Form 4868 for U.S. Expats: Extension Filing Explained

- What Is Form 4868?

- When Should I File Form 4868?

- How Do I File Form 4868?

- What Information Do I Need to Complete Form 4868?

- How Much Should I Pay with Form 4868?

- What Happens If I Don't File or Pay on Time?

- Can I Get More Time Beyond October 15?

- What About FBAR Extensions?

- Does Filing Form 4868 Affect My State Taxes?

- Common Form 4868 Mistakes to Avoid

- What If I Missed the Extension Deadline?

- Get Help Filing Form 4868 and Your Expat Taxes

- Related Resources

Filing taxes from abroad feels overwhelming when you’re coordinating foreign tax documents, tracking days spent overseas, and calculating Foreign Earned Income Exclusion eligibility. Each year, approximately 20 million Americans file for a tax extension, giving themselves crucial extra time to file their returns correctly.

For expats, Form 4868 is even more valuable. You already receive an automatic two-month extension to June 15, 2026, but Form 4868 gives you an additional four months beyond that, extending your deadline all the way to October 15, 2026.

Form 4868 (Application for Automatic Extension of Time to File U.S. Individual Income Tax Return) extends your filing deadline from June 15, 2026, to October 15, 2026, giving you an additional four months to prepare your expat tax return. The extension is automatic when you file the form by June 15, and the IRS doesn’t ask why you need it.

Here’s everything you need to know about filing Form 4868 as an American living abroad.

Key Takeaways

- Americans living abroad already receive an automatic two-month extension to June 15, 2026 without filing any forms.

- Form 4868 extends your filing deadline an additional four months to October 15, 2026.

- Extensions cover filing only, not payment. Any taxes owed are still due April 15, 2026.

- You can file Form 4868 electronically or by mail, and the extension is automatic when filed by the deadline.

- Most expats who properly claim the Foreign Earned Income Exclusion owe little to nothing in U.S. taxes.

What Is Form 4868?

Form 4868 is the IRS form that grants you an automatic six-month extension to file your federal income tax return. For Americans living in the United States, this moves the deadline from April 15, 2026 to October 15, 2026.

For expats, the timeline works differently since you already qualify for an automatic two-month extension to June 15, 2026. Filing Form 4868 gives you an additional four months beyond that, extending your deadline to October 15, 2026.

The extension applies to:

- Form 1040 (U.S. Individual Income Tax Return)

- Form 1040-SR (U.S. Tax Return for Seniors)

- Form 1040-NR (Nonresident Alien Income Tax Return)

The extension gives you more time to file your tax return, not more time to pay taxes you owe. Payment is still due April 15, 2026, regardless of any filing extensions.

See If You Should File Form 4868

When Should I File Form 4868?

Automatic Expat Extension: June 15, 2026

If you live outside the United States and Puerto Rico, on the regular tax filing deadline, you automatically receive a two-month extension to June 15, 2026. You don’t need to file any forms to get this extension. The IRS grants it automatically based on your foreign address.

To qualify for the automatic June 15 extension, you must either:

- Be a U.S. citizen or resident living outside the United States and Puerto Rico on April 15, 2026, or

- Be serving in the military outside the United States and Puerto Rico on April 15, 2026

Additional Extension with Form 4868: October 15, 2026

If you need more time beyond June 15, file Form 4868 by June 15, 2026, to extend your deadline to October 15, 2026. This gives you a total of six months beyond the original April 15 deadline.

Common reasons expats file Form 4868:

- Waiting for foreign tax documents that arrive after local tax deadlines

- Gathering documentation to prove Physical Presence Test qualification (330 days abroad)

- Coordinating complex situations involving Form 5471 for foreign corporations

- Working with an accountant who needs additional time for preparation

- Calculating optimal use of Foreign Earned Income Exclusion vs. Foreign Tax Credit

How Do I File Form 4868?

You have three options for filing Form 4868: electronically, by making a payment, or by mail.

Option 1: File Electronically (Recommended)

Electronic filing is the fastest method and provides instant confirmation. You can e-file Form 4868 through:

- IRS Free File (free for all income levels for extensions)

- Commercial tax preparation software

- A qualified tax professional service like Greenback Expat Tax Services

Make Sure Your Extension Is Filed Correctly

Benefits of e-filing:

- Immediate confirmation from the IRS

- No postage or mailing delays

- Automatic calculation of tax estimates

- Secure transmission

Option 2: File by Making a Payment

If you owe taxes, you can request an extension simply by making an electronic payment and indicating it’s for an extension. The IRS considers this an automatic extension request.

Payment methods that trigger an extension:

- IRS Direct Pay

- Electronic Federal Tax Payment System (EFTPS)

- Credit or debit card through IRS-approved processors

- Payment through your IRS Online Account

When making a payment, select “Extension” as the reason for payment. You’ll receive a confirmation number as proof of your extension request.

Option 3: File by Mail

If you prefer to mail Form 4868:

- Download Form 4868 from the IRS website

- Complete all required information

- Calculate your estimated tax liability

- Mail to the appropriate IRS address based on your location

- Include payment if you owe taxes

Paper forms must be postmarked by June 15, 2026. Don’t wait until the last minute, as international mail can be unpredictable.

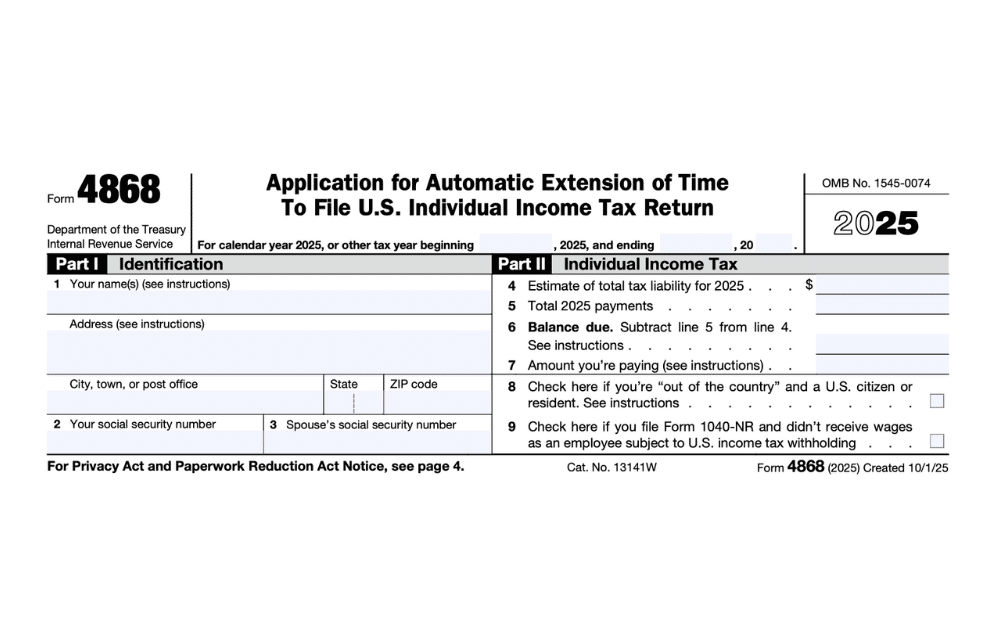

What Information Do I Need to Complete Form 4868?

Form 4868 is straightforward and requires basic information:

Part I: Identification

- Your name and address

- Social Security Number or Individual Taxpayer Identification Number (ITIN)

- If filing jointly, your spouse’s name and SSN/ITIN

Part II: Tax Liability Estimate

- Line 4: Total tax liability you expect for 2025

- Line 5: Total payments already made (withholding, estimated taxes, credits)

- Line 6: Balance due (Line 4 minus Line 5)

- Line 7: The Amount you’re paying with this extension request

Special Boxes for Expats:

- Check the box on Line 8 if you’re filing from outside the U.S. and Puerto Rico

- Check the box on Line 9 if you’re a U.S. citizen or resident filing Form 1040-NR

How Much Should I Pay with Form 4868?

An extension to file is not an extension to pay. You must estimate and pay any taxes you owe by April 15, 2026, to avoid penalties and interest.

Estimating Your Tax Liability

For most expats, estimating taxes involves considering:

- Total foreign earned income for 2025

- Foreign Earned Income Exclusion you’ll claim ($130,000 for 2025 tax year)

- Foreign Tax Credit for taxes paid to foreign governments

- Other income sources (investments, rental income, U.S. income)

Example: Sam earns $95,000 working in Germany and pays $28,000 in German taxes. After claiming the Foreign Earned Income Exclusion, his remaining taxable income of $0 means he owes no U.S. taxes. Sam doesn’t need to make a payment with Form 4868.

Example: Maria earns $160,000 in the UAE (no local income tax). She’ll exclude $130,000 through FEIE, leaving $30,000 taxable. After the $16,100 standard deduction (single filer, 2025), she has $13,900 in taxable income. She should estimate and pay approximately $1,400 with her extension to avoid penalties.

The 90% Rule

To avoid failure-to-pay penalties, you must pay at least 90% of your total tax liability by April 15, 2026. If you underestimate, you’ll owe:

- Interest on the unpaid amount from April 15 forward

- Possible penalties if you paid less than 90%

If You’re Not Sure

If you can’t reliably estimate your tax liability:

- Base your estimate on last year’s tax return if your situation is similar

- Use the previous year’s tax owed as a safe harbor

- Consult with a Greenback accountant who specializes in expat taxes

- Err on the side of caution and slightly overpay (you’ll get a refund)

Remember: 62% of expats owe $0 in U.S. taxes after properly claiming exclusions and credits, so you may not need to pay anything at all.

What Happens If I Don’t File or Pay on Time?

Failure to File Penalty

If you don’t file your tax return (or request an extension) by the deadline, the IRS charges:

- 5% of unpaid taxes for each month or part of a month your return is late

- Maximum penalty of 25% of unpaid taxes

- Minimum penalty of $525 if your return is more than 60 days late

Filing Form 4868 eliminates this penalty entirely, as long as you file your actual return by the extended deadline of October 15, 2026.

Failure to Pay Penalty

If you don’t pay taxes owed by April 15, 2026, the IRS charges:

- 0.5% of unpaid taxes for each month or part of a month after the due date

- Maximum penalty of 25% of unpaid taxes

- The rate increases to 1% per month if the IRS issues a notice of intent to levy

Good news: If you paid at least 90% of your tax liability by April 15, you can often avoid the failure-to-pay penalty.

Interest Charges

In addition to penalties, the IRS charges interest on unpaid taxes from April 15, 2026 until you pay in full. The interest rate is the federal short-term rate plus 3%, adjusted quarterly.

For 2025, interest rates hover around 7-8% annually, compounded daily. This adds up quickly over several months.

Avoid Late-Filing Mistakes With an Extension

Can I Get More Time Beyond October 15?

For most expats, the October 15, 2026, deadline is the final extension available for your tax return. However, there are two special circumstances that may allow additional time:

Discretionary Two-Month Extension to December 15

If you still need more time after October 15, you can request an additional two-month extension to December 15, 202,6 by writing a letter to the IRS.

Requirements:

- You must already have filed Form 4868 for the October 15 extension

- Mail a letter explaining why you need additional time before October 15, 2026

- Send to the IRS address for your region

The IRS won’t notify you if approved. You’ll only hear back if your request is denied. This is the absolute final extension available, and no further extensions are possible beyond December 15, 2026.

Form 2350 for Foreign Earned Income Exclusion Qualification

If you need more time to meet the Physical Presence Test (330 days abroad in a 12-month period), you can file Form 2350 instead of Form 4868.

Form 2350 can extend your filing deadline by one to two years, depending on when you’ll meet the Physical Presence Test requirements. This is specifically for expats who:

- Recently moved abroad and haven’t yet accumulated 330 days

- Are waiting to establish bona fide residence for a full tax year

- Need to complete their qualifying period to maximize their FEIE

Important: Form 2350 cannot be filed electronically. It must be mailed to the IRS.

What About FBAR Extensions?

The FBAR (Foreign Bank Account Report) follows a different schedule than your tax return.

FBAR deadlines:

- Original deadline: April 15, 2026

- Automatic extension: October 15, 2026 (no form required)

The FBAR automatic extension to October 15 happens without filing any forms. Simply file your FBAR by October 15, 2026, and mark it as “delinquent” if you miss the April 15 deadline.

FBAR is filed separately from your tax return through the FinCEN BSA E-Filing System, not through the IRS.

Does Filing Form 4868 Affect My State Taxes?

The automatic federal extension (Form 4868) does not automatically extend your state tax filing deadline. State extension rules vary:

- Some states (like California) automatically grant extensions if you filed a federal extension

- Other states require a separate state extension form

- Some states don’t grant extensions at all

Since you’re living abroad, you may not have any state tax filing obligations. Many states stop taxing residents once they establish residence abroad. Check your state’s specific requirements or consult a tax professional.

Common Form 4868 Mistakes to Avoid

Not Filing at All

The biggest mistake is assuming you don’t need to file because you owe no taxes. Even if you expect a $0 tax liability, filing Form 4868 protects you from failure-to-file penalties if your calculations were wrong.

Missing the June 15 Deadline

For expats, the extension deadline is June 15, 2026, not April 15. Filing Form 4868 after June 15 doesn’t provide an extension, and you may face late-filing penalties.

Underestimating Tax Liability

If you significantly underestimate your taxes and pay less than 90%, you’ll face penalties even with a valid extension. When in doubt, estimate conservatively.

Forgetting to Check the Expat Box

Line 8 on Form 4868 asks if you’re filing from outside the U.S. and Puerto Rico. Checking this box ensures the IRS understands you’re an expat and already used your automatic two-month extension.

Not Keeping Records

Save your confirmation number or mailed form receipt. If questions arise about whether you filed an extension, you’ll need proof.

What If I Missed the Extension Deadline?

If you missed both the June 15 automatic deadline and the October 15 extended deadline, don’t panic. You still have options:

If You Owe No Taxes or Are Due a Refund

The IRS doesn’t penalize you for filing late if you owe no taxes. Since 62% of expats owe $0 after claiming available exclusions, you likely face no penalties. Just file your return as soon as possible.

You have three years from the original due date to claim a refund. After that, you forfeit any refund owed.

If You Owe Taxes

File your return immediately, even if late. The failure-to-file penalty stops accruing once you file. Pay as much as you can to minimize ongoing interest charges.

Consider requesting First Time Penalty Abatement if you have a clean compliance history for the past three years.

If You’re Years Behind

If you haven’t filed in multiple years, you may qualify for the Streamlined Filing Compliance Procedures. This IRS program allows qualifying expats to catch up on the last three years of tax returns and six years of FBARs with minimal or no penalties, provided your failure to file was non-willful.

Get Help Filing Form 4868 and Your Expat Taxes

Whether you’re filing Form 4868 for the first time or need help with a complex expat tax situation, Greenback specializes in helping Americans abroad.

No matter how late, messy, or complex your return may be, we can help. You’ll have peace of mind knowing that your taxes were done right.

If you’re ready to be matched with a Greenback accountant, click the Get Started button below. For general questions on US expat taxes or working with Greenback, contact our Customer Champions.

File Your Extension and Your Return the Right Way

This article provides general information about Form 4868 and U.S. expat tax filing requirements as of the 2025 tax year (filed in 2026). Tax laws change frequently, and individual situations vary. This content should not be considered specific tax advice. Always consult with a qualified tax professional regarding your unique situation.

Related Resources

- Foreign Earned Income Exclusion: Complete Guide

- Form 2350 vs. Form 4868: What’s the Difference?

- Expat Tax Extensions: Your Complete Guide

- What Happens If I File My U.S. Expat Taxes Late?

- Form 1040 for U.S. Expats: Filing Guide

- Physical Presence Test: How to Qualify

- Choosing Between FEIE and Foreign Tax Credit

- FBAR Filing Guide for Expats

- Streamlined Filing Procedures

- Common U.S. Expat Tax Forms