What Is a PFIC, and How Does It Affect My Taxes?

Most American investors are familiar with the basic mechanics of a mutual fund. But many American expats will need to navigate the reporting requirements that come from investing in a passive foreign investment company (PFIC).

The reporting requirements for a PFIC can be a bit intimidating if you’re not familiar with how they work, and US taxpayers may be required to pay additional tax.

If you’re an American expat, you may want to bookmark this page before tax season, as it explains everything you need to know about PFICs and how they work.

Key Takeaways

- A passive foreign investment company (PFIC) is a non-US pooled investment company that attributes at least 75% of its gross income as passive income. Alternatively, at least 50% of its assets produce passive income.

- A PFIC can be taxed by excess distribution, market-to-market, or by using a qualified electing fund.

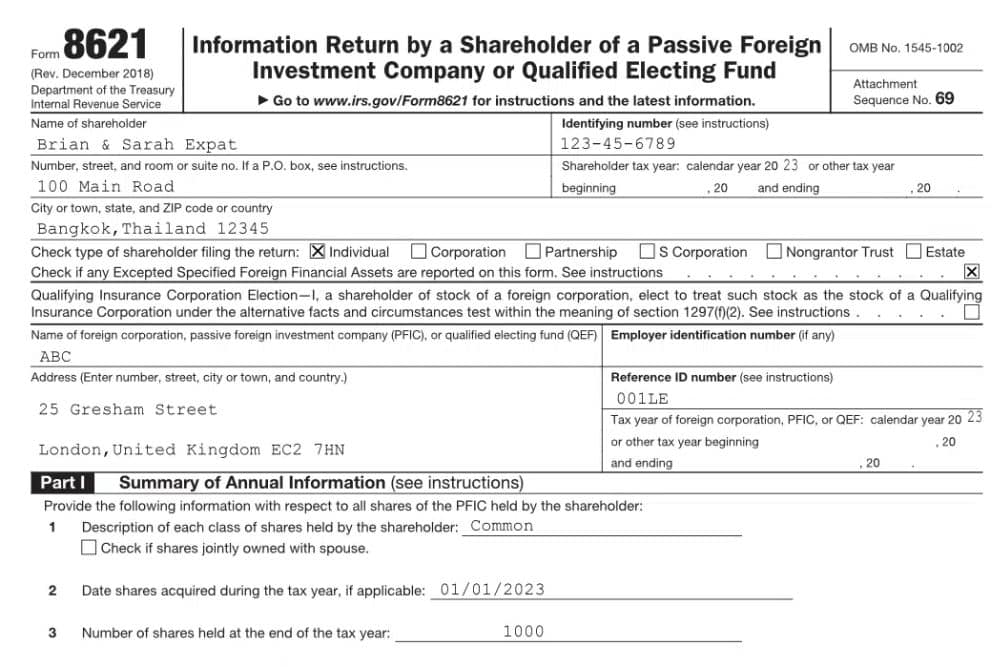

- American expats must file Form 8621 if they receive a distribution or experience a gain from a PFIC, make a QEF or MTM election.

What Is a Passive Foreign Investment Company (PFIC)?

A passive foreign investment company, or PFIC, is a pooled investment that is registered outside the borders of the United States. PFICs are defined by US tax law, and they include a variety of investment funds and certain types of pension investments.

Dreading the last minute scramble pulling together your tax documents? Despair no more! This simple checklist lists the documents you need to have on hand when preparing to file.

The purpose of PFIC status is to prevent US taxpayers from avoiding taxes by investing through foreign accounts and companies that aren’t subject to the same rules as those located within the United States.

If you’re an investor, you may already be familiar with mutual funds, index funds, or exchange-traded funds (ETFs). However, the taxation and reporting rules that govern a PFIC are considerably stricter and more complicated than the rules that govern these other investment vehicles.

Only US citizens or residents are impacted by PFIC rules. If you’re an American expat, you are still required to pay US taxes, which means that you’ll be responsible for abiding by PFIC rules.

These rules apply regardless of how long you have been living abroad; even if you become a resident of a foreign country, you will still need to file a US tax return each year.

How to Identify a PFIC

To determine whether an investment fund is classified as a PFIC, it is necessary to examine the fund’s underlying investments. Most mutual funds and index funds based in the US are not considered to be PFICs, even if they include foreign investments. This is because these investments are registered and regulated under US law, whereas a PFIC is not. An asset can be classified as a passive foreign investment company if and only if it meets at least one of the following criteria:

- Income Test: 75% of gross income comes from passive income

- Asset Test: 50% or more of assets produce passive income

These tests must be applied every taxable year, so it is possible that a particular investment would not qualify as a PFIC one year but would the next.

What Is Considered Passive Income?

For the purpose of these tests, what counts as passive income? Common sources of passive income can include:

- Dividend payments

- Interest

- Royalties

- Annuities

- Rental income

- Income equivalent to interest

- Payments made in lieu of dividends

Additionally, certain types of contracts or asset exchanges can generate passive income. These include:

- Notional principal contracts

- Commodities transactions (e.g., futures)

- Foreign currency exchanges

Again, if 75% or more of an entity’s income comes from these sources — or if 50% or more of its assets produce passive income — it’s classified as a PFIC.

Examples of PFICs

The income and asset tests are the primary criteria by which a PFIC can be identified. Here are some common examples of PFICs that you may encounter:

- ETFs listed on a foreign stock exchange

- Foreign real estate companies and real estate investment trusts (REITs)

- Foreign mutual fund trusts

But keep in mind that the passive component of PFICs can be to your advantage. A foreign company that carries on active business would generally not be classified as a PFIC; therefore, it would not be subject to the same type of PFIC tax requirements.

There is an easy way to determine if a publicly traded investment is a PFIC or not. Every publicly traded investment will have an International Securities Identification Number (ISIN). If the ISIN for a mutual fund, ETF, REIT, or similar investment has the letters “US” as the first two letters, it is not a PFIC. If the first two letters are anything else, then it is a PFIC.

Note that individual shares in a company, such as Vodafone, Shell, and HSBC Bank, are not PFICs. The only pooled investments are PFICs.

How Are PFICs Taxed by the IRS?

If you have investments that are considered passive foreign investment companies (PFICs), there are three ways to choose how they are taxed:

1. Excess Distribution

Excess distribution is the default taxation method. It’s classified as a Section 1291 Fund. This method allows for a deferral of US taxes until either (1) the earnings are distributed or (2) the PFIC is sold. Earnings are taxed as ordinary income, and the excess distribution is spread out over your investment period on a pro-rata basis.

To calculate the excess distribution amount, you’ll need to include both the sale amount of the PFIC and any distributions in which the total annual distributions exceed 125% of the preceding three-year average.

The excess distribution being spread out over the entire time you own the PFIC can result in having to pay a considerable amount of tax. The reason is that there is an interest charge assessed over this time period. The longer you own the investment, the more interest you will have to pay. For example, if you have an excess distribution of $4,000 over a two-year ownership period, you would be assessed interest on $2,000 for one year and interest on $2,000 for two years. If, instead, you had an excess distribution of $4,000 over 4 years, you would be charged interest on $1,000 over one year, interest on $1,000 over two years, interest on $1,000 over three years, and interest on $1,000 over four years. For this reason, the Excess Distribution method tends to result in the most tax, especially if the PFIC has been owned for many years.

2. Market-to-Market (MTM)

To elect the market-to-market (MTM) approach, you must use the option on Form 8621, Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund. While this alternate tax plan will allow you to avoid interest charges and a higher tax, it will also cause you to face an earlier tax obligation.

When you use the MTM approach, you must recognize an annual gain based on the PFIC’s value at the end of the tax year. This gain is taxed as ordinary income or treated as ordinary income loss. You generally cannot claim a loss until the PFIC is sold, but losses from past years can be used to reduce gains in current years.

3. Qualified Electing Fund (QEF)

Like the MTM approach, you can opt for the qualified electing fund (QEF) by selecting the appropriate option on Form 8621. The QEF will also accelerate your tax liability, though it will lower your potential interest and tax obligation.

To use the QEF election, you’ll need to file Form 8621 in the first year that you invest in the PFIC. However, if the PFIC’s annual information statement isn’t available, you may be prevented from exercising this PFIC taxation method.

In the QEF approach, you must list a pro-rata portion of the PFIC’s earnings as part of your annual gross income. Depending on the nature of the income, this may be classified as ordinary income or capital gains.

Note that the QEF method can only be selected during the first year that you own the PFIC. You can make your selection on Form 8621.

Exceptions to Filing Form 8621

There are two primary reasons why an American expat would not file Form 8621.

1. You Have Foreign Pension Plans

Certain types of foreign pension plans may also be exempt. For example, any retirement plan where income is deferred is exempt from PFIC tax reporting requirements until distributions are made. However, if you make adjustments to your retirement plan or cash out early, it may prevent you from using this exemption.

2. The PFIC is a Controlled Foreign Corporation (CFC).

If the company qualifies as a PFIC and it is a CFC, only Form 5471 (Informational Returns of US Persons with Respect to Certain Controlled Foreign Corporations) needs to be filed. Form 8621 does not need to be filed. A CFC is a foreign corporation in which certain US shareholders own more than 50% of the company.

The only shareholders that are considered when determining if a foreign corporation is a CFC are shareholders that own at least 10% of the foreign corporation. The rules regarding CFCs and Form 5471 are extremely complex. If you think these issues may apply to you, you should speak with a tax expert.

When to Seek PFIC Tax Assistance

It is important to understand that PFIC investments come with their own set of tax considerations, and getting help from an experienced professional is the best way to ensure your tax liability is minimized. Knowing when to seek PFIC tax assistance can be the difference between an optimal portfolio and a costly mistake.

A tax advisor can help you fill out Form 8621 and help you make decisions regarding your reporting options (i.e., excess distribution, QEF, or MTM). The advisor will also look for any exemptions that may apply.

For that matter, American expats might also consider using a professional tax advisor to help reduce their overall tax burdens. A tax preparer can highlight key areas where you may qualify for deductions and save money on your yearly taxes, which may help you maximize the earnings you receive from a PFIC.

Need Help with Your PFIC Requirements?

Living abroad yet paying US taxes can be a complex process. PFIC tax requirements only add to the confusion. Greenback Expat Tax Services can help. We will guide you through the requirements and options relating to your PFIC investments and ensure that you comply with all regulations.

Contact us, and one of our customer champions will gladly help. If you need very specific advice on your specific tax situation, you can also click below to get a consultation with one of our expat tax experts.