Common Expat Tax Forms: US Expat Taxes Explained

- What Tax Forms Expats Need: Start With Form 1040

- US Tax Forms for Expats: Form 2555 – Foreign Earned Income Exclusion (FEIE)

- IRS Forms for Expats: Form 1116 – Foreign Tax Credit (FTC)

- Form 8938 – Statement of Specified Foreign Assets

- Form 8833 – Treaty-Based Return Position Disclosure

- Form 5471 – Information Return of US Persons For Certain Foreign Corporations

- Form 8865 – Return of US Persons concerning Certain Foreign Partnerships

- Form 8621 – Information Return by a Shareholder of a Passive Foreign Investment Company (PFIC)

- FinCEN Form 114 – Foreign Bank Account Reporting (FBAR)

- Other IRS Forms for Expats

- Have Additional Questions About US Tax Forms for Expats?

US taxes are complex. The US tax code contains over 74,000 pages, most of which are hard to comprehend – even for professionals! Our experts have compiled a guide to help you understand the most common expat tax forms you may come across as an American living abroad.

Key Takeaways

- Americans living abroad often have additional filing requirements but can also claim additional tax deductions and credits.

- It is key to be aware of all your filing requirements in order to avoid any filing penalties.

What Tax Forms Expats Need: Start With Form 1040

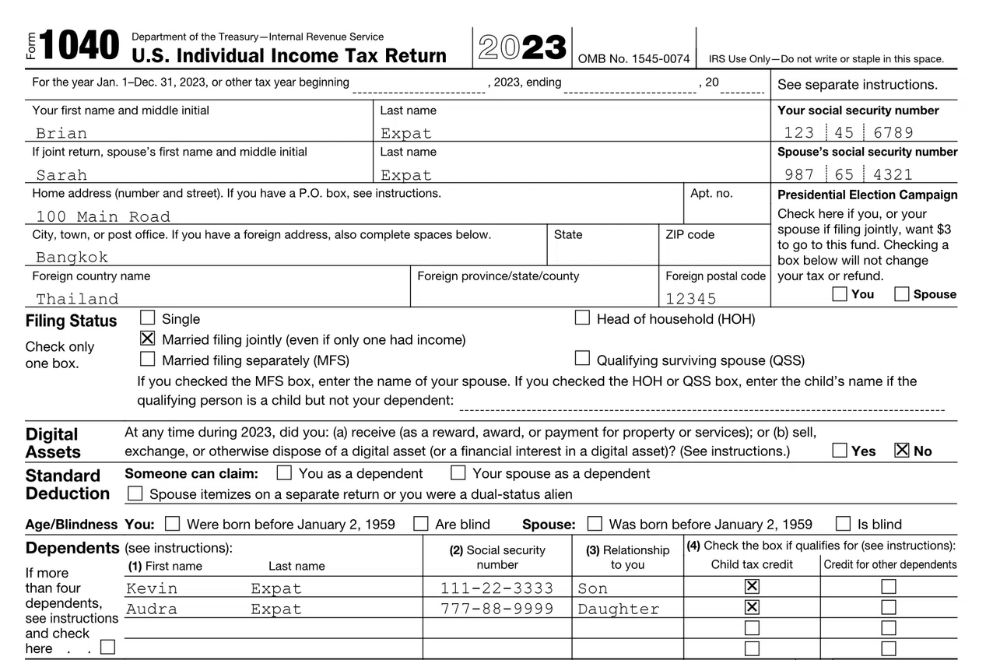

This is an important one. Form 1040 has three different versions: 1040, 1040A, and 1040EZ, but expats almost always use the original: Form 1040. This form reports your name, Social Security number, and address to the IRS. This form has historically been two pages that summarize your income and deductions and calculate the amount you owe or will receive as a refund. Other schedules and forms should be attached to Form 1040 and then submitted when you file your US tax return to complete what tax forms expats need.

US Tax Forms for Expats: Form 2555 – Foreign Earned Income Exclusion (FEIE)

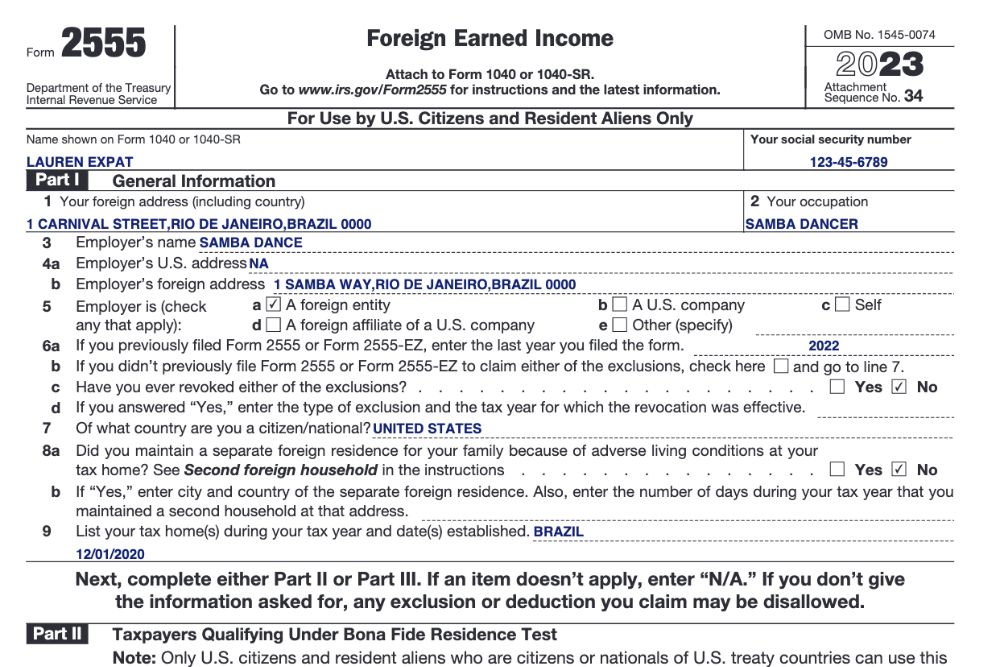

Form 2555 calculates the amount of Foreign Earned Income Exclusion allowed on your US tax forms for expats. The form shows your foreign-earned income amount, your foreign address, your employer’s address, and the dates you traveled to the US during the year. It also calculates the amount of foreign housing expenses you may be able to exclude in addition to your FEIE.

IRS Forms for Expats: Form 1116 – Foreign Tax Credit (FTC)

Form 1116 calculates how much your US tax liability can be reduced due to taxes you paid to the country of your residence. Form 1116 will report your income subject to foreign taxes, the amount of foreign taxes paid or accrued on that income, and the calculation to figure out how much the FTC will lower your current year’s taxes on your tax return. Multiple 1116 IRS forms for expats may be included with your tax return, as different types of income have to be categorized in specific ways.

Form 8938 – Statement of Specified Foreign Assets

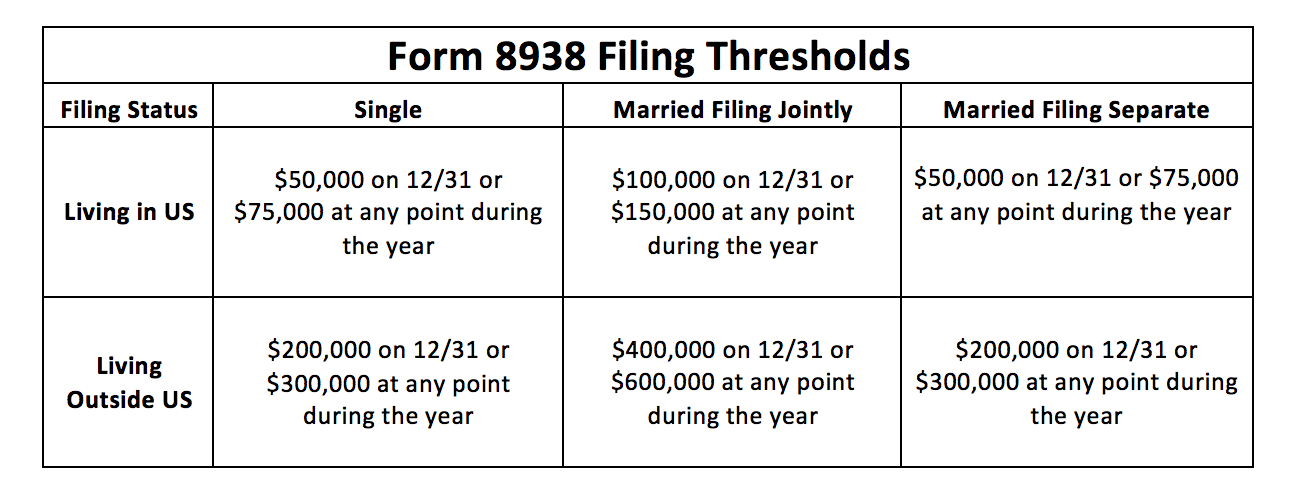

This form is part of the Foreign Account Tax Compliance Act (FATCA) regulations and was created to prevent taxpayers from hiding their assets and income from those assets. This form is required if you exceed the following bank account balance thresholds:

Form 8938 lists your bank account information and balances during the year. It also catalogs the income you have earned from each account during the year. The income reported on Form 8938 should match what you have reported on Schedule B (interest and dividends) for your tax return.

Form 8833 – Treaty-Based Return Position Disclosure

Form 8833 is required if you use a US tax treaty provision to modify your taxes. This form is generally used when you exclude income from taxation due to a difference between your resident country’s laws and US tax laws.

Figuring out whether you need to apply a tax treaty provision to your expatriate tax return can be tricky. You might find it challenging to decide which route is best for your situation. In such a case, it is best to consult an accountant for advice.

Form 5471 – Information Return of US Persons For Certain Foreign Corporations

This form is used for shareholders in foreign corporations. A corporation is a legal entity incorporated under the resident country’s laws. Most filers with more than 10% stock ownership in a foreign corporation must file this form. This is an extensive form with multiple pages and usually requires the corporation’s financial documents. This form is generally filed with your tax return, Form 1040, but may be filed separately in certain circumstances. This form does not tax the corporation; it merely discloses the taxpayer’s interest/ownership in the corporation. Any income from the corporation will be reported elsewhere on your 1040 so it can be taxed accordingly on your tax return.

Form 8865 – Return of US Persons Concerning Certain Foreign Partnerships

This form is used by US persons with a controlling interest (someone who owns 50% or more) in a foreign partnership or who owns 10% of a foreign partnership with another US person holding a controlling interest. A partnership is an organized and legal entity where two or more people enter a business agreement to work together and split the profits. This form requires information regarding the partner (the filer) and the partnership – including the partnership’s financial information, usually filed with your tax return but may be filed separately in certain circumstances. This form does not tax the partnership; it merely discloses the taxpayer’s interest/ownership in the corporation. Any income received from the partnership will be reported elsewhere on your 1040 for it to be taxed accordingly.

Form 8621 – Information Return by a Shareholder of a Passive Foreign Investment Company (PFIC)

A PFIC is a foreign-based corporation where most of its income comes from investments such as interest, dividends, and capital gains. The most common types of PFICs are foreign mutual funds and investment accounts, including stock accounts. If you own a PFIC, you must file form 8621 for each account, sometimes more than one per mutual fund or investment account. Form 8621 requires information regarding the income or proceeds received from each account each year. This form calculates the tax due on investment income. Income earned from a PFIC account is taxable in the US, even if it is not taxable or is tax-deferred in your resident country.

FinCEN Form 114 – Foreign Bank Account Reporting (FBAR)

This form is not technically a tax form, as the IRS does not require it, but most expats will need to file it. FinCEN (Financial Crimes Enforcement Center) is a division of the US Treasury Department. The FBAR form reports your foreign financial account information and the highest balance of the accounts during the year. This form is required if you have any foreign bank accounts with an aggregate balance of $10,000 or more during the year. All US persons with bank accounts exceeding the threshold must file these forms, even minors on their complete tax return.

Other IRS Forms for Expats

The IRS requires expats to file a number of forms with the US government, but it also has some tax rules that are specific to expatriates. Some other IRS forms for expats include:

- Form 3520 – Annual Return To Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts

- Form 3520-A – Annual Information Return of Foreign Trust with a US Owner

Form 3520 – Annual Return to Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts

Form 3520 is required if you have had certain transactions with a foreign trust (a trust not formed under US laws), such as personally owning any assets held in a foreign trust or receiving a distribution from a foreign trust. This form is also required if you receive a distribution of more than $100,000 from a non-resident alien or foreign estate. Form 3520 requires information from the foreign trust and the beneficiary (taxpayer); it is generally several pages long. This form is filed separately from your tax return and is due at the same time as your tax return and other IRS forms for expats.

Form 3520A – Annual Information Return of Foreign Trust with a US Owner

This form is required for any foreign trusts with a US owner. It has many pages and requires the financial information of the trust as well as the names and information of each owner. If the trust has more than one owner, each owner is responsible for ensuring that the 3520A is filed and the proper statements are furnished to all the owners. It is filed separately from your regular tax return and is due March 15th each year (or the 15th day of the 3rd month after the end of the trust’s tax year).

Have Additional Questions About US Tax Forms for Expats?

Greenback is happy to help with any other US tax forms for expats! We’d love to review your specific situation and guide you through which forms need to be completed.

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.