How to Claim the Foreign Earned Income Exclusion in 2026

- What Is the Foreign Earned Income Exclusion?

- How Do I Qualify for the FEIE?

- What Income Qualifies for the Exclusion?

- How Much Can I Exclude?

- How Do I File for the FEIE?

- 2026 Filing Deadlines

- Do I Need to Prorate My Exclusion?

- Can I Combine the FEIE with Other Tax Benefits?

- What Mistakes Should I Avoid? Top 10 FEIE Filing Errors

- Who Should Use the FEIE?

- When NOT to Use FEIE

- What If I'm Behind on Filing?

- How Does the FEIE Work with U.S. State Taxes?

- Special Situations and Advanced Strategies

- What Are My Next Steps?

- Let Greenback Help You Maximize the FEIE

- Related Resources

If you’re working abroad, the Foreign Earned Income Exclusion (FEIE) could save you thousands in U.S. taxes. According to IRS data, qualifying American expats can exclude up to $130,000 of foreign-earned income from U.S. taxation. For many expats, this single benefit eliminates their federal tax liability completely.

To claim the FEIE: File Form 2555 with your tax return, qualify under either the Physical Presence Test (330 days abroad) or Bona Fide Residence Test (full-year foreign resident), and exclude up to $130,000 in foreign income. Married couples who both qualify can exclude up to $260,000 in combined income.

What Is the Foreign Earned Income Exclusion?

The United States taxes citizens on worldwide income, no matter where they live. The FEIE prevents double taxation by allowing qualifying expats to exclude foreign earnings from U.S. federal income tax.

You can exclude up to $130,000 of foreign-earned income. This amount increases annually for inflation.

How it works: If you earn $150,000 while working overseas and qualify for the FEIE, you’ll only be taxed on $20,000. Combined with the standard deduction, this remaining amount often drops to zero.

FEIE Limits by Tax Year

| Tax Year | Filing Deadline | Maximum Exclusion | Married Filing Jointly (Both Qualify) |

|---|---|---|---|

| 2026 | April 15, 2027 | $132,900 | $265,800 |

| 2025 | April 15, 2026 | $130,000 | $260,000 |

| 2024 | April 15, 2025 | $126,500 | $253,000 |

Not sure if you qualify for the Foreign Earned Income Exclusion?

How Do I Qualify for the FEIE?

You must meet three requirements to claim the Foreign Earned Income Exclusion:

- Foreign-earned income: Wages, salary, or self-employment income for work performed abroad

- Tax home in a foreign country: Your regular place of business must be outside the U.S.

- Pass either qualifying test: Physical Presence Test OR Bona Fide Residence Test

Physical Presence Test

You must be physically present in foreign countries for at least 330 full days during any 12-month period.

Key requirements:

- The 330 days don’t need to be consecutive

- The 12-month period can start any day

- Brief U.S. trips are allowed (track carefully)

- International waters and U.S. flight time don’t count

- Full days only (partial days don’t count)

Perfect for: Digital nomads, short-term assignments, contractors, or new expats.

Example: Maria moved to Portugal on March 15, 2025. By March 14, 2026, she spent 340 days abroad with two short holiday trips home. She qualifies under the Physical Presence Test for both her 2025 and 2026 tax years.

Use a spreadsheet or app to track your location daily. Include departure and arrival dates, flight numbers, and destinations. The IRS may request this during an audit.

Learn more: Physical Presence Test Requirements

Bona Fide Residence Test

This test examines your intention to live abroad permanently. You qualify if you’re a bona fide resident of a foreign country for an entire tax year (January 1 through December 31).

Evidence the IRS requires:

- Long-term lease or home ownership abroad (minimum one-year commitment)

- Local bank accounts, credit cards, and financial ties

- Foreign driver’s license or resident permit

- Children enrolled in local schools

- Local employment contract or business registration

- Community integration (memberships, local relationships)

- Minimal ties to the U.S. (no permanent home maintained)

Perfect for: Permanent expats, expatriates with indefinite foreign assignments, or those who’ve established long-term residence abroad.

If you claim non-resident status for local tax purposes in your host country, you cannot claim bona fide residence for the U.S. FEIE. The IRS expects consistency between your U.S. and foreign tax positions.

Example: David moved to Germany in January 2024 with a permanent employment contract. He signed a two-year lease, enrolled his children in local schools, obtained a German driver’s license, and has no plans to return to the U.S. He qualifies under the Bona Fide Residence Test starting with his 2024 tax year.

Learn more: Bona Fide Residence Test Guide

Physical Presence vs. Bona Fide Residence: Which Test Should I Use?

| Situation | Recommended Test | Why |

|---|---|---|

| First year abroad | Physical Presence | Can’t meet full-year bona fide requirement |

| 1-2 year assignment | Physical Presence | Defined return date prevents bona fide residence |

| Moved indefinitely | Bona Fide Residence | Easier once established, covers full years |

| Digital nomad (multiple countries) | Physical Presence | No single country residence established |

| Frequent U.S. trips | Bona Fide Residence | Not affected by U.S. visits once qualified |

| Defined contract ending | Physical Presence | Bona fide requires indefinite residence intention |

What Income Qualifies for the Exclusion?

Only income earned from working in foreign countries qualifies. The location where you perform the work matters, not who pays you.

Qualifying Foreign Earned Income

| Income Type | Qualifies? | Notes |

|---|---|---|

| Wages and salaries from foreign work | ✓ Yes | Must be earned while physically abroad |

| Self-employment income | ✓ Yes | Subject to SE tax separately |

| Professional fees (overseas services) | ✓ Yes | For work performed in foreign countries |

| Bonuses for foreign work | ✓ Yes | Related to foreign employment |

| Commissions and tips | ✓ Yes | From foreign work only |

| Housing provided by employer | ✓ Partial | See Foreign Housing Exclusion |

Non-Qualifying Income

| Income Type | Qualifies? | Alternative Benefit |

|---|---|---|

| Investment income (dividends, interest) | ✗ No | Use Foreign Tax Credit |

| Capital gains | ✗ No | Use Foreign Tax Credit |

| Rental income | ✗ No | Use Foreign Tax Credit |

| Pension distributions | ✗ No | May qualify for treaty benefits |

| Social Security benefits | ✗ No | May qualify for treaty benefits |

| U.S. government wages | ✗ No | Special rules apply |

| Passive business income | ✗ No | Use Foreign Tax Credit |

Key principle: Working remotely from Paris for a U.S. company? That income qualifies. Working from Miami for a German company? That doesn’t qualify because the work was performed in the U.S.

How Much Can I Exclude?

The FEIE amount increases annually for inflation. Here’s what you need to know:

Maximum Exclusion Amounts

- Single taxpayers: Up to $130,000 for tax year 2025 (filed April 2026)

- Married couples (both qualifying): Up to $260,000 for tax year 2025

- 2026 tax year (filed April 2027): $132,900 per person ($265,800 married)

Income Above the FEIE Limit

If your income exceeds the FEIE limit, you have options:

Strategy 1: Foreign Tax Credit on excess income

- Claim FEIE on first $130,000

- Use Foreign Tax Credit on remaining income

- Often results in zero U.S. tax owed

Strategy 2: Foreign Housing Exclusion

- Claim additional housing costs above $20,800

- Varies by city (Hong Kong allows up to $114,300)

- See Foreign Housing Exclusion Guide

Example: Sarah earns $180,000 living in London and pays £45,000 in UK taxes. She claims the $130,000 FEIE and uses the Foreign Tax Credit on the remaining $50,000. Her U.S. tax liability: $0.

How Do I File for the FEIE?

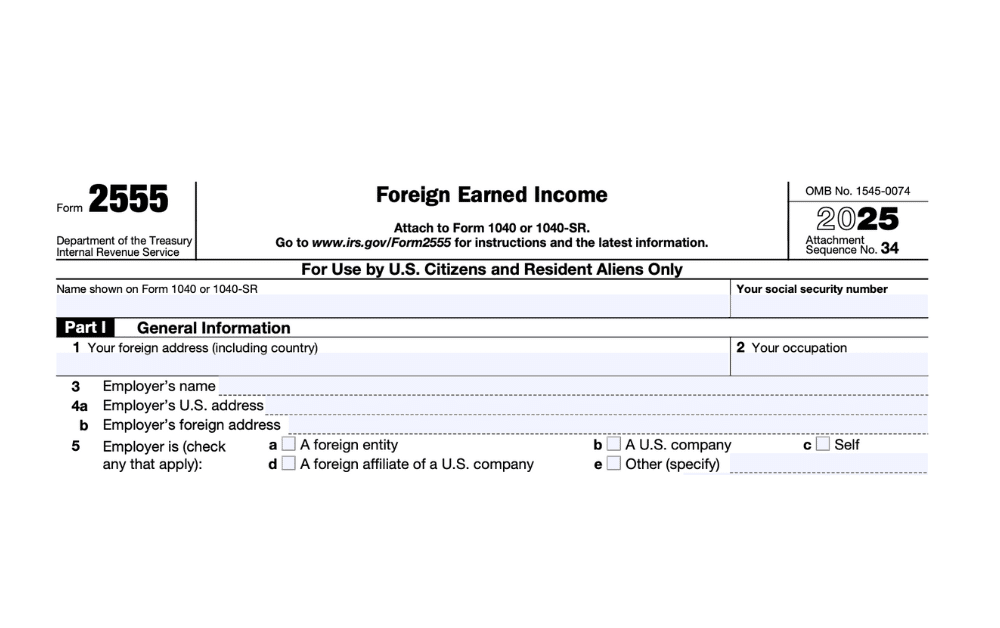

Filing for the FEIE requires specific forms and documentation. Here are some Form 2555 instructions and a step-by-step process:

Required Forms

| Form | Purpose | Required For |

|---|---|---|

| Form 2555 | Claim FEIE | All expats claiming exclusion |

| Form 1040 | Primary tax return | All U.S. taxpayers |

| Schedule 1 | Additional income | If you have adjustments |

| Form 2350 | Extension to qualify | If you need more time to meet 330 days |

| Form 1116 | Foreign Tax Credit | If combining with FTC |

Step-by-Step Filing Process

Step 1: Gather Documentation

- Employment contracts or client agreements

- Pay stubs or income statements for entire year

- Bank statements showing foreign income deposits

- Passport with entry/exit stamps

- Flight itineraries and boarding passes

- Calendar tracking daily location

Step 2: Choose Your Qualifying Test

- Physical Presence: Count your days abroad (need 330 full days)

- Bona Fide Residence: Gather evidence of foreign residency

Step 3: Complete Form 2555

- Part I: General information about foreign residence

- Part II: Choose Physical Presence or Bona Fide Residence Test

- Part III: Report foreign earned income

- Part VI: Calculate housing exclusion (if applicable)

- Parts VII-IX: Final calculations

Step 4: Transfer to Form 1040

- Enter excluded amount from Form 2555

- Complete remaining sections of Form 1040

- Attach all required schedules and forms

Step 5: File by Deadline

- Standard deadline: April 15, 2026 (for 2025 tax year)

- Automatic extension: June 15, 2026 (no form required for expats)

- Final extension: October 15, 2026 (requires Form 4868 filed by June 15)

2026 Filing Deadlines

| Deadline | What’s Due | Notes |

|---|---|---|

| April 15, 2026 | 2025 tax return | Standard deadline for all taxpayers |

| April 15, 2026 | FBAR filing | Report foreign accounts over $10,000 |

| June 15, 2026 | Automatic expat extension | No form required, but interest accrues on taxes owed |

| June 15, 2026 | Form 4868 deadline | Request October extension (must file by this date) |

| October 15, 2026 | Final extended deadline | With Form 4868 filed by June 15 |

| October 15, 2026 | FBAR extended deadline | Automatic extension for FBAR filers |

Even with an extension, pay any estimated taxes by April 15 to avoid interest charges.

Do I Need to Prorate My Exclusion?

If you moved abroad mid-year or only qualify for part of the year, you must prorate your exclusion based on qualifying days.

Proration Formula

Formula: (FEIE Limit) × (Qualifying Days ÷ 365) = Your Maximum Exclusion

Common Proration Scenarios

Scenario 1: Mid-Year Move Abroad

Tom moved to Japan on May 1, 2025, and qualified under the Physical Presence Test by April 30, 2026. He spent 245 days abroad in 2025.

- Calculation: $130,000 × (245 ÷ 365) = $87,260 maximum FEIE for 2025

- 2026 calculation: Full $132,900 if he stays abroad entire year

Scenario 2: Returned to U.S. Mid-Year

Jennifer lived in Australia from January 1 through September 15, 2025 (258 days), then permanently returned to the U.S.

- Calculation: $130,000 × (258 ÷ 365) = $91,890 maximum FEIE for 2025

- 2026: No FEIE eligibility unless she moves abroad again

Scenario 3: Partial Year with Multiple Countries

Alex spent 180 days in Thailand, 90 days in Vietnam, and 95 days in the U.S. during 2025.

- Total qualifying days: 270 days (Thailand + Vietnam)

- Calculation: $130,000 × (270 ÷ 365) = $96,164 maximum FEIE for 2025

- Note: Doesn’t meet 330-day threshold for full exclusion

What If I Haven’t Reached 330 Days by April 15?

File Form 2350 before June 15, 2026, to request an extension until you qualify.

When to use Form 2350:

- You’re close to 330 days but won’t reach it by April 15

- You moved abroad late in 2025

- You’re waiting to establish bona fide residence for a full year

- You need time to document your days abroad

Form 2350 extends your filing deadline but not your payment deadline. Pay estimated taxes by April 15 to avoid interest.

Can I Combine the FEIE with Other Tax Benefits?

Yes! Strategic combination of benefits often eliminates all U.S. tax liability.

Foreign Housing Exclusion

Claim additional amounts for foreign housing expenses beyond $20,800 (for 2025).

Qualifying housing expenses:

- Rent for your principal foreign home

- Basic utilities (electricity, gas, water, sewer)

- Property insurance (homeowner’s or renter’s)

- Non-refundable fees for securing a lease

- Rental furniture and household items

- Residential parking fees

Non-qualifying expenses:

- Mortgage principal payments

- Purchased furniture

- TV, internet, or phone service

- Domestic labor (maids, gardeners)

- Improvements or other capital items

City-specific limits for 2025:

- Standard limit: $39,000 annually

- Hong Kong: $114,300

- London: $73,200

- Tokyo: $82,800

- Paris: $70,100

- Sydney: $69,300

Learn More: Foreign Housing Exclusion

Example: Michael lives in Hong Kong, earns $180,000, and pays $85,000 in rent annually.

- FEIE: $130,000 excluded

- Housing exclusion: $64,200 additional exclusion ($85,000 – $20,800 base)

- Total exclusion: $194,200

- Taxable income: $0 (after standard deduction)

Foreign Tax Credit

The Foreign Tax Credit (FTC) provides dollar-for-dollar credit for foreign taxes paid.

When FTC works better than FEIE:

- You live in a high-tax country (UK, France, Germany, Scandinavia)

- Your income significantly exceeds the FEIE limit

- You have passive income that doesn’t qualify for FEIE

- You need to preserve earned income for IRA contributions

Strategic combination example:

Lisa lives in Germany, earns $160,000, and pays €50,000 in German taxes.

Option 1: FEIE only

- Exclude $130,000 with FEIE

- Taxable income: $30,000

- U.S. tax owed: ~$3,300

- German taxes: €50,000

- Total taxes: €50,000 + $3,300

Option 2: FTC only

- Claim FTC for all German taxes paid

- U.S. tax on $160,000: ~$27,000

- FTC: ~$27,000 (assuming similar foreign tax)

- U.S. tax owed: $0

- Total taxes: €50,000

Option 3: Strategic combination (often best)

- Use FEIE on earned income up to $130,000

- Use FTC on remaining $30,000 and passive income

- Result: $0 U.S. tax owed

Critical rule: You cannot claim both FEIE and FTC on the same dollar of income. This is the most common mistake that triggers IRS audits.

Learn more: FEIE vs FTC: Which Strategy Saves More Money?

What Mistakes Should I Avoid? Top 10 FEIE Filing Errors

1. Not Filing a Tax Return

You must file Form 1040 and Form 2555 even if you owe $0. Not filing means you forfeit the FEIE benefit and may face penalties for unfiled returns.

2. Forgetting to Prorate

Moved abroad July 1? You cannot claim the full $130,000. You must prorate based on qualifying days.

3. Poor Record Keeping

“I think I was abroad 330 days” won’t satisfy the IRS. Keep detailed records:

- Daily location calendar

- Boarding passes and flight itineraries

- Hotel receipts

- Passport stamps

- Credit card statements showing foreign transactions

4. Counting Partial Days as Full Days

Travel days typically don’t count. If you depart the U.S. on Monday evening and arrive Tuesday morning, neither day counts as a full day abroad.

5. Missing the Revocation Trap

Once you claim the FEIE, revoking it locks you out for five years. You cannot switch strategies without serious long-term consequences.

Revocation scenarios that backfire:

- Switching to FTC to claim EITC

- Changing to maximize IRA contributions

- Moving back to the U.S. temporarily

6. Claiming FEIE and FTC on Same Income

This is double-dipping and triggers IRS audits. You must allocate income between FEIE and FTC strategically.

7. Ignoring State Tax Obligations

The FEIE is federal only. Some states still require state tax filing even while living abroad.

8. Tax Home Confusion

Your tax home is your regular place of business, not your family home. If your work assignment is temporary (one year or less), your tax home remains in the U.S., and you don’t qualify for FEIE.

9. Not Considering Self-Employment Tax

FEIE excludes income from income tax, not self-employment tax. Self-employed expats still owe 15.3% SE tax on net earnings unless a totalization agreement applies.

10. Losing Other Tax Benefits

FEIE affects eligibility for:

- IRA contributions (requires earned income that wasn’t excluded)

- Refundable Child Tax Credit

- Premium Tax Credit for health insurance

Who Should Use the FEIE?

Digital Nomads

- Move frequently between countries

- Meet Physical Presence Test through careful tracking

- Earn below $130,000 annually

- Pay low or no foreign income taxes

Corporate Expats on Assignment

- Clear foreign residence for 1-3 years

- Can document 330+ days abroad

- Company handles housing

- Can establish bona fide residence if longer assignment

Self-Employed Expats

- Earn foreign income from international clients

- Pay foreign taxes on earnings

- Need to combine with FTC for SE tax offset

- Work primarily from foreign locations

Teachers Abroad

- Meet Physical Presence Test during school year

- Earn modest salaries that FEIE fully covers

- Have defined contract periods

- Often in low-tax countries

Families with Two Working Spouses

- Both spouses can claim exclusion

- Combined exclusion up to $260,000

- Living in moderate to low-tax countries

- Both qualify under same test

When NOT to Use FEIE

- High earners in high-tax countries: If you earn $200,000+ and pay substantial foreign taxes, FTC often provides better results.

- Expats needing IRA contributions: Excluded income doesn’t count as compensation for IRA purposes.

- Those with significant passive income: Dividends, interest, and capital gains don’t qualify for FEIE. Use FTC instead.

- Expats planning to return soon: If you’ll move back to the U.S. within two years, be cautious about the five-year revocation trap.

What If I’m Behind on Filing?

If you haven’t filed U.S. tax returns while living abroad, the Streamlined Filing Compliance Procedures offer penalty-free ways to catch up.

Streamlined Filing Procedures

Who qualifies:

- Your failure to file was non-willful (you didn’t know or understand the requirements)

- You lived outside the U.S. for at least 330 days in one of the last three years

- You have unfiled returns or unreported foreign income

What you must file:

- Last 3 years of tax returns

- Last 6 years of FBAR reports (FinCEN Form 114)

- Certification of non-willful conduct

Benefits:

- Zero penalties for late filing

- Retroactively claim FEIE for all three years

- Get current with IRS obligations

- Peace of mind

You must act before the IRS contacts you. Once they initiate contact, you no longer qualify for penalty-free treatment.

Example: Robert lived in Australia from 2021 to 2025 without filing U.S. taxes. In January 2026, he discovers his obligations. Through Streamlined Procedures, he files returns for 2022, 2023, and 2024, claiming FEIE for each year. Result: $0 owed, $0 penalties.

Learn more: Streamlined Filing for Late Tax Returns

How Does the FEIE Work with U.S. State Taxes?

The FEIE is a federal benefit only. State tax obligations depend on your state of previous residence.

State Tax Rules for Expats

States with no income tax (no filing required):

Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, Wyoming

States that generally release you:

Most states release you from tax obligations once you establish residence abroad, but you must formally break residency.

States with sticky tax obligations:

- California: Difficult to break residency

- Virginia: Maintains ties to military members

- New Mexico: Requires careful exit strategy

- South Carolina: Has specific rules for expats

How to break state residency:

- File final part-year resident return

- Cancel driver’s license

- Close state bank accounts

- Register to vote in new location

- Notify state tax authority

- Don’t maintain a home in the state

Learn more: Do Expats Have to Pay State Taxes?

Special Situations and Advanced Strategies

FEIE for Self-Employed Expats

Self-employed expats face unique considerations:

Good news:

- Business income qualifies for FEIE if earned abroad

- Business expenses remain fully deductible

Important note:

- FEIE only excludes income tax, not self-employment tax

- You still owe 15.3% SE tax on net self-employment income

- Totalization agreements with 30+ countries can eliminate double SE tax

Forms required:

- Schedule C (Business Income)

- Schedule SE (Self-Employment Tax)

- Form 2555 (FEIE)

Example: Emma runs a freelance design business from Barcelona, earning $110,000 net profit in 2025.

- FEIE: Excludes $110,000 from income tax

- SE tax: Still owes ~$15,500 (15.3% × $110,000 × 92.35%)

- Spain-U.S. totalization agreement: May eliminate SE tax

- Result: No U.S. income tax, possibly no SE tax

FEIE with Multiple Countries

If you work in multiple foreign countries, all days count toward the 330-day requirement as long as you’re in foreign countries (not the U.S.).

Example: James works as a consultant:

- 180 days in Singapore

- 100 days in Thailand

- 60 days in U.S.

- 25 days in Malaysia

- Total qualifying days: 305 days

- Result: Doesn’t meet 330-day threshold (needs 25 more foreign days)

FEIE with Spouse Filing Status

| Filing Status | FEIE Rules | Maximum Exclusion |

|---|---|---|

| Married Filing Jointly | Each spouse who qualifies claims own FEIE | $260,000 (2025) |

| Married Filing Separately | Each files own return and Form 2555 | $130,000 each |

| Head of Household | Rare for expats; must meet specific rules | $130,000 |

| Single | Standard individual filing | $130,000 |

Spouse is not a U.S. citizen:

If your spouse isn’t a U.S. citizen, you can elect to treat them as a resident alien for tax purposes, allowing joint filing and potential double FEIE.

- File Form 1040 with written election statement

- Spouse must have SSN or ITIN

- Report spouse’s worldwide income

- Both can claim FEIE if both qualify

Learn more: Tax Filing for Married Expats with Non-Citizen Spouse.

FEIE for Teachers and Educators

Teachers abroad often benefit significantly from FEIE:

Typical scenario:

- Teaching salary: $65,000

- Housing provided: $15,000 value

- Total compensation: $80,000

- FEIE exclusion: $80,000

- U.S. tax owed: $0

Special considerations:

- School year (August-June) aligns well with Physical Presence Test

- Summer travel must be tracked carefully

- Treaty benefits may apply for certain countries

Countries with teaching tax treaties:

- China, India, Indonesia, and others

- May provide complete exemption from foreign tax

- Can still claim FEIE for U.S. taxes

FEIE for Government Contractors

Military and government contractors have special rules:

Qualifying income:

- Private contractor working in a foreign country: FEIE applies

- Direct U.S. government employee: FEIE does not apply

- Combat zone exclusions may apply separately

Combat zone benefits:

- Separate exclusion for combat zone earnings

- Not subject to FEIE limits

- Can combine with FEIE for other foreign income

Example: Jason works as a private contractor in Qatar (not a combat zone), earning $155,000.

- FEIE: $130,000 excluded

- Regular income tax applies to remaining $25,000

- May use FTC if paying Qatari taxes

What Are My Next Steps?

Action Plan by Situation

If you’re already living abroad:

- Confirm your qualifying test (Physical Presence or Bona Fide)

- Track daily location if relying on Physical Presence Test

- Gather foreign income documentation (pay stubs, contracts)

- Calculate your exclusion amount

- Determine if you need Form 2350 for additional time

- File Form 2555 with Form 1040 by April 15 (or June 15 with automatic extension)

If you’re planning to move abroad:

- Understand FEIE requirements before relocating

- Plan your move date to maximize first-year exclusion

- Establish clear foreign tax home

- Document your residence (lease, work contract)

- Consider state tax exit strategy

- Set up day-tracking system

If you’re behind on filing:

- Don’t panic – solutions exist

- Calculate how many years you’ve missed

- Review Streamlined Filing Procedures eligibility

- Gather documentation for past three years

- File before IRS contacts you

- Claim FEIE retroactively for all eligible years

Resources and Tools

Free FEIE Calculator: Download our Excel calculator to estimate your potential FEIE savings.

Who doesn’t love a tax break? Download our easy-to-use excel calculator to get an estimate of how the foreign earned income exclusion can save you money.

"*" indicates required fields

Day-tracking apps:

- TravelTracker (iOS)

- Trip Journal (Android)

- Excel spreadsheet templates

IRS resources:

Let Greenback Help You Maximize the FEIE

Greenback is an American company founded in 2009 by U.S. expats for expats. We focused exclusively on expat taxes and always have. Many of our CPAs and Enrolled Agents are expats themselves, and because they live in 14 time zones, they experience firsthand the challenges of living abroad.

We’ve helped over 23,000 expats file taxes correctly and completed 71,000+ returns. Our 4.9-star average across 1,200+ TrustPilot reviews and high client retention testify to our consistency, comprehensive expertise, and the way we treat clients.

Get Started Today

No matter how late, messy, or complex your return may be, we can help. You’ll have peace of mind, knowing that your taxes were done right.

If you’re ready to be matched with a Greenback accountant, click the get started button below. For general questions on expat taxes or working with Greenback, contact our Customer Champions.

Ready to file your return and apply the Foreign Earned Income Exclusion?

This article is for informational purposes only and does not constitute tax advice. Tax laws are complex and subject to change. Always consult with a qualified tax professional regarding your specific situation.

Related Resources

Core FEIE Topics

- Form 2555: How to File for the Foreign Earned Income Exclusion

- Physical Presence Test: Requirements and Day Counting

- Bona Fide Residence Test: How to Qualify

- FEIE vs Foreign Tax Credit: Which Strategy Saves More?

Related Tax Benefits

- Foreign Housing Exclusion: Claim Additional Savings

- Foreign Tax Credit Guide for U.S. Expats

- U.S. Expat Tax Deductions and Credits