Freedom to Roam, Confidence to File: U.S. Tax Simplified for Digital Nomads.

We See Your Situation Clearly.

-

Constantly moving between countries, working from cafes worldwide, or changing locations every few months.

-

Earning income from multiple sources like freelance projects, remote contracts, or foreign platforms.

-

Not sure where your tax home is, which complicates your residency status.

-

Needing to prove 330 days outside the U.S. for the Foreign Earned Income Exclusion (FEIE).

-

Worrying about compliance gaps due to multiple time zones, changing addresses, or unclear residency.

Start your U.S. expat tax return today.

"*" indicates required fields

Core Knowledge for the Globally Mobile. Our guides are specifically designed to address the challenges created by constant movement and location-independent income.

Mastering the 330-Day Math Puzzle (FEIE Qualification)

Learn exactly how to track and document your time to meet the Physical Presence Test (PPT) requirement and qualify for the Foreign Earned Income Exclusion.Tax Home Confusion and Residency Risk

Understand how the IRS defines your Tax Home when you are constantly moving, and why this is critical for qualifying for FEIE.Banking and Reporting Obligations (FBAR/FATCA)

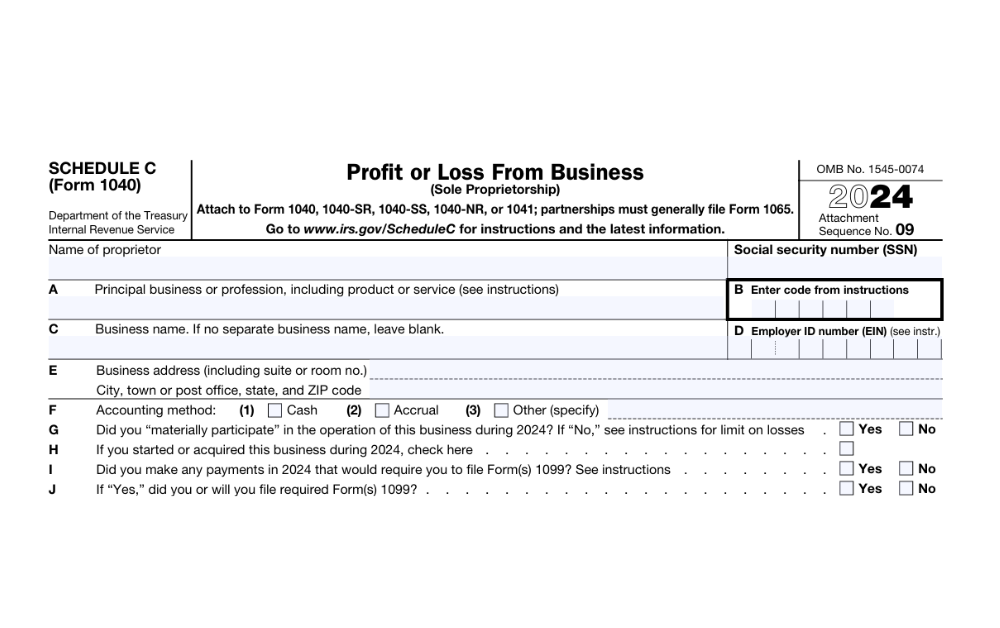

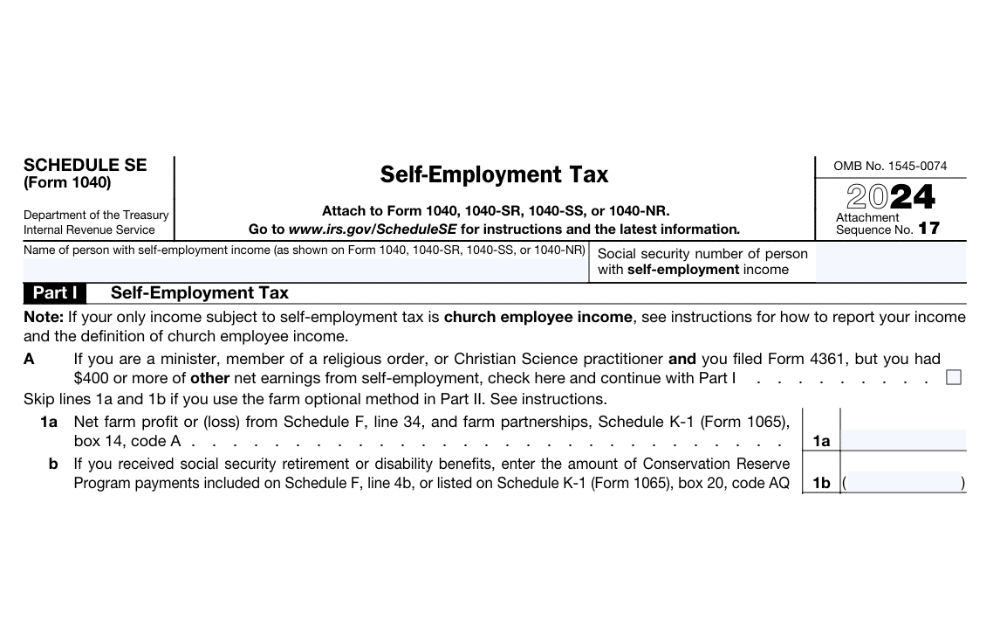

Find out exactly which foreign bank accounts and payment platforms need reporting to avoid $10,000+ penalties. FBARSelf-Employment and Schedule C Compliance

Walk through the complexities of reporting irregular freelance or contract income (1099s) and ensuring correct self-employment tax is calculated.Catch-Up Compliance (Streamlined Filing)

If you are worried you missed previous filing deadlines while traveling, learn about the Streamlined Filing Procedures and how to get compliant penalty-free.Featured In

Verified Reviews From Digital Nomads Who Were Once Where You Are.

I would highly recommend working with Greenback if you are an expat or nomad!

He guided me through everything patiently, answered my questions thoroughly, and completed my return with speed and efficiency. Now that I’m applying for a mortgage, I’ve needed a few statements from him during the underwriting process, and he’s kindly and quickly obliged.

I would highly recommend the services of Greenback to anyone who’s seeking expat tax help!

4.84/5

4.84/5

4.9/5

4.9/5

4.8/5

4.8/5

Specialized Services to Solve Your Nomadic Tax Puzzle.

Annual Expat Tax Filing

We calculate and verify your FEIE eligibility, track your qualifying days, and prepare the documentation the IRS expects. You get clear guidance on what travel counts, what breaks the 330-day rule, and how to protect your exclusion year after year.

$565

USD

Freelancer / Self-Employed Nomad Tax Filing

We help you correctly report freelance, contract, or platform income earned from anywhere in the world. We explain how FEIE interacts with self-employment tax and make sure you’re not paying more than necessary.

$565

USD

Expat Small Business & Entity Filing

Before you create an entity abroad, we help you understand the tax reporting requirements (including Forms 5471/8621) and whether a foreign company helps or hurts your tax situation.

$750

USD

Catch-Up Filing (Streamlined Procedures)

If you missed past filings, we safely bring you into compliance using the IRS Streamlined Program, no stress, no judgment, and often with no penalties.

$1,750

USD

Strategic Tax Consultation

A 30-minute call to map out your tax home, FEIE eligibility, travel calendar, foreign residency questions, and business setup. You leave with clarity and a year-long plan..

$250+

USD

U.S. State Tax Returns

We determine if you have ongoing filing obligations in your previous state of residence and handle all necessary state tax filings.

$185

USD

The Complete Digital Nomad Resource Library

Visit the Knowledge CenterDigital Nomad Tax FAQs

Can I Claim the Foreign Earned Income Exclusion (FEIE) If I’m a Digital Nomad Who Moves Often?

Yes. As a highly mobile digital nomad, you can qualify for the FEIE as long as you meet the Physical Presence Test (PPT). This test requires you to be physically outside the U.S. for at least 330 full days during any period of 12 consecutive months.

-

FEIE Benefit: The FEIE allows you to exclude a significant portion of your foreign earned income from U.S. federal income tax (up to $130,000 for the 2025 tax year).

-

Need to Know: You must also meet the “Tax Home Test,” meaning your tax home (where your principal place of business is) must be in a foreign country.

-

Deep Dive: Digital Nomad Taxes: What U.S. Citizens Working Remotely Abroad Need to Know

What Counts as Proof of 330 Days Abroad for Digital Nomads?

The key is meticulous record-keeping. To substantiate your time abroad for the Physical Presence Test, you should keep and organize records that can clearly document your location and the dates you spent in foreign countries.

Essential Documentation to Keep:

-

Passport entry and exit stamps

-

Flight, train, or bus bookings/boarding passes

-

Accommodation receipts (Airbnb, hotel, rental agreements)

-

Credit card statements and ATM withdrawal receipts showing foreign transactions

-

Recommendation: We help you track, organize, and submit this documentation for Form 2555 (the form used to claim the FEIE).

As a Digital Nomad, What Happens if I Earn Income in Multiple Countries?

That is completely fine. The FEIE is designed to exclude up to the maximum allowable amount of your foreign earned income regardless of which specific countries you earned it in, provided you pass one of the qualifying tests (most commonly the Physical Presence Test for nomads).

The source of the income is the location where you performed the work, not where your clients paid you from.

Exclusion Limit: The maximum exclusion amount is adjusted annually for inflation.

What Address Should a Digital Nomad Use if There Is No Permanent Home?

For U.S. tax filing purposes, you still need a reliable mailing address for IRS correspondence. Digital nomads commonly use the following options:

-

A trusted family member’s address in the U.S.

-

A commercial mail forwarding service (with a U.S. address).

-

The address of a registered agent or your international tax service provider (if permitted).

Pro Tip: Your mailing address does not determine your “tax home” for the FEIE. Your tax home must be in a foreign country. We can help you establish a valid mailing address for all IRS needs.

If I’m Always on the Move, Do I Still Need to Report Foreign Bank Accounts?

Yes, you must report them if the combined maximum value of all your foreign financial accounts (checking, savings, investment, etc.) exceeded $10,000 at any point during the calendar year. This is done by filing the Report of Foreign Bank and Financial Accounts (FBAR), or FinCEN Form 114.

-

FBAR Filing: The FBAR is due by April 15th, with an automatic extension to October 15th.

-

Penalty Risk: This is an informational filing, but the penalties for non-willful failure to file can be substantial.

-

Deep Dive: FBAR Compliance: Reporting Your Foreign Bank Accounts

As a Digital Nomad, Can I Catch Up on Filing If I’ve Been Traveling for Years?

Don’t panic! The IRS has a program specifically for non-willful tax non-compliance by overseas taxpayers. You can typically catch up through the Streamlined Filing Compliance Procedures, which allow you to file the most recent three years of tax returns and six years of FBARs, often with all late-filing and FBAR penalties waived.

-

Key Requirement: You must certify your failure to file was non-willful (due to negligence, inadvertence, or a good faith misunderstanding of the requirements).

-

Deep Dive: Streamlined Filing for U.S. Expats: Your Penalty-Free Path to Tax Compliance