When You’ve Moved: Mid-Year Taxes

- Expat Taxes and Your Mid-Year Move Overseas

- Physical Presence Test and Your Mid-Year Move

- Bona Fide Residence Test and Your Mid-Year Move

- Impact of Moving Mid-Year State Taxes

- Can You Claim the FEIE After Living Abroad for Only One Year?

- Using an Extension to Claim the FEIE

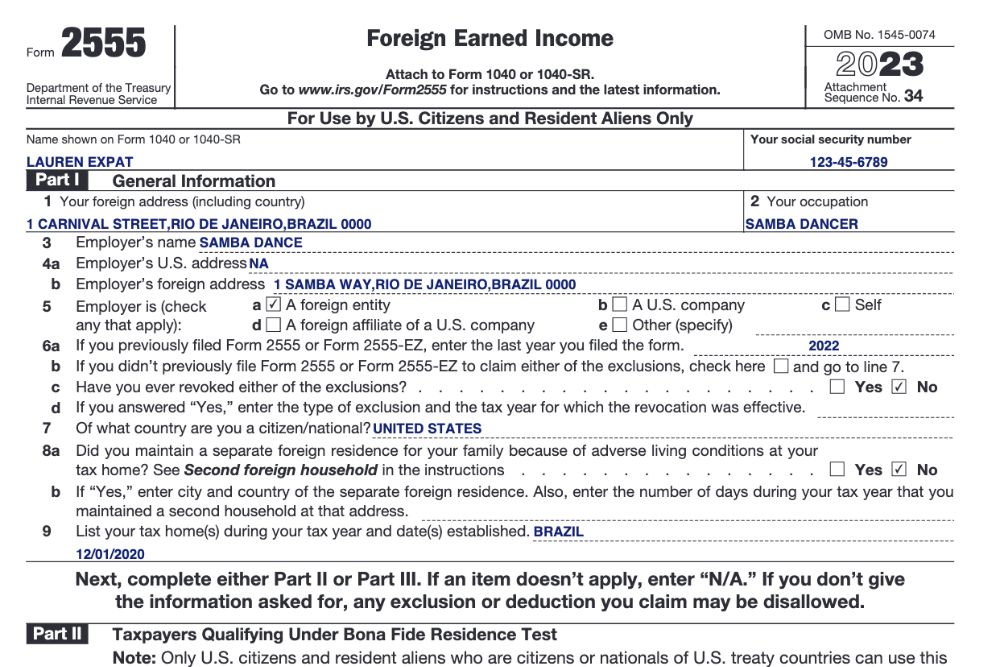

- Example: When You’ve Moved in the Middle of the Tax Year

- Thinking About Mid-Year Move Abroad? We Can Help with Your Taxes!

If you’re considering a move overseas, whether for a job or simply to explore the world, chances are you aren’t making plans based on the tax year. You’re probably going to move when it best fits your schedule, which means there are some implications related to US taxes you should be aware of as an expat. There are certain tax benefits that apply to expats, which might be affected by the time of year you expatriate. That’s right after you’ve moved; mid-year taxes can come into play.

Or, what if you’re living abroad for half the year? Here are the details you need to know!

Key Takeaways

- Moving abroad mid-year can have unique tax implications for US citizens. The US taxes worldwide income, but there are benefits like the Foreign Earned Income Exclusion (FEIE) that can help you avoid double taxation. Timing your move can impact how much foreign income you can exclude in the year of your move.

- Expats can qualify for the FEIE through either the Physical Presence Test or the Bona Fide Residence Test. Both tests have their own set of qualifications and restrictions.

- Even if you move abroad, you may still have to file state taxes depending on your prior state of residence.

Expat Taxes and Your Mid-Year Move Overseas

As you may probably know, the US taxes you on your worldwide income. This means you must report all income earned regardless of where you earned it – even if it was in a foreign country and even if that country also taxes you on the income earned while living there. Fortunately, though, there are some benefits available to expats that prevent being double taxed on all earned income.

One of these benefits is the Foreign Earned Income Exclusion (FEIE), which allows you to exclude a portion of your foreign-earned income from your US taxes. For income earned in 2023, the limit is set to $120,000 and will increase to $126,500 for the 2024 tax year. In order to qualify for the FEIE, you must meet one of two tests as a US taxpayer: the Physical Presence Test or the Bona Fide Residence Test.

Physical Presence Test and Your Mid-Year Move

When first moving abroad, it is likely easier to qualify under the Physical Presence Test. This requires you to live abroad for at least 330 days out of a 365-day time frame. It does not have to be based on a calendar year and can be any period leading up to the filing of your tax return. It’s important to note that the amount of foreign income you’re eligible to exclude will be prorated based on the number of days in the calendar year you were physically present in a foreign country.

Bona Fide Residence Test and Your Mid-Year Move

Once you’ve moved abroad and established a permanent residence for a full tax year, you may qualify for and use the Bona Fide Residence Test. You must have a ‘tax home’ in the foreign country where you are permanently or indefinitely engaged in work for at least a year. If you retained a permanent residence in the US, you can’t be considered to have a ‘tax home’ in a foreign country, so it’s very important to consider all qualifications before attempting to use the Bona Fide Residence Test for the FEIE.

Impact of Moving Mid-Year State Taxes

Whether or not you file state taxes as an expat depends on the individual state’s requirements. Generally, if you are required to file state taxes, you are only taxed on income earned in that particular state – not worldwide income. This means income excluded from the FEIE will also be excluded from state taxes. The year you expatriate, though, you may be required to file a Non-Resident or Part-Year Resident state tax return. Be sure to stay in tune with your state’s requirements so you can file if needed.

Can You Claim the FEIE After Living Abroad for Only One Year?

When you’re moving abroad for a year, taxes can be tricky. But as long as you’ve lived abroad for a year or more, you can qualify for the FEIE. There are actually two ways that you can qualify.

1. Qualifying via the Bona Fide Residence Test

Ordinarily, you can only satisfy the bona fide residence requirements by living overseas for work for more than a year. But if you have spent a full tax year in another country prior to your current country of residence, then you can qualify as a bona fide resident of your present country for a portion of the taxable year.

2. Qualifying via the Physical Presence Test

To satisfy the physical presence requirement, you simply have to spend at least 330 days in a foreign country over the course of a 12-month period. Additionally, your present country must be where you earn income and pay taxes. So if you have lived in your new country for roughly 10 months, you may qualify for the FEIE. Just make sure to keep track of any travel days, as only 330 full days in-country count toward the qualification.

Use our simple excel calculator to get an estimate of how the foreign earned income exclusion will save you money. It will make your day!

Using an Extension to Claim the FEIE

All expats living abroad on Tax Day (April 15th every year) receive an automatic two-month extension to file their US taxes. Expats also have the option to file Form 4868 to request an extension until October 15th. If you need more time to meet the Physical Presence Test after moving abroad from the US, you can also send a detailed request to the IRS for an additional two-month extension.

The extension to file is not an extension to pay. If you owe taxes, they are still due on April 15th and you will be required to pay interest on any amount owed not paid by this deadline. It’s best to estimate your tax liability even if you don’t file by April 15th, so you are able to go ahead and pay what you expect to owe without incurring interest.

Example: When You’ve Moved in the Middle of the Tax Year

Eli Expat and his wife Eliza, lifelong California residents, sold their house and moved to the Netherlands for his new job on May 31, 2022. Before the move, he worked for a company in the US, making $5,000 per month. When they moved to the Netherlands, and he started his new job overseas, he began making $6,000 monthly. So, he will have earned $20,000 before moving abroad and $48,000 after the move. Keep in mind that they moved in the middle of the tax year.

Since they are now permanent residents abroad, he will qualify for an automatic extension of his US expat taxes until June 15, 2023. Waiting this length of time will allow him to claim a portion of the Foreign Earned Income Exclusion on his 2023 US expat taxes, as June 1, 2022, through May 31, 2023, is the time period for which he will qualify for the Physical Present Test.

But, since he was only physically present in The Netherlands for a portion of the 2022 tax year, the amount of foreign earned income he can exclude will be prorated on his 2022 US taxes. Therefore, he will be able to exclude the entire $48,000 that he earned while living abroad, but Eli will be required to pay Federal and state taxes on the $20,000 he earned before his move.

In 2022, Eli fulfilled his US taxes by filing Form 1040 and California Form 540 (for his Californian return). For his 2023 expat taxes, he will file Form 1040, but because he only lived in California for part of the year, he will now file Form 540NR for his non-resident California return. Because Eli sold his property and severed all ties to California before his move to the Netherlands in 2022, he will not need to file a mid-year tax return in California when filing his 2023 US expat taxes.

Thinking About Mid-Year Move Abroad? We Can Help with Your Taxes!

When you’ve moved, mid-year taxes can be a big concern. Greenback can help! Our expat-expert CPAs and IRS Enrolled Agents are here to help you with all things expat tax-related.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.