Is My ITIN Expired? How to Check and What to Do Next

- Why Do ITINs Expire?

- How Do I Check If My ITIN Is Expired?

- What Happens If I File With an Expired ITIN?

- Who Needs to Renew Their ITIN?

- How Do I Renew My Expired ITIN?

- Can I File My Tax Return While Waiting for ITIN Renewal?

- What If My Application Is Rejected?

- Do Spouses and Dependents Need to Renew?

- How Long Does My Renewed ITIN Last?

- Special Situations

- Why Work With Greenback for ITIN Renewal?

- Ready to Renew Your ITIN?

- Related Resources

Your Individual Taxpayer Identification Number (ITIN) doesn’t last forever. According to the IRS, ITINs expire either after three consecutive years of non-use or based on specific number sequences issued before the current expiration rules took effect. The good news? Checking if your ITIN has expired is straightforward, and renewing it follows the same process you used to apply originally.

Since the IRS won’t process U.S. tax returns with expired ITINs, and this can delay refunds or prevent you from claiming tax credits for your dependents, it’s worth taking a few minutes to verify your status right now. Here’s exactly how to check if your ITIN is still valid and what steps to take if it has expired.

At Greenback Expat Tax Services, we’ve helped over 23,000 expats navigate U.S. tax compliance, filing more than 71,000 returns while maintaining a 4.9-star rating. As IRS-authorized Certified Acceptance Agents, we can verify your documents and process your ITIN renewal without you having to mail your passport to the IRS for months.

Check Your ITIN Status With an Expert

Why Do ITINs Expire?

The Protecting Americans from Tax Hikes (PATH) Act of 2015 requires ITINs to expire under specific conditions. The IRS implemented this policy to ensure that only active taxpayers maintain valid identification numbers and to improve tax administration accuracy.

Your ITIN expires if:

1. You haven’t used it on a U.S. federal tax return for three consecutive years

If your ITIN wasn’t included on at least one federal tax return during a three-year period, it automatically expires on December 31 of that third year. For example, if you last used your ITIN to file your 2022 tax return and don’t file for 2023, 2024, or 2025, your ITIN expires on December 31, 2025.

2. It has specific middle digits (positions four and five)

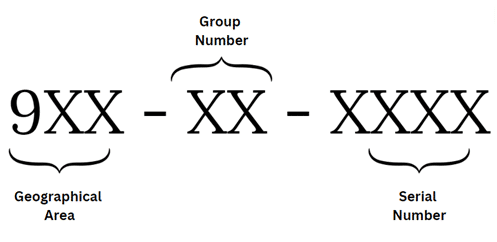

ITINs are formatted as 9XX-XX-XXXX. The following middle digit combinations have expired:

- 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, 88 (all ITINs with these digits have expired)

- 90, 91, 92, 94, 95, 96, 97, 98, 99 (only if your ITIN was assigned before 2013)

If you already renewed your ITIN due to an expired middle digit sequence, you don’t need to renew it again. The same ITIN number stays with you; only its active status changes.

How Do I Check If My ITIN Is Expired?

You can verify your ITIN status in four ways, starting with the quickest method.

Check the Middle Digits of Your ITIN

Look at positions four and five of your nine-digit ITIN (formatted as 9XX-XX-XXXX). You’ll find your ITIN on:

- Your most recent tax return (Form 1040)

- Your CP565 ITIN Assignment Notice from the IRS

- W-2 forms or 1099 forms that include your ITIN

If the middle digits match any of the expired sequences listed above, your ITIN has expired or needs renewal.

Example: An ITIN with a number starting with 9XX-78-XXXX has expired because 78 falls within the expired range. An ITIN showing 9XX-93-XXXX is still valid because 93 isn’t in any expired sequence.

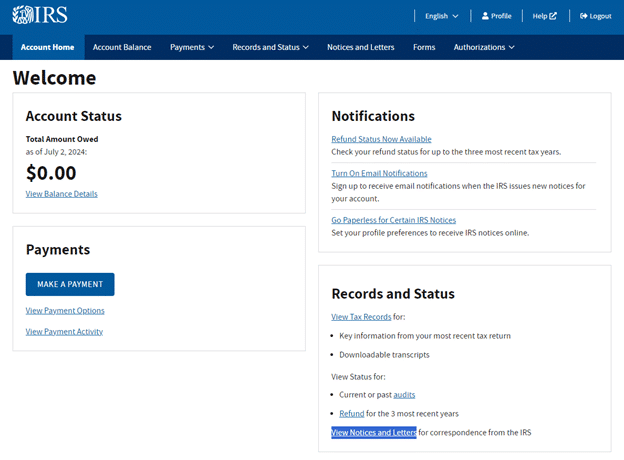

Review Your IRS Online Account

The IRS sends CP48 notices to taxpayers whose ITINs are expiring, but if you’ve moved countries (which many expats do), changed addresses, or if your mail was lost, you might never receive it.

The most reliable way to check for notices:

- Log in to your IRS online account

- Click on “Notices and Letters” at the bottom of your dashboard

- Look for CP48 or CP748 notices about ITIN expiration

If you see no expiration notice and your middle digits aren’t in the expired ranges, your ITIN is likely still active.

Setting up your IRS account: ITIN holders verify their identity through a video chat process. You’ll need a valid email address, proof of your ITIN, one primary identity document, and one secondary document. One document must show proof of your address.

Check Your Filing History

Think about the last time you filed a U.S. tax return or were claimed as a dependent on someone else’s return. ITINs expire after three consecutive years of non-use.

Quick calculation for 2025: If you last used your ITIN on a 2022 tax return and haven’t filed since, your ITIN expires on December 31, 2025. If you filed as recently as 2023, 2024, or 2025, you’re still within the three-year window.

Call the IRS Directly

For absolute certainty, contact the IRS ITIN Operations team at 1-800-829-1040 (available 7 am to 7 pm local time). There’s a specific menu option for checking ITIN application status.

Since the IRS received funding from the Inflation Reduction Act, many taxpayers report considerably shorter wait times than in previous years.

What Happens If I File With an Expired ITIN?

The IRS will still accept your tax return, but there are significant consequences:

Processing delays: Your return won’t be processed until your ITIN is renewed, which can take 7-11 weeks. This means delayed refunds if you’re owed money.

Loss of tax credits: You won’t be able to claim certain credits until your ITIN is renewed, including:

- Foreign Tax Credit

- Additional Child Tax Credit (Note: The standard Child Tax Credit requires an SSN, but the Additional Child Tax Credit and Other Dependent Credit can be claimed with an ITIN)

- Premium Tax Credit

- Credit for Child and Dependent Care Expenses

Potential penalties: Although having an expired ITIN itself doesn’t trigger penalties, the delay in processing could result in late payment penalties if you owe taxes but fail to pay by the April 15 deadline.

Who Needs to Renew Their ITIN?

You must renew your ITIN if it has expired and you need to file a U.S. tax return or will be claimed as a dependent or spouse on someone else’s return.

You don’t need to renew if:

- You obtained a Social Security number (SSN) – contact the IRS to provide both numbers so they can update your records

- Your ITIN is only used on information returns (like Form 1099 for reporting payments you receive)

- You won’t be filing a U.S. tax return and won’t be claimed as a dependent or spouse

Family renewals: If you receive a CP48 notice from the IRS, you can renew ITINs for your entire family at once, even if some family members have ITINs that aren’t expiring yet. Family members include the primary taxpayer, spouse, and all dependents.

How Do I Renew My Expired ITIN?

Renewing an ITIN is identical to applying for a new one. Your original ITIN number stays the same; you’re simply reactivating it.

Step 1: Complete Form W-7

Download and fill out Form W-7, Application for IRS Individual Taxpayer Identification Number.

Critical sections for renewal:

- Top right corner: Check the box “Renew an existing ITIN.”

- Line 6e: Enter your expired ITIN

- Line 6f: Enter the name your ITIN was issued under

- Reason for applying: Check the box that applies to your situation (typically “I am filing a U.S. tax return”)

If you’ve changed your legal name since receiving your ITIN, include documentation supporting the change, such as a marriage certificate or court order.

Step 2: Gather Required Documents

You must provide original documents or certified copies from the issuing agency proving:

- Your identity

- Your foreign status

The best option is a valid passport, which serves both purposes in one document.

If you don’t have a passport, you’ll need two documents:

- One proving identity (national ID card, driver’s license, birth certificate)

- One proving foreign status (birth certificate, visa, national ID card)

Notarized copies are not acceptable. Only original documents or certified copies issued directly by the relevant agency (e.g., passport office, vital records office) qualify.

Step 3: Attach Your Tax Return

For most ITIN renewals, you must attach your current year’s U.S. federal tax return to Form W-7. The IRS processes both together.

Exceptions: You don’t need to attach a tax return if you meet one of the five IRS exceptions (such as being a dependent claimed for an allowable tax benefit, third-party withholding, or tax treaty benefits). Your completed Form W-7 must explain which exception applies.

Step 4: Submit Your Application

You have three submission options:

Option 1: Mail to the IRS

Internal Revenue Service

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

For express or private delivery:

Internal Revenue Service

ITIN Operation

3651 S. Interregional Hwy 35

Austin, TX 78741

Processing time: 7 weeks for standard processing, or 9-11 weeks during tax season (January 15 – April 30), or if you apply from overseas.

The major downside: You must mail your original passport or other original documents, and it can take 60 days or longer to get them returned.

Option 2: Visit an IRS Taxpayer Assistance Center (TAC)

Make an appointment at a TAC location where an IRS employee will authenticate your documents in person. You keep your original documents.

The limitation: TAC locations are only in the United States, making this impractical for expats living abroad.

Option 3: Work With a Certified Acceptance Agent (CAA)

This is the best option for expats. An IRS-authorized Certified Acceptance Agent can verify your documents and certify them without requiring you to mail original documents to the IRS. You’ll have your passport back in a matter of days, not months.

Greenback’s Certified Acceptance Agents can review your Form W-7, authenticate your documents, and submit your renewal application on your behalf. You’ll receive your documents back within a week or two, rather than waiting months.

Can I File My Tax Return While Waiting for ITIN Renewal?

Yes, but the timing affects your refund and credits.

If you file by the deadline with a renewal application attached, the IRS will accept your return, but won’t process it until they issue your renewed ITIN. This delays refunds by 7-11 weeks.

If you need to meet the filing deadline but your spouse’s or dependent’s ITIN isn’t renewed yet, You have options:

- File an extension to give yourself more time

- File “married filing separately” temporarily, and amend your return later if filing jointly would be more beneficial.

- Submit the ITIN renewal application with your return and accept the processing delay.

If you know your ITIN is expiring, start the renewal process early (ideally 3-4 months before you need to file) to avoid these complications entirely.

What If My Application Is Rejected?

The IRS will send you Notice CP567 explaining why your application was rejected. Common reasons include:

- Incomplete Form W-7

- Missing required documentation

- Documents that don’t meet IRS standards (photocopies, notarized copies)

- Incorrect information that doesn’t match supporting documents

You can correct the issues and resubmit your application. If you’re unsure what went wrong, working with a Certified Acceptance Agent can help you avoid repeated rejections.

Do Spouses and Dependents Need to Renew?

Spouses: If you file jointly with your non-U.S. spouse who has an ITIN, their ITIN must be renewed if it’s expired. You can submit both renewal applications together.

Dependents: Children or other dependents with expired ITINs only need to renew if they’re being claimed for an allowable tax benefit (such as the Additional Child Tax Credit or Other Dependent Credit). If they’re simply listed on your return without generating a tax benefit, renewal isn’t required.

After the 2017 tax law changes, the standard Child Tax Credit requires an SSN. However, you can still claim the Additional Child Tax Credit (up to $1,700 per child for 2025) and the Other Dependent Credit (up to $500) with an ITIN.

How Long Does My Renewed ITIN Last?

Once renewed, your ITIN remains valid as long as:

- You continue filing U.S. tax returns (or are claimed as a dependent) at least once every three years

- The IRS doesn’t introduce new expiration rules for specific number sequences

Your original ITIN number stays with you permanently unless it’s revoked (which only happens in rare cases involving fraud or obtaining an SSN).

Special Situations

I’m Moving Back to the U.S. Soon

If you plan to return to the U.S., you may become eligible for a Social Security number upon arrival. Don’t renew your ITIN if you’ll qualify for an SSN within a few months. Instead, contact the IRS once you have your SSN to link both numbers in their system.

I Haven’t Filed in Years

If your ITIN expired due to non-filing, you’ll need to renew it before you can catch up on late returns. Consider using the Streamlined Filing Compliance Procedures to bring your compliance up to date if you’re behind.

My Child Was Born Abroad

If your child was born outside the U.S. and doesn’t have an SSN, they’ll need an ITIN to be claimed as a dependent on your U.S. tax return. This requires the same Form W-7 process. Learn more about getting an ITIN for dependents.

Why Work With Greenback for ITIN Renewal?

Greenback Expat Tax Services is an American company founded in 2009 by U.S. expats for expats. We’ve served over 23,000 expats and filed 71,000+ returns. Our team includes CPAs and Enrolled Agents living in 14 time zones, many of whom are expats themselves experiencing firsthand the challenges of living abroad.

As IRS-authorized Certified Acceptance Agents, we can:

- Review your Form W-7 for completeness and accuracy

- Authenticate your identity documents without requiring you to mail originals to the IRS

- Submit your renewal application on your behalf

- Return your documents within days instead of months

- Handle both your ITIN renewal and your tax return preparation together

Ready to Renew Your ITIN?

No matter how late, messy, or complex your situation may be, we can help. Whether you need to renew an expired ITIN, catch up on late returns, or want peace of mind knowing your taxes are done right, our comprehensive expertise and patient approach make the process surprisingly painless.

If you’re ready to be matched with a Greenback accountant, click the Get Started button below. For general questions on US expat taxes or working with Greenback, contact our Customer Champions.

Ready to Renew Your ITIN or File With Confidence?

Information presented is for educational purposes only and should not be considered tax advice. All cases are different. Tax laws are subject to frequent changes, and this content was created as of December 2025. Please consult a qualified tax professional for guidance on your specific situation.

Related Resources

ITIN-Specific Guides

- Do I Need an ITIN and How Do I Obtain One?

- What is Form W-7: Application for ITIN

- How Much Does It Cost to Get an ITIN?

For Foreign Spouses and Dependents

- Filing Joint Taxes with a Foreign Spouse Without SSN or ITIN

- What If My Spouse Does Not Have a Social Security Number?

- What Is a Dependent?

- Credit for Other Dependents

Tax Credits and Benefits

- Child Tax Credit for Expats

- Foreign Tax Credit: How Expats Can Reduce US Taxes

- U.S. Expat Tax Deductions and Credits

Filing and Compliance

- Form 1040 for U.S. Expats: Complete Filing Guide

- Late Tax Filing: Streamlined Filing Procedures

- Expat Tax Extensions

- What Are the 2025 Tax Year Deadlines for American Expats?

Greenback Services

- Federal Tax Return Preparation Services

- Tax Consultations for Complex Situations

- Meet Our Expat Tax Accountants