You’re Filing as a Dual Status Alien. Your Tax Year Shouldn’t Feel Impossible.

Dual Status Filing Comes With Its Own Set of Questions

-

Arrived in the U.S. midyear with a Green Card or work visa (H-1B, L-1).

You became a U.S. resident partway through the year and need to determine your exact residency start date, split your income between resident and nonresident periods, and file the correct combination of forms.

-

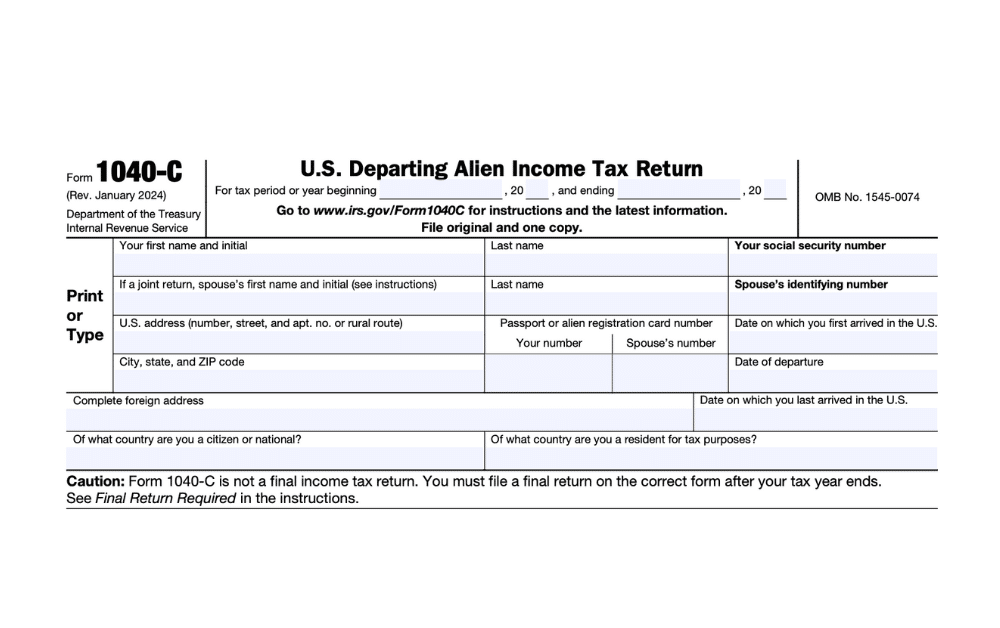

Left the U.S. midyear and gave up residency status.

You ended U.S. residency during the year by giving up your Green Card, leaving on a work visa, or failing the substantial presence test, creating a dual status filing requirement for your departure year.

-

Earned income both inside and outside the U.S. during the same year.

You had employment, business income, or investment income from multiple countries and need to determine how each income source is allocated between your resident and nonresident periods.

-

Unsure whether to file Form 1040 or Form 1040-NR as your primary return.

Your residency status on December 31 determines which form is primary, but the mechanics of dual status filing (paper filing only, dual status statement attachment, income splitting) remain confusing.

-

Wondering if you can file jointly with your spouse despite dual status restrictions.

You know dual status aliens generally cannot file jointly, but you’ve heard about the Nonresident Spouse Election and want to understand if it benefits your situation.

-

Behind on filing because the dual status requirements seemed too complicated.

You didn’t file in your arrival or departure year because you weren’t sure which forms to use, how to split your income, or whether you even needed to file, and now you’re worried about catching up.

Start your U.S. expat tax return today.

"*" indicates required fields

You Need Certainty. We Provide the Blueprint. These guides address the most common questions dual status filers face, so you can understand the requirements, file correctly, and move forward with confidence.

What Is Dual Status and Do I Qualify?

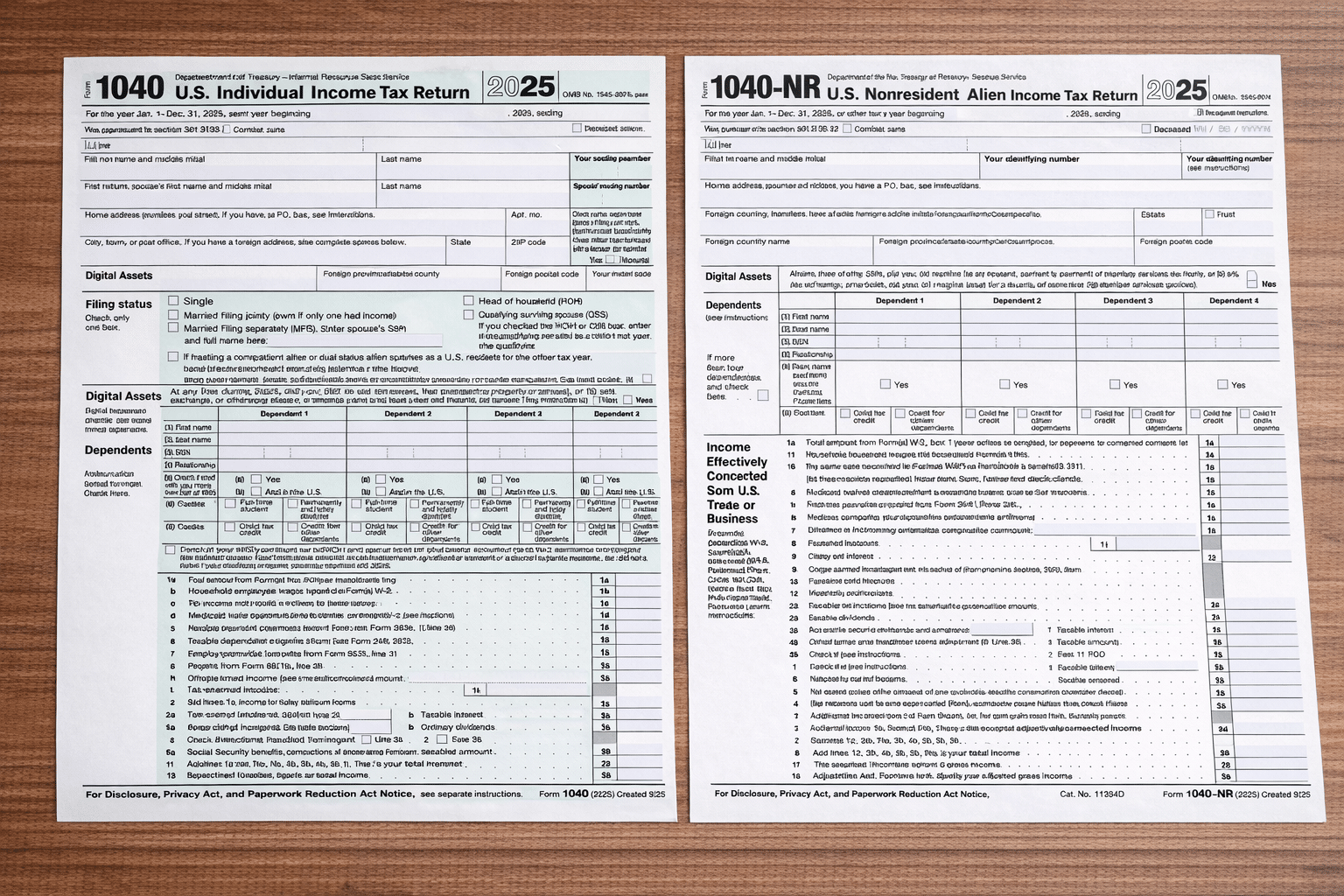

Dual status means you were both a U.S. resident and nonresident alien during the same tax year. This typically happens in your arrival year (moved to the U.S. midyear) or departure year (left the U.S. midyear). Your tax year splits into two periods with different rules for each. Learn more about dual status filing requirementsWhich Form Do I File: 1040 or 1040-NR?

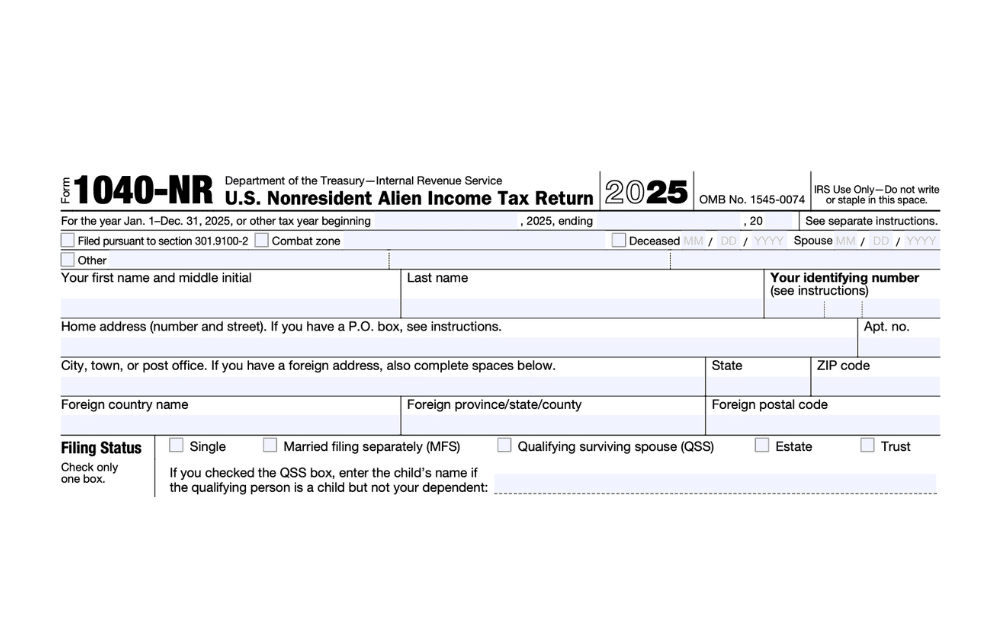

Your residency status on December 31 determines your primary form. If you’re a resident on the last day of the year, file Form 1040 as your primary return with Form 1040-NR attached. If you’re a nonresident on December 31, it’s the reverse. Dual status returns must be mailed—they cannot be e-filed. Learn more about Form 1040 vs Form 1040-NRCan I File Jointly With My Spouse as a Dual Status Filer?

Generally, dual status aliens cannot file joint returns. However, the Nonresident Spouse Election (6013(g)) allows couples to elect to treat the nonresident spouse as a resident for the entire year, enabling joint filing with access to higher standard deductions and tax credits. Learn more about dual status filing optionsHow Do I Split My Income Between Resident and Nonresident Periods?

During your resident period, all worldwide income is taxable. During your nonresident period, only U.S.-source income is taxable. You’ll need to carefully track dates and income sources to allocate correctly between the two periods on your dual status return. Read the complete dual status filing guideWhat Deductions and Credits Can I Claim as Dual Status?

As a dual status filer, you generally cannot claim the standard deduction unless you make the spousal election. You can only deduct expenses directly connected to U.S. income-producing activities. The Foreign Tax Credit and certain treaty benefits may still apply for income earned during your nonresident period. Learn more about dual status tax treatmentWhat If I Filed the Wrong Form or Didn’t Realize I Was Dual Status?

If you filed as a full-year resident or nonresident when you should have filed dual status, you can file an amended return to correct it. Many people discover their dual status filing requirement late. The Streamlined Filing Procedures can help you catch up if you missed filing requirements due to confusion about your status. Learn more about correcting dual status filing errorsFeatured In

Real Stories From Dual Status Filers Just Like You.

4.84/5

4.84/5

4.9/5

4.9/5

4.8/5

4.8/5

U.S. Tax Help for Dual Status Filing

Filing as a dual status alien requires navigating two sets of tax rules within a single year: resident tax treatment for one period and nonresident treatment for another. Our services are designed to help you file correctly, optimize your tax position during your transition year, and ensure compliance with IRS requirements.

Dual Status Tax Return Preparation (Form 1040 & Form 1040-NR)

We handle complete dual status return preparation, including determining which form serves as your primary return based on your December 31 status, correctly splitting income between resident and nonresident periods, and attaching the proper dual status statement. We ensure your return is paper-filed correctly since dual status returns cannot be e-filed. Our CPAs understand the complex allocation rules and help you minimize tax liability during your transition year. Our Dual Status Return package is $875.

$875

USD

FBAR & FATCA Reporting for Dual Status Filers

If your foreign financial accounts exceeded $10,000 at any time during the year, FBAR filing is required regardless of your dual status. We help you determine your reporting thresholds for Form 8938 based on your residency status on December 31, prepare and electronically file FBARs through FinCEN’s system, and ensure compliance with both FBAR and FATCA requirements for your transition year.

$125+

USD

Streamlined Filing for Missed Dual Status Returns

If you didn’t file in your dual status year because you didn’t understand the requirements, the IRS Streamlined Filing Procedures allow penalty-free catch-up. We help you certify that your failure to file was non-willful, prepare the required three years of back returns (including your dual status year), and file six years of FBARs if you had foreign accounts exceeding $10,000.

$1,750

USD

Nonresident Spouse Election (6013(g)) Analysis

If you’re dual status and married, we analyze whether making the Nonresident Spouse Election benefits your situation. This election allows you to treat your nonresident spouse as a resident for the entire year, enabling joint filing with access to the full standard deduction and tax credits. We calculate both scenarios—dual status separate vs. joint election—to determine which approach minimizes your overall tax liability.

$250+

USD

Substantial Presence Test Calculation

Determining whether you meet the substantial presence test is essential for dual status filing. We calculate your physical presence in the U.S. using the required formula (current year days + 1/3 prior year days + 1/6 two years prior), determine your exact residency start or end date, and establish the proper split between resident and nonresident periods. Accurate day counting directly impacts your tax liability.

$250+

USD

Strategic Consultation for Dual Status Situations

If you’re facing a dual status year and want clarity before filing, a consultation with an expat tax expert can help. We walk through your specific arrival or departure situation, explain exactly which forms you’ll need, model the tax impact of different filing strategies (including spousal election), and answer questions about your unique circumstances. Consultations start at $250 and provide personalized guidance.

$250+

USD

Your Questions, Answered: US Tax Guides & Resources

Visit the Knowledge CenterDual Status Returns FAQs

Can Greenback prepare my dual status return (Form 1040 & 1040-NR)?

Yes, Greenback specializes in dual status returns for foreign nationals who moved to or from the U.S. midyear. We handle the complete filing process including determining which form (1040 or 1040-NR) serves as your primary return based on your December 31 residency status, correctly splitting income between resident and nonresident periods, calculating your substantial presence test to establish your exact residency dates, applying treaty benefits and Foreign Tax Credits appropriately for each period, and paper-filing your return with the proper dual status statement attached.

Our Dual Status Return package is $875 and includes both forms and all required calculations. Learn more about our dual status filing services.

Can Greenback help me determine if I qualify as dual status?

Yes, determining dual status requires calculating your substantial presence test (current year days + 1/3 prior year days + 1/6 two years prior), identifying your exact residency start or end date, reviewing your immigration documents (Green Card, visa dates, departure records), and understanding how your specific visa status affects your tax classification.

We analyze your physical presence days, review your immigration timeline, and confirm whether you qualify as dual status or if you’re a full-year resident or nonresident. This analysis is included in our dual status return preparation or available through a strategic consultation ($250).

Can Greenback help me file jointly with my spouse even though I’m dual status?

Yes, while dual status aliens generally cannot file joint returns, the Nonresident Spouse Election (6013(g)) allows you to treat your nonresident spouse as a resident for the entire year, enabling joint filing. We analyze whether this election benefits you by calculating both scenarios—dual status separate filing vs. joint filing with the election. F

or many couples, the joint filing benefits (higher standard deduction of $29,200 for 2025, lower marginal tax rates, access to Earned Income Credit, Child Tax Credit, education credits) outweigh the cost of including the nonresident spouse’s worldwide income. This analysis is included in our dual status return preparation.

Can Greenback help me if I filed the wrong form in my arrival or departure year?

Yes, if you filed as a full-year resident (Form 1040 only) or full-year nonresident (Form 1040-NR only) when you should have filed dual status, we prepare amended returns (Form 1040-X) to correct the error. Many foreign nationals don’t realize they’re dual status in their arrival or departure year and either overpay or underpay taxes by filing the wrong form.

Correcting this often results in refunds you’re entitled to by properly applying dual status treatment, separating resident vs. nonresident income, claiming appropriate deductions and credits, and applying treaty benefits correctly. Amended dual status returns are included in our federal tax services.

Can Greenback help me with FBAR and FATCA reporting if I’m dual status?

Yes, if your foreign financial accounts exceeded $10,000 total at any point during the year, FBAR filing is required regardless of your dual status. We help you determine which accounts must be reported (foreign bank accounts, investment accounts, retirement accounts), calculate the aggregate threshold correctly, and electronically file through FinCEN’s system. We also determine your Form 8938 (FATCA) thresholds based on your residency status on December 31—thresholds are higher for U.S. residents living abroad ($400,000 year-end or $600,000 anytime) than for U.S. residents living in the U.S. ($50,000 year-end or $75,000 anytime for single filers).

Our FBAR service starts at $125 for up to 5 accounts. Learn more about our FBAR filing services.

Can Greenback help me catch up if I didn’t file in my dual status year?

Yes, if you didn’t file in your dual status year because you didn’t understand the requirements, weren’t sure which forms applied, or didn’t know you had a filing obligation, the IRS Streamlined Filing Procedures allow penalty-free catch-up for non-willful situations. We prepare the required three years of back returns (including your dual status year with proper form combinations), file six years of FBARs if you had foreign accounts exceeding $10,000, certify that your failure to file was non-willful (confusion about dual status qualifies), and help you get compliant without triggering late-filing or FBAR penalties.

Our Streamlined Filing Package is $1,750. Learn more about our Streamlined Filing services.

How much does Greenback charge for dual status return preparation?

Our pricing is transparent and flat-fee based. Dual Status Return preparation (Form 1040 & Form 1040-NR combination) is $875, which includes substantial presence test calculation, income splitting between resident and nonresident periods, spousal election analysis, treaty benefit application, and paper filing with dual status statement. FBAR filing starts at $125 for up to 5 accounts. Streamlined Filing Package (3 years returns + 6 years FBARs) is $1,750 and includes dual status year correction.

Strategic consultations for dual status analysis start at $250. Most dual status filers find our expertise worth the investment—proper filing often results in significant tax savings through correct income allocation and treaty benefits. Use our pricing calculator to get an estimate.

Can Greenback help me apply treaty benefits and Foreign Tax Credits for my dual status year?

Yes, if your home country has a tax treaty with the U.S., we help you claim applicable treaty benefits for income earned during your nonresident period. Treaties often exempt certain types of income (scholarships, fellowships, teaching income, research grants) or provide reduced withholding rates on dividends, interest, and royalties. We also apply Foreign Tax Credits if you paid foreign taxes on income that’s taxable in both countries during your resident period.

Proper application of treaty benefits (Form 8833) and Foreign Tax Credits (Form 1116) often significantly reduces or eliminates your U.S. tax liability for both periods of your dual status year. This is included in our dual status return preparation.