FBAR Penalties in 2024: What Expats Need to Know

Many Americans living overseas are required to file a Foreign Bank Account Report (FBAR). Not everyone is aware of this, however, leading to unintentional violations. Here’s an overview of the topic to help you avoid any FBAR penalties.

Key Takeaways

- The FBAR is an annual report that US citizens, residents, and certain other persons must file with the US Treasury Department if they have a financial interest in, or signature authority over, a financial account in a foreign country with an aggregate value of more than $10,000 at any time during the calendar year. Failing to file an FBAR when required can result in severe penalties.

- If you have failed to file FBARs when required, the IRS offers an amnesty program, if you qualify, to help taxpayers catch up without paying any fines.

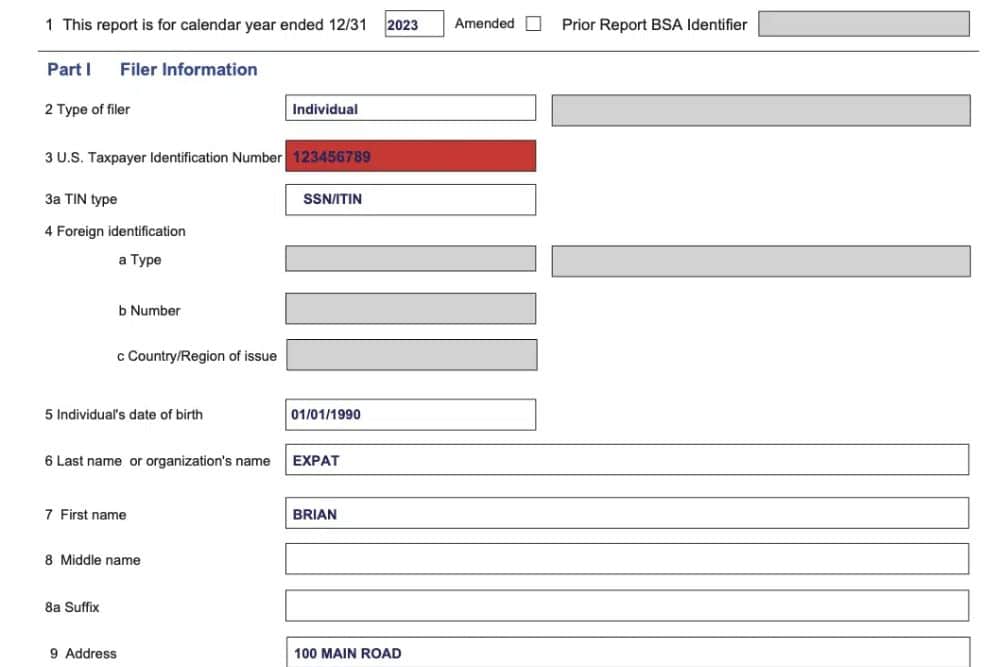

The Foreign Bank Account Report, or FBAR, is a form used to report financial accounts outside the US. The purpose of the FBAR is to prevent Americans from evading their tax obligations by hiding their wealth overseas. Want to learn more? Here is an FBAR Overview.

What Are the Penalties for Not Filing an FBAR?

The US Financial Crimes Enforcement Network or FinCEN regulates the FBAR. (The full name for this form is FinCEN Form 114: Report of Foreign Bank and Financial Accounts.)

While FinCEN regulates the FBAR, the IRS has the delegated authority to enforce penalties for FBAR violations. FBAR penalties vary, depending on whether the failure to file was willful or non-willful.

The FBAR is a purely informational tax form. Filing this form does not create a tax liability. Taxpayers lose nothing by filing when required—but could face stiff penalties if they fail.

FBAR Penalties for Willful Failure to File

Willful failure to file means that a person knew, or reasonably should have known, that they were required to file an FBAR and chose not to. The standard penalty for willful failure to file is $100,000 or 50% of the account’s balance at the time of the violation, whichever is higher, for each year that a required FBAR wasn’t filed.

In some cases, willful failure to file could even result in a prison sentence. (The same penalties apply for knowingly filing a false or fraudulent FBAR.)

FBAR Penalties for Non-Willful Failure to File

A non-willful failure to file means that a person didn’t know, or reasonably couldn’t be expected to know, that they were required to file an FBAR. The standard FBAR penalty for non-willful failure to file is about $12,500 for each year that a required FBAR wasn’t filed.

Previously, there was a legal gray area regarding whether these FBAR penalties were per-form or per account. Per-form would mean that a single penalty would apply for each form that wasn’t filed per year.

For example, if a person failed to disclose their seven foreign accounts for two required years, then they might be fined the non-willful penalty of about $12,500 for each of those years. That comes to a total of $20,000.

However, recent court rulings have made it clear that as of 2022, the IRS is taking a per-account approach to FBAR penalties. This means that the person in the above example could be penalized for each separate account that they failed to disclose. At a $12,500 penalty for seven accounts over two years, that would come to a total FBAR penalty of $87,500 (7 x $12,500 x 2 = $175,000).

Can the IRS Find People Who Haven’t Filed the FBAR?

The short answer is yes. The Foreign Account Tax Compliance Act (FATCA) was passed in 2010, and it mandates that foreign financial institutions report the balance of any accounts held by US citizens to the IRS. Although the US government cannot force foreign countries to comply with US law, the US has entered into numerous formal agreements in which foreign governments and foreign financial institutions agree to comply with this US law. This means that the IRS generally knows who should file an FBAR, and by cross-referencing that information with FBAR filing data, they can identify who has failed to file an FBAR, whether willfully or non-willfully.

The penalties for failing to file an FBAR can be severe. For willful violations, the penalty can be as high as the greater of $100,000 or 50% of the account balance. Non-willful violations carry a penalty of up to $12,500 per violation. In some cases, criminal charges can also be filed.

It’s crucial to understand that the IRS takes FBAR reporting requirements seriously and has significant resources at its disposal to enforce compliance.

When you live in the US, tax day is simple: April 15th! When you move abroad, it’s not so straightforward! Learn about all the expat deadlines and extensions you need to know to file.

What Should I Do If I Didn’t File My FBAR Report?

If you haven’t filed an FBAR when required, don’t panic. The penalties listed above are primarily aimed at US citizens who are “caught” failing to file, and were contacted by the IRS first. If you are an American living abroad and haven’t been contacted yet, you may not be subject to any FBAR penalties.

The IRS provides two voluntary disclosure programs for Americans living abroad filing late taxes:

- The Streamlined Compliance Procedures

- The Delinquent FBAR Submission Procedures

Both tax amnesty programs let non-willful expat violators catch up on their filing obligations—including for the FBAR—without facing any penalties.

The Streamlined Compliance Procedures are designed for US expats who have been delinquent in filing their annual income taxes, and possibly also their required FBARs. If you qualify for the Streamlined Compliance Procedures, all you have to do is:

- Self-certify that your failure to file was not willful

- File the last three delinquent income tax returns and pay any delinquent taxes you owed during that time (with interest)

- File FBARs for the last six years

However, if you have been filing and paying your annual income taxes, you can use the Delinquent FBAR Submissions Procedures. To do this, you have to:

- Self-certify that your failure to file was not willful

- File all delinquent FBARs

In most cases, this should be sufficient to bring you into compliance with IRS standards.

Even if the IRS doesn’t approve you for these amnesty programs, you may still be able to prove “reasonable cause” for your failure to file. If you do, the IRS will likely reduce or eliminate any penalties against you.

Have Questions about FBAR penalties? We’re here to help!

We hope this post has given you a better understanding of how FBAR penalties can impact US expats living abroad. Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.