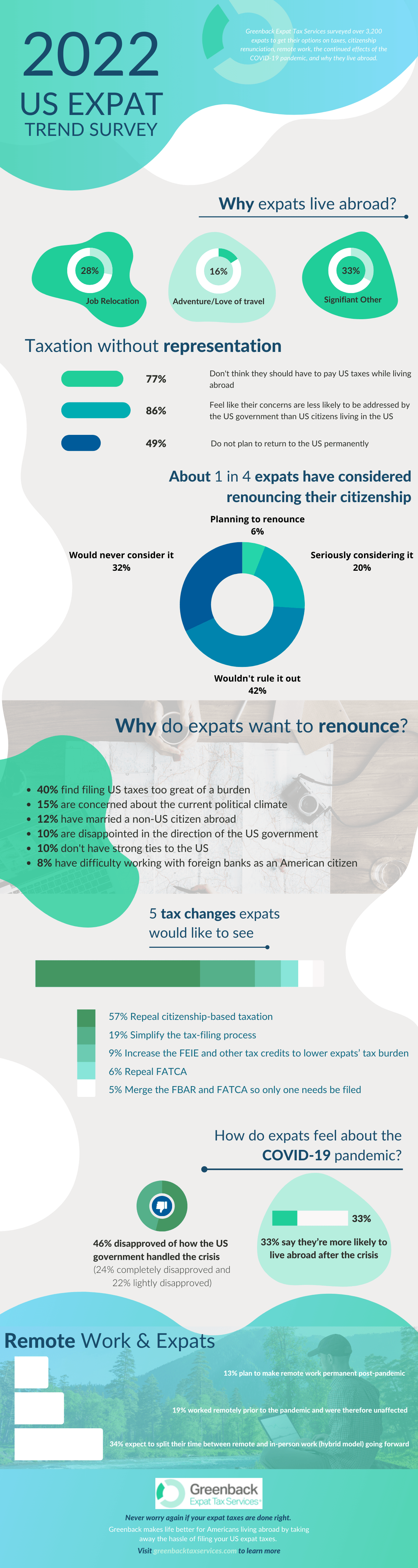

2022 US Expat Trends Survey

Interested in our 2024 survey? Find 2024 expat tax statistics here.

Every year, Greenback surveys US expats on key aspects of life abroad. This year, over 3,200 US citizens living in 121 countries shared their opinions on US expat taxes, foreign financial reporting, the Coronavirus pandemic, remote work, and more.

Why do expats live abroad?

The majority of expats choose to live abroad for their career, significant other, or their love of adventure and travel.

- 28% Job relocation

- 33% Significant other

- 16% Adventure/love of travel

Many expats feel burdened by US tax obligations.

Because the majority of the world’s nations use a system of residence-based taxation, most US expats are required to pay taxes in their host country. Despite this, most also have to pay taxes to the US government on the same income due to the US’s practice of citizenship-based taxation. This taxation method has caused the expat community to feel extremely excluded. 86% feel like their concerns are less likely to be addressed by the US government than US citizens living in the USA.

The US government has put several measures in place to help avoid double taxation, but all expats must still file an annual return—and many still have to pay a US tax bill.

- 77% don’t think they should have to pay US taxes while living abroad

- 10% were feeling worried about filing their US tax return this year

- 30% owed money to the US government last year, 53% did not owe, and 13% received a refund

The US also has rules in place that require Americans to report on foreign financial accounts. The rules were designed to safeguard against tax cheats hiding money in offshore accounts. However, these regulations disproportionately impact expats since they are more likely to have overseas accounts.

This year’s survey indicates that millions of American expats may be unfamiliar with the two main financial reporting requirements. This puts them at risk of noncompliance, which could result in steep penalties from the IRS.

- 6% were unfamiliar with Foreign Bank Account Reporting (FBAR)

- 20% were unfamiliar with the Foreign Account Tax Compliance Act (FATCA)

For those who are aware of the regulation, Foreign Account Tax Compliance Act (FATCA) has created additional filing requirements and banking challenges for 41% of expats. In addition to requirements for individuals, FATCA requires foreign banks that work with Americans to report their accounts to the US government. Rather than face the burden of these requirements, many banks (both US based and foreign) have decided not to work with US citizens.

- 28% of expats need to file additional forms for FATCA

- 6% have had trouble banking abroad due to this reporting requirement

- 4% said their US bank doesn’t want to deal with US persons living abroad

- 3% had to file additional forms while also facing banking issues

For expats who are unaware of their tax and financial reporting requirements, the IRS offers a simplified path to compliance called the Streamlined Filing Procedures. Unfortunately, 40% of the expats surveyed had never heard of the IRS’s Streamlined Filing Procedures.

Top 5 tax changes expats would like to see

When asked about the number one tax change they would like to see, most expats indicated that they’d like to repeal citizenship-based taxation or to simplify expats’ tax-filing obligations.

- 57% Repeal citizenship-based taxation (up 10% compared to 2021)

- 19% Simplify the tax-filing process

- 9% Increase the FEIE and other tax credits to lower expats’ tax burden

- 6% Repeal FATCA

- 5% Merge the FBAR and FATCA so only one needs be filed

About 1 in 4 expats have considered renouncing their US citizenship.

As a consequence of not feeling fairly represented by the US government, many expats have considered renouncing their citizenship. In 2021, the US saw 2,426 Americans renounce their citizenship. A sharp drop after a record breaking 2020 when 6,705 renounced. Some believe we would have seen larger numbers again this year but expats may be having a hard time with Covid-19 closing US Embassies in many countries.

- 6% Planning to renounce

- 20% Seriously considering it

- 42% Wouldn’t rule it out

- 32% Would never consider it

Why do expats want to renounce?

Survey respondents cited taxes as the top reason for considering citizenship renunciation—followed by a variety of other personal and political factors.

- 40% find filing US taxes too great of a burden

- 15% are concerned about the current political climate

- 12% have married a non-US citizen abroad

- 10% are disappointed in the direction of the US government

- 10% don’t have strong ties to the US

- 8% have difficulty working with foreign banks as an American citizen

How are expats still being impacted by the COVID-19 pandemic?

We are seeing Covid-19 still impacting how expats are working and how they are feeling about how the US handled the pandemic.

- 46% disapproved of how the US government handled the crisis (24% completely disapproved and 22% lightly disapproved)

- 33% say they’re more likely to live abroad after the crisis

Expats and remote work

When asked how the Coronavirus (COVID-19) pandemic has changed the way expats will work going forward, the majority indicated that they plan to work remotely at least some of the time post-pandemic.

- 19% worked remotely prior to the pandemic and were therefore unaffected

- 13% plan to make remote work permanent post-pandemic

- 34% expect to split their time between remote and in-person work (hybrid model) going forward

- 4% plan to work remotely temporarily, then return to in-person work

- 30% do not/cannot work remotely

Do expats plan to return to the US permanently?

Most of those surveyed do not have plans to return to the US permanently. Some indicated they were unsure due to the uncertainty surrounding the Coronavirus pandemic, future employment opportunities, and personal ties in the US and abroad.

- 10% plan to return to the US permanently

- 49% do not plan to return to the US permanently

- 41% are unsure

Survey Demographics

Time abroad

- Less than 1 year: 9%

- 1-2 years: 6%

- 3-4 years: 9%

- 5-6 years: 8%

- 7-9 years: 10%

- 10-14 years: 14%

- 15-19 years: 10%

- 20+ years: 34%

Age

- 18 – 24: 1%

- 25 – 34: 13%

- 35 – 44: 21%

- 45 – 54: 20%

- 55 – 64: 19%

- 65+: 23%

- Prefer not to say: 3%

Employment

- Employed by a small organization (1-50): 10%

- Employed by a mid-sized organization (51-250): 10%

- Employed by a large organization (250+): 31%

- Entrepreneur/Small-business owner (you have 1+ employee): 6%

- Self-employed/Freelancer (0 employees working for you): 13%

- Stay-at-home parent and/or spouse: 2%

- Student: 1%

- Retiree: 20%

- I’m not currently employed: 4%

- Prefer not to say: 3%

Income

- $0 – $49,999: 24%

- $50,000 – $99,999: 26%

- $100,000 – $149,999: 17%

- $150,000 – $199,999: 8%

- $200,000 – $249,999: 4%

- $250,000+: 5%

- Prefer not to say: 16%

When you live in the US, tax day is simple: April 15th! When you move abroad, it’s not so straightforward! Learn about all the expat deadlines and extensions you need to know to file.