Do I Need to File Form 1040 Schedule 2?

- What Is Form 1040 Schedule 2?

- Do I Need to File Schedule 2 With My Tax Return?

- When Do I Need Schedule 2 as a Self-Employed Expat?

- When Does Alternative Minimum Tax Require Schedule 2?

- What If I Have Foreign Investment Income?

- Do I Need Schedule 2 for Early Retirement Withdrawals?

- What Other Taxes Get Reported on Schedule 2?

- How Do I File Schedule 2?

- What Mistakes Should I Avoid With Schedule 2?

- Do I Need Professional Help With Schedule 2?

- Related Resources

Most U.S. taxpayers with straightforward W-2 employment under $130,000 don’t need Schedule 2. You’ll need Schedule 2 only if you’re self-employed, earn over $180,000, have certain investments, or face specific additional taxes.

According to the IRS, Schedule 2 reports additional taxes that don’t fit on Form 1040. The three most common Schedule 2 situations are:

- Self-employment tax (15.3% on business income)

- Alternative Minimum Tax (for high earners)

- Additional taxes (from early retirement withdrawals, foreign investments, or excess Premium Tax Credits)

Schedule 2 Often Means Extra Taxes

Here’s exactly when you need Schedule 2 and how to file correctly.

What Is Form 1040 Schedule 2?

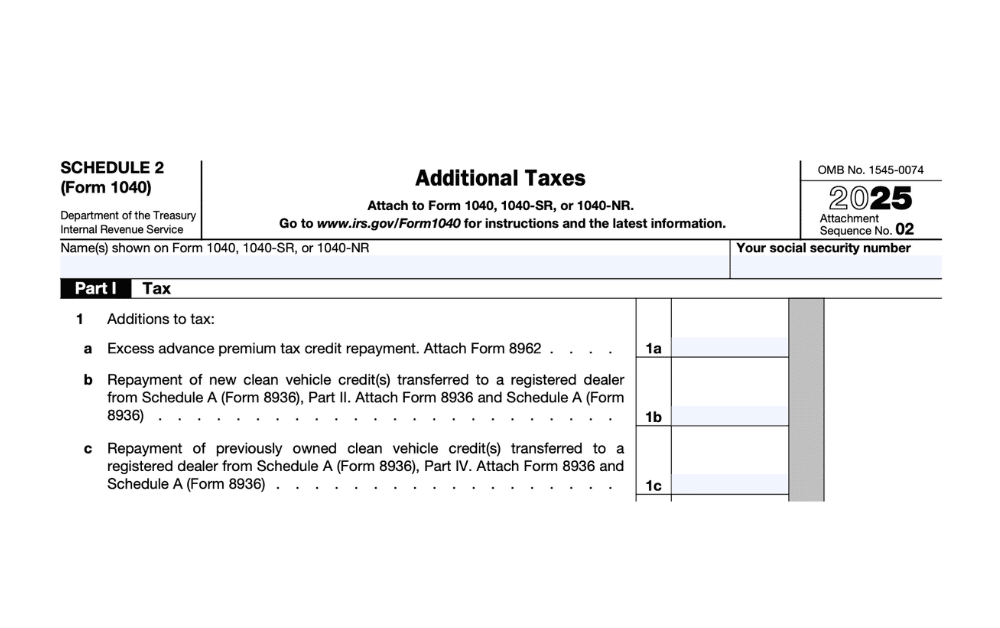

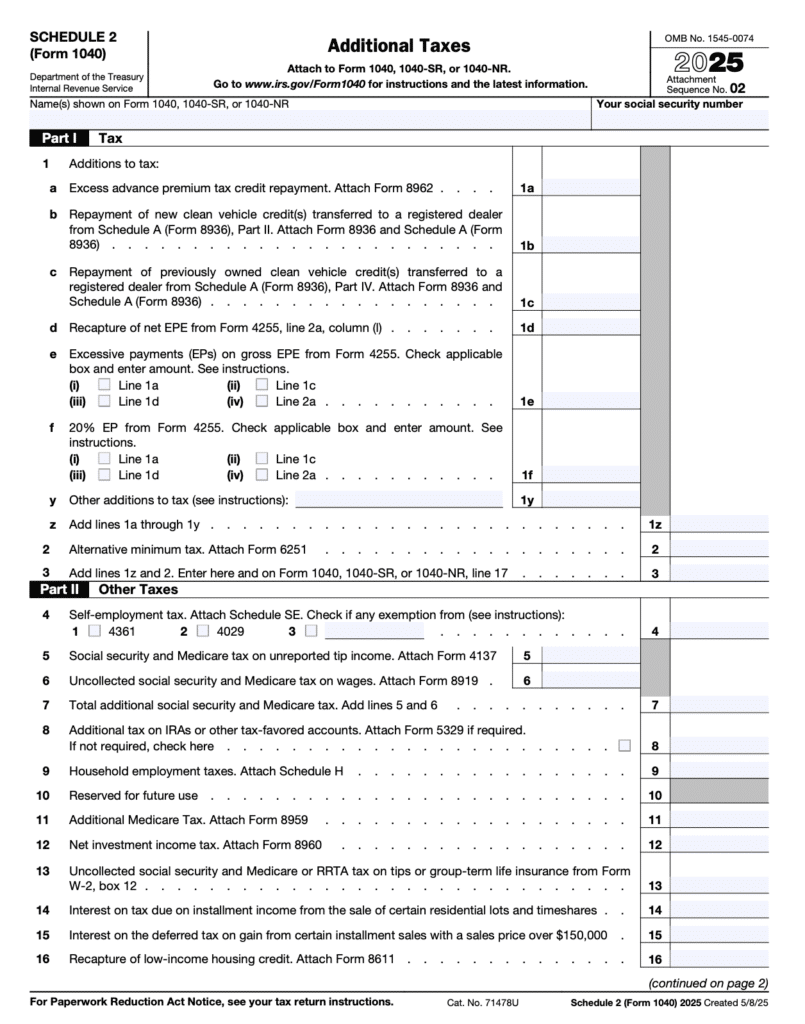

Schedule 2 (officially “Form 1040 Schedule 2: Additional Taxes”) is a two-part supplemental form that captures taxes the streamlined Form 1040 doesn’t have room for. When the IRS consolidated the old 1040, 1040A, and 1040EZ forms into a single Form 1040, it created several schedules to handle more complex tax situations without overcrowding the main form.

For U.S. taxpayers, Schedule 2 matters primarily in these situations:

- Part I reports: Alternative Minimum Tax (AMT), excess Premium Tax Credit repayments, and Net Investment Income Tax

- Part II reports: Self-employment tax, additional Medicare tax, early retirement distribution penalties, household employment taxes, and certain taxes on foreign investments

The completed Schedule 2 attaches to your Form 1040, and the totals from each part flow to specific lines on your main return.

Do I Need to File Schedule 2 With My Tax Return?

Here’s a quick reference guide showing when you need Schedule 2:

| Your Situation | Need Schedule 2? | Why |

|---|---|---|

| W-2 employee earning under $130,000 | No | Standard withholding covers all taxes |

| Self-employed with any net profit | Yes | SE tax applies to all business income |

| High earner ($180,000+) | Maybe | AMT may apply depending on deductions claimed |

| Foreign mutual fund investor (PFIC) | Yes | Excess distribution tax reports on Schedule 2 |

| Early retirement withdrawal (under 59½) | Yes | 10% penalty tax on early distributions |

| Repaying Premium Tax Credit | Yes | Health insurance marketplace credit repayments |

| Additional Medicare tax | Yes | 0.9% on high earners ($200K+ single, $250K+ married) |

| Net Investment Income Tax (NIIT) | Yes | 3.8% on investment income for high earners |

The Relief: Most taxpayers with straightforward W-2 employment won’t need to file Schedule 2. You only need it when specific tax situations apply.

When Do I Need Schedule 2 as a Self-Employed Expat?

If you’re self-employed abroad, Schedule 2 is mandatory regardless of income level. Here’s why:

Self-employment tax is separate from income tax. Whether you run a business in the U.S. or abroad, you owe 15.3% self-employment tax on your net business profit.

How Self-Employment Tax Works:

- Rate: 15.3% on your first $176,100 (2025 tax year), then 2.9% on amounts above that

- Breakdown: 12.4% for Social Security + 2.9% for Medicare

- Applied to: 92.35% of your net self-employment income

- Calculation location: Schedule SE (Self-Employment Tax)

- Reporting location: Schedule 2, Part II, Line 4

Real-World Example:

Marcus runs a freelance graphic design business in Lisbon, Portugal. His net business income for 2025 is $85,000.

- Net earnings subject to SE tax: $85,000 × 92.35% = $78,498

- Self-employment tax owed: $78,498 × 15.3% = $12,010

- This $12,010 gets reported on Schedule 2, Part II, Line 4

- Marcus then deducts half ($6,005) on Schedule 1, Line 15

Even though Marcus uses Form 2555 to exclude his entire $85,000 from income tax (so he owes $0 in federal income tax), he still pays $12,010 in self-employment tax reported on Schedule 2. This same principle applies to all self-employed individuals, whether they use Form 2555, itemize deductions, or claim other tax benefits.

Self-employment tax applies to all business income, regardless of your other tax situations. If you’re working abroad, the Foreign Earned Income Exclusion (FEIE) reduces income tax but never eliminates self-employment tax obligations. Check if your country has a totalization agreement with the U.S. to potentially reduce double social security taxation. If you’re running a business abroad, our specialists can help you handle both Schedule 2 and your business tax forms correctly.

When Does Alternative Minimum Tax Require Schedule 2?

For high-earning taxpayers, Schedule 2 becomes relevant when your income and deductions trigger Alternative Minimum Tax (AMT).

When AMT Applies:

The Alternative Minimum Tax ensures high-income earners pay at least a minimum amount of tax, even after claiming significant deductions and exclusions.

AMT Exemptions for 2025:

- Single filers: $88,100

- Married filing jointly: $137,000

AMT Exemptions for 2026:

- Single filers: $90,100

- Married filing jointly: $140,200

Important change starting 2026: The exemption phaseout threshold drops to $500,000 (single) or $1,000,000 (married) with a faster 50% phaseout rate, meaning more high earners will face AMT.

Real-World Example:

Sarah works as a senior software engineer in London, earning $185,000 in 2025.

- She uses Form 2555 to exclude $130,000

- Remaining taxable income: $55,000

- Because her total income is high and she’s claiming substantial exclusions, AMT calculations kick in

- After running Form 6251 (AMT calculation), she owes $3,800 in additional AMT

- This $3,800 gets reported on Schedule 2, Part I, Line 1

Sarah’s situation shows how the combination of high income and substantial exclusions can create AMT liability that must be reported on Schedule 2. Whether you’re claiming the Foreign Earned Income Exclusion, large state tax deductions, or other significant adjustments, AMT calculations may apply when your income exceeds certain thresholds.

What If I Have Foreign Investment Income?

Passive Foreign Investment Companies (PFICs) create unique Schedule 2 requirements. Many Americans accidentally invest in PFICs through foreign mutual funds, foreign pension schemes, or pooled investments without realizing the severe U.S. tax consequences.

PFIC Tax Reporting on Schedule 2:

If you own shares in a PFIC and receive distributions or sell shares, you may owe additional tax calculated using the “excess distribution” method. This punitive tax treatment includes:

- Tax at ordinary income rates (not capital gains rates)

- Interest charges on deferred taxes

- Complex calculations on Form 8621

The additional PFIC tax gets reported on Schedule 2, Part II, Line 17b.

Real-World Example:

Jennifer, living in Germany, invested €50,000 in a German mutual fund in 2020. In 2025, she sells the shares for a €15,000 gain.

- The German fund qualifies as a PFIC under U.S. law

- She must file Form 8621 to calculate the excess distribution tax

- After Form 8621 calculations, she owes $6,200 in additional PFIC tax

- This $6,200 gets reported on Schedule 2, Part II, Line 17b

PFIC reporting is extraordinarily complex. If you discover you own shares in a foreign mutual fund, ISA, or similar pooled investment, consult with an expat tax specialist immediately. The penalties for incorrect PFIC reporting are severe.

Do I Need Schedule 2 for Early Retirement Withdrawals?

If you withdraw funds from a retirement account before age 59½, you’ll likely face a 10% early distribution penalty, which is reported on Schedule 2.

When Penalties Apply:

- Early withdrawals from IRAs, 401(k)s, or other qualified retirement plans

- Distributions from retirement accounts (domestic or foreign) before age 59½

- Certain exceptions apply (disability, first-time home purchase, qualified higher education expenses, etc.)

The 10% penalty tax gets reported on Schedule 2, Part II, Line 8 (calculated on Form 5329).

Real-World Example:

David, age 52, needs to withdraw $40,000 from his retirement account to cover medical expenses.

- The withdrawal qualifies as an early distribution

- 10% penalty tax: $40,000 × 10% = $4,000

- This $4,000 penalty gets reported on Schedule 2, Part II, Line 8

Some distributions may qualify for penalty exceptions, and foreign pension distributions may have additional treaty considerations. Review the applicable tax treaty provisions if your retirement account is foreign-based.

If Your Tax Return Isn’t “Simple,” Schedule 2 May Be Required

What Other Taxes Get Reported on Schedule 2?

Additional Medicare Tax (Part II, Line 11)

High-earning taxpayers owe an additional 0.9% Medicare tax on wages exceeding:

- $200,000 (single filers)

- $250,000 (married filing jointly)

This applies to total wages from all sources, whether earned domestically or abroad.

Net Investment Income Tax – NIIT (Part I, Line 17)

The 3.8% NIIT applies to net investment income if your Modified Adjusted Gross Income exceeds:

- $200,000 (single filers)

- $250,000 (married filing jointly)

Important nuance: Your MAGI calculation includes certain excluded income added back. For example, if you use the Foreign Earned Income Exclusion (Form 2555), those excluded amounts still count when determining NIIT thresholds.

Premium Tax Credit Repayment (Part I, Line 2)

If you received advance Premium Tax Credit payments through the Health Insurance Marketplace and your actual income exceeded projections, you’ll repay excess credits on Schedule 2 (calculated on Form 8962).

This commonly affects taxpayers during transition years, such as when income significantly increases or when circumstances change mid-year.

How Do I File Schedule 2?

Filing Schedule 2 integrates with your overall tax return. Here’s the step-by-step process:

Step 1: Complete Supporting Forms First

Before filling out Schedule 2, complete these forms as applicable:

- Schedule SE: Self-employment tax calculation

- Form 6251: Alternative Minimum Tax calculation

- Form 8621: PFIC annual information return

- Form 5329: Additional tax on early retirement distributions

- Form 8960: Net Investment Income Tax calculation

- Form 8962: Premium Tax Credit reconciliation

Step 2: Transfer Totals to Schedule 2

Part I (Tax):

- Line 1: AMT from Form 6251, line 11

- Line 2: Excess Premium Tax Credit repayment from Form 8962, line 29

- Line 3: Total additional taxes (add lines 1-2)

Part II (Other Taxes):

- Line 4: Self-employment tax from Schedule SE, line 12

- Line 8: Additional tax on retirement distributions from Form 5329

- Line 11: Additional Medicare tax from Form 8959

- Line 17: NIIT from Form 8960 or Net Investment Income Tax

- Line 17b: Additional PFIC tax from Form 8621

- Line 21: Total other taxes (add all applicable lines)

Step 3: Transfer Schedule 2 Totals to Form 1040

- Part I total (line 3) → Form 1040, line 17

- Part II total (line 21) → Form 1040, line 23

Step 4: File Your Complete Return

Schedule 2 attaches to your Form 1040. You can e-file or mail your complete return package.

Standard filing deadline:

- April 15, 2026: Main filing deadline for most taxpayers

Automatic extensions:

- June 15, 2026: Automatic extension for U.S. citizens and residents living abroad (no forms required)

- October 15, 2026: Extended deadline with Form 4868 extension request

Even with filing extensions, any taxes owed are still due by April 15, 2026. Pay estimated taxes by that date to avoid interest charges.

What Mistakes Should I Avoid With Schedule 2?

Not Filing When Required

Many self-employed taxpayers mistakenly believe that because they owe little or no income tax (whether due to deductions, credits, or exclusions), they don’t need to file Schedule 2. This is incorrect. Self-employment tax applies regardless of income tax liability.

Using Incorrect Currency Conversion

For self-employment income, use the appropriate exchange rates:

- Consistent monthly income: monthly average rates from the U.S. Treasury

- Irregular payments: transaction-date rates

Forgetting the SE Tax Deduction

You can deduct half of your self-employment tax on Schedule 1, Line 15. Don’t forget this valuable deduction that reduces your adjusted gross income.

Not Completing Form 8621 for PFICs

PFIC reporting is mandatory if you own shares in foreign mutual funds, even if you didn’t sell them. Failing to file Form 8621 can result in severe penalties and extend the statute of limitations indefinitely.

Mixing AMT with Regular Tax

AMT is a parallel tax system. You pay whichever is higher: regular tax or AMT. Schedule 2 reports only the excess AMT amount (the difference), not your total AMT liability.

Do I Need Professional Help With Schedule 2?

Schedule 2 can become complex quickly, especially when combined with forms such as Form 2555 (Foreign Earned Income Exclusion), Form 1116 (Foreign Tax Credit), or Form 6251 (Alternative Minimum Tax).

You should strongly consider professional help if you:

- Are self-employed with income above $50,000

- Earn over $180,000 and face potential AMT

- Own foreign investments or pooled funds (potential PFICs)

- Made early withdrawals from retirement accounts

- Have complex tax situations involving multiple states or countries

- Need to file both U.S. federal and state returns while living abroad

Greenback Expat Tax Services specializes in helping all Americans navigate their U.S. tax obligations, whether you’re living in the U.S. or abroad. Our CPAs and Enrolled Agents handle Schedule 2 and all related tax requirements with expertise in both domestic and international tax situations.

If you realize you’re in over your head and worried about making costly mistakes, let us help. You’ll have peace of mind knowing that your taxes were done right.

If you’re ready to be matched with a Greenback accountant, click the Get Started button below. For general questions on U.S. expat taxes or working with Greenback, contact our Customer Champions.

Make Sure You’re Reporting All Additional Taxes Correctly

This article is for informational purposes only and does not constitute tax, legal, or financial advice. Tax laws change frequently, and individual situations vary. For specific advice about your tax situation, consult with a qualified tax professional.

Related Resources

- Schedule SE: Self-Employment Tax for Expats

- Form 2555: How to Claim the Foreign Earned Income Exclusion

- Form 1116: Foreign Tax Credit Instructions

- Schedule C for Expats: Business Tax Filing

- Form 1040 for U.S. Expats: Filing Guide

- Schedule 1 for Expats: Additional Income and Adjustments

- Schedule B: Interest and Dividend Reporting

- Self-Employment Tax for U.S. Expats

- Quarterly Estimated Tax Payments for Expats

- FEIE vs FTC: Which Should I Choose?